|

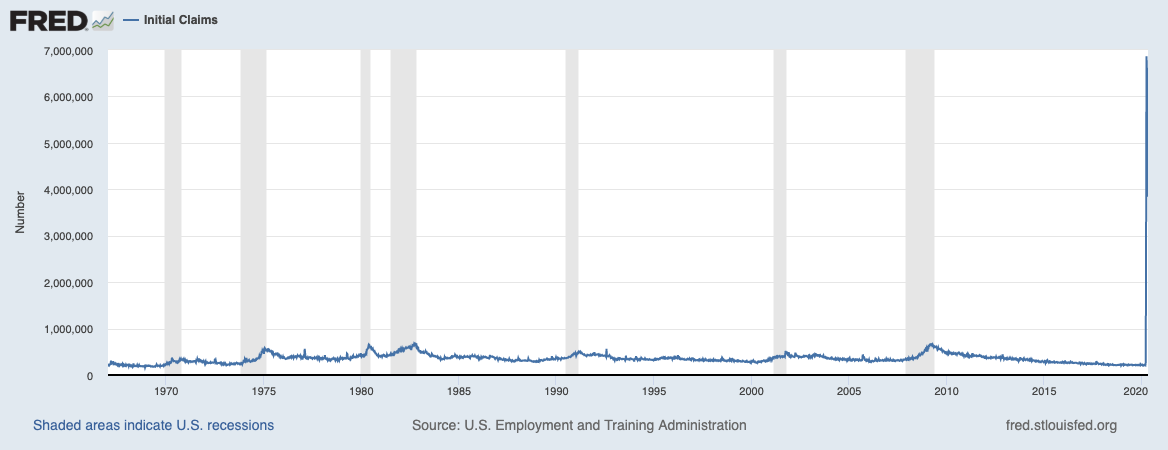

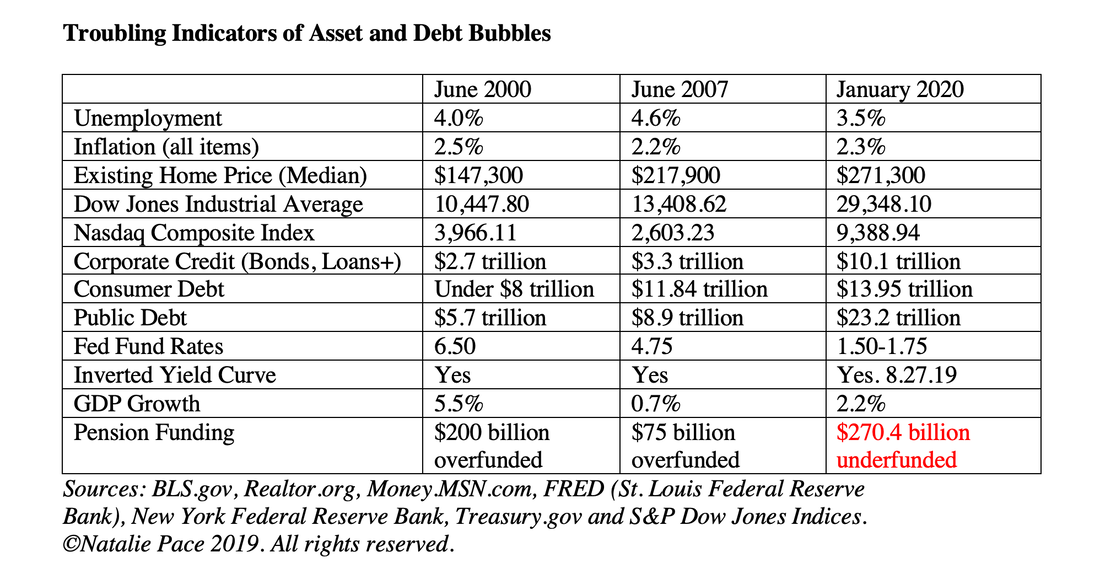

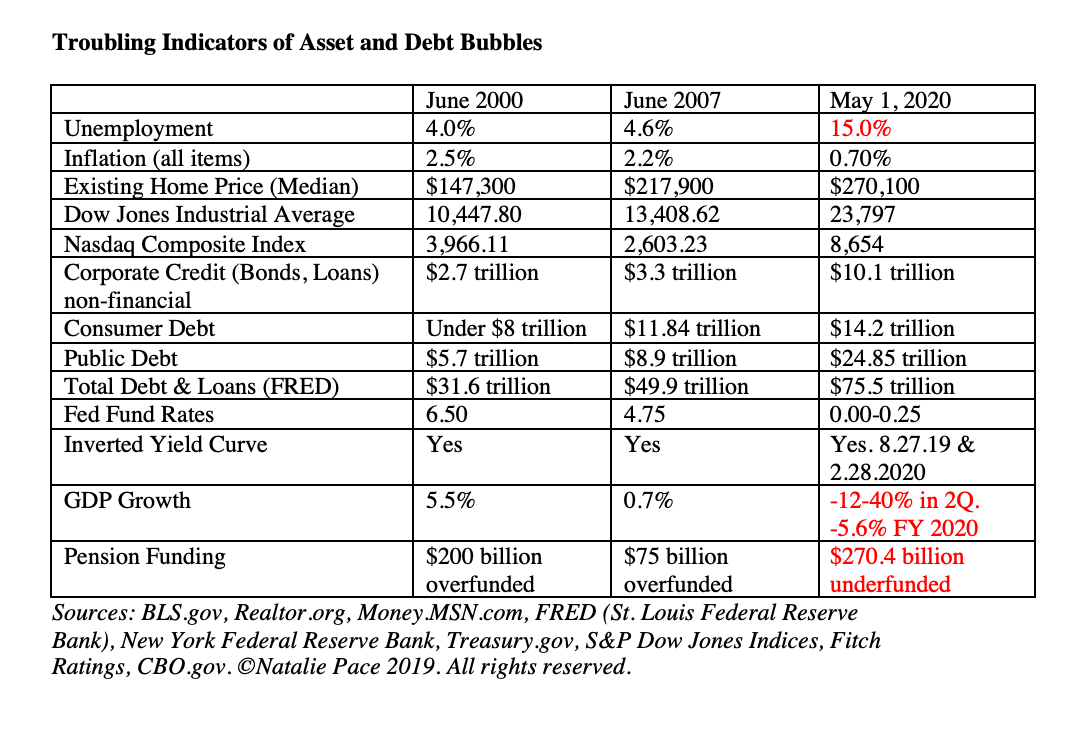

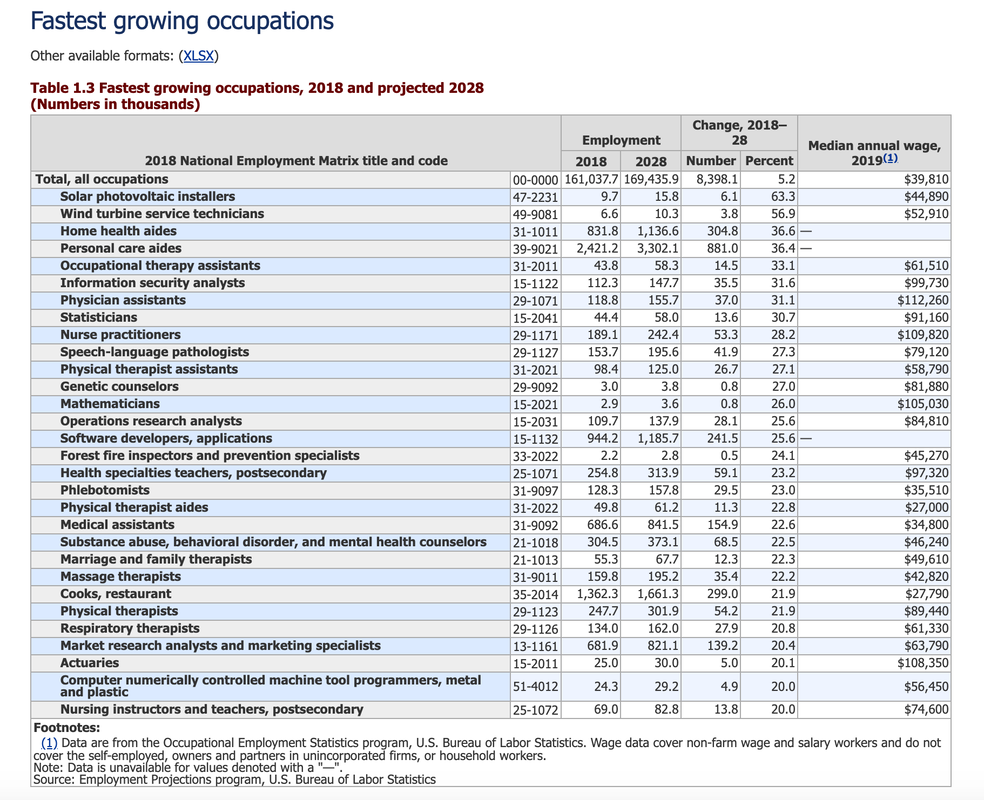

With over 21.8 million Americans filling for unemployment, and millions more who are underemployed, chances are that you or someone you love is experiencing financial hardship. Every industry from General Electric, to the airlines, to the automakers, to retailers and beyond, have already laid off workers or will be trimming back as soon as their bailout package covenants allow them to. (There will likely be hundreds of thousands of individuals laid off in the airline industry on September 30, 2020, when the Direct Payroll Assistance funds of the Cares Act expire.) We’re hearing a lot about corporations having to “right-size” (i.e. lay off) their labor force for a post-pandemic world, in order to keep operating. This is necessary for households, too. The sooner we right-size our lives for the recession, the better off we will be. Below are six areas to address immediately. 6 Ways to Recession Proof Your Life Protect Your Wealth Preserve Your Nest Egg Safeguard Your Home Right-size Your Budget Negotiate Your Debt Learn a New Skill And here is a little more color on each point. Protect Your Wealth Unemployment has soared to unprecedented levels (15% as of April 25, 2020). Asset prices, which were in a bubble before the current crisis, will have to adjust themselves. That means that the stock market and the real estate market are both going to be under downward pressure. Are you sure your nest egg is recession proof? Are you over-leveraged on your home? Did you recently purchase income property that isn’t paying for itself at a lofty price? It’s time to protect the wealth you have. Examine your assets with a forensic eye, like a CFO would. Be the boss of your money. Do not assume that someone else is doing this for you. Nobody cares about your money as much as you do. If you need help with this analysis, call 310-430-2397 or email [email protected]. Preserve Your Nest Egg In recessions, it is imperative to preserve your nest egg by 1) having enough safe, 2) knowing what is safe in a world where bonds are losing money and money market funds have redemption gates and liquidity fees, and, 3) being properly diversified in your at-risk portion. If you’ve just checked off boxes in your 401(k) and you don’t know what you own, or if you have allowed someone else to manage it for you, it is unlikely that you are properly protected and diversified. Now is the time to know exactly what you own and why you own it, rather than relying upon blind faith that you are in good hands. The other part of preserving your nest egg is to protect it from financial predators. This is not just from scammers, phishers, salesmen, opportunists and from bad investments. You must also protect your retirement accounts from the debt collector, the credit card company, the banks and any other corporations and individuals that you owe money to. Your first obligation is to protect your family’s future, not to making everybody else rich. It is important to understand the laws of the land, and to protect and preserve your nest egg as if it were your life boat to a better land. It very well could be. Do not drain your nest egg to keep your business alive, to make credit card companies happy or to stay in a home you can’t afford. Seek out solutions that will sustain you over the long-term, rather than adopting a disastrous near-term Band-aid fix. That solution will include your future, in addition to the obligations and debts that you have. Safeguard Your Home If you were having trouble paying the mortgage or rent before the current crisis, then now is the time to face reality, even if you still have your job. It is a far better idea to embrace intergenerational housing, take on a roommate, or downsize, than it is to keep paying above what you are capable of, taking on more debt and digging yourself into a desperate hole. Right-sizing your life at the core can actually be very freeing. Most of the time thinking bigger and adding in family members or friends will yield better results. When I was a young single mother struggling to make ends meet, I got a bigger house in a better neighborhood that I shared with another single mother. My costs were reduced by at least a third. I had someone to look after my child when I ran to the grocery store. We shared cooking duties, so I only had to cook every other week. There can be blessings, when life shakes up our status quo. Right-Size Your Budget Below is a link to a free web app, so that you can see what a Thrive Budget® looks like. Basically 50% of your income should be used to survive and 50% to thrive. If you are spending 75% or 80% of your income to survive, then you’re going to feel very vulnerable and constantly fear shattering the screen of your smart phone, or any other unexpected expense that you just don’t have the money to cover. Forget about café lattes and avocado toast. That isn’t the problem. Most of us are not shopaholics. Cutting out café lattes might save you hundreds, if you are truly splurging every single day. However, the real problem is the thousands that get siphoned away for big-ticket expenses, like housing, transportation, healthcare, health insurance, insurance of all kinds and even food. Wages have stagnated over the last decades, while the cost of essentials has skyrocketed. Budgeting solutions will not be found in the mainstream self-empowerment books and TV shows. (If they were, why are you in the fix you are in?) Continuing as you are in an unsustainable lifestyle, and borrowing on credit cards to try and make ends meet, is a disastrous scheme that doesn’t end well. It’s important to take a sober look at your big-ticket bills, and adopt innovative solutions. There are some easy ways to do this, and others that will require brave choices. It all starts with knowing what is possible. You can learn more time-proven budgeting solutions in the Thrive Budget® section of The ABCs of Money. Negotiate Your Debt Most of the debt solutions being offered by credit card companies, mortgage providers, and utilities are temporary. Often, they just tack the payments you miss onto the back end, and then charge you interest on that – making things worse down the road. Is it possible that your debt is in need of restructuring? Is it possible that you can negotiate hard to get the bank or credit card company to accept a much lower closeout deal? (If you do, be careful of the fine print. Sometimes they will sell your debt to a debt collector, in addition to taking your offer.) Should you be selling your too expensive overpriced home and downsizing? If you are drowning in debt, you need to know the laws of the land and also the rules of FICO scores. Debt to assets ratio accounts for 1/3 of your FICO score. You could continue to make payments on time, and still have a score that plummets. There is a debt section in The ABCs of Money that can help you to navigate out of the bind you are currently in, and into a better tomorrow. Learn a New Skill Whether you are out of work, or lucky enough to still be working, learn a new skill. Become adept at using tools that are going to be useful in the days ahead. Obvious things to master include: getting familiar with video conferencing, learning to code, polishing up on your Excel skills or becoming more tech or social media savvy. The jobs of tomorrow include clean energy, medicine and climate change. Should you learn how to install solar panels or become a wind turbine technician? Are you interested in being a physician assistant? Should you focus your engineering degree toward fire safety or a clean energy grid? Below is a graph of the jobs of tomorrow. Waiting for politicians to solve problems is often frustrating and futile. It is always a short-term fix. The sooner that you right-size your life, the better able you will be to survive the recession and to soar during the recovery. Liquidity (protecting your wealth) will allow you to purchase assets at a much lower price in the years ahead. Refusing to believe that we are in a recession will be a costly assumption. So be careful of getting your news from the headline news and politicians. If you wait for the headlines that we’re in a recession it will be too late. The experts already know that we are in a contracting economy. Main Street won’t get the headline that we are in a recession (which we are already in) until July 30, 2020. I will be hosting a fireside at five on Monday, May 11, 2020 to discuss these strategies in greater details. If you would like to join us, please call 310-430-2397 or email [email protected] for log-on and pricing information. I am also hosting an online Financial Empowerment Retreat June 13-15, 2020. Click on the flyer below for additional information, including testimonials and the 15+ things you'll learn and start to master. See below for additional blogs you should be reading.  Visit NataliePace.com to learn more. Call 310-430-2397 or email [email protected] for pricing, additional information and to register. Other Blogs of Interest The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed