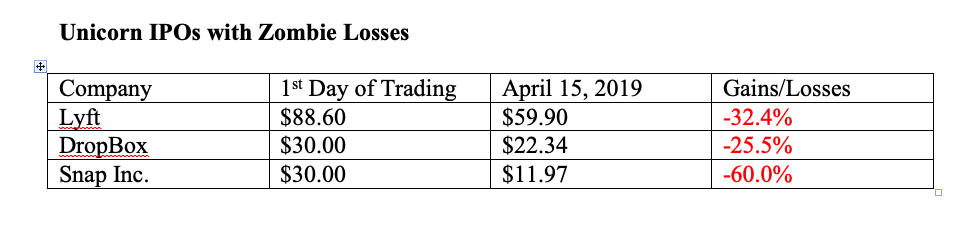

A dozen Indonesian students gathered at the U.S. Embassy in Jakarta (at left in the split-screen video monitor) had the opportunity to query their American high school counterparts on their interests, experiences and culture during the interactive video link-up recently at NASA Dryden's Aerospace Exploration Gallery in Palmdale, Calif. Photo c/o NASA. May 12, 2019. Wiki Commons. Used with permission. We’ve had a series of Initial Public Offerings recently that would have been better labeled as Liquidity Events. Venture Capitalists and early stage investors (including the founders of the company) need to turn their paper money into real currency and things (like homes & nest eggs). So, they go public. Many of these companies are staples of our new sharing, connected and gaming economy, such as Lyft, DropBox and Snap Inc. (Click on the blue highlights for my original IPO warnings on Lyft and Snap Inc.) However the challenge for investors is often more one of valuation, or profitability. If you get caught up in the story of how the company is transforming the landscape of our lives, and fail to look at the fundamentals of sound business, you might drink the Kool-Aid and wake up with losses. So, is Zoom more of a Lyft or more of a Google? Google’s IPO was one of the strongest of all-time. The company had a strong executive team and board, had doubled in revenue growth and was profitable. Google launched in 2004 – just two years into the bull market, so it also had the wind at its back in terms of macro movement. Let’s line up the numbers of Zoom … Zoom has many strengths. The company is the best-in-class. It is achieving viral marketing of its video conferencing by offering free conferences to everyone (with limited time and number of attendees). Many of those freebies, and the friends they invite in, are becoming paid subscribers. The company is also profitable, bringing in $7.6 million in net income for fiscal year 2019. Revenue doubled year over year (up 118%), to $330.5 million. Zoom was named #2 Best Company to work for by Glassdoor in 2019, and Eric S. Yuan, Zoom’s CEO has been racking up the awards for his leadership. However, there is an issue with the board. It’s overweighted with finance people, and underweighted with technology leaders, government relations specialists, product visionaries and marketing geniuses. So, whereas Google was finding ways to diversify its revenue stream under the experienced guidance of Eric Schmidt, it appears that Zoom is focused mainly on subscriptions. This will be a problem if the economy weakens, and individuals find that basic expenses outweigh their desire to convene. Also, when you get too many finance people in the room, there can be too much focus on monetization, and not enough on innovation. The worst example of this was the Sears Holding Co. board. So far, Zoom is doing everything right. However, Microsoft is likely to awaken and want to make Skype more competitive, and this is where the technology and government relations oversight can be key. Zoom shares are expected to hit the NASDAQ stock exchange this week, with trading to start at $28-$32/share. According to Business Insider, at the high end, that would make Zoom Video Conferencing (symbol: ZM) valued at $8.25 billion. Investors have become too complacent with lofty valuations. At the current growth rate, Zoom’s revenue should grow to over half a billion this year. However, the actual earnings ($7.6 million) are a small fraction of the valuation. Even if the earnings triple or quadruple as revenue scales, the valuation of $8.25 billion is still rather rich. If the market were going up, then perhaps you could make a case of buying Zoom high, in the hopes of selling higher. However, there are at least 10 events and economic concerns going on this year that could drive general market weakness. (Click to read those.) So, here’s another unicorn that might be worth more to look at (or to use) than to own, at this time and price. By looking behind the splashy painting, and into the fine print of the numbers, you, too, can identify the Unicorn IPOs from the Zombies. It's no accident that my track record on these IPOs is so high. (Lyft and Snap weren't the only IPOs I said to avoid. Google wasn't the only one I touted on television.) If you'd like to learn these strategies firsthand, join me at my Colorado Investor Educational Retreat this April 27-29, 2019. I'll also be hosting a Real Estate Master Class the day before (April 26, 2019). Click on the flyer links below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more and to register now. Other Blogs of Interest 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 24/4/2019 11:28:37 pm

Actually, my knowledge about Zoom is very limited. I did not know that it is one of the best companies to work in according to Glassdoor. We all know how reliable it could be every time Glassdoor releases this kind of data. Since it was mentioned that it’s one of the best companies, I can assume that the entry level there is a position that is kind of hard to clinch to. Maybe, you should be the best among the class before being qualified with the entry level. Nonetheless, everyone is still encouraged to apply as long as you are a hardworking person. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed