|

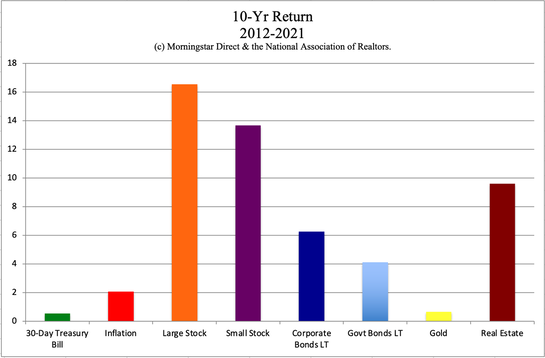

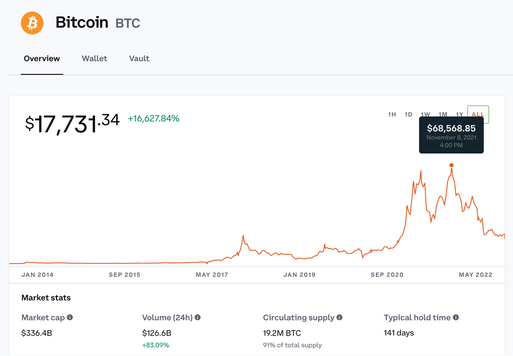

Over the last year, crypto has tanked, gold has lost momentum, and silver remains stuck near a 10-year low. Gold was the worst performer over the last decade, while Bitcoin has been on a spine-splitting rollercoaster. With so much economic turmoil happening, including:

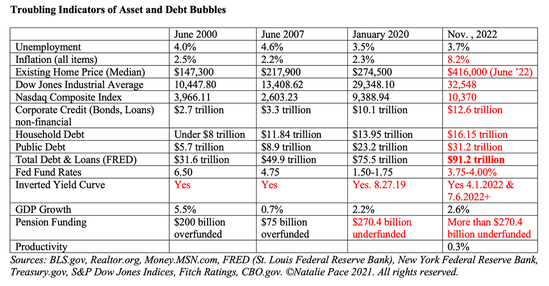

Why in the world aren’t people fleeing to safe havens to protect their wealth? It has a lot to do with hope, a Stimmy Check hiatus, chasing ROI (Return on Investment), and having an oil and gas independent nation buttressed between two large oceans and two friendly neighbors. The sinking of our so-called safe havens has a lot to do with the following phenomena.

Click on the blue-highlighted words to learn more about T-Bills, and whether or not we’re likely to have a recession. What will it take for gold, silver and crypto to shine again? Safe haven investments get very popular when people fear that everything is going to hell in a hand basket. If you think of the last decade for gold and silver, it can be summed up with the phrase: “the longest secular bull market in history.” When stocks are high, no one is swooning over gold. When gold soared to its 20th Century peak of $800/ounce in 1980, the U.S. economy had roadblocks of oil embargoes, runaway inflation, a Fed Fund Rate of almost 20%, high gas prices and stagflation. On September 5, 2011, when gold peaked at $1895/ounce and silver reached for $50/ounce, it was right after the S&P Global rating agency downgraded the U.S. sovereign credit rating from AAA to AA+. (That occurred on August 5, 2011.) Both times, investors flooded into gold, buying at the height of the frenzy, and (sadly), had their futures buried in losses for the next decade. It took over a quarter of a century for gold to recover to the $800 range after 1980. (It didn’t happen until November of 2007.) Cryptocurrencies are marketed to Main Street as the only thing that will be of value when the dollar becomes worthless. Yet, crypto has a very high correlation with stock market performance and a much shorter holding period than most HODL investors are aware of. If you look closely at the chart above, you'll see that Bitcoin's average holding time is only 141 days (less than 5 months). When stocks plunged by -38% in the pandemic, Bitcoin fell off the cliff, too, sinking to a low of under $3,858/coin by March 12, 2020. The volatility in crypto is caused by the large investors capitalizing on the HODL sentiment of cryptophiles. Despite the promise that decentralized currency has for the future, currently it’s used more as a Get Rich Quick trading platform, rife with ruses, whales and opportunists posting as influencers. Main Street investors who sink everything they’ve got into a Hail Mary safe haven investment can bankrupt themselves. Our easy-as-a-pie-chart nest egg strategy helps the over-zealous investor to have a more rational approach. It’s equally important to rebalance regularly, to capture your gains at the high, rather than just waiting and watching them evanesce. Proper diversification with regular rebalancing is a time-proven 21st Century investing strategy that works particularly well for the volatility of hot industries, like crypto, gold and silver. Will These Safe Haven Assets Ever Reward Investors Again? Crypto is definitely out of favor. However, that’s a déjà vu that has played out multiple times. Crypto still has some heavy players on its team, including Andreessen Horowitz, Square, Elon Musk, Coinbase, Tesla, and even countries like the U.S., China and Russia, who are all developing their own coins. It also has a lot of scam artists and fraudsters. Joff Paradise and his cronies of the Trade Coin Club Ponzi scheme were charged by the SEC on Nov. 4, 2022 (finally). The U.S. dollar is strong. However, the winds can change very quickly, particularly in wartime, and especially when we seem caught in 1980s The Sequel. In fact, this week’s videoconference is going to focus on the most recent Federal Reserve Financial Stability Report, which has some new areas of concern ringing warning alarms, including bonds, money market funds and Treasury bills. The entire world is mired in debt. However, the U.S. has the most debt by far of any AAA-rated sovereign. Gold & Silver Outlook: Prices are Down, So is Revenue Revenue for gold and silver mining companies is down. However, prices have fallen even further than revenue, sending yields soaring. BHP Billiton has a price-earnings ratio of under 7 (very low), while Rio Tinto’s is closer to 5. In the 3rd quarter 2022 earnings report, Rob McEwen, the Chairman and Chief Owner of McEwen Mining, addressed the low valuation of his company. According to McEwen, “Another way to look at MUX is that its current share price of $3.66 reflects the low end of potential value of the company’s ownership in McEwen Copper and you get all the other assets for free.” Since that statement, McEwen has rallied to $4.44/share (up 21%). Dividends Rio Tinto and BHP Billiton are offering very high dividends, with yields above 12% currently. You can also get a robust dividend by going into an Australian ETF, which affords you a little more diversity than an individual company offers. iShares Australian ETF, symbol EWA, is paying 8% yield. By comparison, the iShares Global Gold Miners ETF (RING) is paying a 2.99% yield. Remember, however, that everything can sink in a recession. What protects you is keeping the appropriate amount safe (another central theme in our Financial Freedom Retreat). Copper: The New Oil Copper is being called the new oil by Goldman Sachs because this metal is used in electric vehicles and a lot of other things that are part of the clean energy revolution. Many of the mega mining companies like Rio Tinto and BHP Billiton deal in gold, copper and silver (and other materials). McEwen Mining has a 68% interest in McEwen Copper, which owns one of the world’s largest undeveloped deposits in Argentina (Los Azules) and another in Nevada (Elder Creek). Copper is yet another reason why it’s going to be difficult to time the recovery of gold and silver mining. Copper could heat up and cast a glow on the materials industry. Bottom Line As long as the dollar is strong and stocks are resilient, safe havens are likely to be ignored. However sentiment can shift rather rapidly. So rather than trying to wait and see, it might be a good idea to add a little more at a low price (and a low P/E) to your safe haven holdings. Be sure to use your pie chart system to guide you on the right ratios. Also be aware that safe havens are very out of favor right now, and could stay grounded, or even go lower, as the first wave tends to run in tandem with stocks in a decline. However, if stocks truly tank (as they have in all of the 21st Century recessions), and people are disgusted with the amount they’ve lost, the emotional safe haven plays can blast off pretty fast. If you’re a crypto, gold or silver investor who has been through these cycles a few times, you should know by now that when hope is lost, it’s a good time to buy low. When everyone thinks the party won’t end, it’s a good time to sell high. You can do all of this while still HODL a slice or two, once you learn the pie chart system that we teach at our Investor Educational Retreats. Full Disclosure: I own crypto, gold and silver assets, as well as some materials-rich country ETFs. How much have you lost this year (in your paper assets)? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register by Nov.. 13, 2022. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Nov. 13, 2022, to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed