|

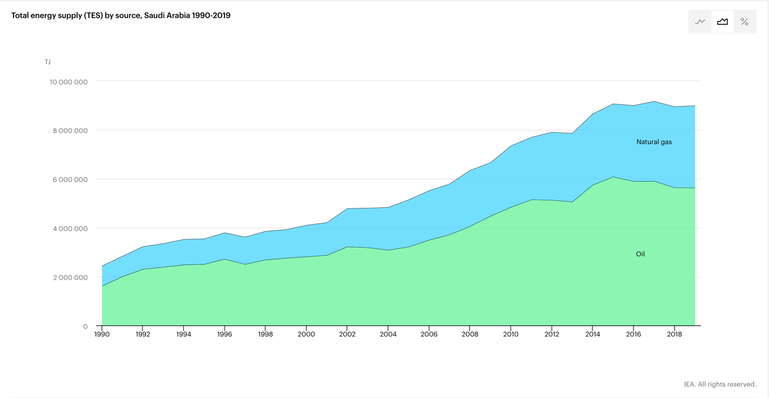

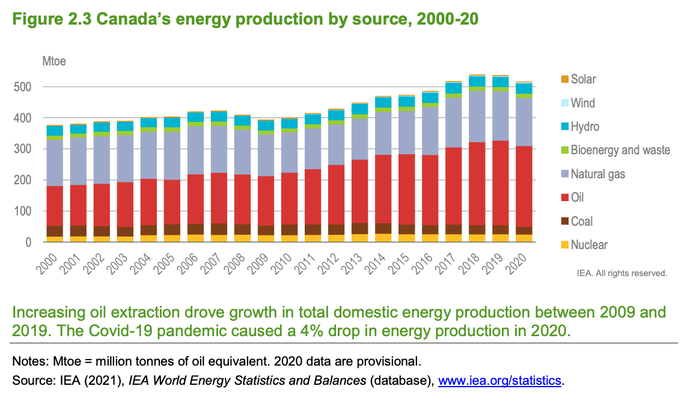

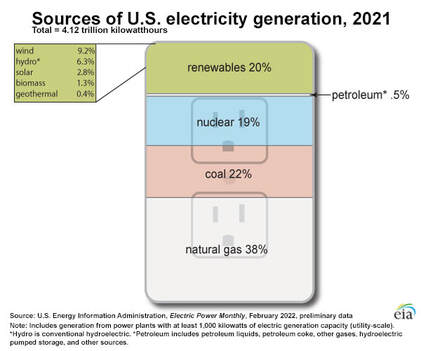

While U.S. equities have slumped into a bear market, Daqo shares have more than doubled. Daqo traded as low as $32/share over the past twelve months, and is currently at $74. The Chinese-based polysilicon manufacturer is enjoying more revenue, largely from a jump in silicon prices from $11.90/kg in Q1 2021 to $32.76/kg in Q1 2022. Production has increased as well, to 31,383 MT in Q1 2022 from 20,185 MT last year. If the 2Q 2022 projections turn out to be accurate, then production could increase 61% in the 2nd quarter (over the same quarter in 2021), with prices up at least 81% year over year. Supply chain bottlenecks sparked another jump in polysilicon prices to $37.77kg last week (source: Bernreuter). All of this bodes quite well for a company boasting the bargain P/E of just 4.91 – with a few caveats. Chinese Lockdowns It is entirely possible that the production targets won’t be met – given the Chinese COVID lockdowns of April and May. There is also the risk that Daqo, which has been identified by the SEC under the HFCAA Act, could be delisted in early 2024, unless the company meets the U.S. audit rules. (This is something that has already been priced in for 2022, but could become more important next year.) Still Daqo is benefiting from a worldwide commitment to clean energy – a commitment which could remain buoyant even as world economic growth projections weaken. Why is Solar Heating Up? The world is taking climate change seriously, and has made bold commitments to clean electricity. Solar is still a small piece of the electric grid in many countries. Saudi Arabia Sunny countries in the Middle East are still powering mostly with oil and gas. According to a new report from Bloomberg New Energy Finance (BNEF), Saudi Arabia will install an additional 7.2 GW of PV capacity by 2022, bringing the total installed capacity up to 10.2 GW. Canada Solar is just a sliver of Canada’s energy production, which is dominated by oil and gas, as well. The country should add 5.5 GW of solar in 2022, according to S&P Global. The United States The U.S. has been cleaning the grid steadily, though slowly, over the last decade. Renewable energy sources contributed just 12% to the grid in 2012. Last year, renewable energy was the 3rd highest source of power generation at 20%, behind natural gas (40%) and coal (22%). Solar accounted for just 2.8% of the total power generation. The United States is projected to increase solar energy production by 21.5 GW in 2022 – accounting for 46% of all new power generation, followed by natural gas at 21%, wind at 17%, batters at 11% and nuclear at 5% (source: EIA.gov). China China and Europe have also made strong commitments to renewables, including solar. In the first quarter of this year, China’s solar power generation investments increased three-fold, to $4.33 billion. Europe Europe’s commitment to clean energy has become acute. As stated in the RePowerEU Plan on May 18, 2022, “There is a double urgency to transform Europe's energy system: ending the EU's dependence on Russian fossil fuels, which are used as an economic and political weapon and cost European taxpayers nearly €100 billion per year, and tackling the climate crisis.” Which Companies Could Benefit the Most? Any solar company with a European, Asian and North American presence should do well in 2022. The high cost of polysilicon plays to the advantage of Daqo, with a net profit margin of 51% in 2021, and against solar panel manufacturers, many of which struggle to maintain a net profit margin in single digits. Email [email protected] with Solar Report Card in the subject line to receive your own copy of the detailed data. China’s Jinkosolar is one of the world’s leading vertically integrated solar manufacturers. The company enjoyed revenue growth of 85% in the 1st quarter of 2022 (compared to one year ago), and anticipates a similar target in the 2nd quarter. The company is trading near a 3-year high, at $75/share, with a lofty Price-Earnings ratio of 45. Renesolar has projects around the world, in the U.S., China and Europe. The company reported terrible earnings in the first quarter of this year, with revenue down -85%. The 2nd quarter should pick up a little, with revenue projected to come in at $13-16 million. That would be a significant sequential improvement over 1Q revenue of just $3.5 million. However, it would still come in under 2021’s $18.5 million revenue in the 2nd quarter. However, if the 2022 forward outlook is on target, Renesolar could rack up $100-$120 million in sales, with the bulk of that – $80-$100 million – coming in the last half of the year. At the high end of the target range, the annual revenue jumps up by 50%, from $80 million in 2021 to $120 million this year. Investors are forward-looking, so it is possible that even with a ho-hum 2Q earnings release in the first week of September, Renesolar’s share price could start to recover. The company is currently trading close to an all-time low of $5.06/share, down from a 3-year high of $36. Like Jinkosolar, the Renesolar P/E of at 81 appears elevated even at the lower price, largely due to subdued profit margins. The Macro Economy A rising tide lifts all ships, and a sinking tide can ground them. As the world’s economy slows and the risk of a recession flashes warning signs, it’s possible that even great companies in a solid industry can see their share price sink. On the other hand, we’ve also seen that great companies that were previously preyed upon by short sellers, like Daqo, can double in record time, even when the general market trend is down. Bottom Line Our sample pie charts are overweighted safe by 20%. So, be sure that you are properly protected and diversified in your nest egg. We also include hot industries in four of our 10 sample diversification allocation. Clean energy, particularly solar, could be a bright spot in at least one of those hot slices. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price and a free 4-part Protect Your Wealth Now webinar that will get you started immediately when you register before July 15, 2022.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed