|

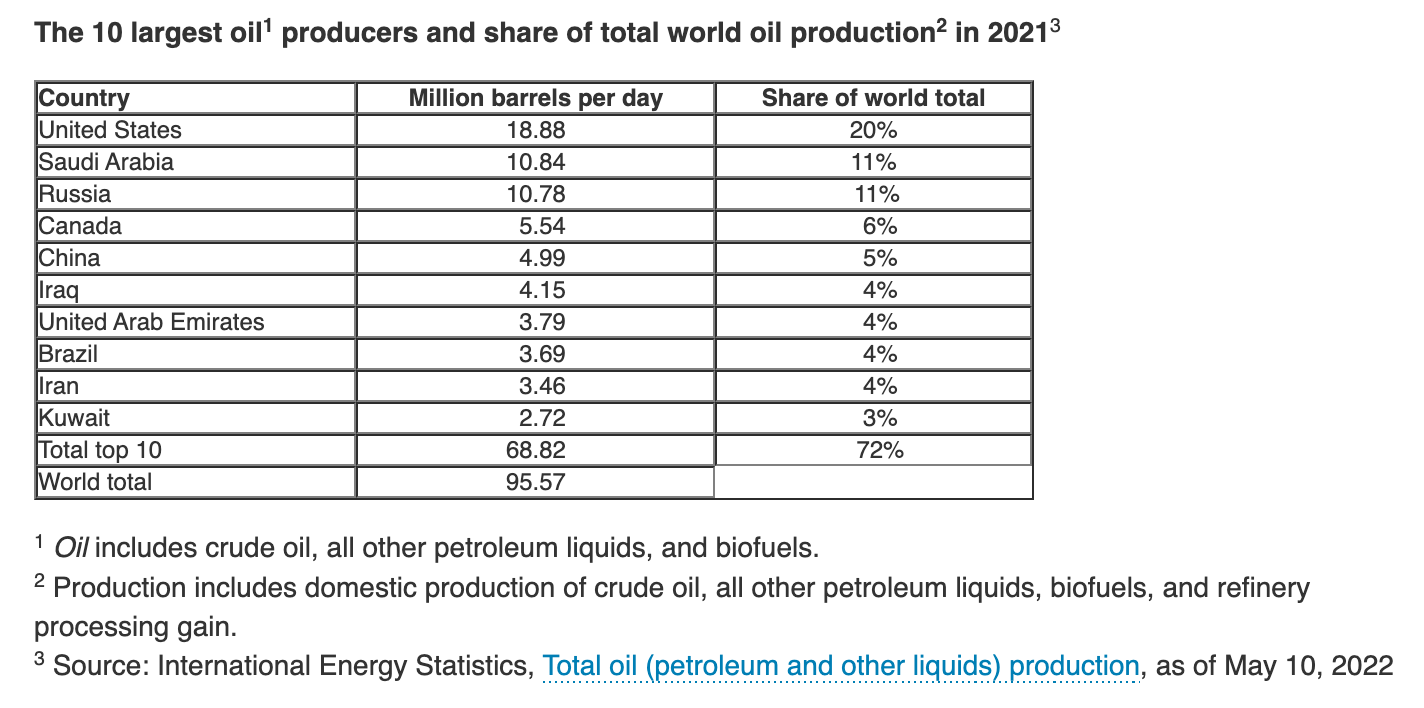

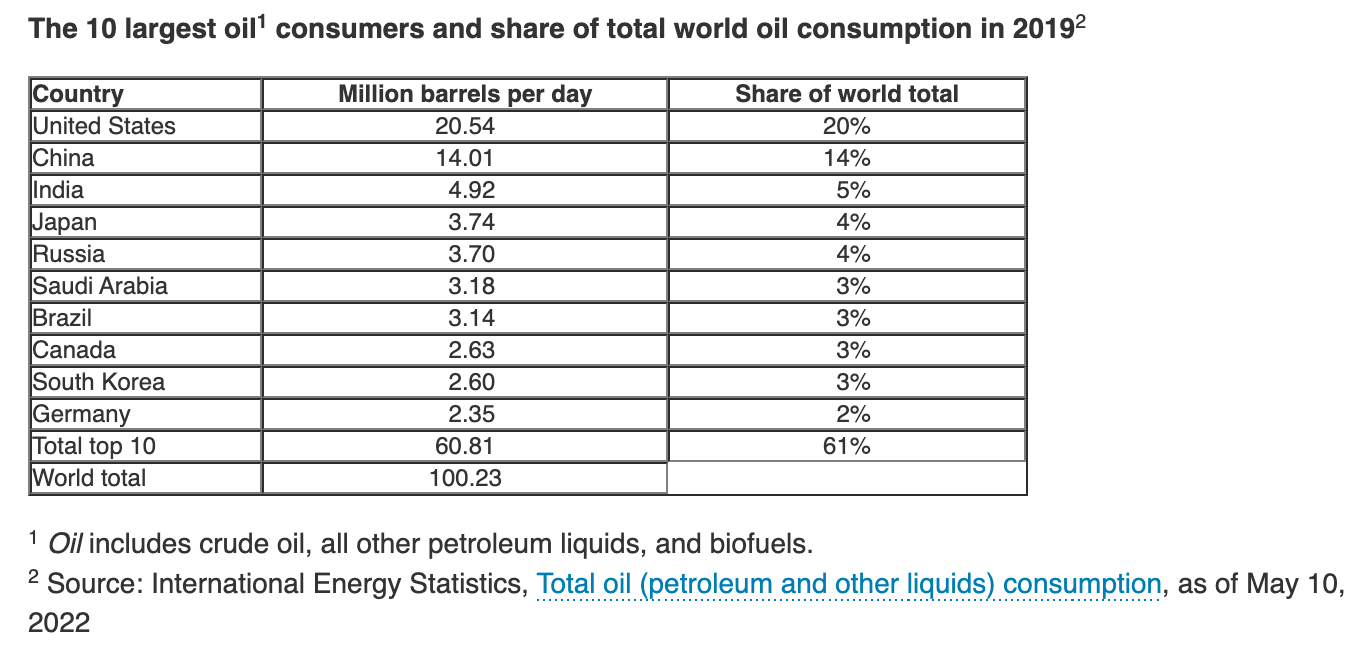

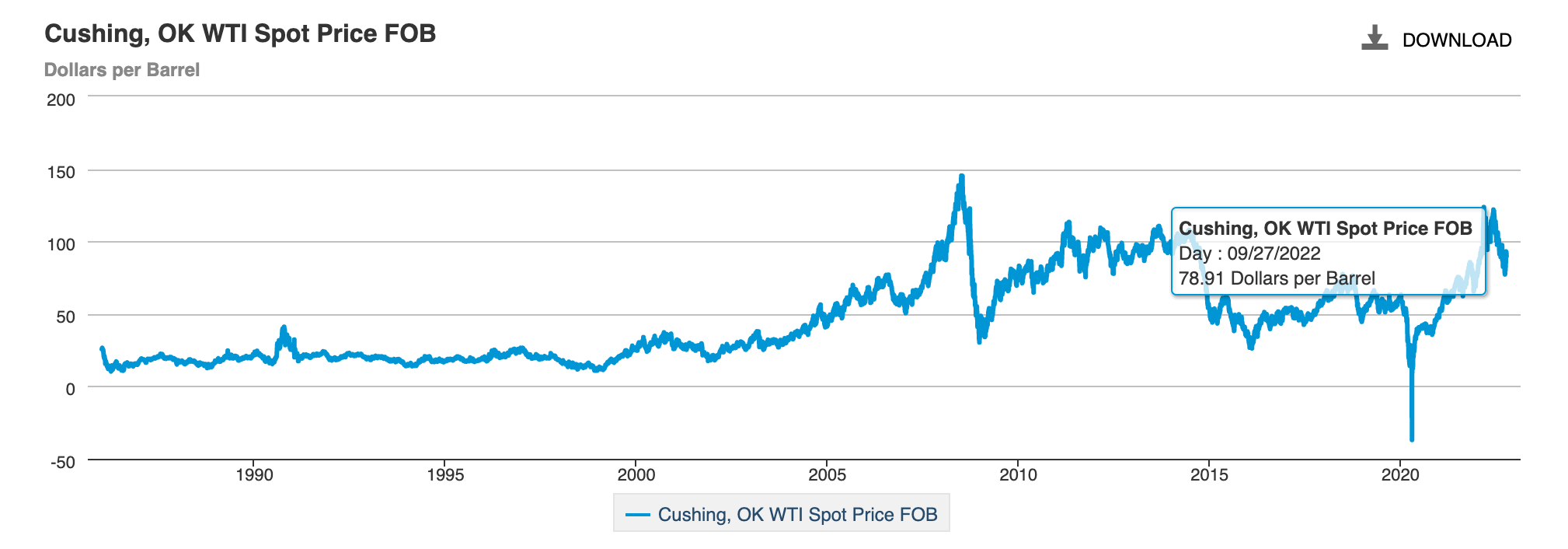

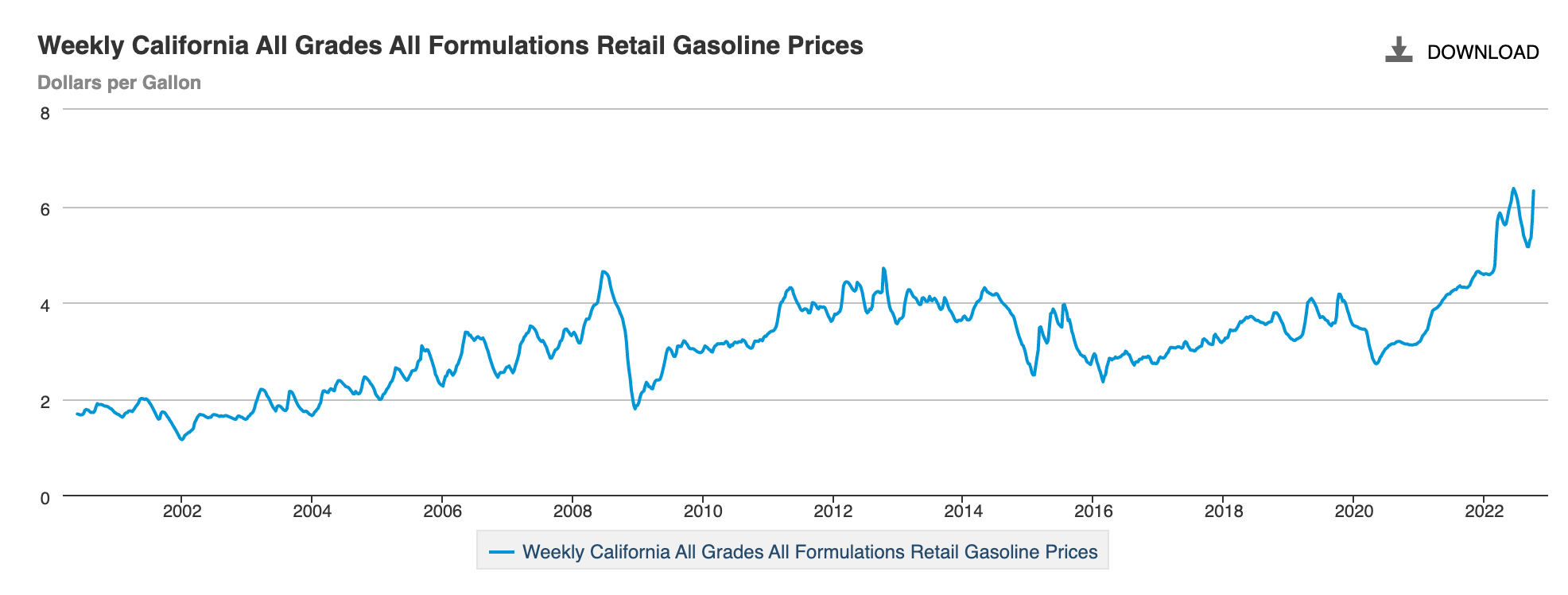

Why OPEC Really Cut Production Includes 7 Key Gas Facts That Each One of Us Should be Very Aware of. Lower gas prices are top of mind for everyone – except oil producers. That is the real reason that OPEC cut oil production – because oil had dropped below their target price point of $90/barrel. "$90 oil is non-negotiable for the OPEC+ leadership, hence they will act to safeguard this price floor," according to Stephen Brennock of the oil broker PVM. Why are oil countries and companies worried about the price of oil dropping? Largely due to economic uncertainty and the risk of a recession. Oil prices can tank in recessions. While OPEC’s meetings and decisions are important because they control supply, that is not all that is at play behind the pump prices. Demand also plays a key role. Below are 7 additional considerations – many of which put the price of oil and gasoline in our own hands. While we want our leaders to solve the problem, we have far more power than most of us realize. 7 Key Factors that Influence High Oil Prices 1. Russia, Saudi Arabia & OPEC+ 2. The U.S. is Oil Independent as Long as We Don’t Fight Wars on Foreign Soil 3. Historical Oil and Gas Prices 4. The 2 Million Barrel per Day Production Cut 5. World Demand & Production 6. Plastic, Polyester & Petrochemicals 7. 20 Oil, Gas & Coal Companies Responsible for Over 1/3 of CO2 And here is additional information on each point. 1. Russia, Saudi Arabia & OPEC+ Do Putin and Mohammed bin Salman have a Bromance going? They certainly have exhibited that on certain key occasions, including that very infamous snubbing of Donald Trump during the G20 meeting in 2018. At the OPEC+ meeting in December of 2018 (under a Trump Presidency) OPEC+ cut production in an attempt to increase gas & oil prices. Russia & Saudi Arabia have a lot in common. Their economies are driven by fossil fuels. They aren’t the only oppressive regimes that feed the world’s oil addiction. Iran and Venezuela are also OPEC members. 2. The U.S. is Oil Independent as Long as We Don’t Fight Wars on Foreign Soil The U.S. produces almost the same amount of oil and gas as we consume. (See the charts below.) However, when we fight wars in the Middle East, we buy oil and gas from Saudi Arabia. So peace is positive for lower gas prices. At the same time it’s important to remember that since oil is a world commodity, the price is set by world demand, not just at-home. So, the war in Ukraine increases demand and prices because the war machine is still heavily reliant on fossil fuels. In fact, the very large natural gas reserve off the coast of Crimea is one of the reasons that Russia wants to control that region. Natural gas prices surged after Russia invaded Ukraine on February 24, 2022. 3. Historical Oil and Gasoline Prices In March of 2022, oil prices hit a high of $130.50. Since then, while prices have been volatile, the trend has been down, finally dropping below $80/barrel on Sept. 26, 2022. The production cut was intended to bump prices above $90 a barrel again, which happened on Oct. 7, 2022. However, it didn’t last, as prices are now back to $85.65 a barrel. U.S. gas prices (average) are at $3.91/gallon, which is very hard on everyone’s wallet, but a little lower than $5.00/gallon seen on June 13, 2022. 4. The 2 Million Barrel per Day Production Cut How much is this? It’s about 2% of global supply. All of the OPEC+ countries have gotten behind the decision, and claim that it was prompted by economic uncertainty and had nothing to do with politics. If you look at the oil chart above, you’ll see that prices plunged during the Great Recession. With the R word appearing in a lot of economists’ crystal balls, OPEC+ has cause to be concerned about reduced demand, which can sink the price of oil. 5. World Demand & Production As we’ve discussed, oil prices are highly correlated with demand, in addition to supply shocks. In April of 2020, when the pandemic lockdowns began, prices plunged into negative territory, to -$37.93/barrel. 6. Plastic, Polyester & Petrochemicals Over half of each barrel is used for plastic, polyester, rubber, asphalt, wax (candles) and other petrochemical products. This expanded understanding of demand is key to helping us transition away from fossil fuels and high gasoline prices. Click to see a more complete list of all of the daily household products that are made from petroleum. 7. 20 Oil, Gas & Coal Companies are Responsible for 1/3 of CO2 While high prices make it hard to balance our family budget, high demand of gasoline and other petrochemical products are impacting the livelihood of many plants and animals on our home planet. Just 20 oil, gas and coal companies are responsible for over a third of the CO2 in our atmosphere. Kicking our oil addiction helps solve both problems. Click to see a list of the publicly-traded and state-owned companies at the top of the CO2 emissions list. It’s been a while since an oil spill made the headlines. The last major one was the BP Oil Spill in the Gulf of Mexico in 2010. However, oil disasters that don’t make headlines happen pretty regularly, and a health crisis has been ongoing in Cancer Alley for decades. Oil-producing countries in the Middle East are the highest per capita contributors to CO2, followed by developed world countries like Australia, Canada and the U.S. (Europeans have a much lower CO2 footprint.) Consumers of oil and gasoline are the drivers of that supply chain. It’s time that we drew the line from our own behaviors at the gas station to the source of product we’re pumping. Having that vision in full view might be the inspiration we need to kick our oil addiction. (There are solutions to long commutes that don’t involve purchasing an electric vehicle. I don’t have a car in Los Angeles, California, a town known for car culture.) If you’d like an updated oil and gas company Stock Report Card, email [email protected]. If you’re interested in being the change our planet needs to heal, and reducing your own CO2 footprint and gas bill, read The Power of 8 Billion: It’s Up to Us for the how-to guide. Bottom Line Reducing our visits to the gas station by 30% or more offers one of the best strategies for lowering gasoline prices and for healing our planet. Transportation is the biggest contributor to CO2. Demand is a big piece of the supply/demand equation. The real challenge to suppress gasoline prices today and in the years ahead is for each of us to find ways to live that are less reliant on oil, gas and other petrochemicals. The Power of 8 Billion: It’s Up to Us challenges each of us to do that and puts the power of prices at the pump firmly in our hands. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price and a complimentary private prosperity coaching session (value $300) when you register by Halloween, Oct. 31, 2022 Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Halloween, Oct. 31, 2022, to receive the best price and a private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed