|

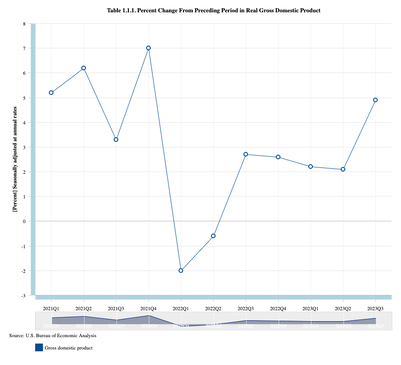

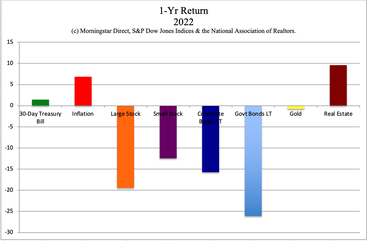

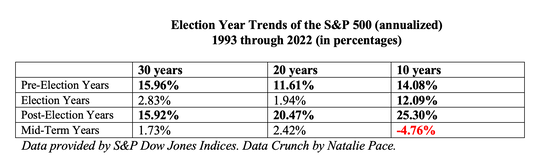

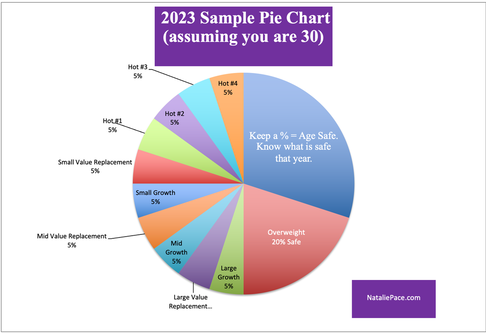

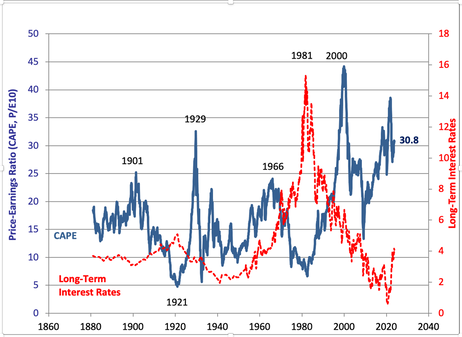

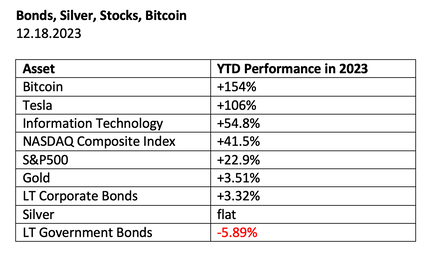

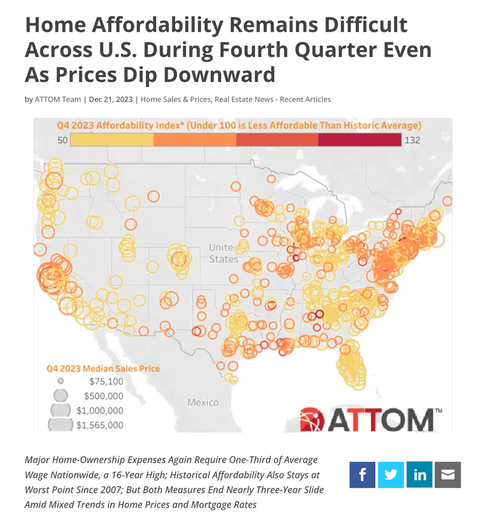

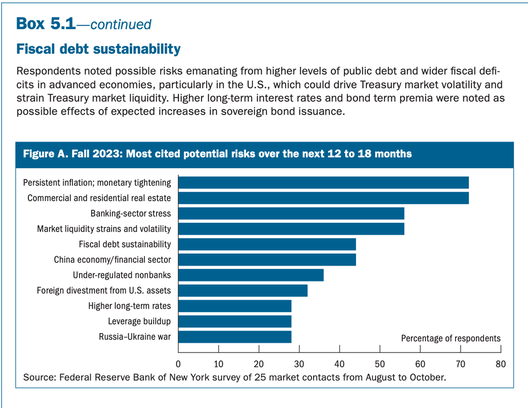

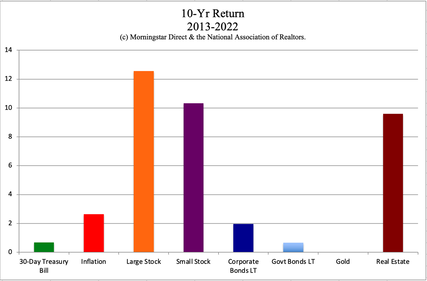

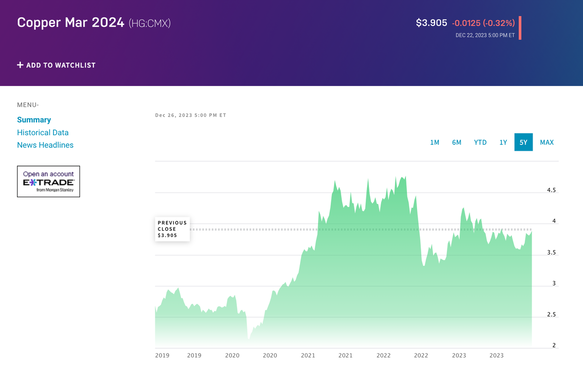

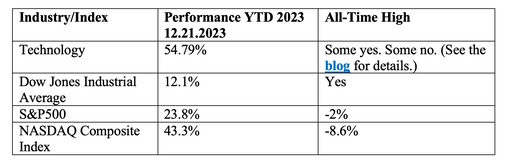

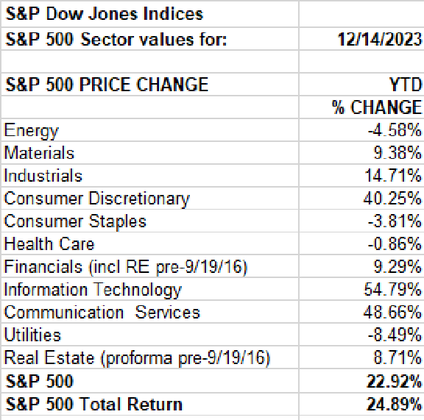

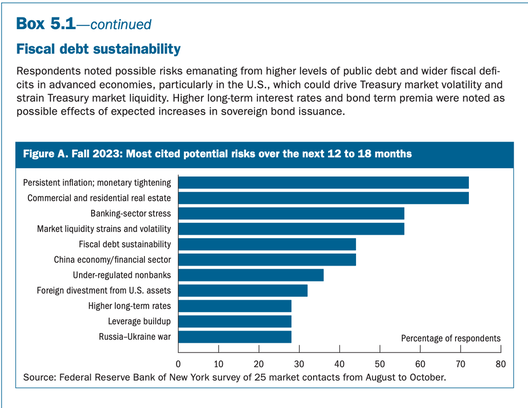

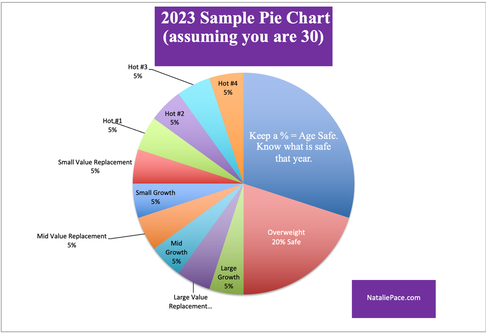

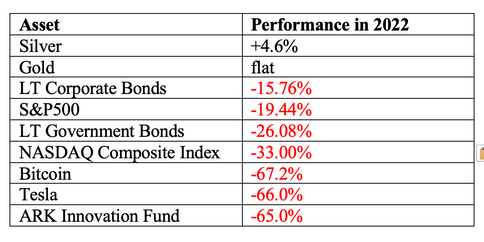

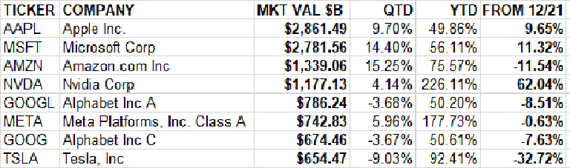

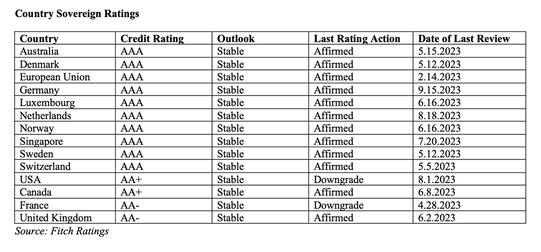

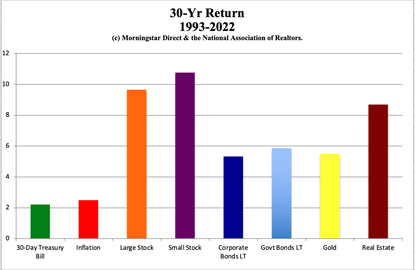

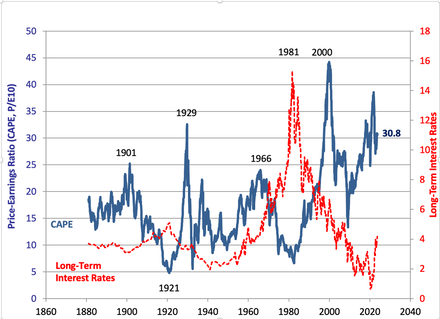

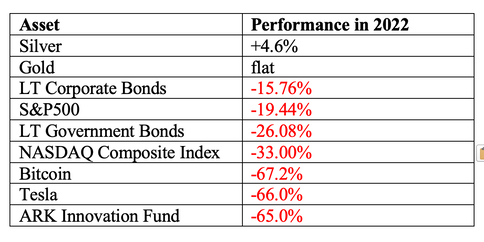

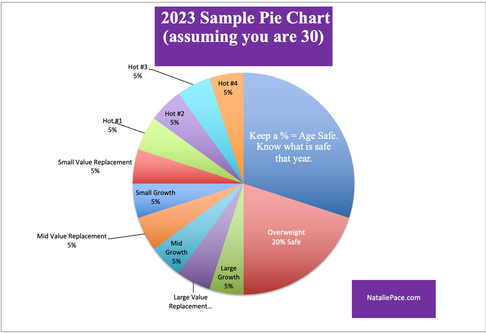

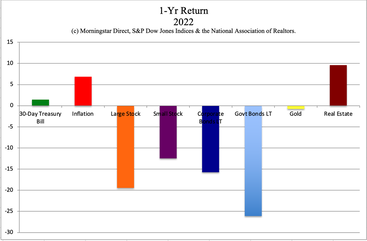

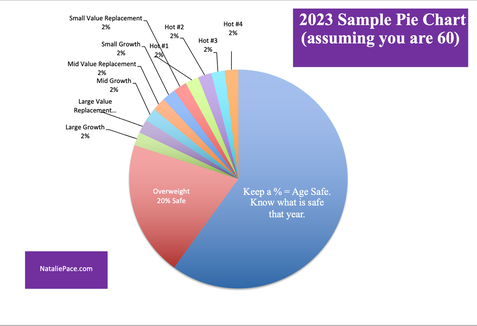

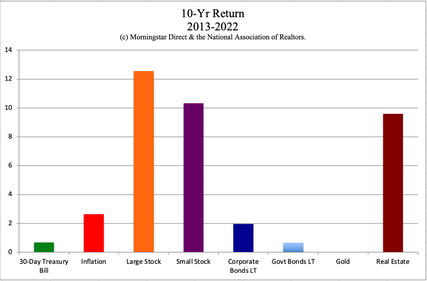

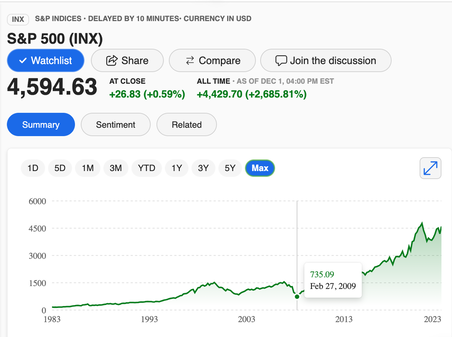

Crystal Ball 2024. Will the Election Year Roar Like the Pre-Election Year Did? Be sure to watch my Crystal Ball 2024 videoconference and my interview with Howard Silverblatt, the senior index analyst of the S&P500. Each year we’re able to see just how far off from, or close to, reality the predictions are. 2023 was a lot stronger than most economists thought it would be, even with five very high-profile bank failures and a USA credit downgrade by Fitch Ratings to AA+. The Wall Street whales decided to stay in stocks (even if many are overvalued). Consumers kept spending. The White House kept lending a hand to student loan borrowers and homeowners who were behind on their mortgage. The Federal Reserve Bank loaned money to keep more banks from failing, and to offer some fuzzy math to keep the bond losses off the earnings reports. All of this financial engineering turned a year that was expected to see a recession into one with an impressive stock rally of 24.9% in the S&P500, as of Dec. 26, 2023. While stocks were simply great in 2023, we can see that the devilish details tell a far more complicated story. Sometimes the headlines we are drawn to, and even the officially declared outcomes, can be misleading. For instance, a recession was predicted for 2022. The U.S. experienced two quarters of economic contraction, which is commonly considered to be a recession. However, the NBER never made it official. So, technically, there was no recession in 2022. However, even without the official label, the S&P500® dropped -19.44% in 2022. Bear markets are also hallmarks of recessions. So 2022 was recession-like in almost everything but name. So what is predicted to happen in 2024? Will the 2023 stock rally continue? Will bonds recover, if interest rates get cut later in the second half of the year? Will housing ever become affordable again? Should you pour cash into safe havens? Which will be hotter: oil or the New Oil, copper? Here are the assets we will cover in this blog. Stocks Bonds Housing Commercial real estate Crypto Gold and Silver Copper: The New Oil And here is more detail on each point. Stocks The Conference Board still thinks there will be a mild recession in the 1st and 2nd quarters of 2024, starting with a contraction of -0.7% in the 1st quarter. While some economists believe that the infallible Feds will achieve the elusive soft landing without a recession, most forecasts call for a slowdown in 2024, from 2.4-2.6% GDP growth in 2023 to 0.9-1.4% in 2024. What does that mean for stocks? As long as there aren’t any bank failures or high profile bankruptcies, stocks could stay buoyant, though lackluster. As you can see in the election-year performance chart below, election years tend to be quite disappointing when compared to the pre-election year Wall Street rally. (The 10-year election year returns are helped by the pandemic 2020 performance of +16% in the S&P500. However, it took printing up $4+ trillion to get us there – something that won’t be happening in 2024.) There are quite a lot of federal guard rails in place to prevent the economy from going off track, including the Bank Term Funding Program, a Veterans Administration Moratorium on Foreclosures, a Homeowner Assistance Fund, an Emergency Rental Assistance Program and a 12-month on-ramp period for student loan borrowers. All of this financial support and a pause on interest rate hikes could keep investors happy to hold on if a mild economic contraction occurs in the first half of 2024. The Federal Reserve Dec. 13, 2023 Summary of Economic Projections signaled up to three rate cuts in the second half of the year – a carrot that could keep investors interested. A robust rally would be a surprise, however. Also, there is a divergence between value and growth, with particularly poor performance in older companies that are laden with excessive debt. I addressed this in greater detail in my blog, “The Underperforming Dow Jones Industrial Average.” (Click to access.) Many companies in the DJIA lost value in 2023. The spectacular performance of Microsoft, Apple, Intel, IBM and Salesforce is responsible for the gains in the DJIA, with the Magnificent 7 leading the index to a new all-time high last week. In our sample pie charts, we have been leaning into the Magnificent 7 in our hot slices as well as in the large cap growth slice. We’ve also been using value replacements, which allow us to diversify by country, some of which offer higher credit quality and yield than the DJIA. (We spend one full day on nest egg strategies at our New Year, New You Financial Freedom Retreat.) Volatility will remain a risk with stock prices being so elevated. The massive swings in share prices over the past three years have been quite a rollercoaster. Many Internet and Artificial Intelligence companies, like Nvidia, are being valued by what they should be worth years from now. Nvidia is a $1.22 trillion dollar company, with only $27.5 billion in annual net profits. With a price-earnings ratio of 64, one earnings report that is less than spectacular can bring the share price crashing back to Earth. Tesla, another member of the Magnificent 7, is still down -37% from its all-time high set on Nov. 5, 2021. As you can see in the chart below, the only two times that stocks have been more expensive than they are today were in the Dot Com Recession and the Great Depression. We know what happened in the Great Depression from our history books. The Dot Com Recession saw the NASDAQ Composite Index plunge by -78% and take 15 years to recover. Buying high is rarely a good idea. If you haven’t rebalanced your nest egg recently, now would be an important time to see and capture all of the gains enjoyed in 2023, while making sure you are properly protected and diversified. Bonds Bonds are tricky. On one hand, we can finally earn a safe(ish) 5% yield. That translates to $50,000 in interest on a million dollars. However, it is important to keep the terms short and the creditworthiness high. Otherwise, we risk losing principal. As you can see in the 1-year performance chart at the top of this blog, long-term government bonds lost even more than stocks did in 2022, at -26.0%. Long-term government bonds lost another -5.89% in 2023. There is an inverse relationship between bonds and interest rates. When the Federal Reserve raises interest rates and tightens monetary policy, bond values plummet (as seen in 2022). When interest rates are cut, bond values can increase (perhaps recovering some of the losses of 2022). Since interest rates might start getting cut in the 2nd half of 2024, bond broker/salesmen might suggest just hanging on or even extending duration. However, due to low credit quality, excessive debt, and the projection that interest rates will remain in the 4.6% range in 2024, a better plan might be to keep the terms short and the creditworthiness high, while being careful of where and how we might consider extending duration by a few years. (Some of my clients have been sold into junk bonds with a maturity date of 30-45 years out – well beyond their own expiration date.) It’s important to do a forensic dive into the safe side of our wealth plan, to read the fine print, and to know what is truly at risk, rather than having blind faith that someone else is protecting our future. Housing The housing market is pretty frozen right now. Interest rates combined with high prices have made buying a home unaffordable in almost every county across the US, with homeownership expenses eating up one-third of wages (source: AttomData). There have been very liberal loan modification and mortgage/foreclosure assistance program in play since the pandemic. This has been a big factor in 5.2% of mortgages being underwater – costing more than the value of the home. (The loans mods put all of the missed payments and fees into the new loan – which is often puts homeowners on the line for more than the value of the home.) This has put some neighborhoods at risk of price declines, including clusters in California, New York, New Jersey and Illinois (source: AttomData). Millennials are ready to start families, and would rather buy a home and build up equity than make the landlord rich. There is a lot of pent-up demand and frustration. Because qualified borrowers are scarce, a lot of people who might want or need to sell a home are not putting it on the market right now. That makes supply tight (even though the underwater mortgages and dried up government support is creating more shadow inventory). This has real estate broker-salesman, including Barbara Corcoran, who owns a real estate company, urging potential homebuyers to buy now even though interest rates and home prices are high. The rationale is that once interest rates get cut, prices are going to rise even higher, due to the HENRYs who are hungry to build up wealth. There certainly are ample predictions for rate cuts in 2024. However, the projections are still calling for a Fed Fund rate of 4.6%. That’s not going to make mortgage loans affordable, especially with home prices still at an all-time high. For those who are really chomping at the bit to buy a new home there are certainly strategies that one can look into, including the shadow market. It’s also very important to check out our 10-point homebuyer checklist before making any binding commitment. I go over some of these strategies in my recent real estate videoconference. The checklist is also located in the Real Estate section of The ABCs of Money, 5th edition. One more word of warning, ex-pat purchasers of Portugal real estate are getting desperate. If you get approached to buy a condo for a great deal with a price cut, don’t take the bait before reading our important alert on Portugal real estate. Portugal has changed the laws for expats. There are a lot of people who got out over their skis, who are getting desperate to offload and trim back on their exposure. Commercial Real Estate Commercial real estate is one of the areas of risk for the economy, as you can see in the survey below, conducted by the Federal Reserve Board. The Treasury Department and Federal Reserve are urging lenders to work with creditworthy commercial real estate developers, rather than just force them into bankruptcy restructuring. The Bank Term Funding Program offers the financial assistance for banks to hold out for another year. However, those CRE companies that are in the most trouble, with very high debt and very low occupancy rates, continue to pose a risk to this distressed industry and the banks, insurance companies, and pension funds that have loaned money to them. As just one example, WeWork filed for Chapter 11 on Nov. 7, 2023. Learn more about CRE in my blog. Cryptocurrency Crypto was the top performer in 2023. Bitcoin started the year at $16,532. As of Dec. 26, 2023, Bitcoin’s value had jumped to just under $42,372, for a return of 156%. This is still -38.6% under the all-time high of $69,000 set on November 21, 2021. Due to the extreme volatility of cryptocurrency, it’s a better idea to include crypto as a hot slice in our pie chart system than it is to put all of our cash into a wallet or Coinbase account. Cryptocurrency is not being used as a currency unless we’re laundering money or buying something illegal. For the most part, it’s a trading platform where whales have been gobbling up Main Street minnows. Our pie chart system with regular rebalancing helps us to be on the right side of the trade, along with the whales, rather than getting drowned in the wake of their tsunami selling. Click over to our blog to learn more. Gold and Silver Gold and silver are a bit like cryptocurrency. When people lose faith in the U.S. dollar, they want a safe haven. When stocks are high, people tend to chase the performance of equities, and ignore old school assets like gold and silver. We’ve effectively been in a secular bull market since the bottom of the Great Recession. Soaring stocks and competition from crypto are a few of the reasons why gold and silver have been such poor performers over the last decade. The U.S. received a credit downgrade from Fitch Ratings on August 1, 2023. However, it did not register with investors at all. When S&P Global downgraded the U.S. on August 5, 2011, both gold and silver rocketed up to their all-time highs. The jury is still out whether or not Gen Z and Millennials will ever get excited about gold and silver. Even with all of the negative headlines of crypto in 2023, cryptocurrency has had an impressive rally. Younger investors love meme stocks. So, if things get worse than expected in the next recession, or if some exogenous shock shatters the sheen of stocks, and gold or silver prices start to soar, they could show up at the party. Gold and silver, like cryptocurrency, see wild swings of valuation. This takes them out of the realm of currency, which is intended to stay constant and safe. You can’t have a dollar that’s worth $69,000 one year and $16,000 the next. These “safe haven” assets have proven to be unstable and even unsafe, particularly if you invest with someone who commits fraud (more common in speculative industries like these). We put our gold and silver into our hot slices. Regular rebalancing will help us to buy low and sell high. It’s very important to remember that the winters of gold and silver can be very long. It took gold a quarter of a century to regain the sky-high gold prices seen in 1980. Copper: the New Oil Copper is essential to the clean energy revolution that is taking place. That has led Goldman Sachs to call it the “new oil.” As you can see in the chart below, copper prices are solid – not as high as the pandemic, but certainly at an attractive price for producers. That is one of the reasons we have listed the copper-rich country of Peru as one of our countries to diversify into. The ETF is one that offers a better yield than most U.S.-based equity funds. Conversely, oil and petrochemical companies are largely losing revenue. The shift to electric vehicles is curtailing demand – particularly in China. Learn more in our blog on the Underperforming DJIA. Bottom Line It’s easy: · To be seduced by headlines when something gets super hot, · To want to make up losses when something tanks, like bonds have, and, · To be complacent when stocks are high. However, a better strategy is to be properly diversified, to rebalance regularly, and to know what is safe in a Debt World, where there is simply too much leverage. It’s time that we all learn the life math that we should have received in high school and college, rather than having blind faith that someone else is protecting our wealth for us. Most managed plans do with the markets do. So they’re going to look pretty great right now, with stocks at an all-time high. However, the lessons of 21st-Century recessions, where most people lose more than half of their wealth, and then take years to crawl back to even, should sober us up, and inspire us to learn these simple, time-proven 21st Century strategies that earned gains in the Dot Com and Great Recessions and outperformed the bull markets in between. For daily money tips, follow me at @nataliewynnepace on my Instagram Broadcast Channel. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Underperforming Dow Jones Industrial Average. Full of Fossil Fuels and Forever Chemicals.21/12/2023

The Underperforming Dow Jones Industrial Average. Full of Fossil Fuels and Forever Chemicals. In last week’s blog, we talked about the Magnificent 7 being largely responsible for the gains in 2023 – yes, just 7 stocks. The technology-rich NASDAQ Composite Index was far and away the winner on Wall Street this year. Meanwhile, energy, consumer staples, healthcare and utilities are all down. The Dow Jones Industrial Average was the laggard of the 2023 pre-election year rally. This has a lot to do with the older companies in the index that are laden with legacy debt and having to borrow money at a high interest rate, all while experiencing a slowdown in revenue growth. (Email [email protected] if you’d like to receive a Stock Report Card of select Dow components.) However, there is another issue with the “leading blue chip” index. It has a lot of old-school companies that are in the business of fossil fuels, either as a producer or as a top customer – something the world agreed to transition away from at COP28. Fossil Fuels in the DJIA Email [email protected], if you’d like to receive our chart of the 30 companies of the Dow Jones Industrial Average, along with some points about their respective fossil fuel dependency. A lot of the technology companies of the DJIA (Apple, Cisco, IBM, Intel, Microsoft and Salesforce) have goals of powering with renewables 70-100% by 2025. However, 13 of the 30 companies, 43.3%, are leading producers or customers of oil, gas, plastic and other petrochemical products. Here are a few examples…

Dow Inc., 3M, Chevron, Nike, Honeywell, Johnson & Johnson, Procter & Gamble, Verizon, and Walgreens are some of the 30 companies of the Dow Jones Industrial Average that are losing value and dragging down the performance of the index. The spectacular performance of Microsoft, Apple, Intel, IBM and Salesforce is responsible for the gains. Oil/Gas & Chemicals Stock Report Card All of the oil and chemical companies I analyzed have lower revenues this year. Most of the chemical companies have elevated levels of debt. Due to the toxic nature of their products, and the deleterious effects they have on water and soil, many chemical companies face ongoing fines and lawsuits. Email [email protected] if you’d like to receive a Stock Report Card of chemical or oil/gas companies. Palestine, Ohio Toxic Train Derailment The toxic oil-based petrochemicals that were spewed across the air, soil and water of Palestine, Ohio on February 3, 2023, included the following. If you look at what the toxins are used to make, you’ll notice that they touch almost every aspect of our lives, from what our things are packaged in, to what we wear and even our laundry detergent. 3M and Dow Inc. (both in the DJIA) are leading manufacturers of these petrochemicals.