|

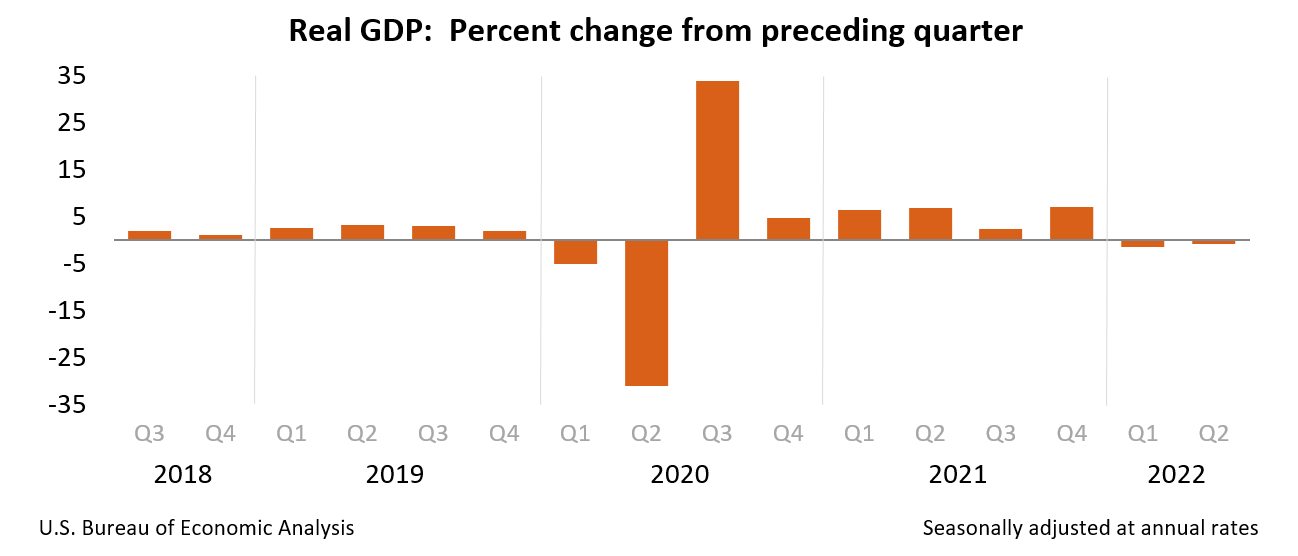

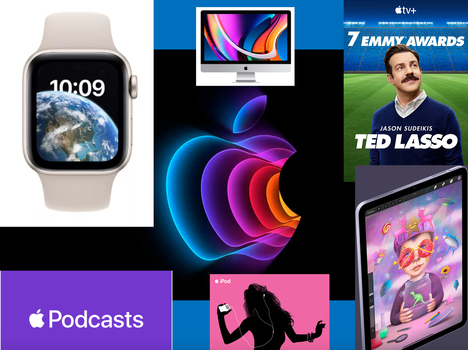

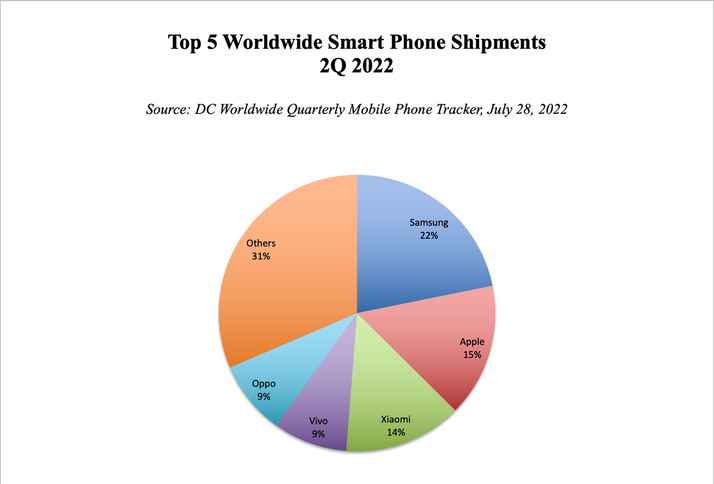

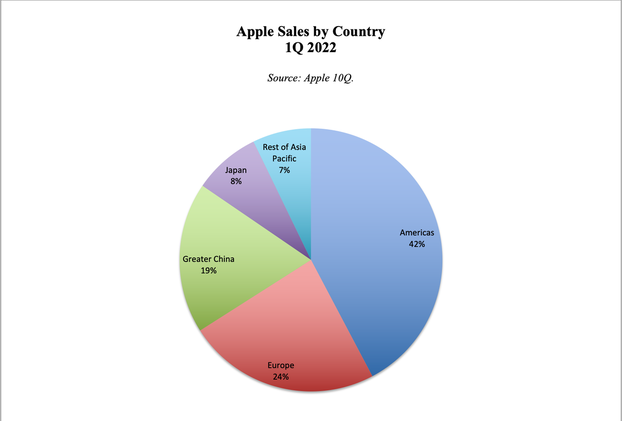

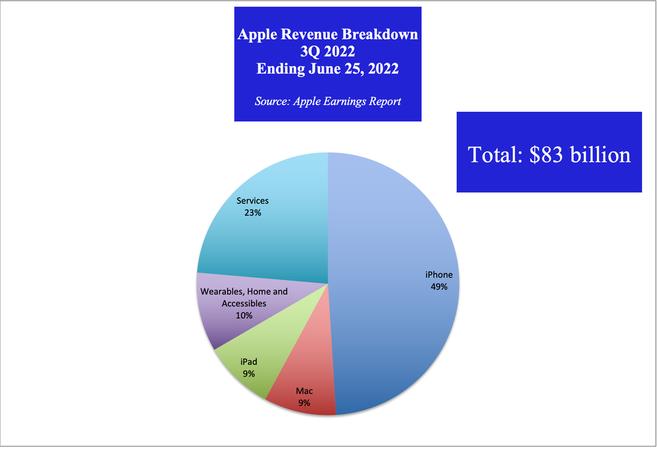

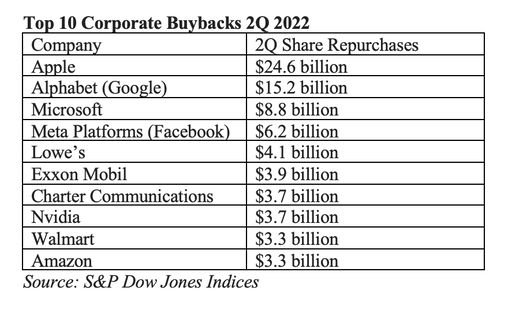

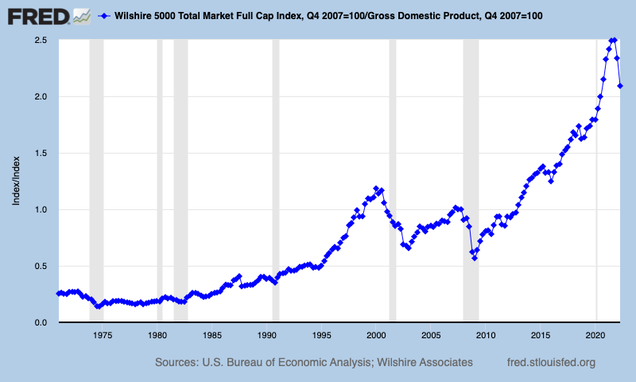

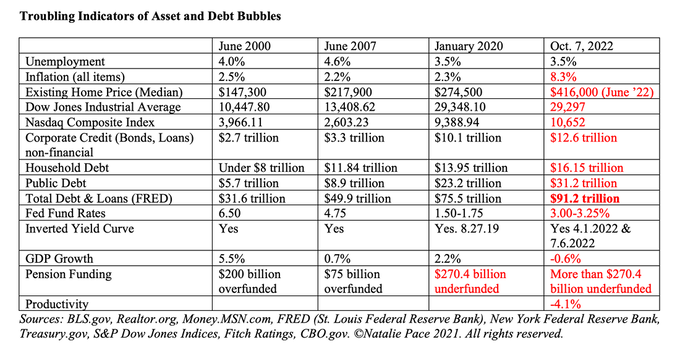

On Thursday, October 27, 2022, at 8:30 am ET (one hour before the stock markets open), the advance report of 3Q 2022 GDP will be released. Forecasters expect a sliver of growth. The Conference Board is projecting 0.05%. However, it should be noted that the Conference Board projected growth in the second quarter of 2022, and that quarter turned out to be negative. We’ve had two quarters of negative growth already this year, which would normally be considered a Recession, but has not yet been characterized as such. So, even though we’ve had a rally over the last week, it’s important not to get too complacent. Mild Recession or Halloween Haunting? We keep hearing the words “mild recession” bandied about. As I mentioned in my blog “Apple and the R Word,” from earlier this week (and as I’ve warned repeatedly all year), it’s quite common for politicians and career economists to downplay the severity of an economic contraction in the early stages. Part of that has to do with the fact that money is emotional. If we all believe that we can keep the economy strong, we’re more likely to achieve it. If we all stop purchasing things, the economy will seize up and become a big problem. It often happens that when Main Street is finally apprised of the recession, stocks have already dropped 40% or more, and is closer to the bottom. Thursdays in October can be spooky. The Great Crash of 1929, which ushered in the Great Depression, occurred on Thursday, October 24, 1929. Black Monday occurred on October 19, 1987. Stocks plunged -22.6% that day. There are breakers to prevent that now. However, markets can sell off severely over a series of days. The Federal Reserve Board and Treasury Department are going to try to prevent a disaster from happening. At the same time, they have to rein in inflation and have been clear that they will keep raising interest rates, perhaps even hitting 4.4% this year and 4.6% next year. With the Fed Funds Rate at 3-3-1/4% now, it’s widely assumed that means the Nov. 2nd meeting could have another 75 basis points increase, with the and Dec. 14th meeting seeing a rise of at least 50 basis points. Last year, we had the hope of a “soft landing” (no recession). According to the Conference Board on October 12, 2022, “Economic weakness will intensify and spread more broadly throughout the US economy over the coming months, with a recession to begin before the end of 2022.” During the FOMC press conference on Sept. 21, 2022, Chairman Jerome Powell said, “We have always understood that restoring price stability while achieving a relatively modest increase in unemployment and a soft landing would be very challenging and we don't know, no one knows, whether this process will lead to a recession, or if so, how significant that recession would be.” That’s about as close as a board governor will get to admitting a recession is likely – until the NBER makes it official. (I discuss the NBER in my Apple and the R Word blog.) What Can We Do to Protect Our Wealth from This Uncertainty? 1. Act according to a time-proven, 21st Century plan, rather than reacting to the headlines. 2. Keep enough safe, and consider overweighting safe due to weak economic conditions. 3. Put the safe side to work strategically. And here’s a little bit more information on each one of these three points. 1. Act according to a time-proven, 21st Century plan, rather than reacting to the headlines. If you wait for the headlines to get yourself properly protected, it’s always too late. Most of the losses occur before the recession call is made. Once the recession is announced, the economy is closer to its inflection point to begin the recovery. There are typically a series of unfortunate events that prompt overnight gap downs before the announcement. There are steps each one of us can make now to protect your wealth. Most of us are not properly protected before we do this forensic analysis. So, what is a time-proven, 21st Century strategy? Proper diversification, keeping enough safe, overweighting safe, regular rebalancing, and knowing what is safe in a world where bonds and fixed income are very tricky. I just did a blog and videoconference on yield. Click to access them. You can learn this time-proven, 21st Century system, which we call the life math that we all should have received in high school, at our New Year, New You Financial Freedom Retreat January 20 - 22nd, 2023. Register now and you get the lowest price and a private prosperity coaching session (value: $300). Invest in the life math that we all should have received in high school and watch how your life transforms. 2. Keep enough safe and consider overweighting safe due to weak economic conditions. It’s very important that we don’t have blind faith that someone else is protecting our future for us. Most people lose more than half of their wealth in recessions, and then spend most of the bull market crawling back to even. In the Dot Com Recession, it took the NASDAQ almost 15 years to hit 5,000 again (from losses of -78%). So rather than think the coming recession is going to be like the Pandemic Recession, we should understand that the U.S. printed up $5 trillion, and gave it out to everybody with a pulse. We are now tightening up the monetary supply, and asking people to repay the money they borrowed. Even the Central Bank is losing money right now. The Federal Reserve Board reported that the central bank lost money in September, and is likely to continue posting losses for a few years. 3. Put the safe side to work strategically. Rising interest rates create opportunities for savers and fixed-income investors. They also create problems. Anyone who had fixed income products last year is likely to be exposed to capital loss, and illiquidity (the inability to get rid of something they no longer want). Because over half of the S&P 500 is at or near junk-bond status, this is a serious problem that should be addressed ASAP. It’s equally important to understand that if we’re interested in a product that we consider to be fairly safe with a good yield, such as the Treasury I Savings Bond, which is still offering 9.62% yield, and your broker can’t get it for you, but instead offers you a TIPS product, that might be because that’s the only product he can sell to you, rather than that is a better investment. Don’t swap out one thing for another indiscriminately. We must be the boss of our money, and understand how and where we can find opportunities that are creditworthy and relatively short term, while also keeping liquidity for better opportunities that will keep coming as interest rates keep rising. This is something I discussed in our “Yield” blog and videoconference this month. It’s also something we spend one full day on at our Investor Educational Retreats. Bottom Line The odds of a recession in 2022 or 2023 are very high. Thursday morning will be a very important day. If the report is negative, there could be a sell-off on Wall Street. Even if Thursday isn’t terrible, the winter months could prove to be quite challenging. Recessions can cost investors more than half of their wealth. In the past, bonds were the saving grace because typically interest rates are cut (and the value of existing bonds rises). In this recession, bonds are very tricky because interest rates are rising. If you have credit risk and duration risk in your existing bond portfolio or if your bond fund has lost money, you should know what your options are now rather than be complacent that everything will work itself out. This may sound like an extra job. However, before a recession it’s a very good idea to give yourself the job of protecting your wealth properly – of fixing the roof of your financial house now, while the sun is still shining. Otherwise, you could be in a position to have to hope and pray that you make up losses over the coming years. And in the meantime, your credit score will suffer, your family and relationships will suffer. Stress levels will be very high. All of this can be avoided by adopting a good plan now that protects our wealth from extreme losses, while positioning us best for the recovery. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price and a complimentary private prosperity coaching session (value $300) when you register by Halloween, Oct. 31, 2022 Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Halloween, Oct. 31, 2022, to receive the best price and a private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Apple and the R Word Why stocks rallied last week, and where they are headed through the end of the year. The Federal Reserve Board keeps raising rates at a rapid pace. The economy experienced two quarters of contraction. So, why haven’t stocks absolutely tanked? Interest rates are finally starting to reward savers. So, when will investors yield to the temptation of fixed income over equities? Are we in a recession? Will it be mild or severe? Just as importantly, should we fix the roof of our financial house now, while the sun is still shining? The answers to those questions lie in the world’s most popular fruit that is almost always in season – Apple – and its $88 billion in buybacks, and the R word that cannot be named (recession). Below are 5 Important Considerations and 1 Bottom Line Apple The R Word hasn’t Been Uttered Yet If You Wait for the Headlines, It’s Too Late Small Caps Have Been Killed Valuation Concerns And here is a little more color on each point. Apple Apple is scheduled to report their fourth-quarter earnings on Thursday after the market closes. As happened in the most recent quarter that ended June 25, 2022, earnings are expected to be slightly above where they were last year in the same quarter. The strong dollar is providing some headwinds that could impact revenue (up to $5 billion). But the strength of the business itself is expected to keep earnings on par. Apple remains the #2 smart phone company by units (and #1 by revenue). Apple has become pervasive in our lives, from the device we can’t live without in our hand, to something we stream and dream about as well. As you can see in the charts below, Apple’s revenue comes in from all over the world. The company is doing a great job of diversifying its income stream. The services and iPhone revenues were higher year over year, while Mac and Wearables revenues were down -10% and -8% respectively, and iPad sales were down -2%. With a market value of almost $2.4 trillion, annual revenue of $367 billion, $95 billion of which is profit, and $180 billion in cash and marketable securities, Apple is a dominant force on Wall Street. Apple’s buyback plan is so aggressive that the markets tend to go in tandem with Apple’s share repurchases. When Apple pauses, the market drops (as it did severely in December of 2018) – the worst December since the Great Depression, with losses of -9.1%. In 2021, the company spent over $88 billion buying back its own stock. 2022 is trending higher with $24.6 billion spent in the second quarter of 2022, and $47.5 billion spent in the first six months. The S&P500 is down -22% since the highs of Jan. 2022. Without Apple support, the drop would likely have been far worse. The question going forward is, “Will the company continue to buy back as robustly in the 2nd half of 2022?” All eyes and ears are definitely going to be on the forward guidance presented at the earnings call on Thursday. Apple isn’t giving hard numbers, however they are providing enough color to gauge whether or not they’re anticipating a strong holiday buying season. Why did Apple stopped repurchasing their own stock in December of 2018? Huawei had taken a big bite out of Apple’s dominance. In the third quarter of 2018, Samsung and Huawei were the top global smart phones sales providers (by units), while Apple was in third. After that, Apple was successful in wiping out Huawei. However, will budget belt-tightening impact Apple sales now and going forward? With the entire market at stake, this is a consumer pulse to keep a finger on. The R Word hasn’t Been Uttered Yet Another reason that stocks rallied last week is that the National Bureau of Economic Research, nber.org, the NGO responsible for naming the sessions, hasn’t made an official declaration of a recession. The agency is notoriously slow about that. As examples, the organization announced the great recession on December 1 of 2008. That was just a few months away from the March 9, 2009 bottom. In fact by the time the recession was called, stocks had already declined -42%. The Dot Com Recession was called on November 26, 2001, after the NASDAQ Composite Index had already posted losses of -66%. The NBER was relatively fast to call the pandemic recession on June 8, 2020. However, the S&P 500 had already plunged almost -40% and was actually on its road to recovery by the time the announcement came. If You Wait for the Headlines, It’s Too Late As you can see in the examples cited above, if you wait for the recession to be officially called, it’s too late to protect your wealth. In fact, it might be closer to the bottom. Many people are tempted to sell low at the time the recession is announced. There were a lot of people who missed out on most of the secular bull market of the last decade because they freaked out at the bottom of the Great Recession, and weren’t ready to get back in until the late stage of the business cycle. Small Caps Have Been Killed There has been a real mismatch between large caps and small caps over the last few years. This has a lot to do with those buy backs that we discussed at the beginning of the blog. Because small companies don’t buy back their own stock and have to borrow money to build the infrastructure and factories they need to expand, even good companies have been destroyed this year. Whereas the general market is down -22%, share prices for many small cap stocks and funds are down -35% of more. This is an area that offers more value. Valuation Concerns Check out Warren Buffett‘s favorite valuation tool in the chart below. As you can see, stock prices are still very overvalued historically. During periods of heightened values, equities tend to drop farther and faster. The Federal Reserve Board is trying to alleviate panic and prevent a repeat of the Dot Com and Great Recession drops (of more than half) by characterizing the expected coming recession as “mild.” A strong labor market is a positive, while zombie companies, inflation and weak, overleveraged industries are all very negative. As we have pointed out quite a lot over the past few years, over half of the S&P 500 is at or near junk-bond status. Debt and loans (leverage) has soared to levels never seen before. Extended periods of low interest rates create asset bubbles. Rising interest rates are going to make it more difficult for troubled companies to keep borrowing from Peter to pay Paul. Industries that are more vulnerable include commercial real estate, retail, highly leverage financial services (like insurance companies, which typically do very poorly in recessions), travel, airlines, advertising-supported businesses (like social media) and other industries that are reliant on consumer discretionary spending. Bottom Line Most of us will continue to need our smart phones, our Wi-Fi, food, housing and other basic needs. We may, however, try to make our existing devices last longer, rather than getting the bright new shiny object. For this reason, it’s never a good idea to just sell all of our stocks. On the other hand, we are overweighting an additional 20% safe in our sample pie charts. Click to access our free web apps where you can personalize your own pie chart. Email [email protected] if you’d like to see our MAAAM Stock Report Card (Microsoft, Apple, Amazon, Alphabet (Google) and Meta (Facebook). If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price and a complimentary private prosperity coaching session (value $300) when you register by Halloween, Oct. 31, 2022 Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Halloween, Oct. 31, 2022, to receive the best price and a private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Yield is Back. But It’s Tricky. It’s Time to Earn Some Income. But the Math is Trickier Than You Might Realize. In this blog, you’ll learn:

I was recently asked to give a 2nd opinion on someone’s managed IRA (Individual Retirement Account). This person had dumped all of his stocks during the pandemic in March of 2020 (and missed the 27% gains of 2021). His financial advisor had him “safe.“ That meant that he was all-in on very low-yielding Treasury Bills and a money market fund. Consequently, this person’s “safe” portfolio lost money. When new issuances were offering a lot better interest rate and ROI (Return on Investment), the value of his existing Treasury bills went down. He will now have to hold them to term before getting his money back (while missing out on the returns that others enjoy). In 2022, after years of not earning anything on the safe side (most bonds have been negative yielding), we finally have the opportunity to earn some income. However, it’s important to keep:

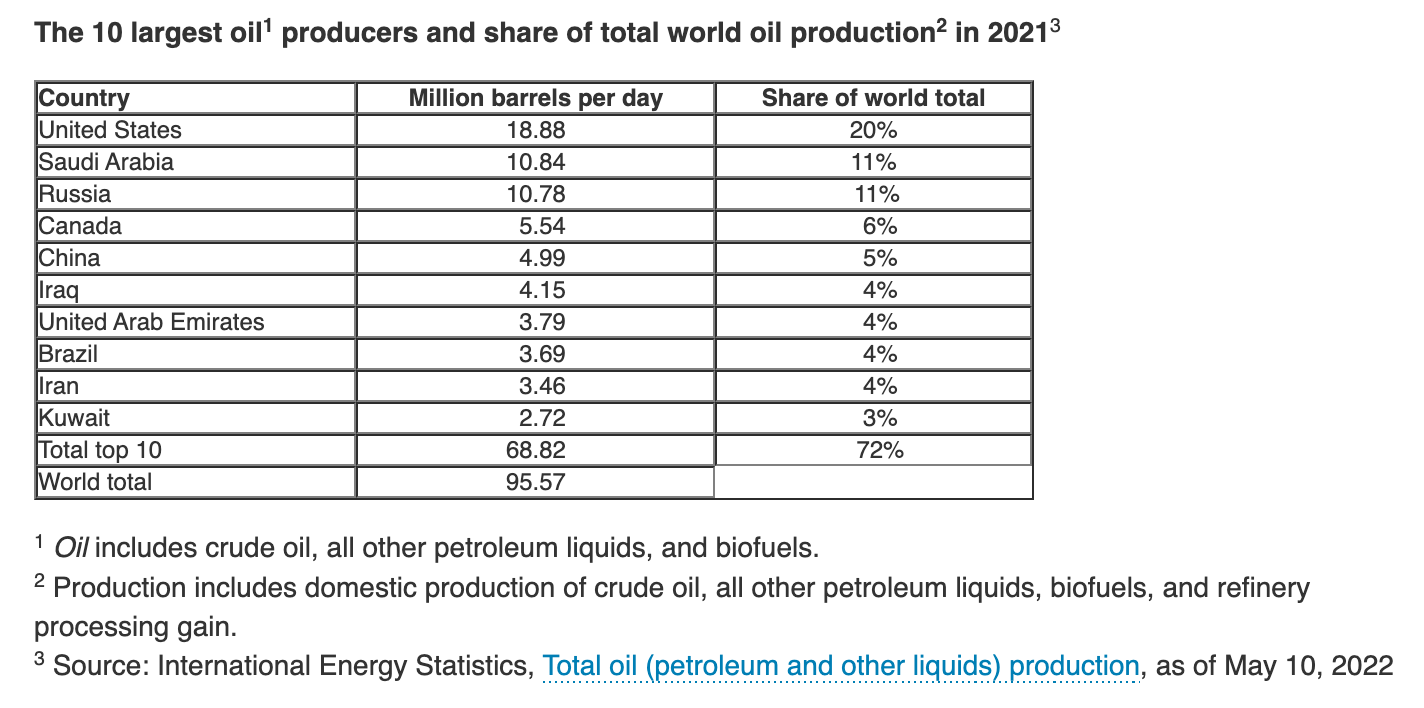

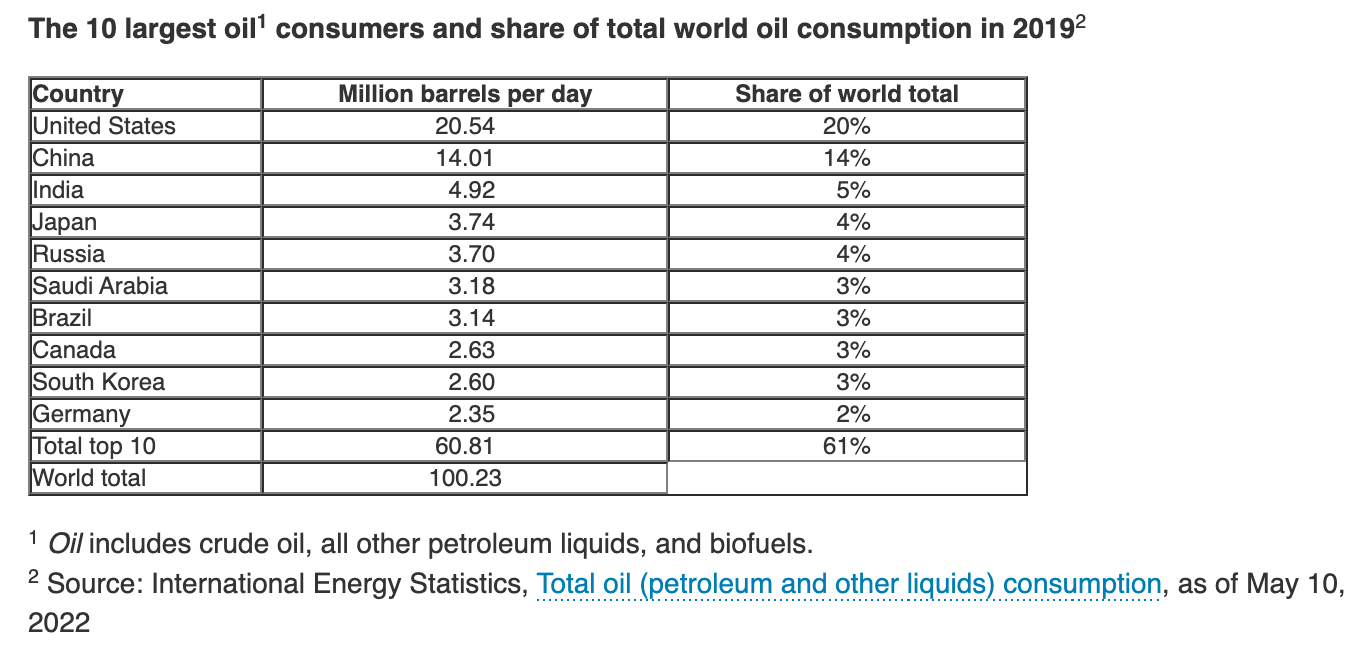

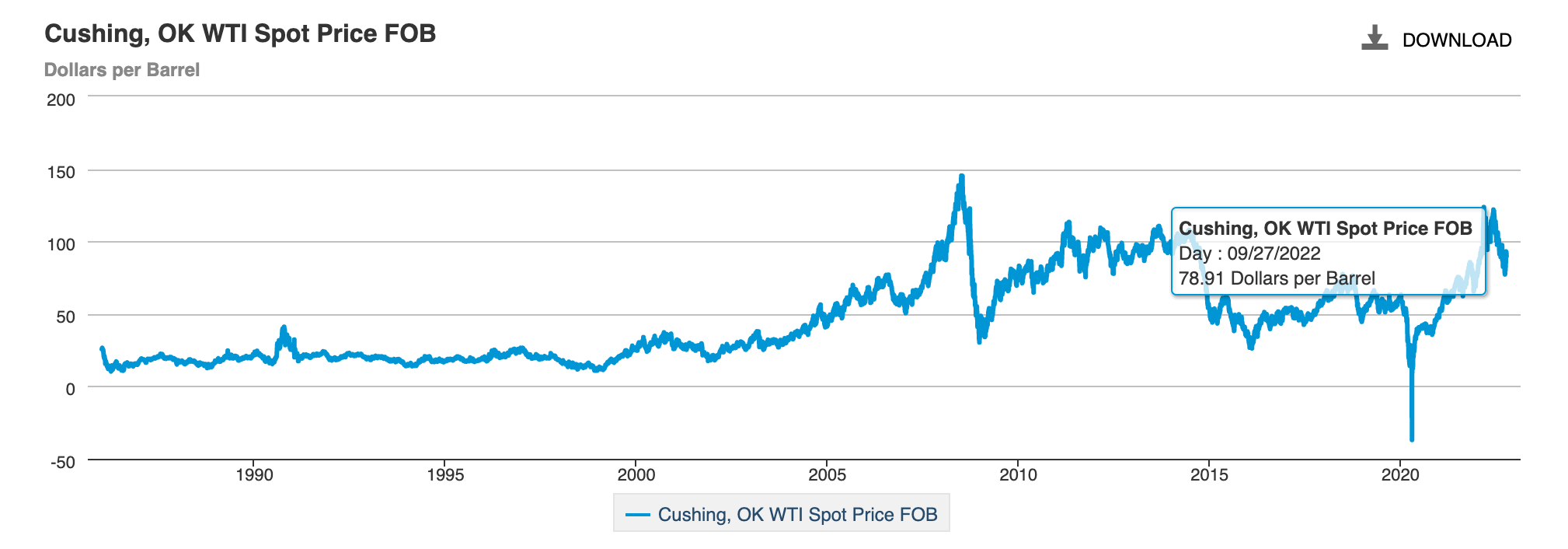

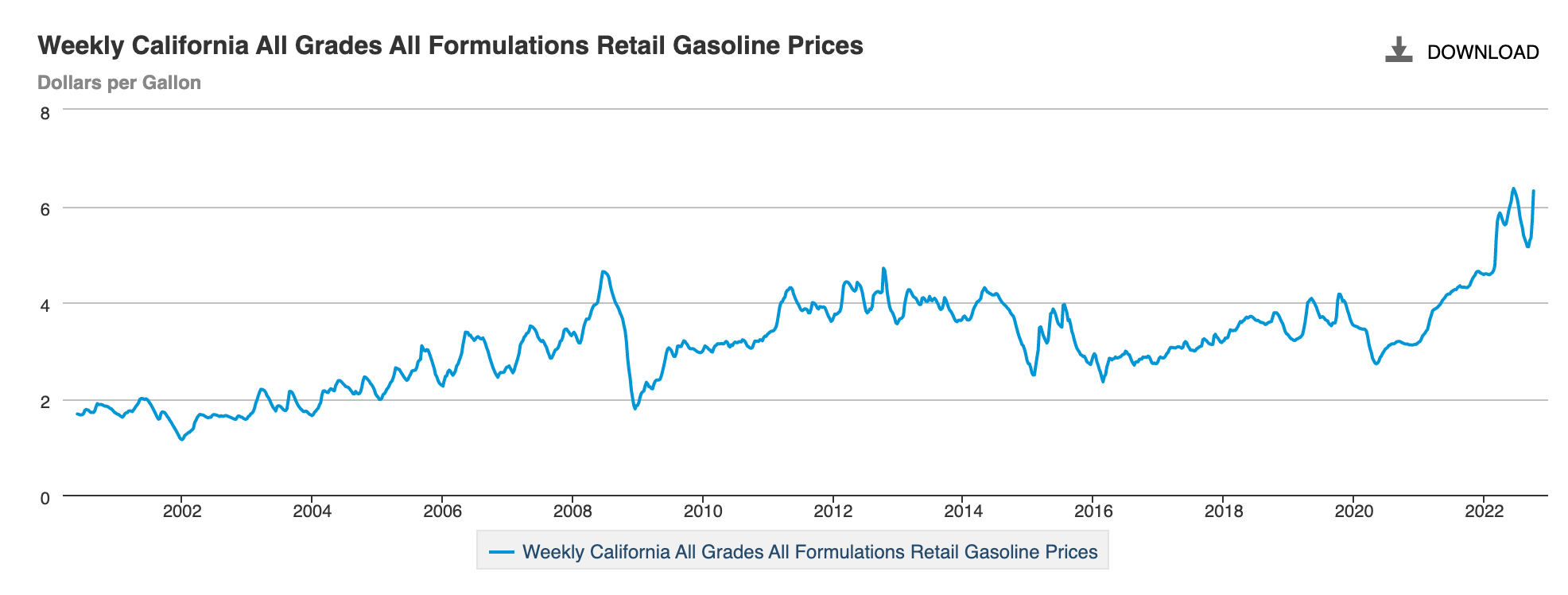

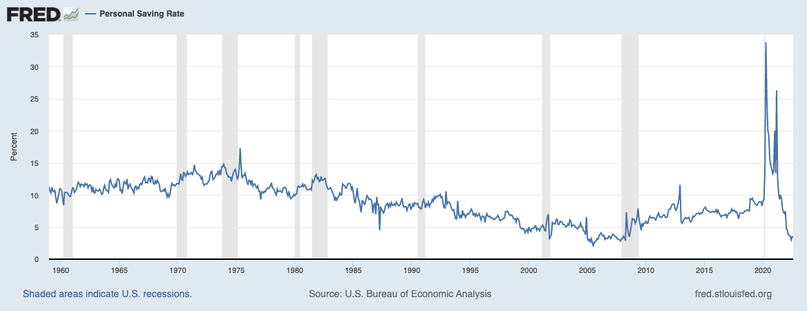

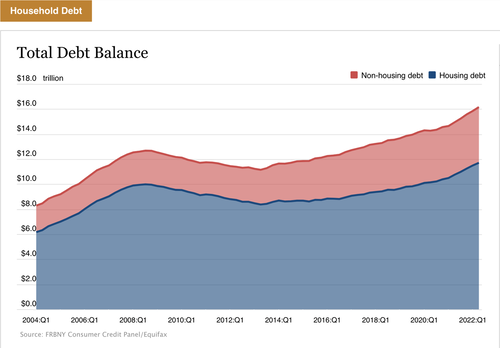

Navigating between the areas of opportunity, while avoiding the massive amount of debt, credit risk, duration risk, opportunity costs, illiquidity and other perilous problems of our leveraged Debt World, is tricky. That is why we spend one full day on what’s safe at our Investor Educational Retreat. That is also why it’s important for you to be the boss of your money, and not just have blind faith that someone else is protecting your future for you. Below are a few ways to start earning some income. However, again, it’s not a good idea to put all of your liquidity into any of these things. Better opportunities are on the horizon, and you want to have the cash on hand to take advantage of them. Treasury I Savings Bond. The yield of the Treasury I Savings Bond is linked to inflation and is paying 9.62% for the next six months. The interest rate will be reset again on November 1, 2022. Since inflation is still high, the reset is expected to be a very good interest rate. Once reset, the rate is locked in for another six months, through May 1, 2023. There are conditions to the Treasury I Savings Bond. It’s important for you to read the fine print. I discuss this more in my free videoconference. (Click to access.) 2-Year Treasury Bill. Currently, the 2-year Treasury bill is paying a greater interest-rate than any other term. The yield curve is inverted. The 30-year T-bill pays only 3.73%, while the 2-year is earning 4.12%. Since the yield on the 2-year Treasury could be much higher in early 2023 than it is right now, it’s a good idea to keep some cash on the sidelines. 8.1% ETF A lot of people are interested in REITs for the high yield. It’s important to remember the difference between empty office buildings (probably not worth the high risk) and apartment REITs that are enjoying the out-of-control shelter inflation of rent. (This is bad, of course, for Main Street, but good, sadly, for Wall Street.) However, there’s another way to get a good yield – while also increasing your diversification. Some countries are offering high-yield. So you might look at Australia and Peru, which are offering 8% and 7% respectively on their iShares exchange-traded funds. Since these are funds, and are invested in publicly traded companies (stocks) in those countries, they go on the “at-risk” side of your portfolio. There are many other nest egg basics to learn, including proper diversification and regular rebalancing. We spend a day on nest egg strategies at the Investor Educational Retreat. Once you learn the life math that we all should have received in high school, you can protect your future, earn money while you sleep, save thousands annually in your budget and live a richer life – all with less time and money than you currently spend. Bottom Line Rising interest rates are finally presenting an opportunity for fixed-income investors to get paid. There is still a great amount of risk, and the returns are still pretty low. So maintaining liquidity, while also getting diversified, is going to be important. The first step in all of this is understanding the life math that we all should’ve received in high school. So I encourage you to watch the videoconference on yield that I hosted earlier this month, as well as attend our January 20-22, 2023 Investor Educational Retreat. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price and a complimentary private prosperity coaching session (value $300) when you register by Halloween, Oct. 31, 2022 Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Halloween, Oct. 31, 2022, to receive the best price and a private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Why OPEC Really Cut Production Includes 7 Key Gas Facts That Each One of Us Should be Very Aware of. Lower gas prices are top of mind for everyone – except oil producers. That is the real reason that OPEC cut oil production – because oil had dropped below their target price point of $90/barrel. "$90 oil is non-negotiable for the OPEC+ leadership, hence they will act to safeguard this price floor," according to Stephen Brennock of the oil broker PVM. Why are oil countries and companies worried about the price of oil dropping? Largely due to economic uncertainty and the risk of a recession. Oil prices can tank in recessions. While OPEC’s meetings and decisions are important because they control supply, that is not all that is at play behind the pump prices. Demand also plays a key role. Below are 7 additional considerations – many of which put the price of oil and gasoline in our own hands. While we want our leaders to solve the problem, we have far more power than most of us realize. 7 Key Factors that Influence High Oil Prices 1. Russia, Saudi Arabia & OPEC+ 2. The U.S. is Oil Independent as Long as We Don’t Fight Wars on Foreign Soil 3. Historical Oil and Gas Prices 4. The 2 Million Barrel per Day Production Cut 5. World Demand & Production 6. Plastic, Polyester & Petrochemicals 7. 20 Oil, Gas & Coal Companies Responsible for Over 1/3 of CO2 And here is additional information on each point. 1. Russia, Saudi Arabia & OPEC+ Do Putin and Mohammed bin Salman have a Bromance going? They certainly have exhibited that on certain key occasions, including that very infamous snubbing of Donald Trump during the G20 meeting in 2018. At the OPEC+ meeting in December of 2018 (under a Trump Presidency) OPEC+ cut production in an attempt to increase gas & oil prices. Russia & Saudi Arabia have a lot in common. Their economies are driven by fossil fuels. They aren’t the only oppressive regimes that feed the world’s oil addiction. Iran and Venezuela are also OPEC members. 2. The U.S. is Oil Independent as Long as We Don’t Fight Wars on Foreign Soil The U.S. produces almost the same amount of oil and gas as we consume. (See the charts below.) However, when we fight wars in the Middle East, we buy oil and gas from Saudi Arabia. So peace is positive for lower gas prices. At the same time it’s important to remember that since oil is a world commodity, the price is set by world demand, not just at-home. So, the war in Ukraine increases demand and prices because the war machine is still heavily reliant on fossil fuels. In fact, the very large natural gas reserve off the coast of Crimea is one of the reasons that Russia wants to control that region. Natural gas prices surged after Russia invaded Ukraine on February 24, 2022. 3. Historical Oil and Gasoline Prices In March of 2022, oil prices hit a high of $130.50. Since then, while prices have been volatile, the trend has been down, finally dropping below $80/barrel on Sept. 26, 2022. The production cut was intended to bump prices above $90 a barrel again, which happened on Oct. 7, 2022. However, it didn’t last, as prices are now back to $85.65 a barrel. U.S. gas prices (average) are at $3.91/gallon, which is very hard on everyone’s wallet, but a little lower than $5.00/gallon seen on June 13, 2022. 4. The 2 Million Barrel per Day Production Cut How much is this? It’s about 2% of global supply. All of the OPEC+ countries have gotten behind the decision, and claim that it was prompted by economic uncertainty and had nothing to do with politics. If you look at the oil chart above, you’ll see that prices plunged during the Great Recession. With the R word appearing in a lot of economists’ crystal balls, OPEC+ has cause to be concerned about reduced demand, which can sink the price of oil. 5. World Demand & Production As we’ve discussed, oil prices are highly correlated with demand, in addition to supply shocks. In April of 2020, when the pandemic lockdowns began, prices plunged into negative territory, to -$37.93/barrel. 6. Plastic, Polyester & Petrochemicals Over half of each barrel is used for plastic, polyester, rubber, asphalt, wax (candles) and other petrochemical products. This expanded understanding of demand is key to helping us transition away from fossil fuels and high gasoline prices. Click to see a more complete list of all of the daily household products that are made from petroleum. 7. 20 Oil, Gas & Coal Companies are Responsible for 1/3 of CO2 While high prices make it hard to balance our family budget, high demand of gasoline and other petrochemical products are impacting the livelihood of many plants and animals on our home planet. Just 20 oil, gas and coal companies are responsible for over a third of the CO2 in our atmosphere. Kicking our oil addiction helps solve both problems. Click to see a list of the publicly-traded and state-owned companies at the top of the CO2 emissions list. It’s been a while since an oil spill made the headlines. The last major one was the BP Oil Spill in the Gulf of Mexico in 2010. However, oil disasters that don’t make headlines happen pretty regularly, and a health crisis has been ongoing in Cancer Alley for decades. Oil-producing countries in the Middle East are the highest per capita contributors to CO2, followed by developed world countries like Australia, Canada and the U.S. (Europeans have a much lower CO2 footprint.) Consumers of oil and gasoline are the drivers of that supply chain. It’s time that we drew the line from our own behaviors at the gas station to the source of product we’re pumping. Having that vision in full view might be the inspiration we need to kick our oil addiction. (There are solutions to long commutes that don’t involve purchasing an electric vehicle. I don’t have a car in Los Angeles, California, a town known for car culture.) If you’d like an updated oil and gas company Stock Report Card, email [email protected]. If you’re interested in being the change our planet needs to heal, and reducing your own CO2 footprint and gas bill, read The Power of 8 Billion: It’s Up to Us for the how-to guide. Bottom Line Reducing our visits to the gas station by 30% or more offers one of the best strategies for lowering gasoline prices and for healing our planet. Transportation is the biggest contributor to CO2. Demand is a big piece of the supply/demand equation. The real challenge to suppress gasoline prices today and in the years ahead is for each of us to find ways to live that are less reliant on oil, gas and other petrochemicals. The Power of 8 Billion: It’s Up to Us challenges each of us to do that and puts the power of prices at the pump firmly in our hands. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price and a complimentary private prosperity coaching session (value $300) when you register by Halloween, Oct. 31, 2022 Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Halloween, Oct. 31, 2022, to receive the best price and a private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Inflation Buster Budget & Investing Plan. 6 Ways to Beat Inflation Now. Household Debt Hits an All-Time High as the Savings Rate Sinks to Pre-Pandemic Lows. Inflation is taking its toll. Americans have burned through all of their stimmy checks and then some. Financial safety nets are disappearing at a very rapid rate. Household debt has soared to an all-time high of $16.15 trillion. Fortunately, defaults remain sparse, largely because there was a long pause on evictions, student loan payments and foreclosures – most of which are gone or on their last leg. However, that is a backward-facing statistic. With housing costs taking up more than 35% of the budget of Americans under the age of 40 (50% or more for renters), according to the National Association of Realtors, that doesn’t leave much room for transportation, food, health insurance, utilities and gasoline. Some basic needs are getting put on a credit card – not a sustainable way of living. According to the New York Federal Reserve Board, “Credit card balances saw their largest year-over-year percentage increase in more than twenty years,” at 13%. Will credit card companies start to see defaults, or have to put more money aside and take a hit on their earnings? If that is the case, Visa and Mastercard might get slammed the hardest by investors, as both companies still have very elevated price-earnings ratios, at 28 and 29, respectively. Email [email protected] with Credit Card Stock Report Card in the subject line to receive an updated document. Just as importantly, while students may appreciate the gesture of having $10,000 forgiven on their student loans, for many it’s a rounding error on the total. Student loan debt is at $1.6 trillion. College debt is responsible for so many Millennials delaying their first home purchase, and for intergenerational housing being as high today as it was in the Great Depression. Clearly, teens need to be better informed about the best path to the career and life of their dreams. (There are ways to get a better degree for up to half of the cost. Keep reading.) The Inflation Buster Plan We often think we just need to earn more income, and all of our problems will be solved. However, in an inflationary world, we also have to be creative and smart about reducing our expenses. It’s not a matter of just cutting out café lattes and avocado toast. (Few of us are really shopaholics.) Below are 6 ways to stop making billionaire companies rich, and to live a richer life. You can get additional information on each point in my bestselling book The ABCs of Money and at our Investor Empowerment Retreats. Rethink & Retool the Big-Ticket “Basic Needs” Expenses

Here’s additional information on each of the 6 areas mentioned above. Rethink & Retool the Big-Ticket “Basic Needs” Expenses

Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed