|

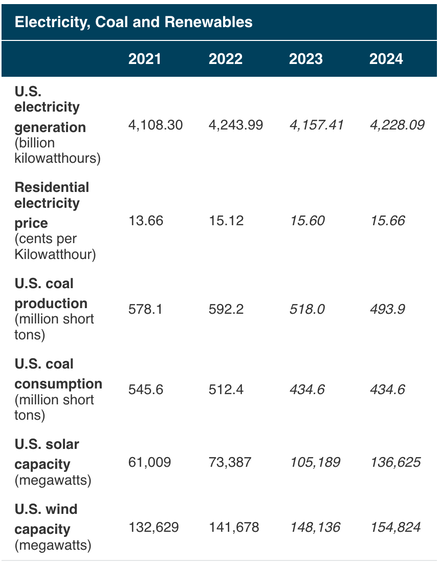

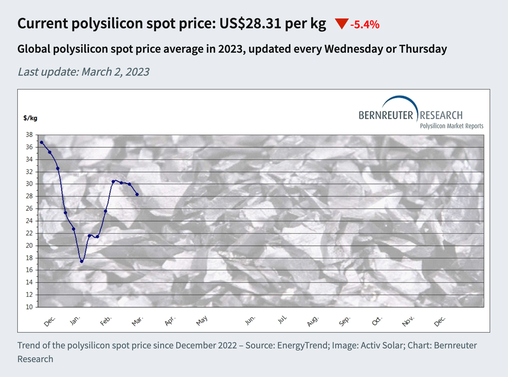

The 2 Best Solar Stocks Includes a warning about a former revenue darling that has seen its revenue and margins plunge. As you can see in the chart below, solar power is predicted to increase by 86% over the next two years. Solar companies are enjoying robust revenue growth – the best they’ve seen in awhile, and this is expected to continue well into 2024, as more individuals and governments wean themselves off of fossil fuels. (Europeans have endured an expensive winter due to their reliance on Russian natural gas for heat and cooking.) Do a quick search on solar companies to invest in and you’ll see First Solar, SolarEdge and Enphase mentioned pretty much across the board. Not surprisingly, these companies are trading at their 3-year highs and at very lofty price-earnings ratios. However, are they the best companies to invest in? Are there any that have great potential that are trading at an attractive price? Bargain vs. Buzz Enphase and SolarEdge both boast of year-over-year revenue growth of 76% and 61%, respectively. Although very impressive, this is not the highest growth on the Solar Report Card, where companies like JinkoSolar and Daqo are more than doubling in revenue annually. (Email [email protected] with Solar Stock Report Card in the subject line to receive your copy.) Additionally, with price-earnings ratios of 77 and 195, the ENPH and SEDG stocks are very expensive, even if the growth continues apace in 2023. First Solar is a laggard on the Solar Stock Report Card, with and net losses of $44 million in 2022. Revenue was down in 2022, to $2.62 billion, from $2.92 billion. Although First Solar is losing money, its stock is trading at a 15-year high, largely thanks to Motley Fool and Jim Cramer. Daqo Interestingly, one of the companies with the highest growth of the Stock Report Card (last year) has a P/E of just 2 – something that is rarely seen with a company that is increasing revenue to the tune of 118% year over year. Daqo Energy supplies polysilicon. Demand was hot and supply was short last year, so prices soared, inflating Daqo’s revenue and net profit margins. Despite that treasure trove, the U.S. scrutiny and threat of delisting Chinese companies caused Daqo’s share price to sink. This year more polysilicon is coming to market. Revenue is expected to plunge for Daqo, starting as soon as the 1st quarter. Daqo is forecasting that 1Q 2023 revenue could be short -37% from the 1st quarter of 2022. Polysilicon prices plunged below $18/kg in January of 2023, but have rebounded back to above $28/kg. The average selling price (ASP) was $37.41/kg in Q4 2022, compared to $36.44/kg in Q3 2022, and $21.76 in 2021. With more polysilicon available in 2023, BloombergNEF is forecasting that the price could drop to $10-$15/kg this year. Daqo enjoyed profit margins as high as 60% in 2022. However, the lower price structure will challenge their margins, and could cause net losses. The company has $4.65 billion in cash and cash equivalents, and is expanding production. According to Longgen Zhang, CEO of Daqo New Energy, Daqo expects to “produce approximately 190,000~195,000 MT of polysilicon in 2023, 42% to 46% more than in 2022.” However, the new price structure will be a stunning reversal of fortune for the company. Forbes recently included Daqo in its 8 Best Solar Power Stocks of 2023 article. Yahoo and Investopedia also featured the company in their recent Best Of lists. While Daqo was one of our favorites in 2021 and 2022, it’s now one that we would underweight. 1Q 2023 results should be released around April 21, 2023. Sunpower Sunpower offers solar and storage solutions. In fall of 2022, the company partnered with General Motors, KB Homes and Ikea to promote residential rooftop solar. GM has selected Sunpower as its exclusive solar provider and preferred EV charger installer, and will tout the bidirectional charging capabilities of the system and GMs cars to “provide whole home backup during a grid outage” (something that has made headlines of late, particularly in Texas and California). Ikea launched Sunpower Home Solar in their California stores in Fall of 2022, with plans to expand in the future. KB Homes, in conjunction with Sunpower, the University of California, Irvine, Schneider Electric, and Southern California Edison, are building an Energy-Smart Connected Community in Menifee, California with 200 all-electric, solar-powered homes connected to a micro-grid with battery storage. Sunpower’s revenue annual growth was 37.8% in the 4th quarter of 2022. The company is forecasting adjusted EBITDA growth of up to 63% in 2023. Sunpower has yet to make major headlines. It’s share price is trading at a discount of 71% off of its Jan. 2021 high of $54.00/share. JinkoSolar JinkoSolar had the highest year-over-year sales growth on the Solar Stock Report Card, with 128% revenue growth. JinkoSolar has global operations and $11 billion in revenue. The company will announce its 4Q and full year 2022 earnings on March 10, 2023 at 7:30 am ET. The company won the Ernst & Young “Sustainability Awards 2022 Outstanding Enterprise” award. The margins are tight at Jinko. Last year’s net income was only $150 million, on $6.4 billion in revenue. With such a low EPS, the price-earnings ratio looks elevated. However, Jinko has the lowest price/sales ratio of the companies we examined (by far). According to the preliminary report, this year’s net income could be closer to $382 million. (We’ll know on March 10th.) At minimum, the company is one to consider putting on a Stock Shopping List. Clean Energy Funds The easiest way to get exposure to clean energy without having to babysit a lot of individual stocks is to purchase a clean energy fund. Be wary of ESG funds. They are typically missing the E (environment), exclude solar companies and justify having 20% or more fossil fuel companies through the S&G portion of their mandate. (Learn more in my ESG: Missing the E blog.) ETFs to consider include ishares ICLN and Invesco’s PBD and PBW. Since Blackrock (owner of ishares) has an AA- rating, compared to Invesco’s BBB+, we’ve been leaning into ICLN at our retreats. Utility Prices Residential utility costs increased by almost 11% in 2022 and are expected to rise in the coming years. This should be positive for rooftop solar companies, like Sunpower. As more homeowners, particularly those in sunny states, are encouraged to do the math, and as the clean energy tax credit of 30% remains in effect for the next decade, rooftop solar offers a lot of benefits to anyone looking to save thousands annually on their utility bill. Macro Concerns Solar energy is a bright spot in a sluggish U.S. economy that is expected to see at least a mild recession in 2023. Homeowners could be pushed by high utility bills to seek budget-saving solutions that have an added benefit of being planet-friendly. This is all positive for the industry. However, it’s important to remember that, while a rising tide lifts all ships, a sinking tide can ground even great companies. If stocks head south, the centrifugal force could pull all share prices down the drain. For that reason, we’re adopting a dollar-cost-averaging approach. Bottom Line A clean energy ETF should be a good addition to the hot slice of our nest egg. Be sure to keep everything in balance, to consider overweighting safe, to rebalance regularly, and to consider dollar-cost-averaging into your slice. All of this is outlined forensically at our Financial Freedom Retreat. Join us April 22-24, 2023. Email [email protected] to learn more. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 8/6/2023 05:49:07 pm

JinkoSolar was raided by the U.S. Feds on May 10, 2023. We still don't know why... https://www.reuters.com/world/us/us-conducts-raids-two-jinko-solar-properties-2023-05-10/ Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed