|

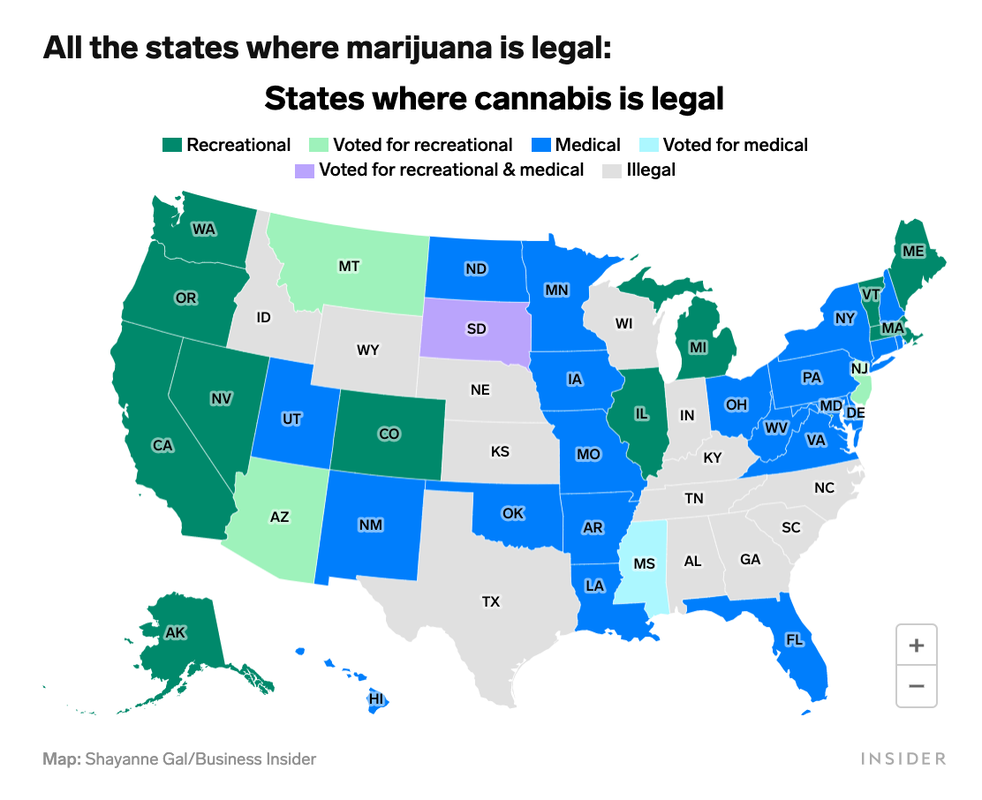

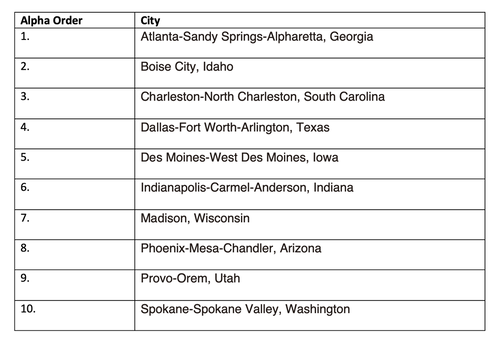

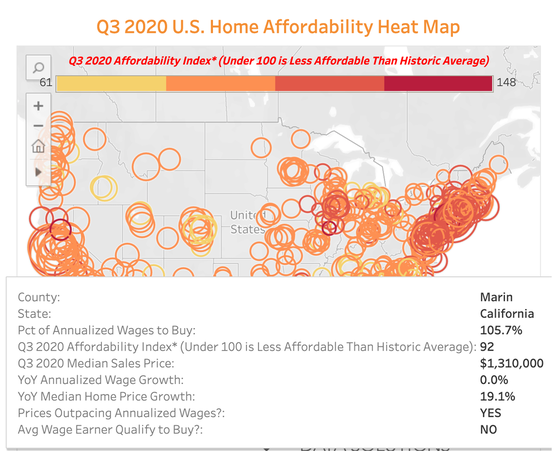

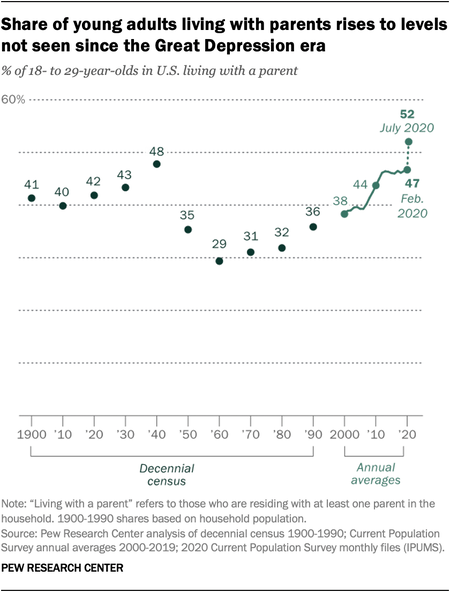

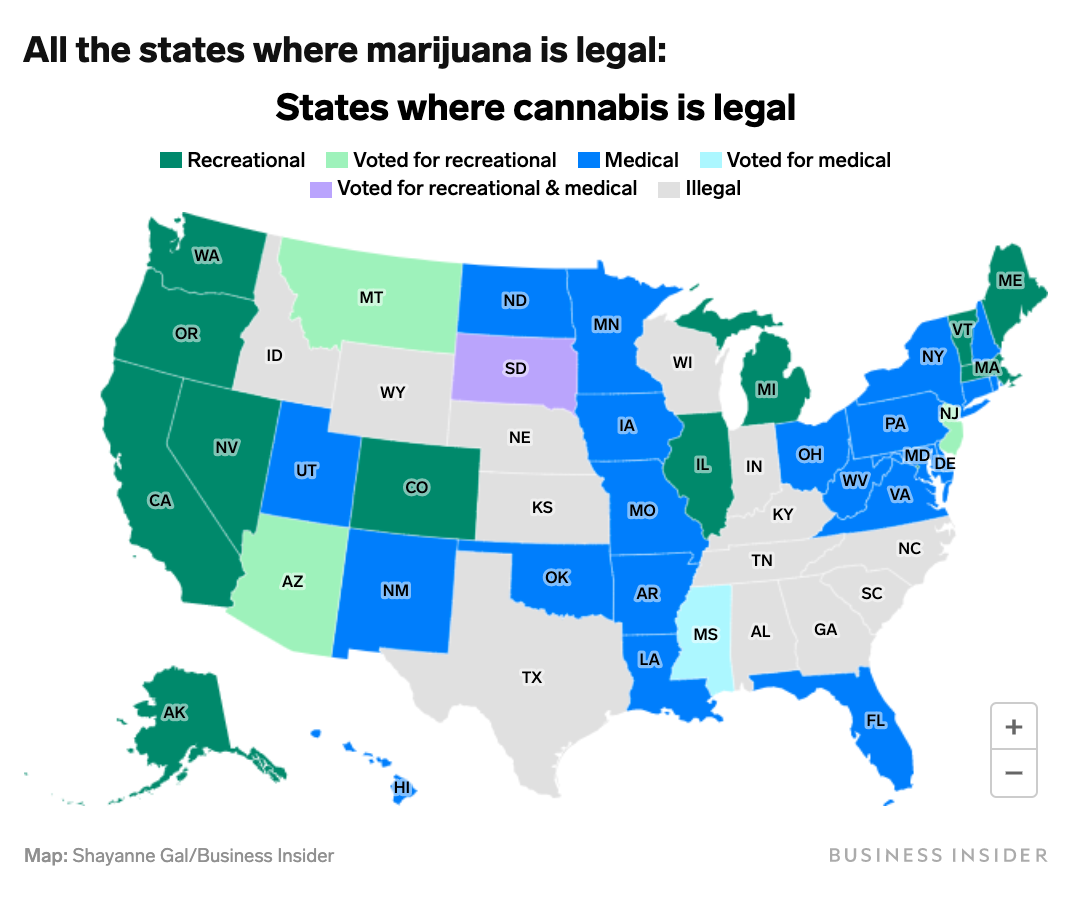

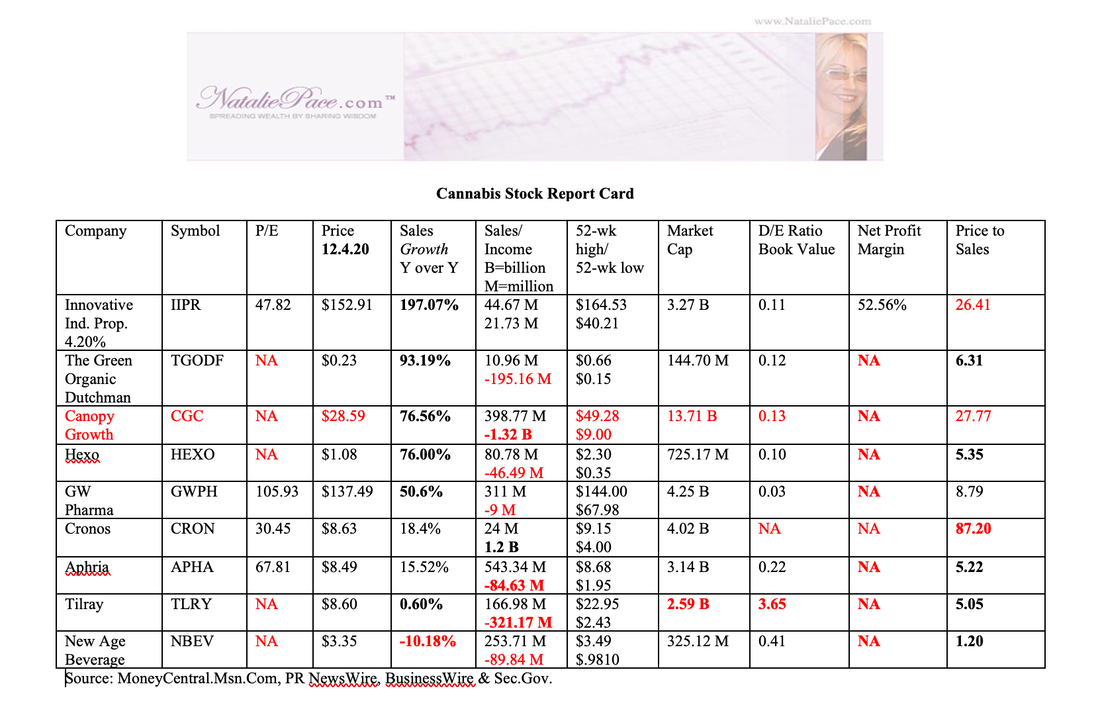

Over the past few weeks, there has been a flurry of activity at MedMen corporate. The beleaguered cannabis retailer, which was attempting to become profitable after ousting its founders and CEO in January of 2020, has been navigating employment lawsuits, executive exodus and boardroom in-fighting, with a dollop of weak sales and pandemic protocol on top. The interim CEO Tom Lynch, who was appointed on March 30, 2020, began beefing up the board with A-list members from Whole Foods, the Coffee Bean and Tea Leaf and Salesforce. In the 1st Quarter (fiscal) 2020 earnings report that was released on December 7, 2020, Tom Lynch assured investors, writing, “With the strength of our team and support of our capital partners, we are ahead of schedule with respect to our turnaround plan. As we get closer to achieving company-wide profitability, we remain committed to growing the MedMen brand and maintaining our position as the leading cannabis retailer in the U.S.” While that statement sounds pretty exciting, there are quite a number of red flags that seem to be pointing in the opposite direction, including executive exodus, weak sales, flying pretty close to the trees (low cash) and a painfully weak share price (under 14 cents today). Executive Exodus On December 18, 2020, CFO Zeeshan Hyder was replaced by Reece Fulgham as Interim Chief Financial Officer. What does Fulgham have that Hyder doesn’t? Restructuring experience. It takes a certain type of skillset (and stomach) for a contentious battle with founders, shareholders, creditors and bondholders. It’s also possible that Hyder just wanted out – to put the whole debacle behind him. Additionally, both Lynch and Fulgham have SierraConstellation Partners as their main gig. SCP is the firm engaged by MedMen to turn the company around. Lynch offered praise to former CFO Hyder, writing, “His steady hand and deep industry knowledge were vital during our turnaround.” On December 16, 2020, two days before Hyder was replaced, Tom Lynch was elected as the MedMen Chairman of the Board. Ben Rosehas resigned as the chairman and from the board effective immediately. In addition to being the former executive chairman of MedMen, Ben Rose is the Chief Investment Officer of Wicklow Capital, a capital investor in MedMen. The abrupt departure signals discord behind the scenes. Did Hyder resign out of loyalty to Rose? Andrew Modlin (a MedMen co-founder) lost his Class A super voting shares on Christmas Eve (12.24.2020). Executive exodus is a red flag, particularly when the CFO and COB depart at the same time. 1Q 2021 (Fiscal) Revenue In the quarter ending September 26, 2020, MedMen revenue was up 35.1% sequentially, but down 10.13% on the year. Revenue was $35.6 million for the quarter ending September 26, 2020, compared to $39.7 million for the same period in 2019. How will the last quarter of 2020 fare? The pandemic came roaring back this fall. While many stores remained open, with social distancing and mask-wearing policies in place, there just wasn’t a lot of customer traffic. I made repeated visits to the “flagship” 5th Avenue MedMen store in Manhattan in December and the Venice, California stores in October and November. In every case, the stores were bereft of customers, with no delivery bikes in sight. Weak cash-flow could present a problem for an out-of-court turnaround. Cash MedMen had $10.3 million in cash and cash equivalents as of September 26, 2020. The net loss in the most recent quarter was -$30.2 million compared to a net loss of -$83.4 million in the same period last year. While this was an improvement, perpetual fundraising is an expensive proposition, particularly when your share price is in penny stock range ($0.139 USD). The U.S. House of Representatives Decriminalized Cannabis Cannabis is becoming more legal in the U.S. The U.S. House of Representatives decriminalized cannabis on December 4, 2020. It’s not law yet, however, because the U.S. Senate hasn’t voted. The House approval sent shares in cannabis companies like Aphria soaring up to 3-fold off of their March lows. (Read my Dec. 5, 2020 Cannabis blog for additional information.) By contrast, MedMen shares have stayed stubbornly close to their all-time low. Is Restructuring Imminent? Because cannabis is still a problem in most countries – with the exception of Canada, Uruguay and a handful of others – whenever a cannabis company wants to borrow money, they must pay a higher interest rate. Since the terms and conditions of previous fundraising efforts have been disastrous for MedMen capital investors (including Wicklow Capital and Gotham Green Partners), Lynch and Fulgham have their work cut out for them. Skirting bankruptcy, even with these financial engineering masters at the helm, might be impossible. Remember: you won’t get prior notice. If MedMen does indeed declare Chapter 11, the already low share price will likely gap down overnight, before you can sell. (Bad news of this nature is typically announced after the markets close.) Are you interested in learning how to pick great stocks and avoid the losers, or in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Give More. Spend Less. By Natalie Pace. Last-minute, affordable gifts that will arrive on time and be treasured. This year presents all kind of challenges for gift-giving. If our budget is leaner, then we might be forced to choose creativity over consumerism. If we still haven’t found the perfect gift, we might have to select something that can be emailed, so that it is sure to arrive on time. (There is a delivery crisis going on right now.) Fortunately, these challenges don’t have to mean that your present winds up in the re-gifting closet. Below are a few ideas for last-minute, affordable holiday gifts that could truly be treasures to those you love. 7 Ways to Give More, While Spending Less. When we think of gift-giving, we often reach for our wallet. However, time and talent are also very valuable and can create lasting memories. Sometimes these shared special moments can be the vicissitude that creates a springboard into a more fulfilling life. Have faith that your thoughtful gift could be the perfect one, even if you don’t purchase it on Amazon. 1. The Gift of Time There are many ways that you can make the gift of time sparkle. If it is for a child, why not have a special King/Queen for a Day card? If it is for a retired parent, perhaps it is a Weekend Adventure Ticket. With a little creativity, you can come up with a special idea for your Sacred Beloved, as well. Doing something special with a loved one doesn’t have to cost a lot. On the 12th Night of Christmas in medieval England, peasants were royalty and royalty were peasants for a day - until midnight ended the reign of the Lord of Misrule. (Rumor has it that Disney puts the execs in character costumes once a year, too.) It takes courage to give the gift of freedom, particularly to your children, but if you are brave enough to make your child King for a Day, the outlandish frolics that ensue will be epic pages in the family history. Let's face it, even when you've been good, there are some years that Santa's gift bag is going to be a little bare. That's when experiences are rich. 2. The Gift of Talent Are you great on TikTok? Can you create a one-of-a-kind slideshow of photos set to music on iMovie? Would a calendar of the grandkids bring a smile to your parents’ faces? Do you knit, sew, write poems, sing or dance? Personalizing your creation in a way that honors the person receiving the gift will make it far more special. Even a dreaded Christmas sweater can be the highlight under the tree if it inspires laughter and jokes. I have a cousin who sends out a Christmas song every year. My sister crafts the most intricate and beautiful afghans. One friend gifts delicious homegrown tangerines annually. Honestly, the handcrafted cards that my son designs are the best gifts I've ever received, while my own coconut oil sugar scrub has been a hit with my girlfriends when I give it. Because many of us already have the studio equipment, trees, yarn, baking goods and calligraphy tools to create their masterpieces, the costs are low, while the value is priceless. 3. The Gift of Money If you just want to know the hot gift of the year, you can Google that. However, there are some fun ways to give money that aren’t on everyone’s radar. For instance, it might sound too practical to fund a College Fund for your kids. However, if you tell them that they are going to invest that money in companies they believe in, it doesn’t feel boring at all. In fact, you achieve a second benefit of starting them on the path to financial literacy and learning more about how to get their money to make money. You might be surprised how excited your tweens and teens get when you empower them with making some investment choices of their own for the college fund. In some cultures, giving a silver coin in a decorative envelope is a tradition for some holidays. That might be a fun gift, particularly if you already have many collectible coins. Be careful here. Many of the retail coin hubs upsell at a premium that is well above the value of the precious metal, and if you purchase from an individual, you’ll need to know how to spot a fake. 4. Family Heirlooms If you’re a little light on cash this year, or feel you need to conserve your capital in case the pandemic or recession persist, why not look into the family heirlooms and see if there is something that might be perfect to gift? Why hoard heirlooms until you pass away, when they might be treasured now by someone you love? The keepsake doesn't have to be auctioned by Christie's to count, particularly if it embodies family folklore. Telling the story about why the momento is precious will add to the value of this gift. 5. Last-Minute, Affordable Gifts The ABCs of Money (4th edition) and The ABCs of Money for College ebooks are both under $5 and can be delivered instantly. (They are Amazon Exclusives.) If you know what literary genre or area of interest your loved one leans toward, it shouldn’t be difficult to find the perfect ebook or iMusic that is instantly delivered – whether it is a Gordon Ramsay cookbook or Duke Ellington’s Nutcracker Suite. A subscription to Spotify, Hulu, Netflix or Amazon Prime might also be valuable in today’s “Do Everything from Home” pandemic-enforced reality. 6. A Free Holiday Gift from Me to You (Which You Can Give to Anyone You Desire) For my Holiday Gift this year, I’ve recorded 21 Days of Prosperity and posted the videos on my YouTube.com/NataliePace channel. Each morning you watch and listen to the day’s prosperity mantra (which might take about 10 minutes) and then keep that mantra and mindset top of mind all day. At the end of 21 days, you’ll have completely changed the way you think about everything, and will be embodying prosperity consciousness. (Many people are trapped in Debt Consciousness without being aware of this.) Shifting out of fear and victimization and into gratitude and ownership is fundamental to all of the things we truly desire – whether it is happiness, a better planet, a sexier body, more loving relationships and even to live a rich life. Fear immobilizes you, prevents you from seeing possibilities that lie right under your own nose, and releases cortisol, the “stress” hormone. So join me in this free 21-day New Year, New You coaching call series, which is based upon my Amazon bestseller, The Gratitude Game. Again, the gift is FREE. There are no strings attached, and you can gift it forward to anyone you desire. Receive your free 21 Days of Prosperity Coaching gift by emailing [email protected] with the subject: I WANT MY FREE HOLIDAY GIFT. 7. Charitable Giving Charity lies at the heart of the winter holidays. In a pandemic, showing goodwill toward those less fortunate carries more meaning than ever. So, rack up the karma points this year by donating time, talent and/or money to help those who are truly suffering most from high unemployment, isolation or other hardships. Sometimes, the best opportunity for charity is within reach - in our own families. It doesn’t have to be a 501c3 or qualify for a tax deduction to be an act of beneficence. One year, we took a family who was near and dear to us, who couldn't afford the tickets, to Disneyland. Bottom Line The lean years helped my family to develop our favorite family traditions - from home-made ornaments, to our Nomads’ Christmases, Bad Santa parties and beyond. If you have a tradition to share, please do so on my pages at Twitter, Facebook and Instagram, and use the hashtag #NataliePace, so that I’ll be sure to see them! Are you interested in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Why not gift yourself a free money makeover? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Bitcoin soared to new highs today, hitting a high of $23,750 just after midnight on December 17, 2020. The rise has been meteoric this winter, after quite a rollercoaster ride in February and March. Bitcoin began the year at $7,174, and dropped as low as $3,858 in mid-March when the U.S. economy imploded. Since October, Bitcoin has doubled in value. What Sparked the Spree? Square announced a $50 million Bitcoin purchase on October 8, 2020 (1% of Square’s assets). This month, the majority of Jack Dorsey’s tweets and retweets have been related to Bitcoin. On October 21, 2020, Paypal announced that the company would allow accountholders to buy, sell and hold cryptocurrency. The plan is to make cryptocurrency available as a payment to Paypal’s 26 million worldwide merchants. Square’s investment has already doubled. Cryptophiles swooned on the news. On October 26, 2020, JP Morgan Global Markets Strategy group noted that Bitcoin might double or triple based upon Millennial investors who view it as a hedge against a weak dollar – a replacement for the role that gold traditionally plays. At the time, Bitcoin was trading in the $13,000/coin range. In the same JP Morgan research note, analysts worried that profit-taking might make the coin vulnerable in the near-term. Beware of Profit-Taking Profit-taking spoiled the party the last time Bitcoin soared to $20,000/coin. Bitcoin hit $20,000 a coin in late December of 2017. Hedge funds and institutional investors sold en masse. By February 7, 2018, the value had dropped to $7,575.76. Most Main Street Bitcoin traders were not able to execute a trade at the high, due to preferential treatment that is given to registered investors. What Strategy Works for Volatile Investments like Bitcoin? In a world where Bitcoin can be worth $4000 in March and $23,000 in December, your best strategy remains using the hot slice system of our nest egg pie charts. Being on the wrong side of an all-in trade can destroy your next decade. (There were Bitcoin suicides in 2018.) Having a slice or two of cryptocurrency in your diversified investment portfolio, with a system of rebalancing 1-3 times a year, is a buy low, sell high system on auto-pilot. When your one or two hot slices become four, then you simply sell high and trim it back to one or two slices again. If you still believe in Bitcoin, then stay invested, within reason. The nest egg pie chart system suggests limiting your “hot” slices to four of ten slices. Did you feel like buying more Bitcoin when it dropped to $4000/coin? The rebalancing system can prompt you to do that because when a slice gets thin, it prompts you to buy more at a lower price to fill up the slice. When you’re just watching your asset go up and down in value, wondering what to do, your emotions get jacked all over the place. If the value goes down, you don’t feel like buying because now you’re just hoping to make up losses. When the value goes up, you worry about selling too early. When you have a simple, effective strategy, then adhering to the age-old, time-proven plan of buying low and selling high becomes easy to do. Click to customize your own nest egg pie chart. Learn more about the value of Rebalancing in my blog. (Click to access.) All Cyrptocurrencies Are Not Created Equal There have been Bitcoin Club scams and many crypto criminals. Click for a report in 2017 on popular clubs that proved to be ruses. A search on Trade Coin Club and Joff Paradise reveals ample warnings from burned believers. Investopedia has a blog listing 5 Common Bitcoin Scams. Coinbase is a reputable place for wallets and trading. Square and Paypal are also supporting Bitcoin. Coinbase has over 100 cryptocurrencies listed. JPM Coin was launched by JP Morgan. Venezuela launched the Petro Coin December 3, 2017. That coin was supposed to be backed by the country’s oil, gasoline, gold and diamonds. In August of 2018, Reuters discovered that there wasn’t an office or website for the Petro Coin. Imagine the risk of the coin that is launched by someone you’ve never heard of, or is solicited through an email blast. Bottom Line Bitcoin is a very volatile investment and all cryptocurrencies have been on a rollercoaster ride of gains and losses. Currently, cryptocurrencies are a trader’s paradise, not a viable currency. You can’t have a currency that is worth $4,000 one month and $23,000 another. If you’ve doubled or tripled your investment, now could be the perfect time to capture profits, while keeping a hot slice that can continue to increase in value. In the event that hot slice implodes and Bitcoin drops to $4000/coin again, you’ll feel more confident buying more at a lower price because you captured gains at the high. That is how annual rebalancing with proper diversification becomes a buy low, sell high plan on auto-pilot. It is also the only way you can take your emotions out of investing and rely upon a time-proven plan. The Coinbase IPO Coinbase is planning an IPO for 2021. The valuation in a 2018 funding round was $8 billion. It is unclear if Coinbase will use a SPAC to list, or will host a traditional IPO and roadshow. More news to come as the story develops. Are you interested in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. A group of housing experts and economists that were surveyed by the National Association of Realtors is forecasting that the median home price in the U.S. will rise by 8.0% in 2021 and by 5.5% in 2022. Real estate prices are indeed rising, but not necessarily in your neighborhood. In October 2020, the median existing home price was $313,000 – more than 16% higher than the same time in 2019. However, expensive areas like San Francisco and New York City have seen a jump in listings and a drop in prices. San Francisco homes for sale have almost doubled this year (Zillow.com), which has softened prices by at least 5%. Manhattan prices are also down 5% on the year, with sellers accepting bids far below the asking price. According to StreetEasy.com, Manhattan home sales were 88.6% of the asking price – the lowest on record, in October of 2020. The nation is being led by ten hot markets, according to NAR, in states like Georgia, Idaho, South Carolina, Texas, Iowa, Indiana, Wisconsin, Arizona, Utah and Washington. See the city list directly below. What is Spurring the Migration? Housing unaffordability is one of the key factors contributing to the suburban migration. If your paycheck is going mostly for rent or a mortgage in San Francisco, and you’re now working at home, why not try Arizona, Idaho or even Utah instead? Instead of making the landlord rich, perhaps you can start contributing to your own equity. As Lawrence Yun, the chief economist of NAR explained, "Some markets have been performing exceptionally well throughout the pandemic and they'll likely carry that momentum well into 2021 and beyond because of strong in-migration of new residents, faster local job market recoveries and environments conducive to work-from-home arrangements and other factors." Will Work from Home Trends Persist? There are some jobs, such as essential workers are doing right now, that must be done in-person. NAR predicts that working from home will be 18% in 2021 and 12% in 2022, down from 21% in 2020. Many technology CEOs are embracing the Work from Home trend, however. Twitter and Square’s CEO Jack Dorsey has told employees that they can work from home in perpetuity – even after offices open up again. (Certain jobs, like server maintenance, must be done in person, however.) CNBC reports that 95% of Facebook staff are currently working from home. Facebook CEO Mark Zuckerberg has indicated that up to 50% of the Facebook work force may be working from home going forward. If the tech Work from Home trend persists, that might be the best thing that ever happened to real estate affordability for Silicon Valley, Silicon Beach, Silicon Alley and every other tech hub that has seen real estate prices and rent costs soar over the last nine years. (The bottom for real estate prices on a nationwide basis was in 2011.) As you can see in the chart below, provided by AttomData, in many of these expensive cities, the average worker would be putting more than 50% of her salary into housing. San Francisco and Manhattan San Francisco and Manhattan are two of the least affordable cities in the U.S. According to AttomData.com. In San Francisco, workers have been priced out of home ownership for years, where the average worker would need 106% of their income going toward a home purchase. 42.5% of wages are needed to purchase in Boulder, while 67% of the salary goes to housing in New York, even with the 5% drop. (Manhattan unaffordability is much higher than the metropolitan area.) Seattle, Los Angeles, Denver, Boulder, Miami So far Los Angeles, Washington DC, Seattle, Denver and Miami are not seeing the same flood of new listings that have swamped San Francisco and Manhattan, even though housing affordability is a crisis with home costs above 1/3 of the average salary. (Attomdata’s interactive map allows you to see the problem county by county.) However, the current moratorium on evictions and foreclosures is likely masking a deeper problem. The Mortgage Bankers Association reported that over 6 million renters and homeowners missed a payment in September of 2020. How Accurate are Forecasts? In January of 2006, in an NAR blog, Robert Freedman predicted a price appreciation of 5.3% for the year, down from 12.4% in 2005. In January of 2007, in a blog entitled “On the Road to Recovery,” Freedman wrote, “The bad news is mostly behind us.” He predicted that many markets would pick up in 2007 and that a full turnaround would occur in 2008. Price growth was predicted to inch down to 1.7% in 2007, after a modest increase of 1.9% in 2006. So, what really happened? Well, the Great Recession. Home prices plunged by 25% on a nationwide basis between 2006 and 2011. If you were in a bubblicious area like Las Vegas, Miami or Phoenix, home values plunged by more than half. Over 10 million homes were lost through deed in lieu, short sales, foreclosures and auctions. That process was hellish for everyone who went through it. Some didn’t survive the stress. What Could Go Wrong?

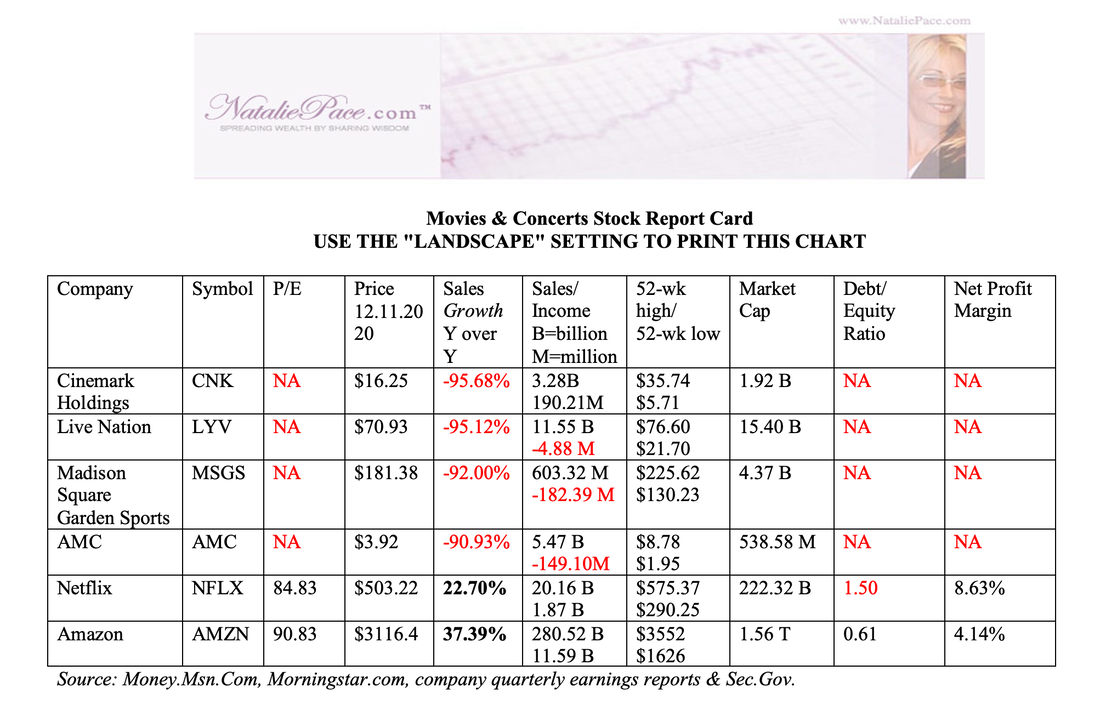

Over 50% of Airbnb Hosts indicated that they are using the income provided by sharing their home to pay their own rent or mortgage. If the travel industry and conference marketplace do not return to pre-pandemic levels, this is another cohort of the housing market that might be distressed. Bottom Line Real estate predictions have been notoriously wrong – perilously wrong for late-stage purchasers. The industry experts simply have a hard time predicting a weakness in housing prices. While the forecasts include current supply and appetite in their forecasts, if they fail to properly account for shadow inventory, distressed consumer debt loads, macro economic weakness and structural shifts in the travel and hospitality industry (which affects the viability for at least 2 million homeowners), then the predictions could be way off. Again. The fundamentals of housing are more important now that ever. Buy only what you can afford, and only at a good price (not at the top of the market). If you are struggling to make ends meet, or spending more than 28% of your income on housing, then embracing a new housing solution that leaves more money in your wallet will go a long way to transforming your life. If you are siphoning money from your retirement account to stay in a home you really can’t afford, the sooner you adopt a better plan that preserves your life boat (your retirement wealth) the better. (There are solutions. However, if you are getting your budgeting strategy from the debt collector, you’ll never learn them before it’s too late.) Now is the perfect time to do this analysis, while real estate is high. If you wait for the headlines that the prices have fallen, it's always too late to protect yourself. You can read about real estate solutions in The ABCs of Money. You can learn about them in our New Year, New You Financial Empowerment Retreat Jan. 16-18, 2021 and in my Real Estate Master Class on January 23, 2021. Call 310-430-2397 or email [email protected] to learn more. Are you interested in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The pandemic has devastated many industries. (Click to see a list of 30 companies that have gone under in 2020, compiled by CNN.) Many movie theaters have been closed since Spring of 2020. Concerts have been postponed, while sporting events have limited or no live audiences. Can Movie Theaters and Live Entertainment Make It? On December 10, 2020, AMC Entertainment Holdings, Inc. admitted that if the company can’t raise $750 million, they might be forced into bankruptcy as early as January 2021. In the SEC filing, AMC wrote, "Given the uncertainty regarding our ability to raise material amounts of additional liquidity and the uncertainty as to the time at which attendance levels might normalize, substantial doubt exists about the Company’s ability to continue as a going concern." AMC's revenue is down -92% in the U.S. and -86% internationally. Live Nation (concerts), Madison Square Garden Sports and Cinemark Holdings (movies) have all seen revenue implode to 10% or less of where sales stood a year ago. By contrast, Netflix revenue is up 23%. Amazon which is benefitting from all things from home, including streaming, saw sales soar 37% in the most recent quarter. The problems for AMC (and other theater and live entertainment chains) are many-fold. In addition to having almost no money coming in, companies must prioritize which bills to pay, in the hopes of staying alive until people can have fun again. As AMC put it in their SEC filing, “In order to avoid bankruptcy, [we] must reach accommodations with [our] landlords to abate or defer a substantial portion of the Company’s rent obligations.” Liquidity challenges and a stalemate in the negotiations could force AMC to cease paying rent, which would then snowball into an involuntary insolvency proceeding. No one wants that to happen. If AMC declares bankruptcy, the stock will likely become worthless, and bondholders will take a haircut on their principal. Stocks and Bonds On December 11, 2020, AMC announced that the company would raise $100 million with first lien notes at 15-17% interest. Goldman Sachs is running an at-the-market equity offering of up to 178 million shares. Together, if both capital campaigns are successful, it is possible that AMC will raise enough cash to meet their $750 million threshold. How long will that liquidity last? The 4th quarter lock-downs aren’t going to help revenue any. Will a vaccine inspire moviegoers to return en masse to movies, or have entertainment habits fundamentally changed for the foreseeable future? These are all questions that must be answered adequately before sophisticated stock and bond investors will be convinced to jump in. Are Theaters Doomed? When will people be comfortable sitting with strangers in an enclosed space to watch movies that they can now watch (safely) from home? On December 3, 2020, Warner Bros. announced that their 2021 movie schedule would be streamed on HBO Max simultaneously with the theater release. If other studios follow suit that could easily be a death knell for theater chains. AMC Shares are still down by half from their February 2020 highs of $8.78. However, AMC is has also doubled from the March 23, 2020 low of $1.95, as have most of the companies listed in the above Stock Report Card. Live Nation has recovered almost all of its pandemic valuation losses. Wall Street is benefitting from the Federal Reserve Rally. Investors are betting that things will go back to normal after the vaccine. However, as you can see from the above Stock Report Card, companies in the industries most severely impacted by the Stay-at-Home Orders may have trouble operating through the crisis and hanging on until that vision of that better tomorrow becomes a reality. On October 1, 2020 S&P Global downgraded AMC Entertainment to CCC- with a negative outlook. Bottom Line AMC Entertainment’s troubles are not limited to that one company. There are many industries and companies that were overleveraged with slow or negative revenue growth before the pandemic hit. (Have you read my blog, “Is Your Bank a Junk Bond?”) While everyone is drunk on the rally, it’s a good idea to sober up and remember how things looked and felt in March of this year. If you were worried then, it will pay to look past the headlines and into the fundamentals of what a healthy nest egg and investment strategy look like. Yes, a vaccine is going to help us all get past this pandemic. However, the best-case scenario has already been overpriced into equities. Our team can help. Market timing isn’t a strategy. A well-designed plan protects your wealth, while properly diversifying the appropriate amount of your at-risk money. Call 310-430-2397 or email [email protected] to learn more now. Would you like to learn how to construct your own Stock Report Card and pick stocks like a No. 1 stock picker? Are you interested in an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Airbnb Should Have a Spectacular IPO Today. Yesterday, Airbnb priced the IPO at $68/share with a market cap of $47 billion. According to the NY Times, that makes Airbnb’s IPO the largest of the year, with over $3 billion raised. Warning: Do NOT Place a MARKET ORDER for the Airbnb IPO (symbol: ABNB). The share prices are expected to surge. You want to be sure that you get the price you want. This could bode well for the first few days of trading, particularly when you consider that DoorDash’s shares soared 86% yesterday on the first day of trading. Airbnb originally hoped to sell shares for $44-$50/share. The increase to $68/share indicates good investor appetite for the home-sharing company. By contrast, when We Work tried to launch its IPO last year, the company’s value imploded, the IPO was scratched and the CEO was canned. Airbnb had to scrap its March 2020 IPO plans this year. However, investor interest has returned (even if revenue is still down 18% year over year). $47 Billion or $18 Billion When Airbnb had to raise money in April of this year, the company value sank to just $18 billion. So, is it worth $47 billion or $18 billion? Is the potential marketplace really $1.5 trillion (the serviceable market they anticipated pre-pandemic)? How much longer will Airbnb be cash negative? (The company has never turned a profit in 13 years of business.) What Could Go Wrong? There are still the pesky issues of: