|

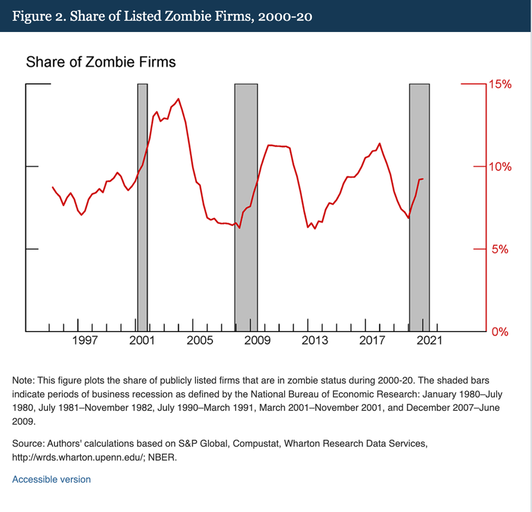

It’s not all that surprising that after a pandemic forced us all to stop traveling and having vacations, there are a few companies in travel and hospitality that are in trouble. This is exacerbated even more by the amount of debt in the world today (which was already heightened before the pandemic). Rising interest rates make it more expensive and difficult to borrow money, particularly for the most troubled firms. What is a zombie company? It is a company that is so heavily indebted and so weakened by revenue losses that they are having difficulty making even the interest payments on their debt service. The Federal Reserve describes such firms as “highly leveraged and unprofitable.” In a July 30, 2021 report, it was noted that zombie firms were concentrated in retail and manufacturing. The pandemic severely damaged the travel and hospitality sectors. Many of the companies are in junk bond status, with revenue that is far below 2019 levels. The question on the minds of policymakers is whether or not travel, work, and lifestyle have suffered structural shifts that will force some of these firms to rightsize and/or restructure operations based upon lower expectations of revenue. Work from home, Zoom conferences and even climate action have impacted travel choices. Will that remain the case as the world moves out of a pandemic mindset and into living with the risks of COVID as an endemic virus? The IMF pointed out recently that governments are going to have to decide which firms to support, which to restructure and which will have to liquidate. In an IMF blog on Feb. 23, 2022, Ceyla Pazarbasioglu and Rhoda Weeks-Brown wrote: Shoring up these systems is critical as there are shortcomings in many important areas at present and countries may need to tackle many cases at once. There is not much time to prepare… Governments were right to support firms financially through the worst of the pandemic. They recognized the initial large premium on speed over precision and provided rapid support without distinguishing between enterprises that could be saved and those that should not. Now policymakers should calibrate financial support and direct it efficiently to companies that are in need. They should also be prepared to restructure or liquidate badly scarred firms. How Do You Know Which Companies are Zombie Firms? If you have a 401K, an IRA or any kind of investment portfolio, now is the time to know what you own. As you can see in the chart below, zombie firms become more common and problematic during recessions. Stock market downturns precede recessions. Zombie firm implosions increase uncertainty and investor anxiety, and accelerate selling. If you look at a chart of the downturns in 2000 and 2008, each major slide was associated with a bankruptcy, bailout or restructuring. 5 Factors for Identifying The Most Vulnerable Companies

And here is more color on each point. 5 Factors for Identifying The Most Vulnerable Companies 1. The Higher the Dividend, the Higher the Risk If any company is offering you an interest rate above 3%, you are taking on risk to earn a very small yield. This is heightened with higher interest rates, particularly when they are coupled with longer terms. If you own bonds, bond funds or a private placement investment, it’s time to know what you own. Shorter terms and high creditworthiness are essential as we cycle out of free and easy money and into more expensive, tighter policies. 2. Revenue is Substantially Lower Today Than in 2019 Airlines, casinos, hotels and even cruise ships are showing outstanding year-over-year revenue growth. However, when you compare today’s sales and net losses with 2019, it becomes clear that extreme rightsizing is going to be needed to survive, unless there is a massive increase in travel and sales. The Retail Apocalypse continues to weigh down the economy, particularly as the Work-from-Home trend limits the need for business attire. 3. Highly Leveraged and Unprofitable The 2020 and 2021 losses in the airlines, cruise lines, commercial real estate and casinos were enough to wipe-out most of the companies had there not been government support. The airlines, cruise lines and casinos are all rated as speculative (junk bonds). If you’d like to see the Stock Report Cards of key companies in these industries, just email [email protected] with Zombie Stock Report Cards in the subject line. 4. The Firm is Unable to Make Key Interest Payments The rating agencies offer details on which companies are coming up on key payments, and even their ability to meet these. You can also check the company’s cash on hand in their earnings reports. The interesting thing about some beleaguered, low-rated firms is that some still use funds to repurchase their own stock. MGM Resorts repurchased $1.75 billion shares in 2021. This is just one of the reasons why you don’t use a rising stock price as your due diligence analysis of the fiscal health of a firm. 5. Larger Firms are More Likely to Be Rescued Than Smaller Companies During and after the Great Recession, 489 banks failed. FDIC-insured depositors simply found a new company name on their bank statements. However, investors were keenly aware of the losses that their stock and bond investments suffered from holdings in Lehman Bros., Countrywide, Washington Mutual, Merrill Lynch, Bear Stearns and the many smaller, community banks that failed (and were absorbed by larger firms). Despite the sins of Boeing, many of which were outlined in the new Netflix documentary Downfall, the company is more likely to be rescued than the airlines, which have experienced a cycle of restructuring in all of the 21st Century recessions. Boeing is a Dow Jones Industrial Average component, just as AIG was prior to its bailout in 2008. Bottom Line Zombie firms could begin to usher in stock market weakness. The typical market correction can be stretched over a period of 18 months or longer, with the market dropping and then stabilizing at a new low each time a large company fails. The top of the market in the Dot Com Recession was March 2000, with Dot Com stocks bottoming out with losses of -78% by October of 2002. The Great Recession started from a high in October of 2007, and was down -55% by March of 2009. Because market dives tend to be a series of unfortunate events over an extended period rather than an instant crash, your best strategy is not jumping all in or all out. Rather, make sure that you are safe, protected, hot and diversified, and that you know what is safe in a world where fixed income assets, like bonds, can lose money and are high-risk, negative-yielding and potentially illiquid. We’re overweighting 10-20% safe in our sample pie charts for 2022. Wisdom is the cure. It’s time to step off the Buy & Hope Wall Street rollercoaster and into time-proven, 21st Century systems. They are easy as a pie chart.  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Monday, February 28, 2022, to receive the best price. Click for testimonials & details. Other Blogs of Interest Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed