Corona Virus Update. Recession 2020? Free Teleconference Next Thursday, March 5, 2020 at 9 am PT/noon ET. Get call-in details at the end of this blog. Here is the Corona Virus scorecard so far. Apple and Microsoft have warned that they will miss their earnings guidance. Disney CEO Bob Iger abruptly gave his job to someone else on February 25, 2020. (This is a red flag. Iger wants to cement his stellar reputation of increasing Disney’s market capitalization five-fold, with the acquisitions of Pixar, Marvel, LucasFilm and Twenty-First Century Fox.) The Dow has dropped over 3000 points since the high set on Feb. 12, 2020 (as of the market open on February 27, 2020). The global market has lost over $4 trillion. Why is the Corona Virus causing such a stir? Will the markets recover, or is this the beginning of a recession in 2020? Let's discuss the facts and data, and a time-proven, recession-proof, strategy you can easily employ now. Update Our hearts and prayers are with anyone who is struggling with this virus, those who have lost loved ones and anyone who is quarantined or furloughed from work. The very personal, human cost is always the greatest. Below is an update on the economic cost of the virus.

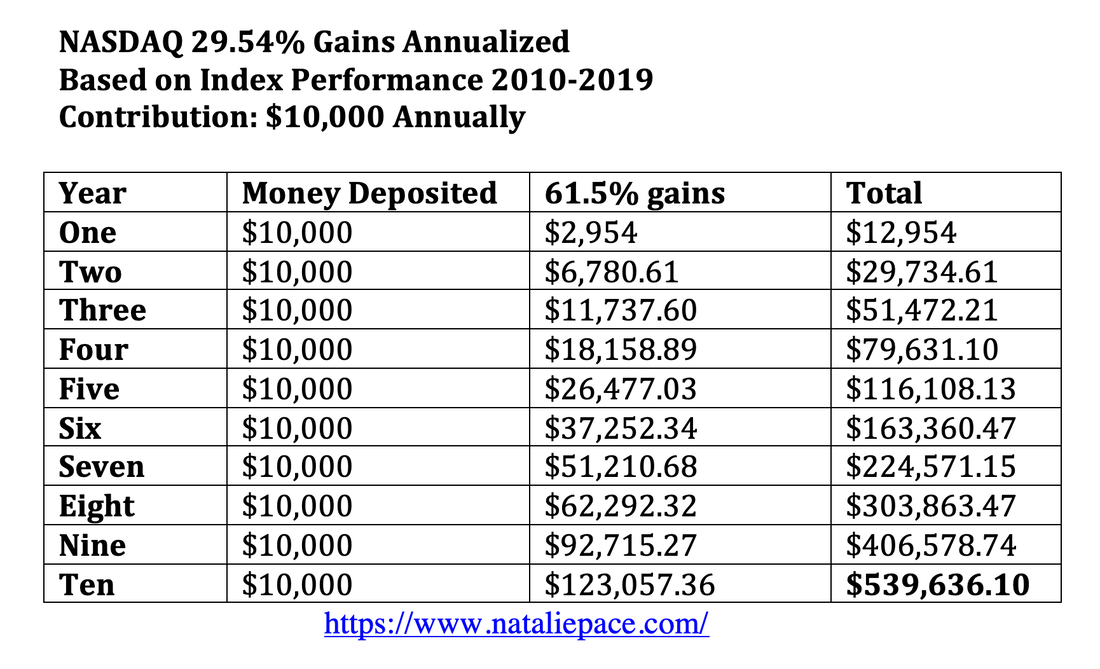

Beware of Bad Advice

What Does Work

Get your questions answered live in our free teleconference next Thursday, March 5, 2020, at 9 am PT/noon ET. Call: (347) 215-7305 Listen back 24/7 on demand at https://www.BlogTalkRadio.com/NataliePace. . Other Blogs of Interest The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Banks and brokerages have a new bail-in plan. The next time they get in trouble, taxpayers won’t have to bail them out. The customers will. How? In 2016, the rules changed around money market funds. The changes are buried in the fine print. Basically, your investment in a money market fund is subject to losses, redemption gates (a temporary suspension of your ability to sell your shares in the fund) and liquidity fees (a fee charged to sell your shares). Money market funds are not FDIC-inured. Here are links to the fine print of a Schwab, Oppenheimer and JP Morgan money market fund. They are all subject to the same rules – redemption gates and liquidity fees. However, each company has a different way of explaining what will transpire if the bank needs to keep your money. Scroll to the bottom of the page to read the fine print. Bank staff are trained to sell customers away from FDIC insured accounts and into money market funds, where they will at least earn a little return. The gates and fees were part of a plan to thwart a run on the bank. These restrictions are also the reason why you hear the federal reserve board and other bankers talk about greater stability at the banks. Since banks and brokerages can prevent you from withdrawing your money, they’re become less vulnerable. How many of customers really understand what they’ve signed up for, when they agree to transfer their money out of an FDIC insured account and into a money market fund? Oftentimes, the percentage rate is only one or two percent higher. If the value of the fund shares fall, then you can lose money on the principal, in addition to having the redemption gate and liquidity fees risks. I have yet to meet any Main Street investor who has ever even heard about the rule, though many own money market funds. Either the salesman who sold them into the money market fund doesn’t understand the risks, or she does, and sold them into it anyway. Either way, when you are sold into a product that you don’t understand, you’re still subject to the terms and conditions that you signed up for. Trying to sue because you don’t feel you were properly informed is not a good strategy. Never Reach for Yield This is a reminder that in today’s world, when interest rates are so low, trying to get any return at all on your safe side can be more dangerous than you think. It is a fool’s game to gamble that everything will keep coming up roses, when deficits and debts are ballooning, while economic growth is predicted to be under 2% in 2020. (The coronavirus is predicted to impact the first quarter pretty severely worldwide, and to slow growth in most countries this year.) We all know that you cannot borrow from Peter to pay Paul forever. There comes a time when Peter wants his money back, too. Another $3.4 trillion has been added to the public debt over the last three years, which has soared to $23.4 trillion. Consumer debt is higher than it has ever been, at $14+ trillion. Corporate debt has gone completely bonkers. 50% of corporate bonds are at the lowest rung of credit rating, just above junk bond status. Trying to get a measly 2% on cash, or 4% in a bond, puts you in speculative territory. The truth of the matter is buried in the fine print. You may have bond or money market funds in your nest egg that you’ve owned for years, which have now become far riskier than they were just a few years ago. Many bond funds lost money in 2018. Money Market and Bond Funds are vulnerable Cash and bonds are supposed to be the safe side of your portfolio. If you tell your certified financial planner that you are worried about the risk in bonds, then they might try to sell you into money market funds. If you balk at that, then you might get sold into an annuity or REIT (both have risks). That is just the way that a commission-based business plan works. Brokerages sincerely want you to make a return on your money. Everyone wins in that scenario. They also have to protect themselves from downturns, as business cycles include recessions. The Bottom Line It’s time for you to know exactly what you own in your financial plan, and why. A good salesman will always lead you to believe that you are just fine the way you are – or sell you something else that might earn them a higher commission. That is why you have to know the ABC’s of Money that we all should’ve received in high school. If you can’t access your money, get charged to access your money, or lose your money, you don’t have much recourse, other than just to wait and hope that everything recovers sooner rather than later. The safe side of your financial plan is supposed to be protected from loss of your principal. Everything is coming up roses today. Stocks are higher than ever. Real estate prices are higher than ever, and unaffordable in 71% of US cities. Debt is eye-popping & astronomical. That is why, rather than enjoying the ride (if you’re on the right side of the income disparity), it’s time to fix the roof while the sun is still shining. The Wealth Challenge That is why our team has issued a wealth challenge to you. Add up everything you have in all of your accounts, including your 401(k) your IRA, your HSA, annuity, REITs and any savings accounts you might have. Once you get that total, celebrate! Hopefully it makes you very happy to see how much wealth you have amassed. Then divide that number by half. Ask yourself if you are really willing to risk losing that much money. Why? Because the last two recessions have cost investors more than that. Buy & hope is a 20th-century strategy that hasn’t worked in the 21st-century, and will not work going forward until we cycle through this period of extremely high debt and very low economic growth. If your strategy is just to contribute and never look at your statements, then you are just riding a Wall Street roller coaster. If you lost a third or more last time and haven’t made any changes, you’re just as vulnerable today as you were in 2007. We’re at the high now. It’s time to keep your wealth. Is there a better plan than Buy & Hope? Yes. Our easy-as-a-pie-chart nest egg strategy is based upon a trademarked system of Modern Portfolio Theory, with annual rebalancing, that earned gains in the last two recessions and has outperformed the bull markets in between. (Click to see Nilo Bolden’s video testimonial.) The time to get wealth savvy and adopt a time-proven plan is now. You have a lot to gain by understanding what you own, and getting properly protected and diversified, and a lot to lose if you don’t. If you wait for the headlines that the economy is in trouble it will be too late to protect yourself. Politicians don’t admit that the economy is contracting until most of the losses have already occurred. Call 310-430-2397 to get pricing and information on our unbiased 2nd opinion of your current wealth strategy, or to attend a 3-day life transformational investor educational retreat, where you will learn the ABCs of Money that we all should have received in high school. Wisdom is the cure. Other Blogs of Interest NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. This blog was updated on March 10, 2020. NASDAQ went from a low of 1,577.03 on December 30, 2008 to a high of 9,700 by February 18, 2020. That is a 6-fold+ increase. Those kind of returns, 46.8% annualized over an 11-year period, can compound your contribution and gains dramatically. As you can see from the chart below, if you were depositing $10,000 into a tax-protected retirement account, and investing in the NASDAQ Composite Index through an index fund, you'd have over half a million in just 10 years. If your nest egg isn't worth significantly more today than it was in 2009, that's a sign that your financial plan is faulty. Have you spent the last decade, until very recently, trying to gain back losses? That’s a red flag that you are adhering to a 20th Century Buy & Hope strategy that hasn’t worked at all in the 21st Century. There is a time-proven system that works. It’s time to learn it. Did you sell low at the bottom of the market, thinking we were headed into a Depression? Are you tempted to jump in now and join the party? That is investing based upon emotions – which is always going to be on the wrong side of the trade – selling low and buying high. It is also possible that you have been led astray by listening to the wrong advice. In truth, a properly diversified plan would not put the entire $10,000 annual contribution into NASDAQ stocks. However, this calculation is a sobering reminder of the opportunity cost of: * Neglecting to fund your retirement accounts, * Opting to pay off old debts before you contribute to your own future, * Waiting until you pay off debt to invest, * Hoping that someone else will manage your money for you * Following headlines or investing based upon a hunch, an email or a friend’s recommendations… Our easy-as-a-pie-chart nest egg strategies with annual rebalancing earned gains in the last two recessions and have outperformed the bull markets in between. Why? Because: * You always keep enough safe, which limits your losses in a downturn, * Your investments are properly diversified, which adds stability and increases performance, * Adding in hot industries and countries increases performance, too, * Overweighting safe when there is greater risk of a correction is a better strategy than market timing, * Annual rebalancing is a Buy Low, Sell High system on auto-pilot, * The pie chart takes the emotions out of it, prompting you to do what you are supposed to do. In today’s world, you also have to know what’s safe at a time when: * Bonds are overleveraged and vulnerable to loss of principal, * Money market funds have redemption gates and liquidity fees and, * Long-term securities are high-risk, with low reward, and expose you to illiquidity and opportunity costs. It’s time to know what you own, to be the boss of your money and to adopt 21st Century strategies that work. Call 310-430-2397 or email [email protected] to register for our next Investor Educational Retreat. I am also offering an unbiased 2nd opinion on your current strategy. Wisdom is the cure. Other Blogs of Interest CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. As of February 14, 2020, the CoronaVirus had claimed the lives of 1,382 individuals, with more than 64,000 known cases of the virus. That is a very high mortality rate for a virus, at 2.2%. Most of us think about getting over a cold or flu within a few days or weeks, so having a deadly virus like COVID-19 is alarming and causing an “abundance of caution” for a great many people around the world, particularly any company that has a factory or store in China. Many U.S. companies fall into that category – particularly in the technology industry. There is a cruise ship quarantined in Japan, where sadly one person passed away. (There has also been a death in the Philippines.) Travel in certain areas of China has been severely restricted. On Feb. 12, 2020, Mobile World Congress 2020 Barcelona, the largest mobile communications trade show, was canceled. One of the world’s largest Chinese factories, FoxConn, has been dark since the news of the virus hit, and is still off-line. Apple headquarters and retail stores in China are closed, as are Tesla stores, though Tesla claims that their Gigafactory is back to work. Schools have been conducting classes online. As Federal Reserve Board Chairman Jerome Powell told Congress on Feb. 7, 2020, “Possible spillovers from the effects of the coronavirus in China have presented a new risk to the outlook.” Before news of the virus, the economy was predicted to grow 2.0% in the U.S. in 2020 and 5.9% in China. Economists have warned that China could dip as low as 3.8%. Although the multinational companies are scrubbing the Internet of news of their store and factory closures, it seems pretty clear that the factory closures will cause global supply chain disruptions and inventory backlogs and lackluster product sales in China in the first quarter of 2020. The only real questions are, “How much?” and “Which countries and companies will be impacted the most?” Which Countries and Companies Will be Impacted the Most By COVID-19?

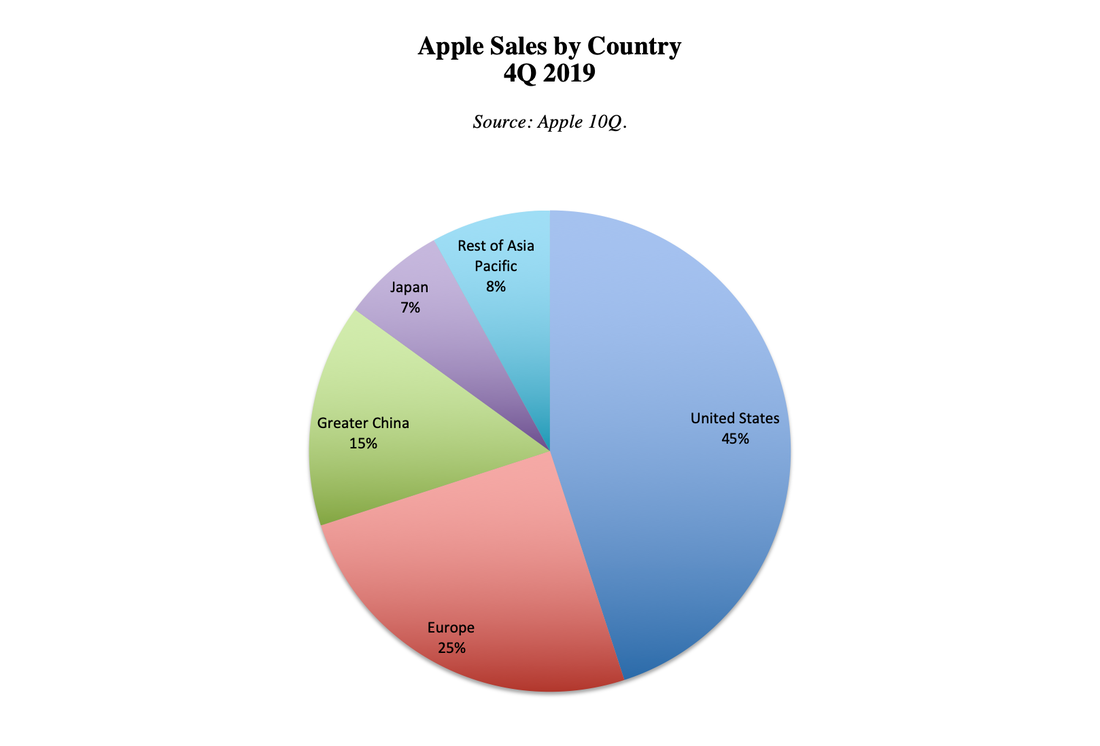

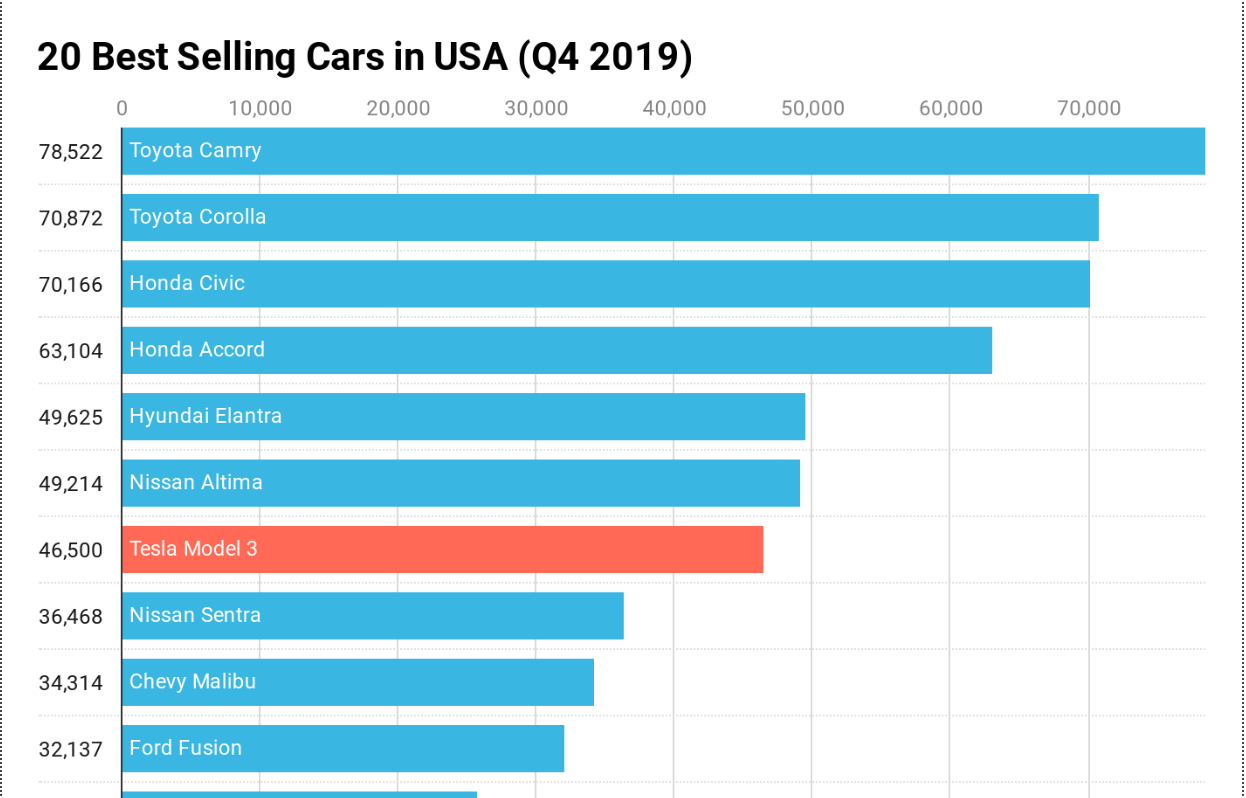

Many companies are trying to reduce the impact of the virus on their next earnings report by widening their forward projections. Qualcomm has a forward outlook on revenue of $4.9-$5.7 billion, with non-GAAP earnings per share of $0.80 to $0.95. That is an unprecedented $800 million window of revenue room to be right in. Apple did the same, projecting revenue of $63-$67 billion, with a $4 billion spread. If earnings hit the low end of the target range, then the headlines could be kind. A miss might create concern, at minimum, and alarm if the miss is, well, alarming. The bottom line is that the coronavirus, and the important steps that have been taken to contain the outbreak’s spread, will slow down the world’s economy. Store closures, factory suspensions, travel restrictions and health concerns have put multinational manufacturing on hold, Chinese consumer spending on pause and global citizens on high alert. With any luck, the virus will be contained quickly, and the mortality rate will drop to zero. However, things play out, there will be a negative impact on the next earnings season in April, and on global growth in 2020. Listen to my free teleconference on the subject at BlogTalkRadio.com/NataliePace. Are you interested in protecting your wealth now, while stocks are at an all-time high? Call 310-430-2397 to register for our next Investor Educational Retreat. Investor Educational Retreats We are hosting an Earth Day Retreat in England April 24-27, 2020, an iconic Santa Monica Beach Retreat June 5-7, 2020 and a Wild West Arizona Adventure Oct. 10-12, 2020. Visit NataliePace.com for additional information on these retreats. Register by Feb. 29, 2020 and you’ll receive the best price. Call 310-430-2397 or email [email protected] to learn more and to register now. Other Blogs of Interest Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. As a child, there was a female in our family in a prominent position who spread rumors, gossip and lies about other women. In so doing, she was able to sequester our father, and keep him all to herself. As a result, my father had very little contact with his children for decades. A lot of people will say, “There are two sides to every story.“ In that experience, there were indeed two sides to the story. There were the lies, and there was the truth. The gossip, rumors and lies were very loud and ever present. Sometimes they were built upon a small amount of truth, which would be blown completely out of proportion, and into a crisis. Other times, they were completely fabricated. All of the lies added up to an ultimatum. “Do you choose them or me?” Love doesn’t like to enter into the fray and fight like a liar. Even when attacked, love never seeks to harm, not even an attacker. (When the weapons are words, and the person caught in the cross-fire is a loved one, it’s hard to make a case for self-defense.) So, love, and truth, might retreat. However, even on the horizon, or out of view, love is still love and the truth is still the truth. They are quiet, constant fires that refuse to be extinguished. They gather their strength. Their return will not be loud. In a sense, love never left. My wishes and prayers were constant for my father. As I gained understanding about the mental health challenges of the woman who had sequestered him, and the abuse she had suffered in her life, I slowly developed compassion for her. I practiced loving unconditionally, while also protecting myself from attacks. I lived far away, but attempted short visits. At first, it was only a meal every year or so. That led to more contact, but never long, and always with an eye on my back and the exit. In all fairness, I cannot say that I loved the attacker. However, I was able to get to the point where I had compassion toward her. And the lesson that I took away from the experience is that forgiveness is a gift you give yourself. Resentments are a heavy load to carry. As Carrie Fisher was fond of saying, “Resentment is like drinking poison and expecting the other person to die.” I also learned that real love is constant and quiet. Fear, jealousy and insecurity are loud. Love would never seek to harm others, or separate a family member from their tribe. When insecurities dominate the channel of one’s emotions, they can create maliciousness. I guess that is why love and all of her close companions (compassion, kindness) require practice. The heart is a muscle. It's pretty easy to feel and taste when I am letting resentment, fear, jealousy, etc. try to steer my emotions. Real love remains constant and awaits the day that you knock on her door. And when you do, you are greeted with an open heart and loving arms. Love is honorable and doesn’t need to bring others down. There is no malicious gossip on the tongue of a truth-telling lover. Even when someone is headed on the wrong path, there is no need for carping. Compassion might be the warmth that guides the lost back home. So my wish for each of us today is that we immerse ourselves in love, and her companions of warmheartedness, kindness and truth. My father now has a good relationship with all of his children. Because love always wins. Happy Valentine’s Day. With love to you, and gratitude for you being in our tribe, Natalie Other Blogs of Interest Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On February 4, 2020, Tesla hit an all-time high of $969/share, for a total value of $175 billion. Today, the stock has pulled back to $748.96/share, with a market capitalization of $132.43 billion. That is $49 billion more than the combined value of General Motors and Ford Motor Company, with market caps of $48.18 billion and $35.60 billion, respectively. If you invested low in Tesla, and are now a gazillionaire, congratulations. If you are tempted to buy in now, then splash some water on your face, and let’s take a closer look at Tesla’s price and potential. The real question is, “Is Tesla worth GM and Ford combined?” The answer today is, “Yup, if you listen to investors.” However, if you look at the data, the valuation seems quite a bit frothy, even with the share price pullback over the last few days. Tesla’s sales of $24.58 billion in 2019 are still a fraction of GM’s $147 billion & Ford’s $160.34 billion. Investors are betting on Tesla’s sales growth, particularly in China. However, Tesla’s 2019 year over year revenue was up only 2%. 4Q 2019 net income was $105 million, with a full year loss of -$775 million. Yes, sales in China will start ramping up and showing on the earnings going forward. However, that is at least partially offset by the expiration of the federal EV tax credit, which makes Tesla cars much more expensive in the U.S. There’s no question that Tesla has become the greatest market disruption success story of the early 21st century. VOIP never displaced AT&T. Rather than offering a secure, private and democratic way to bypass banks, cryptocurrency has been rife with crooks and scams. However, Tesla set out to make gas guzzlers a thing of the past, and is making good on its promise. Tesla started with a sexy Roadster in 2008 that could beat a Porsche from zero to 60. The Tesla Roadster was a far cry from the golf cart electric vehicles available at that time. In 2013, the Tesla Model S scored the highest safety rating by the NHTSA. The Tesla 3 launched in 2017, and quickly became the #1 bestselling car by revenue in July and August of 2018. The Tesla 3 is still the #7 bestselling car in the U.S. Both Ford and GM were pushed out of the sedan business by Tesla in 2019. General Motors’ CEO Mary Barra believes that self-driving electric cars are the product of tomorrow, and is investing heavily in “a future of zero emissions and zero accidents.” Jim Hackett, Ford’s CEO, is leaning into EVs as well, with plans to launch 16 EVs by 2022. The purchase price of a Tesla 3 is higher than the 6 cars ahead of it (all made by foreign manufacturers). However, the dramatically lower costs of fuel and maintenance make the cost of ownership lower than the bargain brand competition. This story has not been well-marketed, however. The average car buyer is not be in the loop on this yet, and is still making purchases based on price, not quality and fuel/maintenance savings. Tesla’s solar roof tiles look amazing. However, revenue from Tesla’s energy storage and generation vertical was lower in 2019, despite a 30% federal tax credit being in play. I spoke to a developer recently who declared that the price of the solar roof tiles is absolutely eye-watering. Price and financing options are likely to have hands in the slow rate of adoption. Once price becomes as appealing as the product, solar roof tiles could take the world by storm. We’re not there yet. Investing in a cash negative car company that is currently valued at 1.3 billion times more than earnings seems foolish in any marketplace and downright delirious in the late stage of the current business cycle. Elon Musk has been tireless, crafty and magical in achieving milestones that seemed impossible. Tesla cars are stunning feats of ingenuity, performance and beauty. However, betting that Tesla will continue to be the only electric luxury sedan in town (around the world) is a dangerous game. And valuing the company at 1.5 times the value of the other two major American automakers is a little too early to declare a complete knockout by Tesla of the competition. Anyone who has been in the Northeast and has witnessed how fearful drivers are of driving an EV in the snow understands that this market has a way to go to completely displace gasoline-powered vehicles. Both Ford and GM are currently constrained by a last century business model and execution plan. Ford and GM sales come mostly from gas guzzling pickup trucks and SUVs. Additionally, Ford and GM are still heavily weighted down by legacy promises of pensions and other post-employment benefits (OPEBs), such as health care. GM exited bankruptcy in 2009. However, the company’s debt/equity ratio is still 1.56. GM is currently underfunded on its pensions and OPEBs by $17.2 billion (#5 on the most severely underfunded list). Ford’s D/E is 2.82, with $11.86 billion underfunded on pensions and OPEBs (source: S&P Dow Jones Indices). By comparison, Tesla has no pension obligations. Tesla has a lot of debt, too, and is carrying a D/E of 1.76. However. Tesla’s debt is being used to build more factories to keep up with demand. GM and Ford are borrowing to pay for legacy promises that they are having difficulty keeping. Ford’s plans for innovation and relevance in the autonomous electric vehicle marketplace is further complicated by potential capital constraints. The company was downgraded to junk by Moody’s in 2019. Ford is paying a yield of 6.7% to stockholders to keep them interested. The strategy of high dividends accompanied by massive borrowing and declining sales didn’t work out very well for GE. When GE cut its dividend, the stock fell by half instantaneously. GE shares are valued at about a third of what they were in January of 2017. GM and Chrysler both had to restructure their debt in the Great Recession. Ford skirted restructuring in 2008. However, Ford suffers from the same legacy costs that took down the other century-old auto manufacturers. Ford’s unit sales were down 10% in 2019 (from 2018), with revenue off 3%, to $156 billion. Net income imploded. Ford’s 2019 net income was just $84 million, down from $3.7 billion in 2018 and $7.8 billion in 2017. With over $154 billion in long-term debt, and $220.5 billion in total liabilities, restructuring could be forced on Ford Motor Company, which is one of the reasons why the company is now rated “speculative.” The CoronaVirus All three of these U.S. car companies have sales and supply chains in China. So, the coronavirus is another variable that casts shade on Tesla’s sunny stock summit. With any luck, the coronavirus scare will pass soon, without too much economic impact or more deaths. However, that is another variable that makes the current frothy valuation quite speculative. I love Tesla cars, and believe strongly in this company. However, this valuation is too rich for my blood. If I were in the money, I’d be selling. Other Blogs of Interest Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed