|

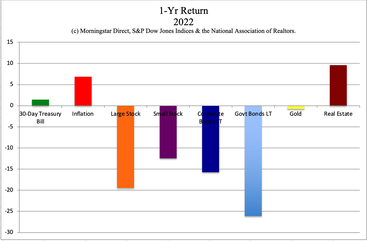

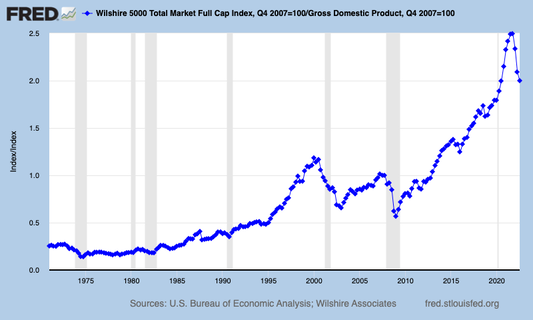

Rebalance by the End of March. One of the most important tools any investor has is to know when to take gains off the table and protect our wealth. Regular rebalancing is one of the easiest and most efficacious ways to do that when you are properly diversified and protected. (Traditional fixed income assets have lost a lot of value over the past decade; long-term government bonds performed worse than the S&P500 in 2022. That’s why we spend one full day on “What’s Safe?” at our Financial Freedom retreats.) Typically a good rebalancing time would be at the end of April – after the Spring Rally. This year, it is a good idea to move the date up a few weeks because the 1st Quarter GDP report will be issued on Thursday, April 27th, 2023 at 8:30 am ET. While the exact numbers are anyone’s guess, the Conference Board is predicting a “mild” recession beginning in Q1. In the February 1, 2023 minutes of the FOMC meeting, which were released on February 22, 2023, “the staff projected real GDP growth to slow markedly this year and the labor market to soften.” With all of the recession warnings, it’s smarter to be early rather than late. The large, market-mover investors are forward-thinking and act prior to the official announcement. When we wait for the headlines, it’s too late to protect our wealth. A Mild Recession? If it’s only a mild recession that is predicted, why not just ride it out until 2024, when the economy is expected to grow again (at a rather lackluster 1.6%)? There are many reasons to adopt a diversified plan with regular rebalancing (at least 1-3 times a year), rather than Buy & Hold. 21st Century recessions are characterized by severe losses that require years to recover. Stocks are very expensive. A balanced plan allows us to profit when markets go up and protects us from losses when equities plunge, whereas Buy & Hope can force us to hope the bull market makes up our losses. See below for additional information. Stocks are Still Expensive The S&P500 lost -19.44% in 2022. Broker/salesmen might be encouraging us to buy on the dip, without advising us that stocks are still expensive. In the minutes of the FOMC meeting (and also in my interview with Howard Silverblatt, the senior index analyst of the S&P500), investors are being advised that “the forward price-to-earnings ratio for S&P 500 firms remained above its median value despite the decline in equity prices over the past year.” In my blog on Streaming, I noted that “Most streaming companies are trading at very lofty valuations, with Disney at a P/E of 65, Netflix at 40 and Apple at 26. Should a company like Netflix that generated only $4.5 billion in net profit last year be worth $163 billion?” For comparison, average P/Es tend to be in the 17 range. Below is a chart of Warren Buffett’s favorite stock valuation tool, a comparison of all stocks in the Wilshire 5000 to U.S. GDP. As you can see, stocks are still far more elevated now than they were in 2000, before the Dot Com Recession when the NASDAQ Composite Index dropped 78%, and took 15 years to crawl back to even. If you haven’t rebalanced in over a year, rather than buying the dip, it’s a better idea to make sure that you have enough safe, and are not invested in stocks or funds. We’re overweighting an additional 20% safe in our sample pie charts. For those of us who are too light in equities, we’re taking a dollar-cost averaging approach in 2023. Email [email protected] if you'd like our 2023 Sample Pie Chart. Why Two-Year Returns are Deceiving We’ve been hearing a lot of people boast that they are still up over the past three years. That actually doesn’t mean much. The system was flooded with cash and low interest rates, which caused asset bubbles to balloon up and inflation to soar. It’s important not to confuse a secular bull market and an emergency pandemic rescue with wisdom. The next recovery will not be a three-month recovery fueled by $5 trillion of new cash being printed up and handed out to everybody with a heartbeat. 21st Century recessions can take seven years or more to recover. (The Dot Com Recession took 15 years.) So it’s very important to have a strategy that can protect our wealth in the event of what has become rather common in the 21st-century – severe downturns of more than 50% in bear markets. Braggarts were aplenty in 1999, before being wiped out by October of 2002. A balanced plan with regular rebalancing pulls the emotions (and hubris/devastation) out of the equation. Also, a 50-year-old investor who is overweighting 20% safe only has 30% at risk – with total equity losses of -16.5% in the event of 55% losses. 15-Year Returns If we want to know how our plan is really performing, it’s important to get a chart of our account versus the S&P500 over a 20-year period. That chart will include The Great Recession and the Pandemic. It should still look like a lot of gains, since we’ve been in a secular bull market since the bottom in 2009. However, if we see that the lines run in parallel, we are vulnerable to losing half or more of our wealth in the next downturn – twice as much or more of the current -19-26% losses. If our plan is running beneath the S&P500, then we may have even more at risk. The Dow Jones Industrial Average lost -55% in the Great Recession, dropping to a low of 6547 on March 9, 2009. It took about seven years to recover. (Lehman Bros. investors never recovered.) Also, it’s important to remember that our portfolio comes back slower because 10% of $1 million ($100,000) is a heck of a lot more than 10% of $450,000 ($45,000). Going forward, achieving a 10% annualized gain is likely to be difficult. Never Confuse a Bull Market with Wisdom It’s pretty easy to make gains in a bull market. It’s pretty easy to lose a lot in a recession. Counting on things doing well going forward because we’re still in the black over the 3-year period is not a very efficacious strategy. Again, the 2020-2021 bull market was financially engineered to keep us from entering a severe recession during the pandemic, which many economists worried could be as bad as the Great Depression. However, flooding the market with cash has left us with is unsustainable debt loads, overpriced assets, strained budgets, drained savings accounts, and very high consumer debt. This is of enough concern for the US to be listed in the top 10 of developed world countries that are the most vulnerable to financial instability, due to the massive amount of corporate leverage (source: IMF). Be sure to read my Bank blog for additional information. Be The Boss of Our Money It’s time to know exactly what we own and why, and to be the boss of our money, rather than having blind faith that someone is protecting our wealth. When we don’t understand or believe in our plan, it could be because it is intentionally opague. If you’d like an unbiased 2nd opinion from me personally, where you will understand clearly exactly what you own and how much you have at risk, email [email protected] for pricing and information. Bottom Line Having blind faith that somebody else is protecting our wealth for us works well in bull markets. However, it can be devastating in bear markets. And the sad thing is, there’s really not much you can do to about losses once they happen, outside of hoping and praying to recover. That’s why it’s important to be the boss of our money now. Our time-proven 21st-Century strategies with regular rebalancing earned gains in the Dot Com and the Great Recessions, and outperformed the bull markets in between. This plan can also incorporate ESG investing (whereas most ESG funds are actually invested in major polluters, including Exxon Mobil). Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed