|

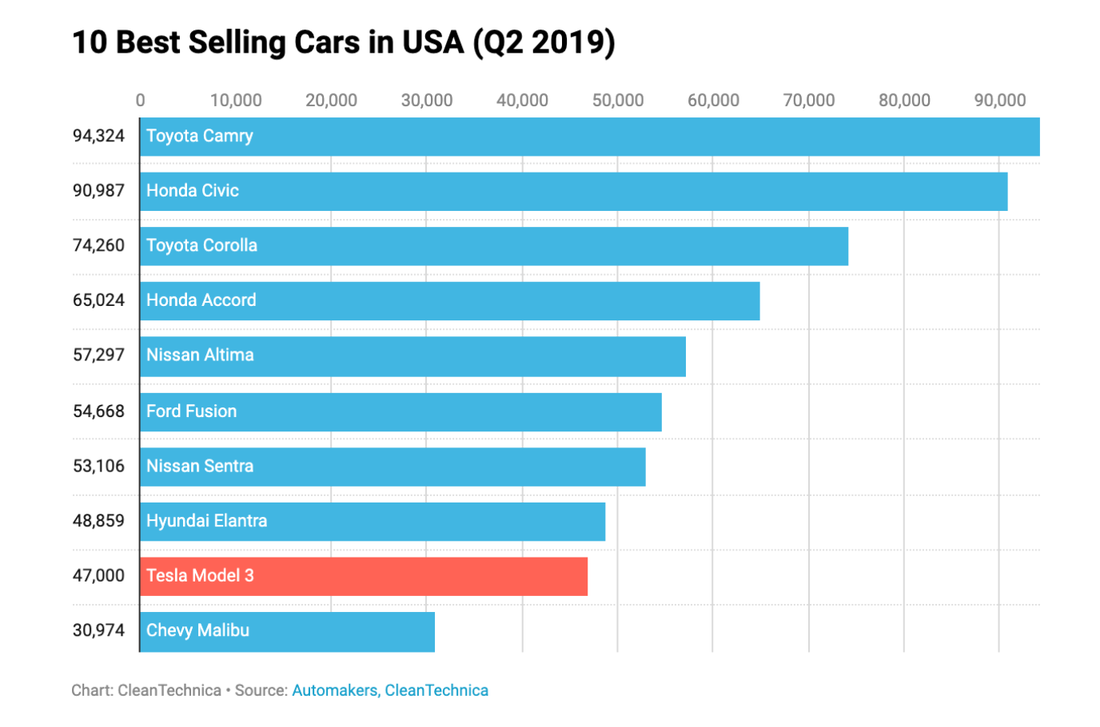

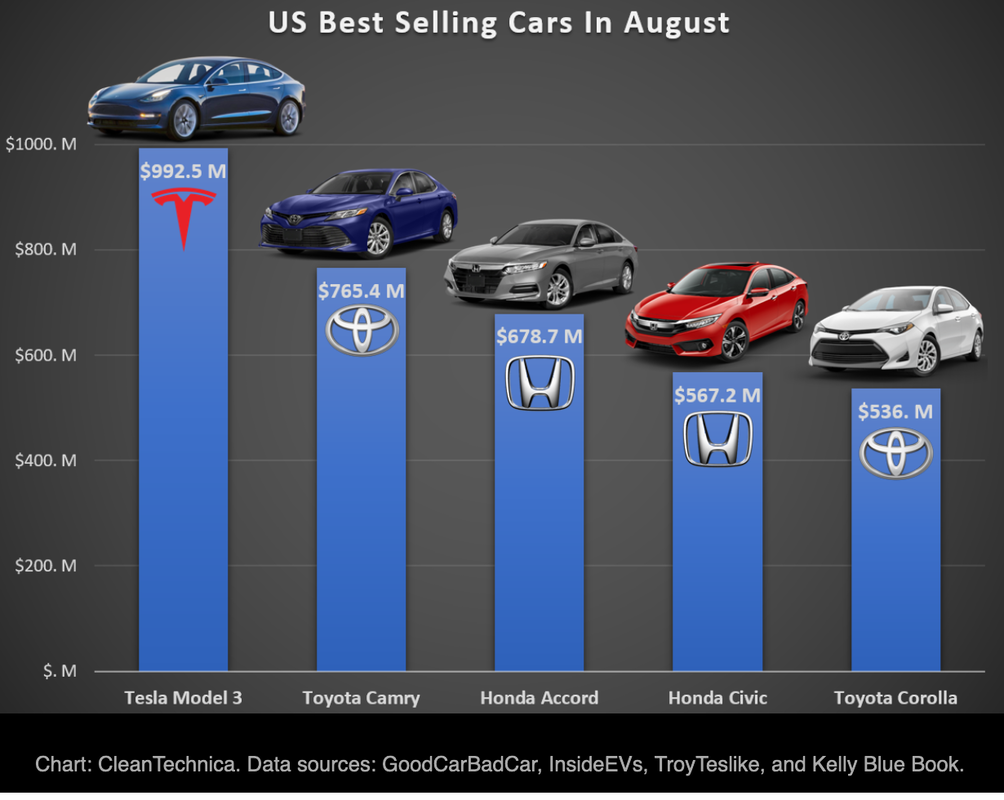

This blog was updated at 4:55 p.m. PT on Oct. 1, 2019. The Tesla 3 was the #1 vehicle in the U.S. by revenue and the #5 by unit sales in August of 2018. In the 2nd quarter of 2019, it was the #9 bestseller by unit sells. The 2Q 2019 Tesla Vehicle Production and Deliveries report was outstanding. The one tomorrow should be even better. After Tesla reported on July 2, 2019 that the company had delivered 95,356 vehicles in the 2nd quarter of 2019, the share price popped from $224 to $265 over the next few weeks. Investor euphoria proved to be very short-lived, however. On July 24, 2019, when Tesla reported their 2nd quarter earnings, which included a net loss of $408 million, the previous share price gains were completely wiped out. This time around, Tesla stock is starting out slightly higher, at $243.43 (on a day when the Dow Jones Industrial Average has been down 324 points). If the stock rises to $265 again, that’s only a 9% gain. However, a leaked report from Elon Musk has investors believing that Tesla’s Delivery Report for 3Q 2019, which could be released as early as tomorrow, “has a shot” at being outstanding – above 100,000 vehicles for the first time in the company’s history. Having an outstanding delivery report right now, while Ford and General Motors are struggling, could attract investors who are looking for something to believe in. Ford bonds were just downgraded to junk by Moody’s. General Motors is entering the 3rd week of a company-wide strike. Tesla is aiming for cash positive in the 3rd quarter 2019 and believes the company can be self-funding now, after a $2.4 billion equity and convertible bond raise in the 2nd quarter that left the company with $5 billion cash and cash equivalents on hand. The company is expanding rapidly: building the Shanghai factory, a Model Y factory and an expansion of the Gigafactory. So, there will likely still be cash negative quarters going forward, particularly around product launches. This means Tesla stock could easily continue the rollercoaster ride, even though the general trend in worldwide sales is stellar. Tesla Sales are on Fire Worldwide Tesla was the #1 bestselling car in the U.S. by revenue, and was in the top 5 by unit sales in August of 2018. In the 2nd quarter of this year (2019), the unit sales had slipped, and the Tesla 3 was in the 9th position. The company is the #1 bestselling car in Norway, with 11,517 cars delivered in August. Tesla is the #1 bestselling car in The Netherlands, with 10,000-11,000 cars sold in September. The company soared to #3 bestseller in the United Kingdom. Tesla is enjoying a meteoric rise in every market where it delivers. (Sources: InsideEVs.com and CleanTechnica.com). Next Stop: China. Tesla is targeting production at their new Shanghai Factory by the end of this year. Analysts are a little wary of that target. However, Tesla sales are already exploding in popularity, with up to 6400 vehicles delivered in China in the 3rd quarter (source: JL Warren Capital). A new Chinese tax break for electric vehicles, amounting to about $14,000 U.S., should keep Tesla sales in high demand. If Musk is to be believed, the 3rd quarter 2019 earnings report shouldn’t crash into cash negative, unless there is a significant, unexpected event, which of course can always happen with factories, particularly ones that are getting up and running as fast as Tesla’s are. The earnings report should be released in the 3rd week of October, around October 24, 2019. The one bugaboo to investing in this strong company is you must factor in the marketplace itself. This is the late stage of the business cycle (i.e. at some point stocks will weaken). The Institute for Supply Management’s September Manufacturing ISM Report on Business was the weakest the U.S. has experienced in a decade (yup, since the Great Recession, June 2009). September was the second month of contraction -- marking the official start to the 2019 Manufacturing Recession. Investing in the Late Stage of the Business Cycle There are certain times when the wind is at your back in trading, and others when it’s in your face. For the last decade, stocks have made money. You didn’t have to be a great stock picker. You just had to be invested. When stocks weaken, however, even great stock pickers can be eaten alive. Most stocks will head south in a general downturn, just as they did in 2009. Apple iPhone was on fire in 2009, after a game-changing launch in 2006. The company had figured out how to charge a lot for a phone (over $600), and still give it away for free via the wireless carrier. And yet the stock still tanked after the Lehman Brothers, General Motors and Chrysler bankruptcies in 2008-2009. So, in 2019, even with an outstanding company like Tesla, which is leading one of the fastest growing industries in the world (electric vehicles), you still have to ask these three questions before investing. What can the company do? What can the industry do? What will the general market do? And if you do invest, and you find yourself on the right side of the trade, it’s a good idea to take your profits early and often. There have been multiple opportunities to trade Tesla “around the core” over the past few years. Full Disclosure: I’ve been actively trading Tesla for the past two years. Other Blogs of Interest Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed