|

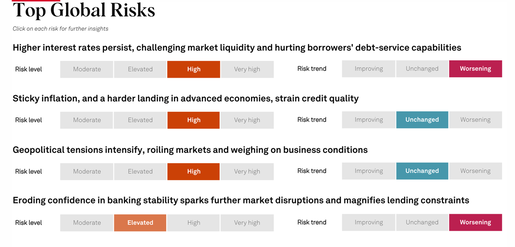

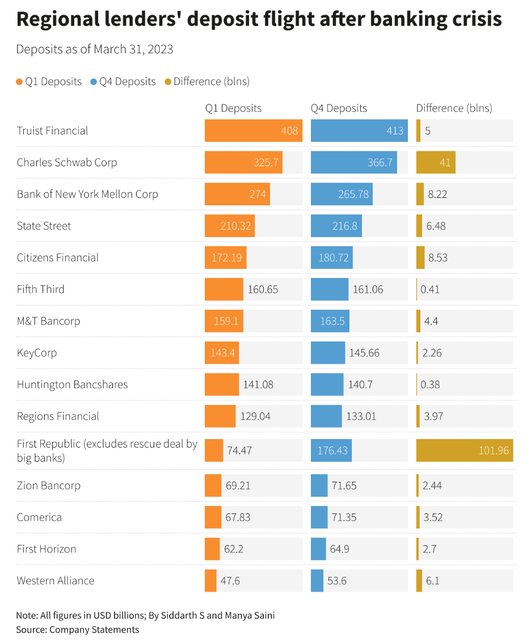

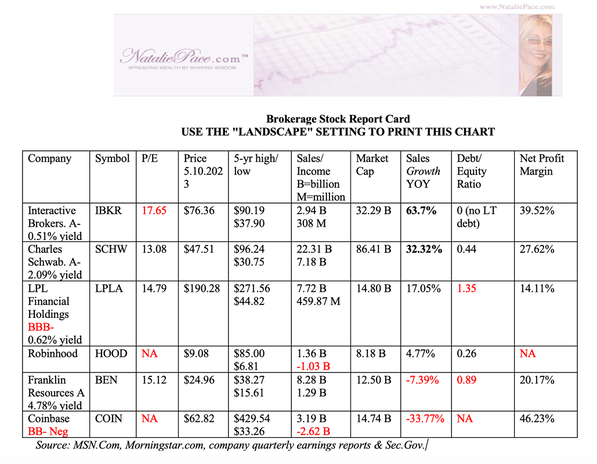

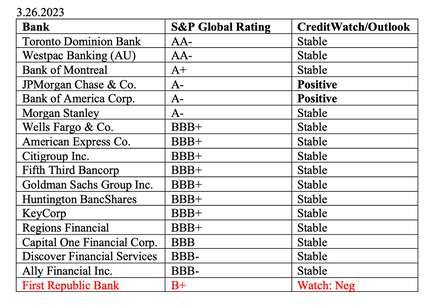

Schwab Loses $41 Billion in Cash Deposits. Brokerages: Are They the Next Financial Services Companies to Fail? History teaches us that recessions are tough on all financial services companies. Banks (pretty much all of them), brokerages (Bear Stearns, Merrill Lynch, Smith Barney and more) and insurance companies (AIG+) were bailed out or rescued in the Great Recession. Lehman Bros. went out of business. During that period, the online discount brokerages, including Charles Schwab and TD AMERITRADE (now owned by Schwab), skirted the riskiest SIVs, and fared the crisis better than many of their legacy competitors (although TD AMERITRADE was sued by the SEC for selling its clients into high-yield money market funds that were represented to be “safe”). However, Charles Schwab’s most recent earnings report revealed that the company had seen an outflow of $41 billion in cash deposits. That was more than all of the banks listed in the chart below, with the exception of First Republic Bank (which failed, and is now owned by JPMorgan). Is this cause for alarm? www.nataliepace.com/blog While many pundits are telling us that the 2023 recession should be mild, with banks failing, should we believe them? Or should we examine the creditworthiness and fiscal health of every bank, brokerage, insurance company or credit union that is entrusted with protecting our money? That would be a smarter plan than just reading a headline and jumping to a false conclusion, or burying our head in the sand. (We’ve already discussed a bank and bond strategy in previous blogs and videoconferences, and we educate attendees on a time-proven wealth plan for cash, stocks, bonds, real estate, debt reduction and the Thrive Budget® at our Financial Empowerment Retreat and in my private coaching practice.) Brokerages differentiate themselves through their products, their customers, their value proposition, their track record and their creditworthiness. So, let’s examine some of the top brokerages, including Charles Schwab, considering all of those criteria. Here are a few of the topics we’ll dive into. Futures, Options, Crypto and the Brokerages That Sell Them Cash Reserves Wall Street Casino: Zero-Day-to-Expiry Option Trading The Crypto Winter Hedge Funds Credit Ratings Financial Stability Futures, Options, Crypto and the Brokerages That Sell Them FTX and Voyager Digital went bankrupt. Binance is being sued by the Commodity Futures Trading Commission. Some brokerages offer Buy & Hope products, while others empower the Main Street investor, and encourage diversification and regular rebalancing. Robinhood introduced the gamification of trading, while Interactive Brokers is championing hedge funds, and futures and options traders. It’s important to understand the business model of the brokerage you’re entrusting your future to, so that you are aware of the kind of products that are going to be sold/offered to you. Trying to force a Modern Portfolio Theory approach onto a Buy & Hold brokerage invites constant conflict. An active trader platform is likely to steer you toward charts and technical analysis. In all cases, it’s easy to make money in bull markets, and easy to lose in bear markets. So, knowing what we own and why now is key. There have been many instances where broker-salesmen put their clients into products they promised were safe, which went on to lose a lot of money. Losses tend to happen without forewarning, which is why it’s important to be ahead of the economic storm, particularly in a world where we are seeing misrepresentations of what is protected and what is not. (Voyager Digital promised depositors their funds were FDIC-insured. They were not.) Cash Reserves On the face of it, the plunge in cash deposits at Charles Schwab looks alarming. However, according to Schwab’s CFO Peter Crawford, it isn’t a cash flight, it’s a cash “realignment.” (This characterization aligns with what I’m seeing in my private coaching practice as well.) In his CFO commentary, Crawford wrote, “The balances are staying at Schwab and they are being redeployed by clients into other products across the firm to help them meet their financial goals. While Bank Sweep Deposits plus BDA balances are down $104 billion year-to-date, select yield products (including certificates of deposit, purchased money market funds, and fixed income securities) have increased by $194 billion over the same period.” While Schwab is sweeping their clients out of cash and into other yielding products, Interactive Brokers is offering 4.6% on the cash in their accounts (above $100,000). However, it’s important to remember that the cash held at brokerages is not FDIC-insured, unless it is swept over into an FDIC-insured bank – and, even then, there can be complications. Wall Street Casino: Zero-Day-to-Expiry Option Trading The popularity of 0DTE (Zero-Day-to-Expiry) option trading is playing into the success of Interactive Brokers and other online discount brokerages that cater to options trading. While Interactive Broker’s Chairman Thomas Peterffy believes that 0DTE options trading is “very sustainable” because the products are inexpensive, analysts are concerned about a “potential volatility shock that could ripple out to the broader stock market.” J.P. Morgan notes that the daily volume for 0DTEs is now about a trillion dollars. A large intraday market move could expose options traders to large losses. A brokerage with large exposure to margin loans could be vulnerable in that scenario. The economic outlook couldn’t be more different from the mouth of the Interactive Brokers chairman Thomas Peterffy, compared to Charles Schwab’s co-chairman and CEO Walt Bettinger. Bettinger began his comments in the Schwab 1st quarter 2023 earnings press release with a throwback to the Great Recession. He talked about a bearish investor sentiment. In the Interactive Brokers 1st quarter 2023 earnings call, Thomas Peterffy reported that, “more and more investors are looking to the markets to earn a return that will allow them to build their wealth beyond the level of inflation.“ The question is which captain do you believe will steer their ship best through the economic challenges we are facing? Will the ride under their aegis be challenging and stormy, smooth sailing or a wild ride? If our cash is being stowed in their ship, we must believe in the navigation and the final destination, and understand what remedies are available should the ship wreck. Hedge Funds Some brokerages cater to hedge funds. Others to 401(k)s. Some are expanding into high net worth. Of all of these categories, the hedge funds tend to have the greatest risk. According to the Financial Stability report that was just released by the Federal Reserve Board on May 8, 2023, hedge fund leverage is elevated. According to the earnings call transcript of Interactive Brokers, their hedge fund clients have a mixed record of success. According to Thomas Peterffy, “quite a lot of them lose money, and quite a few of them make money. So some of them drop out, and some of them become large.” According to SEC chairman Gary Gensler, private funds, like hedge funds, now account for $25 trillion in gross assets, which is above the $23 trillion U.S. banking sector. Fast money is one of the reasons why we’re seeing such volatility on Wall Street. The shortest bear market on record (in March of 2020) followed the quickest period that a bull became a bear (in February of 2020). This is yet another reason why it’s important to have a solid plan in place before headlines, rather than waiting and reacting on a whim. When we wait for the headlines, we’re too late. The Crypto Winter Some brokerages cater to crypto clients. Those sadly are the ones that look pretty ugly on the stock report card. This has a lot to do the series of crypto-related bankruptcies, including FTX, Voyager Digital, 3 Arrows and more, and the contagion of those toxic assets and even so-called stable coins, like Terra Luna. The real question here is, “When will crypto become popular again?” The crypto winter has lasted for over a year. However, since, the beginning of 2023, Bitcoin has moved from $17,000 to $28,000. So can Coinbase and Robinhood, two brokerages that cater to crypto clients, start recovering? Though Coinbase has a low credit rating, it also has experience getting through 4 crypto winters without going belly up. With Bitcoin showing signs of life again, and if there is investor uncertainty around the debt ceiling, bank failures, stock volatility, etc., there could be more interest again in cryptocurrency. Of course, there are a lot of ifs in that sentence. However, we certainly have seen a rebound in prices, and that bodes well for Coinbase – if the rally continues. Credit Ratings I’ve included the credit ratings of a few of the brokerages in the stock report card listed above. While many banks are at the lowest rung of investment grade, at BBB, Interactive Brokers, Charles Schwab, and even Franklin Resources are still rated A. However, First Republic Bank was also rated A- when it got into trouble and was downgraded to junk without forewarning. While I’d want my brokerage and my bank to have a high credit score, it is also important to understand where cash is protected and where it is not, and how to get a safe yield, without taking on high risk, illiquidity or even losses. Again, this maneuvering is so tricky that we spend one full day discussing it at the Investor Empowerment Retreat. The June 10-12, 2023 retreat is the last retreat before October. Since September can be the worst performing month of the year, it’s a good idea to protect our wealth before we go away on summer vacation. Financial Stability Few people believe we’ve seen the last of the banking crisis. However, the Federal Reserve facility that has been set up to help banks deal with unrealized losses in their long-term bonds allows the banks to not have to mark those assets to market and declare losses on their earnings reports. In short, their financials are not fully indicative of the liabilities that the companies are holding. So while the Feds will tell us not to panic, it’s important not to be complacent as well. For that reason, it’s key to have a plan for diversifying the safe side of our portfolio to make sure that it actually does stay safe in the event of more bank failures, a recession or other economic uncertainty. Incidentally, liquidity risks for life insurance companies are also elevated, according to the Financial Stability Report, as the share of illiquid and risky assets that insurers hold continued to edge up. So it’s not just our bank deposits that we want to be protective of, but also our annuities and life insurance policies, particularly since these products are never FDIC-insured. Bottom Line Where we bank and where we do our trading matters quite a lot. We want to know how creditworthy, trustworthy and compatible they are. At the same time, even if all of those things line up, it’s still important to be the boss of our money, and to know exactly what we own and why. Clients tend to love their financial planners in bull markets, while bear markets bring on broker churn and client dissatisfaction. Why? Because most managed plans merely ride the waves of Wall Street, soaring in bulls and sinking in bears. Riding on top of the waves without getting crushed by them requires a time-proven, 21st Century strategy – something we’ve been proud to offer since 1999. That system is less time and less money than most people spend, and is easy-as-a-pie-chart – literally. It’s easy in today’s world of inflation, where so many things just don’t add up, to not want to have one more thing on our to-do list. However it’s always a good idea to fix the roof while the sun is still shining. There are economic storms on the horizon. It is unlikely that the banking crisis is over. Therefore, a little Spring cleaning now could mean that we have a lot more fun over the summer on our vacation, and come home ready for a Fall harvest, rather than just a fall. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register by May 15, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed