|

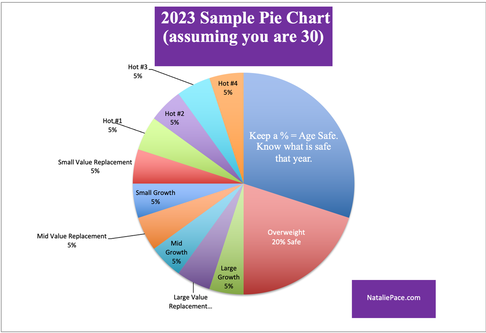

Artificial Intelligence Report. Micron Banned by China. Intel Slashes Dividend. Artificial intelligence is one of the hottest industries in the world today. ChatGPT dropped November 2022, and since then has spread like wildfire. For many entrepreneurs, our virtual assistant has become as indispensable as the C-Suite executive secretary. At the same time, Intel slashed their dividend by 66% in February, and on Monday Micron Technology was banned in China. Revenue is plunging for all AI companies. So, how does AI look for investors? Is this an industry you should be leaning into or underweighting? Are AI stocks on sale or overpriced? Is the revenue rout temporary, or will it be reversed? Micron Technology Micron was banned in China on Sunday, May 21, 2023. The company said that it expects a revenue impact in the single digits. However, the CFO Mark Murphy also indicated that about a quarter of Micron’s revenue comes from companies headquartered in China, either directly or indirectly. The Chinese ban comes at a time when Micron was already losing revenue, with the 1st quarter revenue down -53%. Before the ban, the company was projecting $3.7 billion in revenue for the June quarter of 2023. That’s likely to be a miss now. Revenue could plunge by -60% or more year over year. Micron has a lot of cash on hand – $9.8 billion as of March 2, 2023. However, they burned through $2.3 billion in the first quarter. Will the company have to slash their dividend (like Intel) to conserve capital through the challenging climate they find themselves in? The share price has held strong since the unexpected news of the Chinese ban. Micron shares, like other high-profile technology companies, are still very expensive, with a price/earnings ratio of 48. TikTok Banned by Montana It is worth noting that Micron was banned just a few days after TikTok was banned in Montana (on May 17, 2023). Details of whatever the Micron security breach is that the Chinese regulators are concerned about have yet to emerge. However, we are seeing continued stress between Chinese and U.S. relations, which is still weighing on Chinese equities that are traded on the NYSE or NASDAQ stock exchanges. Intel Intel cut its dividend by 66% on February 22, 2023, slashing it from 36½ cents per share to 12½ cents. According to the Intel press release, “The improved financial flexibility will support the critical investments needed to execute Intel’s transformation during this period of macroeconomic uncertainty.” Intel is another company that saw revenue decline year over year. In the most recent quarter, revenue was down -36%. The 2nd quarter projections are for $11.5-$12.5 billion in revenue, -18-25% lower than last year’s $15.32 billion. The results should be announced around July 27, 2023. Advanced Micro Devices AMD is projecting lower revenue in the 2nd quarter as well, down -20-24% year over year, from $6.6 billion in 2022 to $5.3 billion. The biggest weakness came from AMD’s client processor business, which saw revenue decline by -65%. Gaming revenue declined by -6%. Meanwhile, this company is trading at a very elevated share price. With net income of just $1.32 billion last year, AMD is valued at $174 billion by Wall Street investors. Will Nvidia Stop Buying Back Its Own Stock? Nvidia will release its earnings report tomorrow, May 24, 2023, after the markets close. The company is projecting that revenue will decline by -21.6%. This will mark the 3rd straight quarter of revenue and net income declines. However, the company is still trading at an all-time high, with an outlandish price/earnings ratio of 179. Nvidia has been a darling on Reddit for over a year and a half. However, the resilience of the stock, and its meme stock throne may be coming to an end. Nvidia has been on an aggressive stock buyback spree. Between May 23, 2022 and January 29, 2023. Nvidia repurchased $17.12 billion of their own stock. After that flurry of shopping, they are left with only $7.23 billion authorized to repurchase stock through the end of 2023, unless the board authorizes more. With revenues down by -21% percent and net income down by -53% in the first quarter of this year, the company may be lucky to hang onto their modest annual dividend of $0.16. It’s unlikely they’re going to be able to authorize more share repurchases, unless the economy and revenue rally unexpectedly. Should a company that earns less than $5 billion a year in net income be worth $763 billion? ChatGPT ChatGPT is an OpenAI project that made headlines in November – with not all of them being good. Though the AI chatbot can write term papers for students, it can also have a rather cavalier attitude about outrageously inaccurate information. These “hallucinations” have also been racist, misogynistic and misguided. The valuation of OpenAI is about $29 billion. Elon Musk was a board member, and Microsoft has invested $19 billion in the nonprofit/for-profit hybrid endeavor (according to Wikipedia). What About an AI ETF? Investing in individual companies that are offering artificial intelligence could prove to be a problem. Many of the stocks are still very expensive. Most of the companies are losing revenue and net income, and burning through cash, at a time when borrowing is cost-prohibitive. On the other hand, artificial intelligence is here to stay. It’s become embedded and essential in so many of our products, from gaming, to smart phones, automobiles, marketing, law-enforcement, data centers and beyond. The Artificial Intelligence ETF offered by iShares, symbol IRBO, is currently trading in the range of $30 a share. It hit its high of 51 in February 2021. If we invested in IRBO previously, chances are that the slice has gotten smaller, as the share price plunged. (This is why rebalancing is so important. If your slice becomes two, sell one high!) Rather than just fill up the slice now to be fully invested, with a recession on the horizon and continued weakness in AI projected, a better strategy might be dollar cost averaging. Basically, whatever the amount is that you would have in your slice, divide that by 12 and do a monthly purchase, or divide it by three and do a quarterly purchase. That way, if the value of the ETF weekends, you’re are buying more at a lower price, rather than just watching your investment go down. If you’d like to add a slice of artificial intelligence to your diversified plan, the same strategy might be a good idea. Take it slow and easy. Bottom Line AI is here to stay. Dividends, however can be here today and gone tomorrow, such as we saw with Intel in February 2023. Share prices can plunge as well, as we saw in the pandemic recession, when most of the AI companies dropped to prices that are half or more below where the shares are trading today. Nobody is predicting the 2023 recession to be as terrible as the pandemic, due to a tight labor market, and continued consumer spending. However, we’re taking a cautious approach, nonetheless, and overweighting 20% additional safe in our nest egg pie chart strategy. If you’d like to mock up your own personalized pie chart, email [email protected] with Free Web Apps in the subject line. Our web applications are complimentary to you. We’re happy to send you a link so that you can start learning how to protect and grow your wealth with time-proven, 21st Century strategies. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed