|

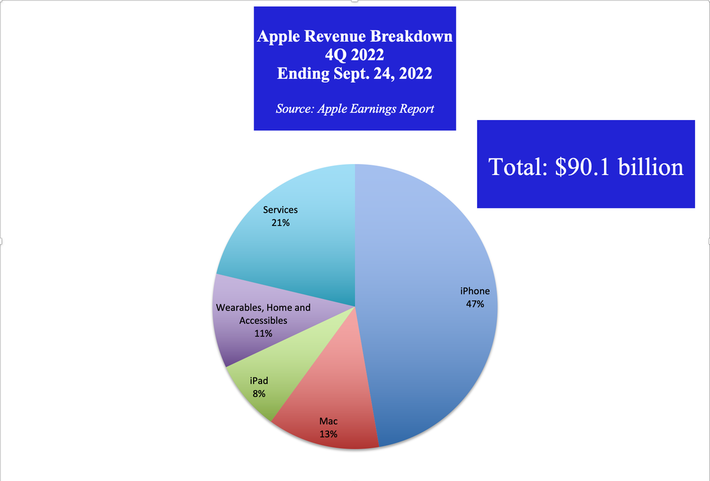

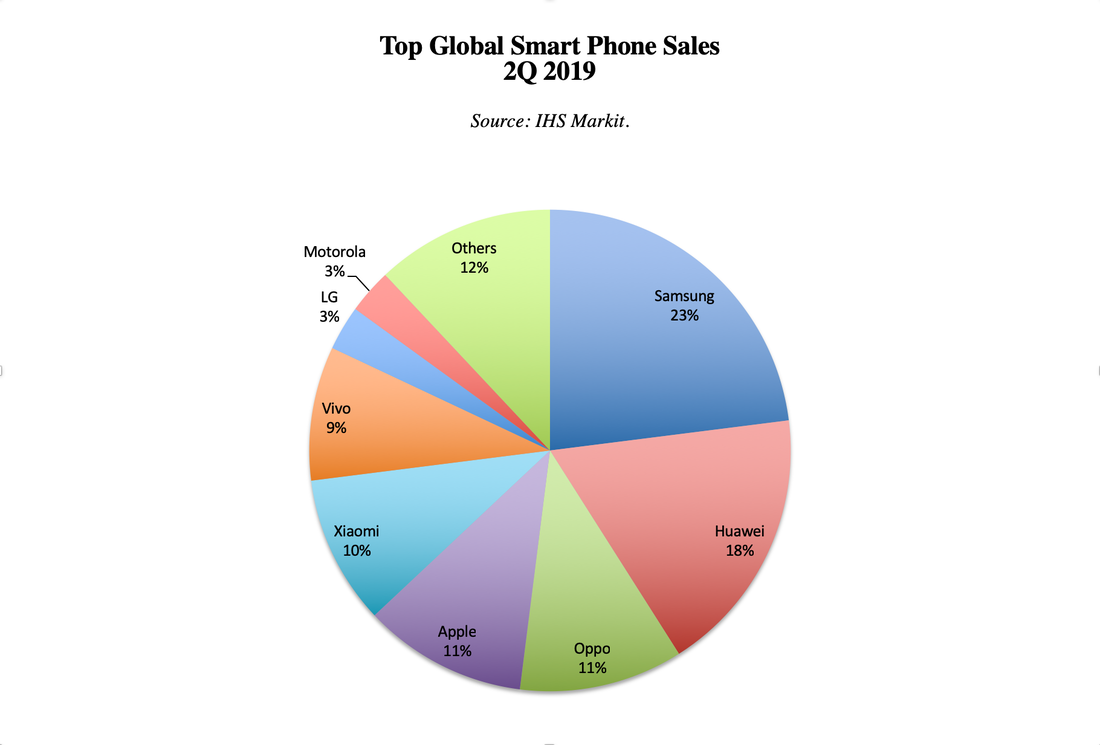

Will Ted Lasso Save Apple’s Holiday? Apple Warns that December Quarter Will “Decelerate” from September. During the Apple September 2022 quarter earnings call on October 27, 2022, Luca Maestri, the CFO of Apple, warned that “total company year-over-year revenue performance will decelerate during the December quarter as compared to the September quarter for a number of reasons.” Foreign exchange is predicted to negatively impact revenue by 10 percentage points, and “Mac revenue [is expected] to decline substantially year over year,” largely due to a robust comparison with the 2021 holiday season. Holiday Spending Holiday spending on electronics is predicted to be softer this year, down to 24% of consumers wanting a tech gift, compared to 27% in 2020. This could be another headwind for Apple. What Would Decelerating Look Like? The September quarter posted 8% year-over-year revenue gains of $90.1 billion. Most of the revenue came from the iPhone, at $42.6 billion, with Services in second ($19.2 billion), followed by Mac ($11.5 billion), Wearables ($9.65 billion), and then iPad ($7.2 billion). If the December quarter’s year-over-year revenue growth slows to 5%, the holiday sales quarter would come in at $130.2 billion. That would still be an all-time high. Apple would sing that song, accompanied by the analysts. Apple buybacks would continue. A Santa Rally could be in the cards, if investors don’t get too spooked by the November and December rate hikes, and the recession on the horizon. Foreign Exchange However, it’s important to remember that decelerate is a rather nebulous word. Apple isn’t offering guidance per se, and that the CFO mentioned twice that there would be a 10 percentage point headwind on FX. By comparison, the FX effect in the September quarter was 70 basis points – less than 1%. It was clear on the call that most analysts are expecting growth, even if it is low single digits. So, even a small amount of growth should appease Wall Street, when it’s reported around January 27, 2023. The problem is that if Apple knows that its holiday season is a miss on expectations, the company may stop their share repurchases – likely in December. It wouldn’t be the first time that Apple projected low single-digit growth, and then missed. The Holiday Slowdown in 2018 On January 29, 2019, Apple reported that their 2018 holiday sales quarter had declined by -5% from the December quarter of 2017. That had a lot to do with Huawei, which had jumped to the 2nd most popular smart phone in the world. It was a miss on expectations. However, the sell-off began in early December, almost two months before the announcement. Buybacks Throughout 2018, Apple had a robust buyback plan in play of $19.3 billion to $22.9 billion each quarter. In the December quarter of 2018, share repurchases dropped by half to $10.1 billion (source: S&P Dow Jones Indices), with almost no buybacks in December of 2018. When Apple stopped buying, Wall Street saw the worst December since the Great Depression. The S&P500 dropped -9.2%. Apple repurchased $25.2 billion of their common stock in the September 2022 quarter. If they slow or cease buybacks in December, the markets will drop. Mac Sales According to Luca Maestri, “We expect Mac revenue to decline substantially year over year during the December quarter.” Mac sales were stronger in the September 2022 quarter than they were in the 2021 holiday season, at $11.5 billion, compared to $10.4 billion. There might have been more back-to-school Mac buying than there will be wrapped gifts under the tree. Ted Lasso Will the iPhone, iPad, Wearables and Services make up for the expected decline in Mac sales? Will Ted Lasso be released in time to save the day? There is no official release date for the popular, Emmy-Award winning series. Filming began in March. On Halloween, Twitter lit up with images of the crew all dressed up as Ted Lasso for filming in Richmond. Was it a wrap? Can the post production team get everything in the can for a drop before December 31, 2022 (when the December quarter ends for Apple)? 14 Weeks Compared to 13 There is one bright spot that could help the company meet expectations. Apple will have an extra week of earnings in the December quarter this year – comparing 14 weeks in 2022 to 13 weeks in 2021. Of course, a miss on earnings will resonate even more with analysts, if it happens. Recession? The Federal Reserve Board is widely expected to increase interest rates another 75 basis points on November 2, 2022, with the Fed Fund rate hitting as high as 4.4% in 2022, and 4.6% in 2023 (according to the FOMC Summary of Economic Projections from September 21, 2022). With inflation still running way too hot, particularly shelter inflation (rents), it’s possible that the SEP will show higher rate hikes in 2023. (I’ve heard Paul Voelker’s name mentioned more in 2022 than in my entire career.) We’ll get the next look at their crystal ball on Dec. 14, 2022. Rapid rate hikes are correlated with recessions. As I’ve mentioned repeatedly throughout the year, the NBER (the organization tasked with calling the recession) is notoriously slow. If you wait for the headlines that we are in a recession, it will be too late to protect your wealth. It’s a good idea to adopt a time-proven, 21st Century plan now – to fix the roof while the sun is still shining. Join us for our online New Year, New You Retreat Jan. 20-22, 2023. Email [email protected] or call 310-430-2397 to learn more and register now. Register by Nov. 13, 2022 to receive the best price. Bottom Line Will there be a Santa Rally in 2022? Or will we see a repeat of December 2018, when Apple knew they were going to miss earnings expectations, stopped buybacks and sparked a Wall Street sell-off to the tune of -9.2%? Does the fate of our holiday season lie in the hands of the Federal Reserve Board or Jason Sudeikis? (There is likely to be plenty of pressure on the Ted Lasso team to drop the 3rd season before Christmas.) Either way, now is the perfect time to have a recession-proof plan that protects your wealth, while still allowing you to stay in the game. September plunged -9.34%. October recovered some of those losses with 8% gains. Stocks are still down -20% from their January highs. However, with rate hikes and a continued economic slowdown are on the horizon, it’s a better idea to plan for continued challenges than to hope for an unlikely recovery. 21st Century recessions tend to be a series of unfortunate events, with plunges, followed by lackluster rallies and then more drops. When the NBER finally names the recession, stocks are closer to the bottom. If you sell then, you’re likely to be selling low. The Buy & Hope price tag can be losses of half or more of your wealth in most 21st Century recessions. Wisdom and time-proven systems are the cure. The time is now. How much have you lost? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register by Nov.. 13, 2022. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Nov. 13, 2022, to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed