|

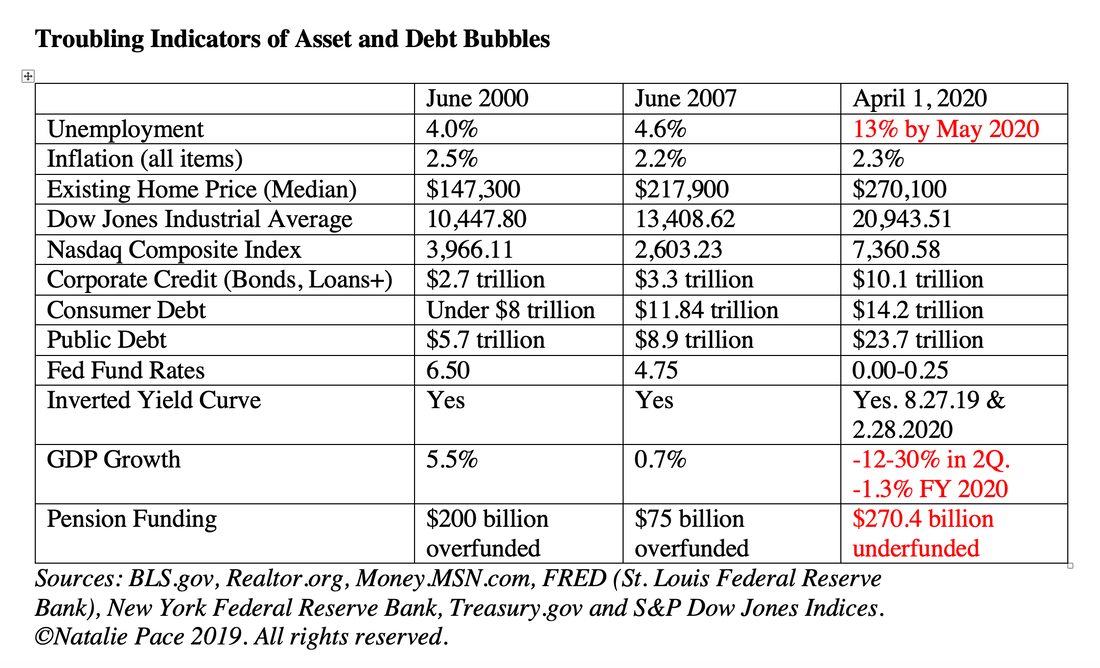

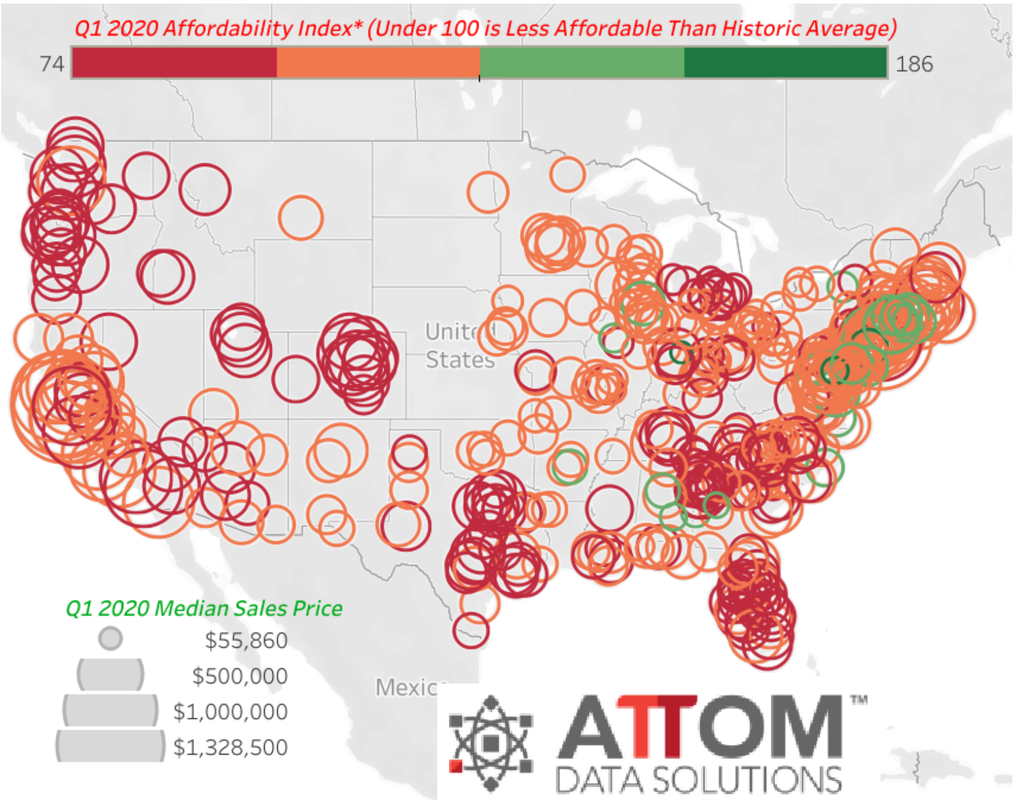

We are in a recession. Those are not my words. On April 7, 2020, Kristalina Georgieva, IMF Managing Director, made the declaration: “It is already clear that global growth will turn sharply negative in 2020, as you will see in our World Economic Outlook next week. In fact, we anticipate the worst economic fallout since the Great Depression.” Yesterday, the Federal Reserve Board released their Beige Book, writing, “Economic activity contracted sharply and abruptly across all regions in the United States as a result of the COVID-19 pandemic.” The Feds say that the hardest hit industries were leisure, hospitality and retail, other than essential goods. Unemployment is astronomical. Prices are falling. (I offer more color on this and more below.) The Beige Book neglects to remind everyone that banking and financial services had to be bailed out behind the scenes on March 3, 2020 and again on March 15, 2020. The rescue in the overnight bank lending market began in September of 2019. Keep reading for additional information on that. However, if you’ve wondered why your bonds have lost value, when you were told bonds are safe and can actually increase in value during recessions, the financial industry bailout information is required reading. It’s also a good idea to re-visit the bond blog I wrote on March 25, 2020. The Official Reports of the Recession The 1st Quarter 2020 economic contraction will be reported in the GDP report that will be released on April 29, 2020 at 8:30 am ET. The official declaration of the recession will happen when the advance 2nd Quarter 2020 GDP report is released, on July 30, 2020. If you wait for the headlines on this, you will be late. The informed money has known that the economy was likely in a recession since at least March 8, 2020, when I issued my blog. The fact that the Federal Reserve Board pulled their Summary of Economic Projections from the March 15, 2020 Emergency Meeting was a huge red flag… So, why have stocks recovered a little bit? That’s actually quite normal. The smart money moves first. It catches Main Street off guard. Then everything settles down. Your broker/salesman starts calling and telling you now is a great time to buy. Main Street buys in. Wall Street insiders breathe a sigh of relief, and hit the sell button again. The journey from the top of the market to the bottom is a series of unfortunate events with multiple plunges, plateaus and mini-recoveries. The bottom of the Great Recession (with up to 55% losses) happened on March 9, 2009. The top was October of 2007. The bottom of the Dot Com Recession (with up to 78% losses) was in October of 2002. The top was March of 2000. If you are being told that March 2020 was an all-time low, you are not receiving the truth. You are being pitched and primed for a sale. V-Shaped Recovery? A lot of people are hoping for a V-shaped recovery, that as soon as we get back to work things will return to normal. However, we are neglecting that life before the pandemic was not normal. Real estate was unaffordable. Stocks and bonds were in a bubble. Financial leverage was astronomical. It seemed like everyone, including nations, corporations and individuals, were all borrowing from Peter to pay Paul. Alan Greenspan warned of this as early as January of 2018. Robert Shiller has been warning that stocks were overpriced for years. Warren Buffett claimed that bonds should come with warning labels as early as 2012. (Our team has been warning of bonds since 2009.) If Americans couldn’t afford to make ends meet without taking on debt before the crisis, when they had a job and could still borrow money, then there is little hope that we can return to the inflated asset values of early February 2020, after so many have lost their jobs and access to capital. Even stellar consumer credit is having trouble accessing loans this month. (This has a lot to do with the liquidity crisis in the financial services industry.) Consumer debt was higher than ever before the Coronavirus Recession, as was corporate and public debt. What happens when people can no longer afford things? Prices have to fall. What happens when companies take on too much debt and can no longer keep borrowing money at rock-bottom rates? They have to restructure their debt. Stockholders are typically wiped out. Bondholders take a haircut. Pensioners and employees typically have even more at stake. Bailouts have been promised to businesses big and small. However, there will still be winners and losers, just as there was in the Great Recession. The Federal Reserve is not going to make a loan to a business that can’t pay it back. Some businesses will have to restructure their debt (as the airline and auto industry did in the Great Recession). Some will be forced to liquidate (Lehman Bros.) or sell themselves on the cheap (Countrywide, Bear Stearns). So, if you’re tempted to “buy low” in hopes of a bail-out and recovery, buyer beware. Your stock might become toilet paper. Ramifications of the Financial Industry Bailout on March 15, 2020 On Sunday, March 15, 2020, the Federal Reserve Board had their 2nd emergency meeting of the month. The FOMC slashed interest rates to zero, and infused liquidity into many financial markets that were freezing up. According to the transcript from the press conference of March 15, 2020, Federal Reserve Board Chairman Jerome Powell noted, “In the past week, several important financial markets, including the market for U.S. Treasury securities, have at times shown signs of stress and impaired liquidity… The cost of credit has risen for all but the strongest borrowers.” With over half of the corporate bonds at the lowest credit rating, just above junk bond status (and munis in just as bad of shape), there were a lot of CEOs with their hands out, hoping for a bail-out and having to sell whatever they had on hand to keep operating. (Even Berkshire Hathaway has been on a selling spree this month…) Dividends Suspended and Share Repurchases Canceled Many companies, including most banks, have suspended their share repurchase plans. This is a huge issue because the entire bull market post Great Recession was built upon corporations borrowing money very cheaply and buying back their own stock. A lot of dividend paying companies are going to be under pressure to cancel their dividends, too. Without corporate buybacks, there is a massive reduction in demand for stocks, putting downward pressure on the markets. The airlines have agreed to cancel buybacks and dividends for the life of their loans, as part of their bailout package. Ford suspended their dividend on April 13, 2020. Ford has $30 billion in cash, and is looking for more funding options. According to their press release, they have enough liquidity to get through the 3rd quarter of 2020. That’s flying quite close to the trees. The official 1st quarter 2020 earnings report is due at the end of the month. The suspension of dividends and buybacks is a hard pill for fixed-income investors to swallow. However, it is better than bankruptcy. In previous bailouts, many companies continued to pay dividends until the moment they declared bankruptcy. Unemployment Initial jobless claims are higher than they have ever been in our recorded history of the data. Over 21 million Americans have filed for unemployment in the last four weeks. Real Estate Real estate had been unaffordable in up to 74% of the U.S. markets prior to the current crisis. Prices have been dropping since the highs set in June of 2019. Currently, 66% of the U.S. markets remain unaffordable to renters and buyers. There are 3.5 million mortgages that are severely underwater (source: AttomData). This statistic was in play before the current new wave of mortgage relief. Over Leverage Was a Problem Well Before the Current Pandemic Any good business owner knows that you want to have excess reserves on hand to prepare for hard times. However, many corporations were willing to borrow very cheaply, allow their credit to go to the lowest rung of investment grade, just above junk-bond status, buy back their own stock to keep the share price high, pay high dividends, and then have limited reserves and very high debt when bad times hit. Half of the corporate bond market is in this boat. Economists have been warning for years now that stocks and bonds were in a bubble. This is not a problem that crept on us like a thief in the night. What Is Your Best Move Now? Turn off the news and educate yourself. If you didn’t hear that stocks and bonds were in a bubble in 2018, then you are not getting the news you need to make informed choices. The time-proven solutions are easy-as-a-pie-chart. You just need to learn and implement them, and to stop trusting salesmen to do this for you. Our team has free web apps. We just published the 3rd edition of The ABCs of Money. If you want to do it yourself start there. If you have wealth to protect, call our offices now to get an unbiased 2nd opinion on your current risk exposure and what you can do to protect your wealth. We can be reached at [email protected] or 310-430-2397. If you would like to learn time-proven, 21st century strategies that will work going forward and have worked fantastically in the last 2 recessions, when most people lost half of their wealth, then join us this weekend for our Online Zoom Retreat. Wisdom and time-proven budgeting and investing strategies are the cure. The time to learn and implement them is now. Other Blogs of Interest Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed