|

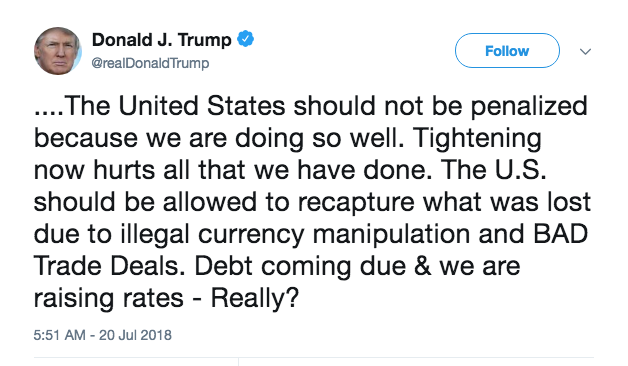

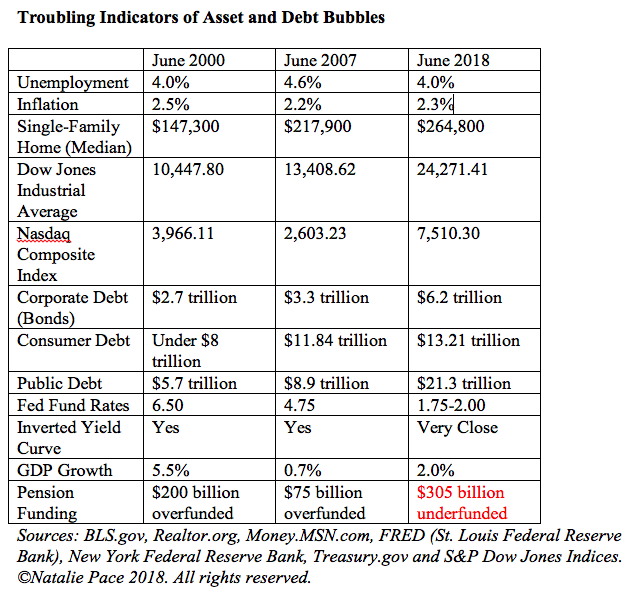

On Friday, July 20, 2018, the White House Tweet du Jour was a clear rebuke of the Federal Reserve Board’s policy of raising interest rates. The Federal Reserve Board is supposed to be independent from politics and the President – so that the board governors can have a long-term vision of what is best for the country. Previous Presidents have refrained from publicly commenting on Federal Reserve policy to show respect for FOMC independence. So, is the President meddling, or is he trying to save the U.S. economy from a misguided policy? Is raising the Fed Fund rate “penalizing” the U.S.? Is the economy doing as well as the President claims? What is the real reason that interest rates are on the rise, and how high will they go? Who wins and who loses with low interest rates? Is raising the Fed Fund rate “penalizing” the U.S.? Since the Great Recession, the Federal Reserve Board has adopted an “accommodative” stance, keeping interest rates rock bottom. This is a dangerous game on many fronts – one that all economists know well. And here are two reasons why. 1. Low Interest Rates Create Bubbles. In 2000, the free, easy money flowed into Dot Com stocks – many of which had been cash negative for five years or more and had little hope of breaking even. You couldn’t even load your shopping cart online before the dial-up connection crashed! In 2007, anyone with a pulse was getting a Liar’s Loan – culminating in the real estate bubble and crash. Today, Alan Greenspan, Warren Buffett and Nobel Prize winning economist Robert Shiller have all gone on record saying that stocks and bonds are in a bubble. In February of 2018, former Federal Reserve Board chairman Janet Yellen, said on CNBC, “It is a source of some concern that asset valuations are so high.” Each time before the crash, the headlines touted (and politicians bragged) that the party was just getting started. In 2000, it was eight years of prosperity and a New Economy. Today, everyone is enamored with their 5% dividends, unaware of the risk of capital loss and dividend cuts, except those General Electric investors who sobered up after losing half of their principal. Ignoring asset bubbles means that the fallout when they pop is more severe. This was one of the concerns raised in the June 12-13, 2018 Federal Reserve Board meeting. The minutes read, “Some participants raised the concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn.” Investors lost 78% of their NASDAQ holdings in the Dot Com Recession and 55% of their Blue Chip value in the Great Recession. Over 10 million homes went to auction in the wake of the Great Recession and 5.2 million are still underwater today. Today’s assets are far more overvalued and troubling than they were in 2000 or 2008. (See below.) So, while the politicians point to unemployment and GDP growth (which isn’t that impressive at just 2.0% in the 1st quarter) as signs that the U.S. is doing great, if you include over-inflated assets like real estate, stocks and bonds, the unaffordable costs of housing, medical insurance, health care, transportation, utilities, taxes and education and the astronomical debt, today’s economy is nowhere near as healthy as the headlines tout.

2. The Feds Need More Tools to Deal With the Next Recession. When recessions kick in, lowering the Fed Fund rate can jumpstart economic activity. If rates are already rock bottom, as they are today nine years into the recovery, there’s no room to move and few ways to help. Is the economy doing as well as the President claims? Today’s Gig Economy has a very low Labor Participation rate -- the lowest seen since 2000. As a result of underemployment, stagnating wages, staggering student loan debt, and unaffordable housing, the U.S. now sports the highest consumer debt the nation has ever seen. People just can’t seem to get ahead without making ends meet on their credit card. Student loan debt has doubled over the past decade. GDP Growth has stalled out to a projected 2.8% for the year (below the promised 3% and higher). The public debt has soared to $21.3 trillion. Corporate debt is astronomical. U.S. Pensions and Other Post Employment Benefits are underfunded by more than half a trillion dollars. And the trustees for Social Security and Medicare just warned that depletion dates are already on the horizon. What is the real reason that interest rates are on the rise, and how high will they go? The projections are for the Fed Fund rate to rise to 2.4% this year, 3.1% next year and 3.4% in 2020. The asset bubbles are too staggering to be ignored, with high-profile individuals (such as Shiller, Greenspan, Yellen and Buffett) sounding warnings over the airwaves. There is troubling economic data. Tariffs have made it doubtful that GDP growth will hit its projections. So, there is a lot of pressure on the Federal Reserve Board to get more tools in its belt before the next downturn. Who wins and who loses with low interest rates? In truth, having policy that is too accommodative tends to create what some business leaders have called “Hot Potato,” others have called “The Biggest Fool Syndrome” and still others just refer to as bubbles. When money gets too free and easy, big business can borrow and speculate. The problem is that in a competitive business environment, everyone who can speculates, driving up asset prices, which then creates the Hot Potato and Biggest Fool Syndrome. Before the Great Recession, business leaders lumped toxic Liar Loan mortgages into SIVs and CDOs, purchased insurance from AIG and other insurance companies to make these high-risk assets look foolproof, gave them fancy names and then sold them to investors. Pretty much everyone who created the products knew there was a problem. The financial overleverage was beyond the levels seen since the Great Depression. However, profits were so high that selling mortgages to anyone with a heartbeat and then reselling the assets to unsuspecting investors simply had to be done. Banks, mortgage providers and even realtors couldn’t afford to stand on the sidelines and let their competitors profit hand over fist. The goal was just to not be the Biggest Fool left holding all of the toxic assets, like Lehman Bros., Bear Stearns and AIG were. And so a great game of Hot Potato ensued. In 2018, corporations have been able to borrow money very cheaply to buy back their own stock, pushing stock prices to all-time highs. Mortgages are low, pushing housing prices back to all-time highs. The average American loses big-time in this scenario because their savings are earning nothing, their stocks are losing more than half in the recessions. Main Street is being sold into the toxic assets, and their credit card interest rates are still 29%. When real estate prices correct, their mortgage could go underwater. Will Powell Buckle on the Pressure of the Tweets? In a press conference on June 13, 2018, Federal Reserve Board chairman Jerome Powell said clearly that his concern was “appropriate policy.” Keeping interest rates low is a short-term fix that politicians like to promote because it is easier to get elected when the economy is strong. That’s short-term thinking. It is the job of the Federal Reserve to have a longer vision, so that recessions can be milder, growth can continue and inflation can be kept at bay. Business cycles (bull markets and recessions) are inevitable. Making sure that recessions don’t become depressions is critically important. There will be a lot of eyes on the August 1, 2018 Federal Reserve Board press release and conference, to see if the Federal Reserve will raise rates again, and stay on target to hit a 2.4% Fed Fund rate in 2018. (The Fed Fund Rate is currently at 1.75-2.00%.) The flattened yield curve has economists worried, as an inverted yield curve is an event that is highly correlated with recessions. However, the fallout from keeping interest rates low could be far worse. In short, I’d be surprised if the Feds don’t raise interest rates at least twice this year, as they have indicated in their projections. Other Blogs of Interest How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Healthcare Costs in Half Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. If you want to make sure that you are safe and protected before the next recession and stock market downturn, come to my next Investor Educational Retreat. Call 310-430-2397 to learn more now.

Sterling Harris

23/7/2018 01:05:55 pm

Hey Natalie, 24/7/2018 10:04:05 am

Thanks Sterling. As you know, it's my pleasure to offer the news, information and education Main Street needs to thrive. I love my job! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed