|

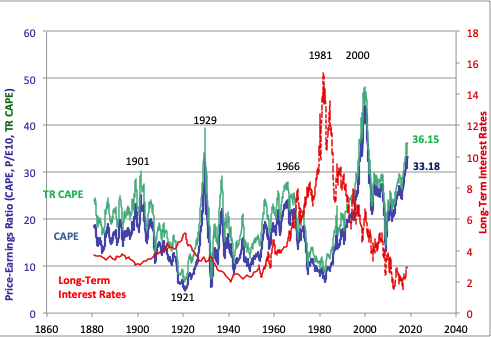

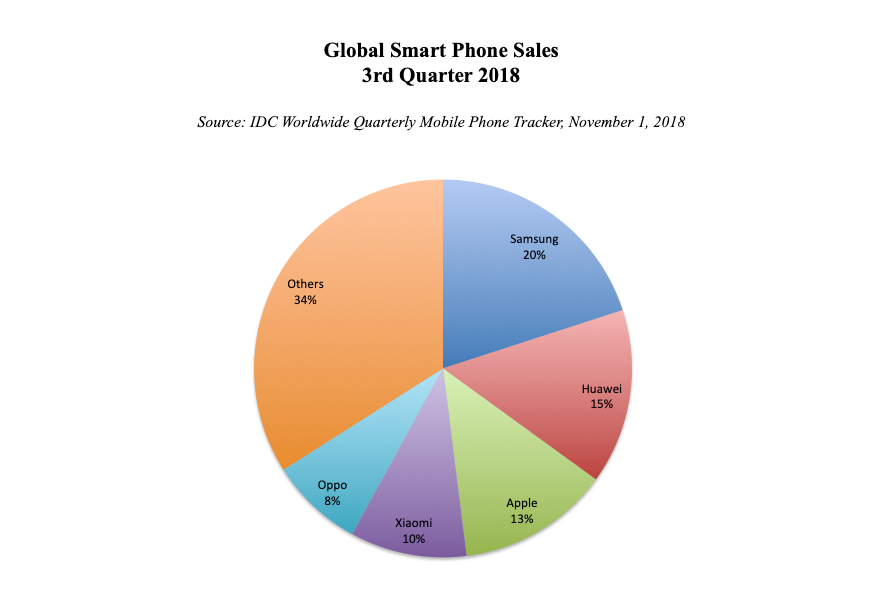

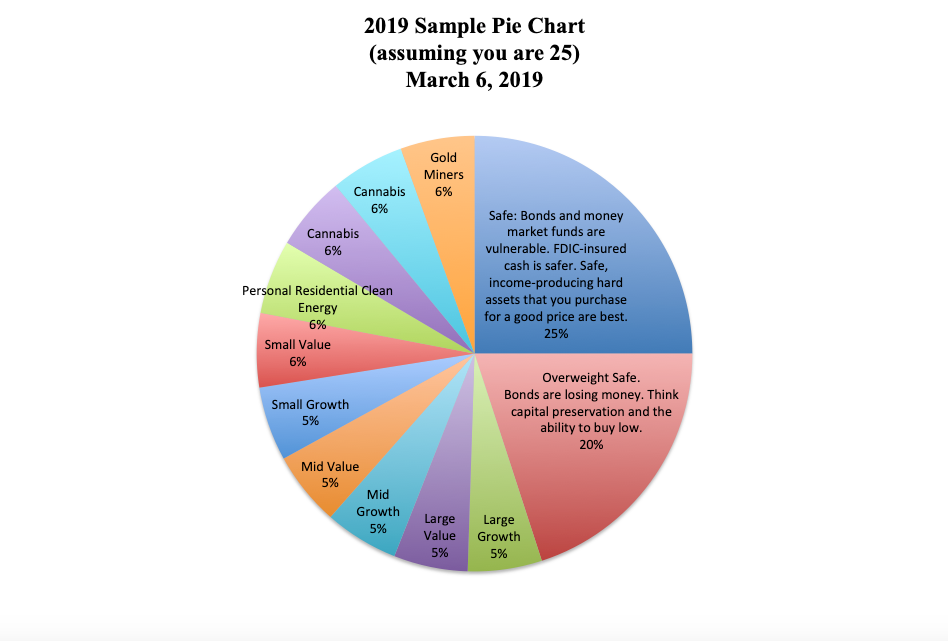

Real estate was the “lowest hanging fruit” to invest in, back in 2009. Since then, prices are up 47% nationwide. Detroit real estate has quadrupled in some areas. Here’s a segment of me discussing the upside of real estate a few years ago on Fox News. After that segment, areas like Denver and Idaho popped by another 45%-52%. Last year, the nest egg pie charts featured a hot newcomer – publicly traded cannabis stocks. There were a few tricks that were important to consider, such as avoiding penny pot stock scams and newly formed ETFs. However, those who learned how to evaluate the opportunity have seen their investment in companies like Cronos double. What’s hot and what’s safe changes every year, which is why it is important to rebalance your nest egg annually, and get updated on the latest trends. There is a lot of noise in financial media from people with very little experience and, frankly, terrible results. So, grade your guru before you listen to anything she has to say. Otherwise, your hot tips might be nothing more than paid promotional pump-and-dump schemes, a loser product that pays high commissions to salesmen or just plain, old-fashioned bad advice. So, what’ hot for 2019? Real estate prices are astronomical and unaffordable in many cities. We’re starting to see weakness in sales. Stocks valuations are higher than ever, and lost money in 2018. Bonds have more credit risk than most people realize, and have been losing value for over a year. Many respected economists have been quite frank about saying that stocks and bonds are in a bubble, including Alan Greenspan and Warren Buffett. According to Robert Shiller, Nobel Prize winning economist and Yale professor of economics, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” In 2000, when NASDAQ began a descent into losses of 78%, the hottest asset was cash, and 2019 may well be another year where that is the case. Keeping your money can be a great investment when everyone around you loses more than half, which is what happened in the last two recessions. (See the charts below.) Since the economic data today is even more troubling that it was in 2000 or 2008, it’s important to keep this top of mind. As Warren Buffett reminded his shareholders in 2017, “There is simply no telling how far stocks can fall in a short period... No one can tell you when [market reverses] will happen. The light can at any time go from green to red without pausing at yellow." Below are charts of the Dow Jones Industrial Average dropping 55% in the Great Recession (2007-2009), and the NASDAQ Composite Index dropping 78% in the Dot Com Recession (2000-2002). in You need money to invest in order to take advantage of any hot opportunity. That is why it is so important to be properly balanced, diversified and to have enough of your money safe and liquid (something covered extensively at our Investor Educational Retreats). (Money market funds are riskier than most people are aware. See the disclaimer below that appears on most MM fund websites.) The reason most people don’t buy low is that they can’t buy low. When bubbles pop, you have to wait (and hope) to get your money back, if you were caught at the top. You can’t buy low at the bottom of anything, if you were all in on stocks and just riding the Wall Street rollercoaster when it descended into a correction. (If you’d like an unbiased second opinion on the risk in your portfolio, call 310-430-2397). Having said all of that, and placing emphasis on the point that getting hot centers upon your ability to keep your capital safe enough to allow you to buy low, there are a few areas of opportunity to consider. Cannabis Everywhere I turn there’s a new sign advertising CBD Oil. In many major cities, there are new cannabis retail shops popping up. Once you mention the word cannabis in a public setting, expect for strangers around you to confess that they use it to reduce anxiety, help them sleep, numb pain or even as a cure-all for everything from cancer to other inflammatory-based diseases. The revenue growth in the publicly-traded cannabis companies is astonishing. Cronos has sales growth of 428%. Medmen, a retail cannabis shop with locations in California, New York, Florida, Nevada, Arizona and Illinois, reported almost as much revenue in the 2nd quarter of Fiscal Year 2019 ($29.9 million) as they did in the entire fiscal year of 2018 ($39.8). Medmen plans to open up another 16 locations in 2019 – 12 in Florida. The risk with cannabis, in addition to share price volatility, is that everyone is setting up shop, and penny pot stock scams still abound off the boards. You have to know how to properly evaluate a company, including how to pick the leader and buy for a good price. Cronos has more than doubled since October of 2018. On the other hand, Tilray soared to $300/share in October and then sank like a rock back to $75/share, where it is still trading today. (Day 2 of the Investor Education Retreats focuses on picking winners.) This is an emerging industry where examining who is in the C-Suite and on the board will help you to separate the winners from the losers. Medmen has one of the strongest executive teams, boards and expansion plan of the industry. The share price has experienced extreme volatility. Gold Gold is a great hedge against a stock market downturn. In the early stage of the correction, gold prices could get drug down. However, there is a strong correlation between stocks sinking and gold soaring. Gold prices typically rise when oil prices rise – something that should happen now that Putin and OPEC have cut oil production. Gold’s high of $1895/ounce in September of 2011 occurred just after Standard and Poor’s cut the U.S. credit rating from AAA to AA+. Fitch Ratings has warned that if the Debt Ceiling isn’t raised before the U.S. runs out of money, the U.S. faces a downgrade. We are currently using extraordinary means to pay bills. (Click to read more about that.) Gold prices are down by 32% since the high, whereas many of the gold miners are trading at a 75% discount. iShares has a gold miner fund, symbol: RING. Direxion has a popular 3X gold bull fund, symbol: NUGT, with average volume of 7.5 million shares traded daily. Chinese Internet Stocks Everyone has been talking about a “slowdown” in China’s economy, without really putting that slowdown into context. China’s growth in 2018 was 6.6%. In 2019, China’s economic growth is predicted to slide back to 6.0-6.5%. By contrast, the U.S. GDP growth for 2018 was 2.9%, with 2019 predicted to come in at 2.3%. China’s robust, but slowing, growth is reflected in the Chinese technology stocks, which continue to grow by leaps and bounds over their American competitors, even in markets like Europe. Huawei replaced Apple for the #2 position in worldwide smart phone sales in 2018. However, Apple was back at #2 in the 1st quarter of 2019. (Samsung is number one.) Huawei's shipments grew by 45%, while Apple's declined by -11.5%. Alibaba’s sales growth is 41.30%, compared to Amazon’s 19.70%, with profits at 20% compared to Amazon’s 4%. Twitter and Facebook have strong profit margins (40%) and growth (24% and 30%, respectively). However, Weibo, China’s Twitter, has much higher revenue growth year over year of 44%. Risks The worldwide marketplace of equities is interconnected. When any major market weakens, it ripples around the globe. This late in the business cycle, with high valuations and slowing growth, I’d be concerned about all stocks now. However, having a Chinese Internet fund on your shopping list, or tiptoeing in with a dollar-cost averaging buy plan, might be a sound strategy. Guggenheim has a Chinese technology fund, symbol: CQQQ. Clean Energy Clean energy stocks continues to have a rough time, with many solar companies still operating cash negative. Tariffs have made matters much worse, by increasing the costs of a global supply chain. This also affects the lithium manufacturers, who are enjoying a field day in sales, particularly to lithium battery makers and electric vehicle manufacturers. The race to capture market share is on, and that affects the deals that are already in place and others that are being inked. Livent is having trouble keeping its lithium carbonate deal in place with Nemaska Lithium. Albermarle recently settled with CORFO, Chile’s Economic Development Agency, to expand its lithium mining in Chile. A few years ago, SQM lost its CEO Patricio Contesse, when he was accused of campaign finance violations. So, even though clean energy funds like PBW, PBD (Invesco) and ICLN (iShares) are trading at an all-time low, tariffs and red tape might keep any upside from catching wind in the share prices. However, that doesn’t mean that clean energy isn’t hot! The low-hanging fruit on clean energy strikes close to home. If you live in a sunny state, the payback on solar can be as low as 4-7 years, and the yield (from savings on your utility bill) can be as high as 25% -- more if you are powering your own electric vehicle with solar. The energy efficiency tax credits that are offered by the U.S. government start phasing out at the end of 2019, so now is the time to evaluate the ROI for your home. Click to go to the Department of Energy’s website for additional information on how you can obtain up to 30% tax credit for your energy efficiency upgrades, including solar. Late Stage of the Business Cycle It’s always a good idea to get hot in your investments. However, this late in the business cycle, it’s even more important to make sure that you protect your assets. My warnings on real estate and to stop using home equity as an ATM machine began in April of 2005. My warning on underweighting stocks was issued on Dec. 23, 2007. When you wait for the headlines that things are heading south, it’s too late to protect yourself. Having a properly balanced and diversified plan allows you to buy low and sell high on auto-pilot in your nest egg, and protects your safe assets from capital loss, so that you can consider low-priced, hot opportunities when they come up. Full disclosure: I own positions in the cannabis companies, in Albermarle and in the gold miner funds mentioned in this article. Make sure that your financial house is secure enough to withstand the economic storms that are on the horizon. Call 310-430-2397 to learn easy, time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between. Join No. 1 stock picker Natalie Pace at a 3-day Investor Educational Retreat. Register for the Colorado Retreat scheduled for April 27-29, 2019 now. Other Blogs of Interest The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Schwab SWVXX Money Fund Disclaimer You could lose money by investing in the Schwab Money Funds. All Schwab Money Funds with the exception of Schwab Variable Share Price Money Fund seek to preserve the value of your investment at $1.00 per share, but cannot guarantee they will do so. Because the share price of the Schwab Variable Share Price Money Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. All Schwab Money Funds with the exception of Schwab Government Money Fund, Schwab U.S. Treasury Money Fund, Schwab Treasury Obligations Money Fund, Schwab Government Money Market Portfolio, and Schwab Retirement Government Money Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Schwab Money Funds is not insured or guaranteed by the FDIC or any other government agency. The Schwab Money Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time. 4/2/2020 12:53:25 am

In today's era, it is hard to find such a residential place in a fantastic location that is available in the affordable price range. I am also living in the suburbs of New York because I cannot afford the residential expenses of the city. 29/3/2020 06:00:36 pm

I was reading through some of your posts on this site and I believe this website is really informative! Continue posting. 29/3/2020 06:40:49 pm

I have gone through many articles as I am having some thoughts of using CBD for curing my anxiety. Finally, I have found such an informative and realistic article. Keep the good work. 5/5/2020 12:02:32 am

Like these stats and especially about the real estate. In places like London, real estate is a bit expensive but you can get the right prices if you find the right dealers. Another big decision to make these days is choosing between buying a new house vs constructing a new one. 16/7/2020 03:11:01 am

Your thing with respect to making will be for all intents and purposes nothing hard to come by of amazing. This instructive article is unimaginably valuable and contains offered myself a superior answer for have the option to my own issues.

I really thank you for the gainful data on this wonderful subject and foresee more inconceivable posts. Thankful for getting a charge out of this greatness article with me. I am esteeming everything that much! Envisioning another great article. Favorable circumstances to the maker! All the best! 15/6/2021 05:48:08 am

I really thank you for the gainful data on this wonderful subject and foresee more inconceivable posts. Thankful for getting a charge out of this greatness article with me. I am esteeming everything that much! Envisioning another great article. Favorable circumstances to the maker! All the best! 13/7/2021 11:32:31 pm

I was extremely satisfied to discover this site. I needed to thank you for ones time for this especially awesome read!! I unquestionably liked every single piece of it and I have you bookmarked to take a gander at new data in your web. 25/11/2021 01:49:46 am

you are in place of reality a brilliant website admin. The sitee stacking pace is astounding. It kind of feels that you're doing any exceptional stunt. Moreover, The substance are magnum opus. you have done a brilliant errand in this! 25/11/2021 03:18:57 am

I trust all of you are having an incredible end of the week. I added another rundown. This one is more modest, yet at the same time valuable. I think the following one will be greater. 17/10/2022 03:13:15 am

I was intrigued accepting that you at whatever point imagined of changing the plan of your site? Its very much made I genuinely like what you've got to say. However, no doubt you might somewhat more in the technique for material at some point so individuals could get along with it better. 24/11/2022 10:57:43 pm

Remarkable post, you have brought up a few eminent subtleties , I too consider this s an exceptionally extraordinary site. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed