|

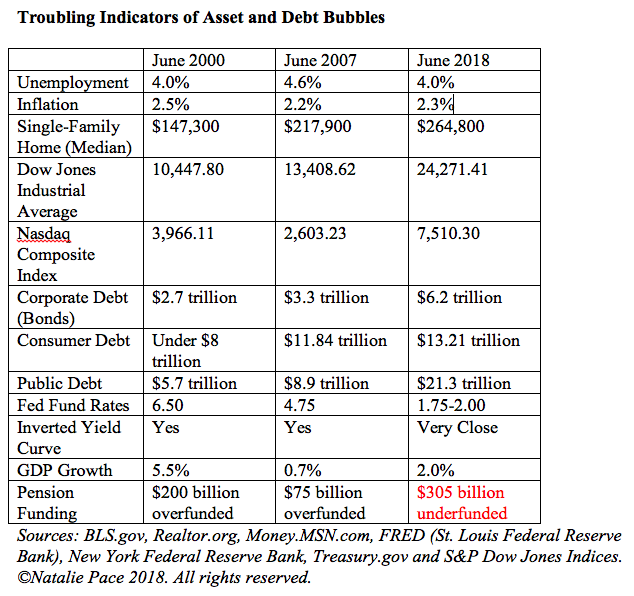

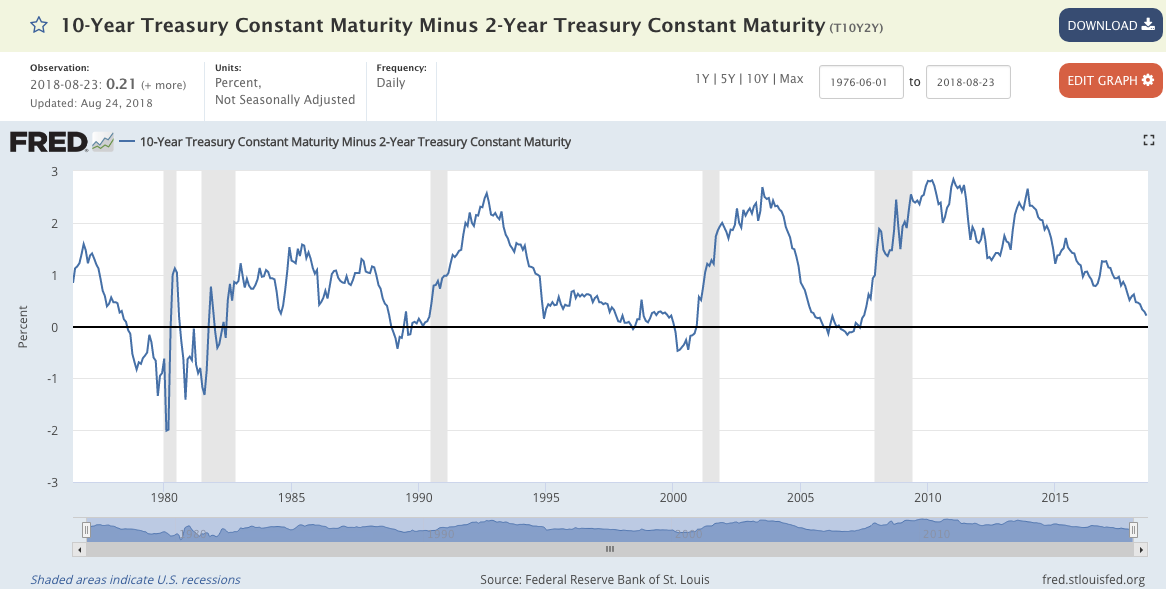

Odds of an Interest Rate Hike September 26, 2018 Are At 90%. And other important take-aways from Federal Reserve Chairman Jerome Powell’s speech on August 24, 2018 at Jackson Hole, Wyoming and the FOMC minutes of the August 1, 2018 Meeting. This blog was updated on September 22, 2018. According to the minutes of the July 31-August 1, 2018 Federal Open Market Committee meeting, the Fed Funds futures contracts put the odds of a Fed Funds rate increase at the September 26, 2018 meeting at higher than 90%, even though the yield curve has flattened. If Federal Reserve Chairman Jerome Powell raises rates, as is expected, this will be in direct opposition to the Tweets of the President. So should interest rates rise, or is this slaying the 10-year old bull market before its time? There are many takeaways from Federal Reserve Chairman Jerome Powell’s speech on August 24, 2018 at Jackson Hole, Wyoming and the FOMC minutes of the August 1, 2018 Meeting that explain why the Feds are raising the Fed Fund rate at this time. For additional information on the case for raising interest rates, refer to my blog, “The Federal Reserve vs. The White House.” Jerome Powell explained why he and his colleagues are looking beyond just unemployment and inflation as harbingers of the next recession in his speech at Jackson Hole on August 24, 2018, saying, “In the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.” This is easily seen in the chart below. Before the Dot Com Recession and the Great Recession, unemployment was historically low (below 5%) and inflation was also low (at 2.5% or below). However, there was a lot of free, easy money flowing into asset bubbles. Low interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, it was the housing bubble. Today the asset bubbles in stocks, bonds and real estate are more troublesome than they were in 2000 or 2008, and debt has become absolutely astronomical. This has been something the Feds have been concerned about for at least two years. At a special meeting of the Federal Advisory Council and the Board of Governors on September 7, 2016, it was recorded that “If rate normalization happens in a steady and more predictable approach, the economy can incorporate this change in rates and psychology and make investment decisions based on the best allocation of capital to productive sources versus riding the asset bubble being generated by the easy-money policies around the globe.” Rate hikes have caused market volatility (on the downside) this year, so it is likely that the afternoon of September 26, 2018 will be an active day. The following morning will be another strong GDP report -- the 3rd estimate of the 2nd quarter 2018 GDP, which should come in close to 4.2%. There could be another rate hike at the November or December Federal Reserve Board Meetings, and the 3rd quarter 2018 GDP growth report is expected to come in lower than the 2nd quarter. Will this kill a Santa Rally? I'll keep an eye on things as we move through these events and keep reporting here in this blog. However, the 10th year of a bull market is a very good time to get defensive, and make sure that you have enough safe and know what is safe in a world where both stocks and bonds are in a bubble (according to Alan Greenspan, Warren Buffett, Robert Shiller and multiple economists). It’s never a good idea to go all or nothing, or try market timing. My easy-as-a-pie-chart nest egg strategies work great, having earned gains in the last two recessions and outperforming the bull markets in between. (Call 310-430-2397 to learn more about these time-proven strategies.) Here are a few more take-aways from the August 1, 2018 Federal Open Market Committee meeting and Jerome Powell’s speech of August 24, 2018. 1. The strong 2Q 2018 GDP report was bumped up (temporarily) as much as 1% by a rush to avoid tariffs. Exports, led by “agricultural products (particularly soybeans) and capital goods, increased strongly and imports increased only modestly. In June, however, advance data suggested that nominal goods exports fell and imports rose,” according to the FOMC minutes. GDP growth for the rest of the year is expected to cool off from the 2Q GDP growth of 4.1%. 2.8% is the expected full-year 2018 GDP growth rate. We’ll see if the estimates change at the Sept. 26, 2018 FOMC meeting. 2. The Flat Treasury Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Every rate hike takes the data closer to an inversion. So, why not do everything in your power to avoid that? During the August 1, 2018 FOMC meeting, some participants said, “Inferring economic causality from statistical correlations was not appropriate.” They noted that a worldwide desire for safe assets and central bank asset purchases could be responsible for the Yield Curve phenomenon and that it just might not be relevant this time. The more likely reason for ignoring the Yield Curve is that keeping interest rates low and letting the asset bubbles grow even more out of whack would only create a longer and more severe recession. The last two recessions have been more like depressions in terms of their losses to household balance sheets. The Dot Com Recession saw losses of 78% in the NASDAQ, which took 15 years to crawl back to even. The Great Recession saw losses of 55% in the Dow Jones Industrial Average, and over 10 million homes went to auction. 3. Asset Bubbles. The most telling phrase of monetary policy was buried in the FOMC minutes section on financial stability: “Vulnerabilities associated with asset valuation pressures continued to be elevated, with no major asset class exhibiting valuations below their historical midpoints.” The job of the Feds is to correct imbalances before they erupt into a catastrophe. In this period, which has now been labeled The Global Financial Crisis, reading the tea leaves of indicators beyond inflation and unemployment is critically important. Asset Bubbles were not properly addressed before the Dot Com Recession (“irrational exuberance”) and the Great Recession (using your home as an ATM machine). Jerome Powell is reading data and white papers from history, which appear to be determining his Fed Fund rate policy more than Presidential Tweets. Powell also warns that Federal Monetary policy cannot do much about wage stagnation, the federal deficit or economic mobility – all American problems that have been on an unsustainable path for over a decade. Jerome Powell ended his speech at Jackson Hole, saying, “The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one. My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.” Click to access the FOMC Minutes and the speech from Federal Reserve Chairman Jerome Powell from Jackson Hole, Wyoming on August 24, 2018. Other Blogs of Interest It's Fun to Buy Gold Low. Russia is Dumping U.S. Treasuries and Buying Gold Instead. The Federal Reserve Vs. The White House. How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. If you want to make sure that you are safe and protected before the next recession and stock market downturn, come to my next Investor Educational Retreat. Call 310-430-2397 or email info @ NataliePace.com to learn more now. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Sterling Harris

22/9/2018 12:03:31 pm

“Vulnerabilities associated with asset valuation pressures continued to be elevated, with no major asset class exhibiting valuations below their historical midpoints.”

Dear Sterling, Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed