|

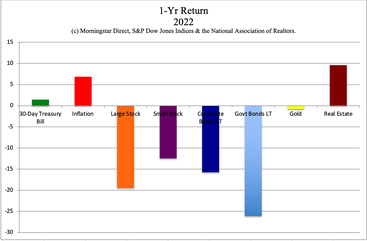

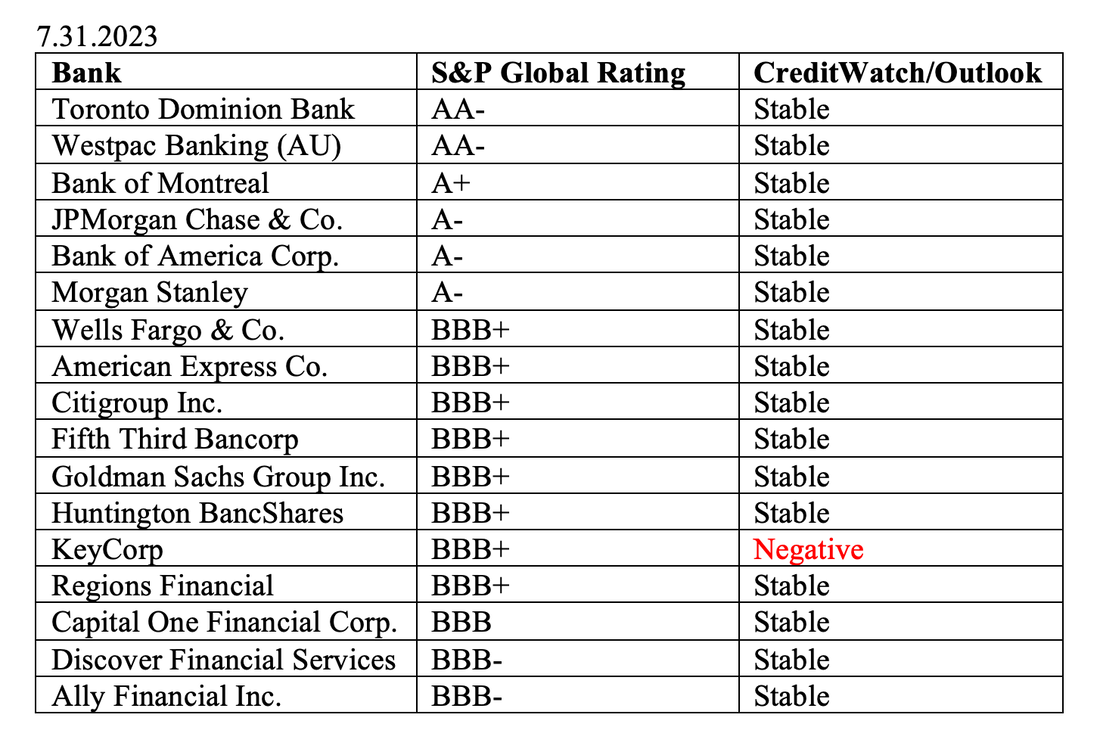

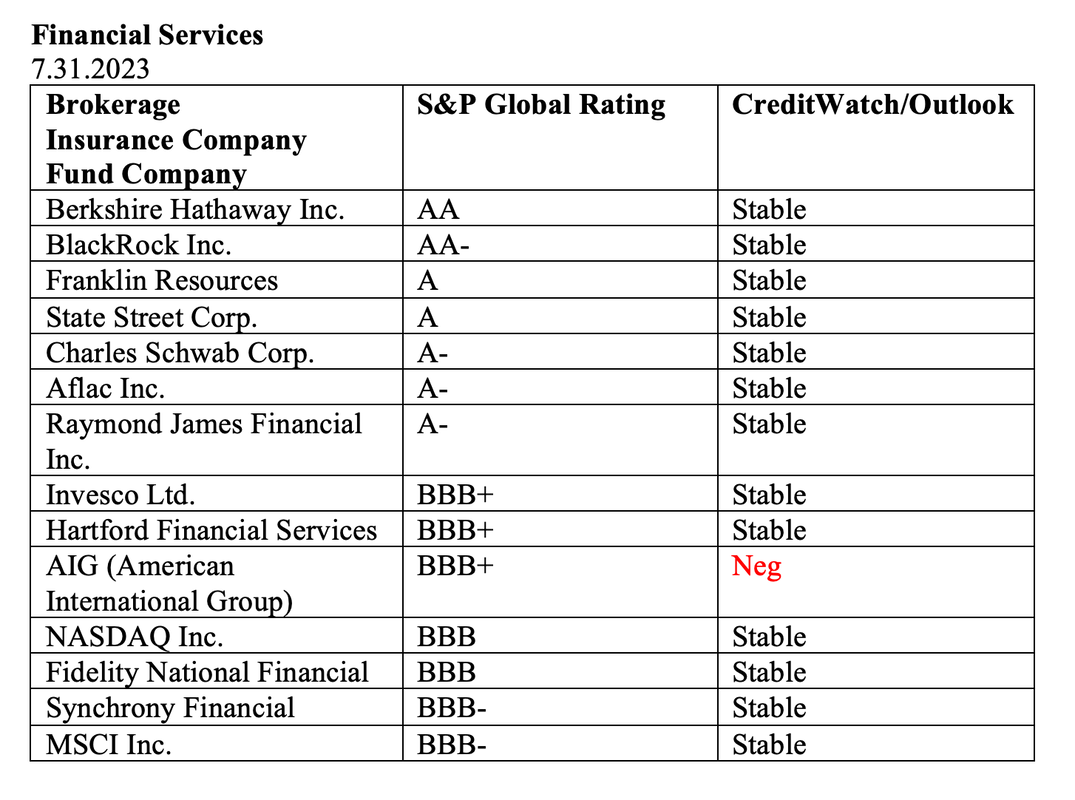

Bank of America Has $100 Billion Paper Loss on Bonds. Upstart Holdings Revenue Drops by 63%. Is the banking crisis really over? (No, the Heartland Tri-State Bank of Kansas failed last Thursday, on July 28, 2023.) Why does this matter to you? What can/should you do about it? Here are the things we’ll cover. Bond Losses Affect All of Us Upstart Holdings PacWest, Heartland Tri-State Bank and Community Banking Faith and Creditworthiness Is Your Bank Close to Becoming a Junk Bond? A Very High-Profile Credit Downgrade Be Careful of Outstanding Earnings Reports in the Financial Industry And here is additional information on each point. Bond Losses Affect All of Us Even if we are not a Bank of America customer or live in another country, the bond losses are important to know about and factor into our own wealth plans. (If you are a Bank of America client, look at the credit scores and leverage of the other banks before switching.) Why? Because most of us have bond losses in our own retirement plan (even those of us who live outside of the U.S.). The safe side of our wealth plan, where bonds traditionally are placed, is not supposed to lose money. That puts all of us at greater risk in the next recession, if we don’t take steps to protect our wealth now. Our team has been warning for over a decade that we weren’t being paid to take on the risk of long-term bonds. Many of these holdings have terms of 35 years or more, meaning we don’t get our money back until well beyond our own expiry date. That’s why it’s vital to understand exactly what we own and why, not just on the at-risk, stock/equity/fund side, but also on the “safe” side of our wealth plan. (Join us at our Oct. 7-9, 2023 Investor Empowerment Retreat or consider receiving an unbiased 2nd opinion from me personally through our private coaching. Email [email protected] for pricing and information.) Upstart Holdings With regard to the Upstart Holdings challenges, many people are still relying upon Reddit, social media ads, emails, get rich quick schemes and hot tips from friends and family – hoping to “win” some money during the current Wall Street rally. Chasing gains, hot tips, Hail Mary’s and other desperate acts are more likely to lose money than to make us millionaires. Upstart Holdings’ core business model of personal and auto loans isn’t working well in the current interest rate environment. Many people don’t want to borrow at the current interest rates, while others no longer qualify. The company’s revenues are down -63% year over year. The net loss in the most recent quarter was $129 million, and Upstart has been in the red for over a year now. Upstart Holdings was a meme stock whose price soared to $400/share in October of 2021, only to crash to a low of $12 merely a year later. It’s not surprising that someone is bragging about earning some gains on Reddit, perhaps in the hopes of generating another pump-and-dump opportunity. If you have holdings in this or any other meme stock or individual company that has lost so much, you might consider attending our retreat and learning how to invest in a time-proven strategy, rather than relying upon Shoot the Moon hopes that are thin on fundamentals, and are riding high on hot air. YOLOs can be fun when they work, but they shouldn’t be the entire plan. HODL is a last-century strategy that doesn’t work on today’s Wall Street rollercoaster. PacWest, Heartland Tri-State Bank and Community Banking Community banks are in distress. As the National Association of Realtors’ chief economist, Lawrence Yun, wrote on May 3, 2023, “The fast rate hikes by the Fed have upended the balance sheets of many small regional banks. They are becoming zombie-like banks, unable to lend even to good businesses as they are more concerned with balance sheet shuffling for survival.” Bond losses, uninsured deposits, rate hikes and the recent bank failures have anyone with cash feeling a bit jittery. So far, we’ve only seen four banks fail in 2023, with the Heartland Tri-State Bank of Kansas being the most recent (on 7.28.2023). Headlines are so focused on Wall Street gains that you might not have even heard there was another bank failure last week. PacWest took a significant hit in their most recent earnings report, with their revenue down by -84% year over here and a net loss of $207 million. The bank lost $1.2 billion in the 1st quarter of 2023, and has been cash negative for more than a year. They just completed a merger with Banc of California to strengthen their balance sheet, and are trying to reassure depositors that 81% of the money is FDIC-insured. However, that still leaves $5.3 billion uninsured. It’s important for all cash depositors to realize that the fine print is key. There’s a loophole in the coverage for all non-banks, including brokerages that promise FDIC-insurance. (Click to learn more about that.) The special exemption that was made for the Silicon Valley Bank uninsured depositors is unlikely to be repeated. (There was no mention of non-insured depositors being rescued in the two most recent bank failures.) The FDIC fine print hasn’t changed. Faith and Creditworthiness While 2Q earnings reports generally looked pretty good in the big banks, it’s important to understand that a lot of that relies upon financial engineering and government support. There are policies to help banks that have exposure to commercial real estate, a Federal Reserve facility that erases bond losses for a year (the Bank Term Funding Program), and a Homeowners Assistance Fund that saved 318,000 homes from foreclosure (with a price tag of $3.7 billion). In other words, government bailouts, not financial restraint or conservative underwriting practices, are largely responsible for the slowdown of bank failures. The impressive, recent rally in financial stocks has a lot of phantoms in the wings, including a spike in corporate bankruptcies. The banking industry is based upon a presumption of faith. When faith surrenders to fear, you get a run on the banks, which could cause a bank to fold, since banks have a small fraction of depositors’ cash on hand. (Watch It’s a Wonderful Life for a good tutorial on this.) Is Your Bank Close to Becoming a Junk Bond? So how much faith should we have in US banks? And are there banks in other countries that are more creditworthy? In February of this year, before the bank failures (and for years in my books and at our retreats), we warned that we were underweighting the U.S. financial industry. Over half of the S&P500 is at or near junk bond status, including a lot of U.S. banks, insurance companies and brokerages. It’s important to know that First Republic Bank was rated A- the week before it had to be rescued on March 16, 2023 (by a consortium of 11 large banks and a collective $30 billion buffer). On May 1, 2023, First Republic Bank was swallowed up by JP Morgan. (Noninsured depositors weren’t offered coverage from the FDIC.) So, First Republic Bank went from investment grade to failing without any warning. As you can see in the charts above, there are a lot of banks, insurance companies and brokerages that are rated BBB – the lowest rung of investment grade. A downgrade would make them a junk bond. There is no advance notice of the rating action. As long as people continue to pay their mortgages, car loans and credit card debt, and the charge-offs remain low, then we might get through a few more quarters of good bank earnings reports. However, it’s hard to imagine what will get these credit scores up and the debt/leverage more manageable, when GDP is expected to be less than 1.8% over the next few years (at best, assuming there is no recession) and there has been a surge in corporate bankruptcies in 2023. Financials have had a great recovery over the last quarter, mostly as a result of “Don’t fight the Fed” mentality on Wall Street. Things have stabilized (outside of the Kansas bank failure last Thursday) since the high-profile Silicon Valley Bank, Signature Bank and First Republic Bank failures of March and May. However, that doesn’t mean that all financial companies are out of the woods. We’re still underweighting U.S. financials in our sample pie charts. There are banks in other countries with higher credit ratings and higher yields. (Click to access that blog.) Join us at our Oct. 7-9, 2023 Financial Freedom Retreat for additional strategies and time-proven systems to employ in your wealth plan. (We spend one full day on What’s Safe.) A Very High-Profile Credit Downgrade Meanwhile, the U.S. could face a very high-profile credit downgrade, which could be coming in the next few weeks. Fitch Ratings has the USA AAA sovereign rating on a Negative Watch. Click to learn more in my blog. This would be negative for stocks and bonds, and potentially positive for precious metals and perhaps even crypto. Be Careful of Outstanding Earnings Reports in the Financial Industry First Citizens Bancshares assumed the assets and liabilities of Silicon Valley Bank. As a result of that one time event, their year-over-year revenue growth looks stunning, at 641%. However, it comes with a great deal of risk and a very low credit rating (BBB) with a negative outlook from S&PGlobal (click to read their commentary). So, even if you have learned our Stock Report Card system, you need to understand where the revenue gains are actually coming from, and be wary about whether or not those gains will be repeated in the next quarter, or if it was a one-time event, or if the liabilities are going to be a drain on profits and cause cash burn and losses in the months ahead – particularly if the economy weakens (as it is predicted to do). If you would like a copy of our updated Bank Stock Report Card, just email [email protected]. Bottom Line The Federal Reserve and government support are making things look a lot better for banks, credit unions, insurance companies and brokerages than they really are – at least temporarily. As we learned from Silicon Valley Bank, Signature Bank, First Republic Bank, and now the Heartland Tri-State Bank, the headlines come out of nowhere. If we wait for the headlines, it’s too late to protect our wealth. That is why we spend one full day on what is safe at our investor empowerment retreats. Earning a safe yield is tricky, and making sure that your deposits are federally insured is, as well. Tricky, but doable, once you learn time-proven, 21st Century strategies that are literally easy-as-a-pie-chart. Blind faith that someone else is protecting our wealth for us (like our financial planner) is a terrible idea right now because most managed plans simply do what the market does. That means that most of us already have a great deal of losses in bonds (where we’re not supposed to lose principal), and could be subject to losses in stocks in the event of another bear market or recession. Reading the fine print can be very confusing – if you’ve never had it broken down before. However, financial wisdom is cumulative. There are certain years when protecting our wealth is our most important job, worth far more than we can earn in many years at the office, punching a clock… Wisdom is the cure. The time is now. Join us for our October 7-9, 2023 online Financial Empowerment Retreat. Register by July 31, 2023 to receive the best price. If you’re interested in private coaching or an unbiased 2nd opinion before then, reach out now. September is often the worst performing month of the year, so it’s a good idea to be ahead of the headlines. Again, feel free to email [email protected] or call 310-430-2397. Our unbiased 2nd opinion details exactly what you own, with color codes to show you what’s toxic in your portfolio, what’s great, and what should be better diversified. You will have a blueprint of how to get safe, protected, hot and diversified. Why is it unbiased? We don’t sell financial products. We have no incentive to sell you something that might lose money or that you don’t need. Our business model is financial education, providing the news, information, and education that Main Street investors need to thrive and live a richer life.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register by July 31, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed