|

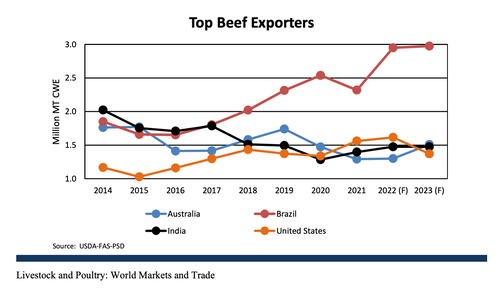

Cash Burn & Inflation Toasted the Plant-Based Protein Companies Kim Kardashian, the Chief Taste Consultant for Beyond Meat, hasn’t saved the day. Yet… During the early days of the pandemic, there were production problems at many of the meat factories. Meat prices soared. The grocery shelves were bare. Consumers wanted to stockpile their freezers with something, and plant-based proteins began flying off the shelf. Today the tables have turned. Now the price of plant-based protein is a lot higher than meat, and consumers have ample choices. That has caused the sales of plant-based protein to plunge. As Ethan Brown, the president and CEO of Beyond Meat noted in the company’s 3rd quarter 2022 earnings call, “As consumers intensify focus on making ends meet, health and environmental considerations take a back seat.” Because plant-based protein companies experienced such explosive growth in 2020, they invested in expansion, which now has them out over their skis, as sales contract. Cash negative operations combined with lower revenue is a recipe for disaster, one that has companies like The Very Good Food Company on the ropes. Companies have been forced to quickly pivot to streamline production and to outline a pathway of profitability. Investors have fled in droves. However, planet-conscious and vegetarian consumers still love the mission and the taste of these products. Many are very interested in reducing their CO2 footprint by embracing plant-based proteins solutions for most, if not all, of their protein needs. So, if the purveyors can find a price point that consumers love and get the word out about the ramifications of buying and consuming cheap meat, the product should become popular again. Below is additional information on the industry and two select companies, Beyond Meat and The Very Good Food Company. 2020’s Golden Moment Cheap Meat Opportunity Pathway to Profitability Competition Reviews The Very Good Food Company Beyond Meat And here is additional information on each point. 2020’s Golden Moment The real question is, “Will there be another golden moment for plant-based protein?” The COVID-19 vaccine and more effective treatments have made it less likely that there will be pandemic-related supply chain disruptions. However, there are other factors at play, such as the flooding of cheap meat on the market, where that meat originates from and the ramifications of supporting toxic livestock practices. Cheap Meat Are we eating rainforest beef and Cancer Alley chicken? Many of us think there’s very little we can do to help save the rainforest in Brazil, without ever realizing that we’re the reason they’re being destroyed in the first place. Brazil is the top exporter of beef. The US, China and many other countries are the top consumers of Brazilian rainforest beef. If you want an inside look at the thrash and burn going on, check out the documentary The Territory, available now on Nat Geo (Disney Plus). Transporting beef and poultry around the world requires a lot of gasoline. Slashing and burning old-growth forests means there are fewer trees to photosynthesize the CO2 into the air we breathe. Grain, potash, petrochemicals, hormones and antibiotics quickly fatten up animals that are intended to be grazing on grass, but destroy the soil and have contributed to a crisis with antibiotic-resistant bacteria. Not only is industrial livestock production unhealthy for the planet, it’s also toxic for the animals and for the people who eat them. Cheap chicken and agriculture run-off is correlated with the Dead Zone in the Gulf of Mexico. If you have never learned about the Dead Zone or Cancer Alley, Google them. You can discover more facts about why it is important to eat local and organic meat products and produce in The Power of 8 Billion: It’s Up to Us. There is a general consensus that reducing meat consumption is healthy for both the planet and individuals. Plant-based protein is an important part of that plan. Opportunity Right now it doesn’t look like there are many opportunities for proteins to become a star on the meat shelf again. (They are often stored in a separate area.) However, there are a lot of things that play to a more favorable outcome. There are many people in the world who are interested in reducing their consumption of meat. There is definitely an increased focus on reducing CO2. If consumers become aware of the environmental footprint of factory-farmed sheep, meat and chicken, and that they might be eating rainforest beef, this could play into a renaissance for plant-based proteins. (Livestock is an important piece of the regenerative agriculture puzzle.) That requires a strong push in awareness to counter the misinformation attacks that are more prevalent today on social media. That might seem like an insurmountable task at this moment when so much of the news on plant-based proteins are negative. However, things can change quickly, once the word catches the wind. We used to all smoke regularly and see smoking in films. Will we kick Cancer Alley chicken and Rainforest beef in the same way? Pathway to Profitability It’s quite common for innovations to have a boom and bust cycle. This phenomenon wipes out a lot of companies. In the wake of the fallout, the companies that survive become stronger and more efficient, and their products become more affordable. The strong ones will become the name brands of tomorrow. We’ve seen it happen with Google after the Internet bust, with Bitcoin through at least four crypto winters, and with Tesla, as it battled to transform the gas guzzling empire of ancient auto manufacturing. The Very Good Food company is quite vulnerable at this moment. They are low on cash and may not make it through the end of the year. Beyond Meat is in a better seat. (Keep reading.) Competition There certainly is a lot of competition in the freezer for plant-based protein. All of the old-school food service providers, including Tyson, Kellogg and ConAgra, have a plant-based protein product. However, meat alternatives compete with meat, as well. Currently the biggest competition is coming from lower-priced meat and chicken. Reviews Beyond Meat, Impossible and The Very Good Food Company all enjoy great reviews. I have tasted both Beyond Meat and Impossible, and it’s truly uncanny that the taste is so delicious and the texture is so meat-like. The Very Good Food Company’s products get very high reviews, and boasted the most explosive growth in sales, before their company had a liquidity crisis. Very Good Food Company Because its products were so popular and the growth was so stellar in 2020, The Very Good Food Company focused on keeping up with demand. The company opened up new factories. This worked while it was easy to bring in new cash and posting year-over-year sales growth of 300%. Smaller companies began having a difficult time raising capital in 2021, which quickly plunged cash-negative companies like The Very Good Food Company into a liquidity crisis. Within a few months, the company did not have enough capital to pay their monthly expenses. The co-founders (one who was the CEO) were canned in April of 2022. Since then, The Very Good Food Company has scrambled to keep people in the C-Suite and on their board. The company has warned that if they don’t raise more capital before the end of December, they could be forced into debt restructuring (bankruptcy). At the same time, the company has also signed new deals with grocers, including Albertson’s. I checked at the local Erewhon in Santa Monica, which still had their products available in-store. This is a very high risk investment. Most investors have already lost most of their capital. The Very Good Food Company still has far more obligations than capital. The unlikely turnaround will be impressive, if they are able to spring it. Something like this has happened before. LoudCloud was able to morph into Opsware and soar to a $14 billion valuation, after sinking to rock bottom in the Dot Com Recession. I wouldn’t hold my breath. However, as was the case with LoudCloud, The Very Good Food Company’s products are well-liked by its customers. Beyond Meat Beyond Meat is another company whose share price has been destroyed. The company is losing product sales, facing foreign exchange headwinds and having to mark down prices. The largest drop was in the international marketplace, with retail pounds sold sinking by 37% year over year. International food service was also down 22%, while U.S. food service increased by 32.2%. Beyond Meat has partnerships with McDonald’s, Kentucky Fried Chicken, Pizza Hut, Taco Bell and Panda Express. The company has recently added Beyond Steak, Beyond Chicken Tenders, Nuggets and Popcorn Chicken to their retail line in the U.S., at Kroger, Walmart and Albertson’s. Beyond Meat’s third quarter’s revenue dropped 22%. The fourth quarter is expected to come in even worse, perhaps plunging 40% from the same quarter in 2021. The company is letting go of staff and streamlining production, in an effort to conserve their $390 million in cash. Beyond Meat’s share price is trading -80% from its 52-week high. Things could get worse before they improve for Beyond Meat. The major inflection point for Beyond Meat and other plant-based protein companies will be when consumers start voting with their dollars and promoting the message of the importance of plant-based protein. Grocers could help by putting plant-based protein back in the Meat section (like it was in the pandemic when meat was scarce). Email [email protected] with Beyond Meat SRC in the subject line, if you’d like a copy of our plant-based protein stock report card. Bottom Line Plant-based products are quite tasty, and definitely have a lower carbon footprint than most meat production, which is industrialized. Consuming less factory-farm raised beef, chicken and pork, while increasing the consumption of local, organic and plant-based protein is important to protecting and healing our own health and that of our planet. Are consumers aware of this? Will this awareness be enough to entice them to overlook the price differential? Will the companies streamline operations, overcome the liquidity crisis, find a way to profitability that includes a more competitive and affordable product, and start gaining in popularity? Which companies will survive, which will merge and which will go out of business? The next few months will be very telling. One thing is for sure. The long-term appeal of a planet-friendly, healthy, tasty protein option remains appetizing for many, particularly Millennials and Gen Z. When these very large demographics jump back on board, there should be a halo effect for this industry and the companies that survive. New Year, New You Financial Freedom Retreat If you're interested in learning 21st Century time-proven investing strategies for building and protecting your wealth, investing in renewable energy, saving thousands in your budget with smarter energy choices, and managing challenging economic times (from a No. 1 stock picker,) join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed