|

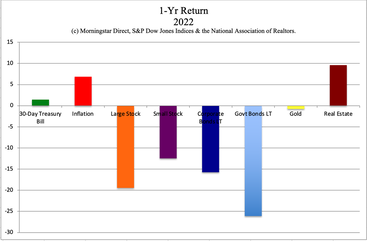

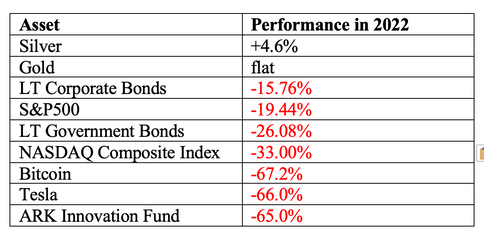

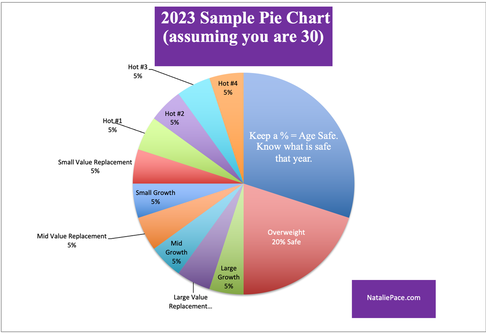

Are You Anxious or Depressed Over Money? It’s easy to be worried about money today. It’s easy for those worries to spill over into anxiety or depression. Once they do, it’s natural for us to think that we should just go to a psychologist or psychiatrist for help. While that profession specializes in mental health, if the source of our distress is money, then every time we leave the session, the real world problem engulfs us again. So, in order to truly address a mental disorder that’s rooted in a money problem, we must fix the money problem. Below are a few important things to consider if we are anxious or depressed about money in the current economic climate. Are We Out Over Our Skis? Tax-Protected Retirement Accounts Separate Our Business & Personal Accounts Batten-Down the Hatches of Our Budget & Think Outside the Box Be Wary of Salesmen, Celebrities, Emails, MSM and Social Media Protect Our Wealth: Know What We Own and Why And here is more information on each of the above-highlighted issues. Are We Out Over Our Skis? This is an expression that’s used frequently in the world of finance. It refers to someone who is going to crash and burn because they were going too hard and fast, or were overinvested in something that ended up catapulting them off a cliff. There’s a rule on Wall Street, “Bull make money. Bears make money. Pigs get slaughtered.” Often when we are experiencing money anxiety, there is one bugaboo that is the chief problem. We want to make sure that we are looking directly into the abyss of that problematic money pit, that we are seeing the issue clearly, and that we are prepared to get the sound guidance needed to avoid a crash landing. While it’s common to want to look away, justify, wallow in the past or avoid the real problem with all kinds of diversions, if we do, things are likely to get worse. There are solutions, even if we don’t yet see them. While it might be tempting to turn to friends and family for help, one of the most common ways to get into money trouble is by acting on advice from them. How do we get out over our skis in the first place? Sometimes we are lured into a Hail Mary investment because we’re desperate, while other times we might be seduced in with neon signs of getting rich quick. Small business owners might be borrowing from the bank of the family in order to prop up a business that is cash negative. In today’s world, it’s actually quite easy to be over our skis on basic needs. This is not necessarily due to any fault of our own. Life doesn’t add up, particularly for anyone under the age of 40. If our money is managed, it’s key to know what we own now because it’s easy to make money in bull markets and easy to lose (a lot) in 21st Century recessions. Never confuse a bull market with wisdom. If our accounts dropped by 30% or more in the pandemic, or we have a lot of bonds or bond funds, we are at more risk than we realize. If there is a money pit in your life that is giving you extreme anxiety, be sure that you write that problem at the top of the page, with a goal of figuring out how to resolve it as soon as possible with the professional help of a trusted expert (not just a broker/salesman). Getting on the right side of the challenge may require consulting with a small business strategist, learning the life math that we all should’ve received in high school, reading the Thrive Budget, Stocks, Debt and/or Bonds section of The ABCs of Money, or setting up a private prosperity consultation with me personally. (Email [email protected] for pricing and information.) Tax-Protected Retirement Accounts Rich people do not put their money in jars. They put their assets into tax-protected retirement accounts. The billionaire Peter Thiel allegedly has over $4 billion in his Roth IRA (source: ProPublica). Not only did he not have to pay capital gains taxes on the companies he invested in, he will not pay income tax when he withdraws it from the Roth IRA, unless the tax rules are changed. So, making sure that we are putting 10% of our income religiously into tax-protected retirement accounts, and investing with a time-proven 21st-century strategy that doesn’t rely on riding the Wall Street rollercoaster up and down, is a great way to protect and grow our wealth. One other upside that many people are not aware of, particularly small business owners, is that retirement accounts are financial predator proof. They are the best way to protect your personal wealth and future from others. If your business goes belly-up or is sued, the money within your personal retirement accounts is exempt from being levied. It is not included when the debt collectors and lien holders come to divvy up your assets. That is one of the primary reasons why it is very important for all of us to understand which retirement accounts, dependent IRAs, college funds and health savings accounts that we might qualify for. Separate Our Business & Personal Accounts When you set up and maintain your personal retirement accounts, you are starting the process of separating your personal wealth and future from your businesses. That is money that your business is not allowed to tap in order to make ends meet. (There should be more than this in the family wealth that is safe from the business.) The accounts are also, ideally, a deterrent to keep you from tapping your nest egg to pay bills or debt collectors. If we are siphoning our retirement to pay mortgage on a home we can’t afford or to pay basic bills, then we are ignoring the fundamental problem that our lifestyle doesn’t add up. Debt or credit card trouble is, at its heart, a budgeting snafu. Sometimes, it is the small business not supporting itself, and the entrepreneur being caged in a debt trap. There are solutions, but they are rarely found in the mainstream media or fixed by politicians. Sadly, I can’t tell you how many people I have coached over the decades who have gotten into serious financial trouble because they did not separate their personal accounts from their business accounts. When accounts are all tangled up, things can go south very rapidly in troubled financial times, such as we are experiencing today. It is very important to have a sound fiscal health strategy for your personal wealth that includes a prudent budget and providing for your future, which is separate from how you earn your income. Batten-Down the Hatches of Our Budget & Think Outside the Box The Thrive Budget posits that a sustainable allocation of our income apportions 50% for basic needs and survival and invests the remaining 50% on things that provide for our health, wellness, future and fun. Yet recent data indicates that many people, particularly adults under the age of 40, are spending up to 50% of their income on housing alone. After we pay for transportation costs, which can be $8000 or more every year, health insurance, which can be in the tens of thousands annually, and taxes, we might find ourselves putting food on credit cards. In a world where basic needs can easily eat up the majority of our income, the only way that life is going to add up, is to learn how to: * Save thousands annually with smarter survival choices * Reduce our tax burden, * Increase our “money while we sleep,” and, * Stop making everyone else rich at our own expense, including the landlord, the mortgage provider, the gas station, the utility company, the tax man, the health insurance company, broker/salesmen and others. We must jettison the idea of a nuclear family, and embrace the new reality that take an intergenerational approach to family wealth is going to make our entire family more fiscally fit. There are more than a few potential solutions to a budgetary crisis. However, they require reducing the big-ticket items, rather than just cutting out avocado toast, café lattes and fun. Be Wary of Salesmen, Celebrities, Emails, MSM and Social Media We have seen a wave of boom and bust cycles over the last few years. Cryptocurrency, cannabis, technology and biotechnology are the most notable. However, there also have been a lot of scams, misleading claims and outright pump-and-dump schemes. If someone is offering us any type of financial opportunity or investment, it’s very important to understand how they might be compensated for what they’re proposing. This is something that’s rarely discussed between the broker/salesmen or marketing guru and their target client. If you ask them how they’re compensated, you might not be told the truth, but instead be given a runaround, particularly if the opportunity smells a little fishy. Celebrities are getting hit hard by the SEC for not being transparent enough about their pay-to-play gigs. Paul Pierce, Kim Kardashian, Tom Brady, Gisele and many others have been involved in paid promotions or as brand ambassadors for crypto businesses that have been accused of being fraudulent. Voyager Digital claimed to be FDIC-insured, and was issued a cease-and-desist by the FDIC. Ark Funds were the stars of 2020 and the duds of 2022. It may seem impossible to know who or what to trust. In general, I would assume that any celebrity or bestselling author has skin in the game – is receiving some sort of compensation to promote. We must always grade our guru before listening or buying anything they say or sell. We should also understand that most of the time we are presented with a moneymaking opportunity, the person with the goods in front of us is being paid a finder’s fee, a commission, or has some other benefit from us buying what they’re selling. They may have all kinds of data to justify why we should do it. However, past performance does not equate with future performance. Due diligence requires a lot more than a few charts. The harder the sell, and the smaller our window of opportunity to consider, the more likely it is something that we will regret. Protect Our Wealth: Know What We Own and Why The world today has a lot of financial uncertainty and economic storms on the horizon, including expensive stocks, far too much debt, rising interest rates, inflation and more leverage than most of us are factoring in. That is why we have to know exactly what we own and why, rather than relying upon friends, family members, or a broker/salesman (financial planner) to protect our wealth for us, with fuzzy details on how that is actually happening. If someone else loses our money, it is our loss, not theirs. A time-proven 21st-century plan will have the appropriate amount of our wealth at risk, based upon our age and current market conditions, and the appropriate amount, safe, i.e. not at risk of losing principle. This is trickier than a lot of people realize because long-term government bonds lost more money last year than the S&P 500. Pretty much everything was a money loser in 2022, outside of silver. That doesn’t mean that we should make a Hail Mary investment in silver, although we might consider having a slice or two of the at-risk side of our liquid assets invested here. In addition to knowing what we own and diversifying our risk, we should consider overweighting an additional 10 to 20% safe. Rebalancing regularly, 1-3 times a year, is also key. That system is as easy as a pie chart. It is a buy low, sell high plan on auto pilot. If you’d like to create your personalized pie chart, email [email protected] with Free Web Apps in the subject line. This time-proven strategy removes our emotions from the equation, and relies instead upon data and statistics. Whenever someone is trying to scare the heck out of us or jack our emotions, whether it is by stoking our fear or greed, and then offers us the panacea, we should run in the other direction. Bottom Line A solid wealth plan protects our wealth in tough times, while also increasing in value during good times. The sooner we get to a place where our budget is in balance, our retirement plans are protected, and our business is not allowed to siphon from our future, the more at peace we will be, and the less time and money we will need to spend on therapy for money anxiety. When we identify the root cause of what our personal finance problems are, then we can identify and adopt the solutions. That is something our team has specialized in since 1999. Reach out. We’d love to help. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Photo of Natalie Pace by Marie Commiskey. Photo of Natalie Pace by Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed