|

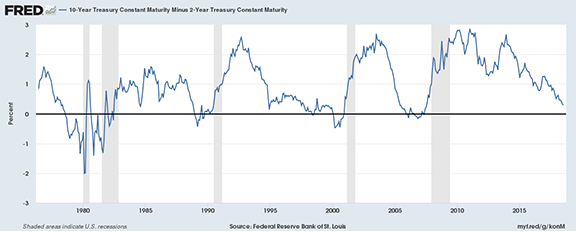

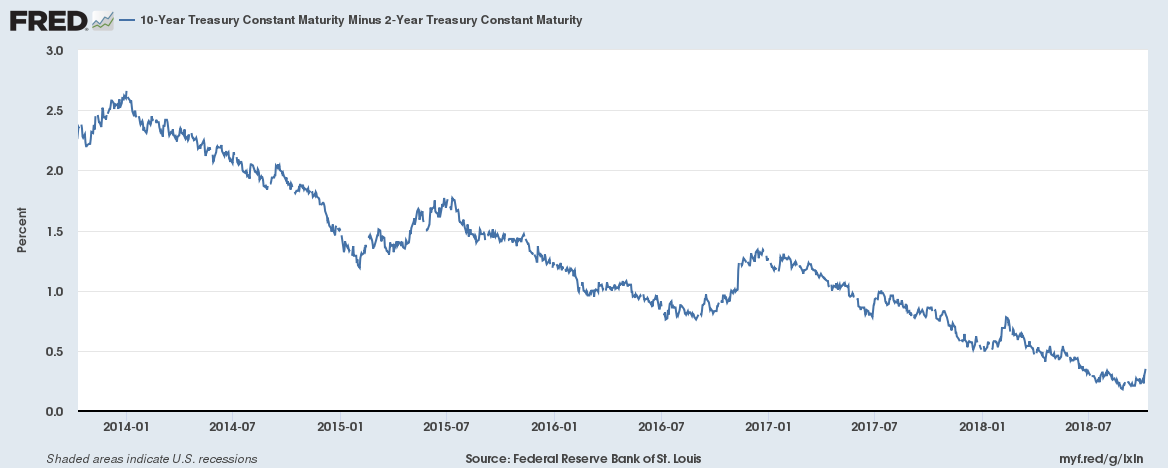

The Dow Dropped 832 Points Today. What Really Happened? It was a cascade. Bond rates fell. The yield curve flattened. That spooked investors. Sparking a sell-off. An inverted yield curve has a very high correlation (100%) with recessions, and a flat yield curve is dangerously close to an inverted yield curve. As you can see in the chart below, every recession since 1980 was preceded by an inverted yield curve. Recessions are indicated in grey. When the blue line dips below 0, the yield curve is inverted. As you can see in the chart below, the difference between the yield on the 2-year Treasury bill and the 10-year Treasury bill is negligible at 2.88% and 3.21%, respectively. In other words, the yield curve is flat. Even if you don't know the first thing about yield curves, you can get informed on what is driving today's sell-off, and how to protect yourself. Read more on the yield curve and why the Federal Reserve Board is determined to keep raising interest rates, in my blogs "5 Warning Signs of a Recession" and "Odds of an Interest Rate Hike are Above 90%." It is being reported that everything fell, which isn't true. There was one industry that gained. Since that asset is selling at a bargain right now, it's worthy of consideration as a hedge against further losses. Remember, however, that a healthy nest egg is never all in/all out, but is, rather, based upon time-proven, easy-as-a-pie-chart strategies that earn gains in recessions and outperform the bull markets in between. Wisdom, now more than ever, is the cure! (We teach these at our Investor Educational Retreats. Call 310-430-2397 to learn more.) So, will the problems and issues continue. Or will the markets stabilize? The near-term financial indicators support a Santa Rally. The long-term financial indicators support getting defensive. As I said in my "Back to School Stock Sales?" blog on September 13, 2018: Earnings support a Santa Rally this year, if the interest rate hikes don’t spook investors. There is a big if in that sentence, so the most important stance for the Santa Rally is a defensive one. Make sure your assets are protected, that you have enough safe and that you know what is safe in a world where bonds are in a bubble. It’s never a matter of jumping all in or all out. Today, interest rates spooked investors, pushing up the clock on when you should make sure that you are safe from the next downturn, and that you know what is safe in a world where bonds are losing money, too. Call 310-430-2397 to learn my time-proven, easy-as-a-pie-chart nest egg strategies. They earned gains in the last two recessions and have outperformed the bull markets in between, which is why they are enthusiastically recommended by Nobel Prize winning economist Gary Becker and TD AMERITRADE chairman Joe Moglia. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "I earned gains in the Great Recession. Thank you Natalie for saving my retirement!" Nilo and Bill Bolden Other Blogs of Interest Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 11/10/2018 01:22:27 pm

The Dow Down is down 1,378 Points, 5.2%, in 2 Days (with another 546 point drop today, Oct. 11, 2018). The NASDAQ is off 5% over the same period. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed