|

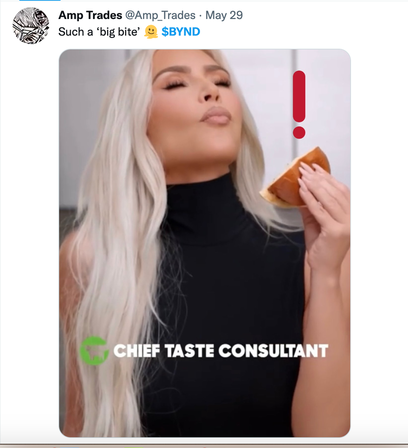

Beyond Meat is trading near an all-time low of $25/share (after soaring to $240/share during the pandemic). Kim Kardashian, yes the influencer with 314 million followers on Instagram, just signed on to be the Chief Taste Consultant. So, is this a rare opportunity to buy into the plant-based protein of tomorrow, or is Beyond Meat done? Kim Kardashian Kim Kardashian is reinventing herself yet again. She is taking advantage of opportunities like hosting Saturday Night Live, dating Pete Davidson and Keeping Up With the Kardashians’ constant headline-grabbing drama to capitalize on one of her passions – a “non-strict” vegetarian diet. Click to watch her Beyond Meat promo, which has already received 1.2 million likes and over 18,700 comments (not all good). Is this all that Beyond Meat needs to find itself back in the freezers of fans and stock portfolios of investors? Beef, Pork & Chicken Prices Are Rising In the early days of the pandemic, there was a supply disruption of meat. Beyond Meat products flew off the shelf. By October of 2020, the BYND share price soared to $200/share, from a low of $36/share in March (at the market bottom). In 2022, the USDA is projecting that meat prices could jump 9-10%, with pork up 6-7%. We’ve seen the shift away from meat before during the pandemic. Will inflation price out traditional meat and welcome plant-based protein back into kitchens? It’s a question worth asking before you sell your shares. 2022 Outlook This year, supply chain disruptions, labor shortages, a lockdown in China and inflation are all impacting Beyond Meat, as well as the other plant-based protein and traditional protein competitors. These factors make forecasting highly uncertain. However, Beyond Meat is projecting a double-digit increase in revenues this year, to $560-$620 million (+21-33%). After subtracting the 1st quarter 2022 revenue of $109.5 million, that parcels out to revenue of $150-$180 million per quarter for the coming three quarters. Last year, the 2nd quarter revenue was $149.4 million. So, 2Q 2022 revenue growth may not be impressive. (Expect the 2Q 2022 earnings report in the 2nd week of August.) However, if the chips start falling in Beyond Meat’s favor or if Kim K’s influence attracts more home cooks, the second half of 2022 could bring more exciting quarterly comparables. The third and fourth quarters of 2021 were $106.4 million and $100.7 million, respectively. At the high-end, the year-over-year revenue growth would be about 70% -- something that should spark investor excitement. If fans love what Kim Kardashian eats as much as they enjoy how she looks, then all bets are off. Her SKIMs clothing line just hit a valuation of $3.2 billion – doubling in value since April of 2021. Forbes estimates that Kim K. is a billionaire. Her endorsement is a major coup for Beyond Meat – despite the snarky comments by trolls and the yammering of bloggers featuring the negative publicity. Competition (The Very Good Food Company & Oatly) Very Good Food Company The Very Good Food Company announced their 1Q 2022 earnings on May 17, 2022. Revenue decreased -24% YOY to $2 million from $2.64 million a year ago. The 4th Quarter 2021 revenue was $4.3 million, making 1Q look dismal indeed. Investors are throwing in the towel on this company. However, the company’s new interim CEO isn’t. The company recently hired former Nestle executive Matthew Hall as the interim CEO. According to the 1Q 2022 earnings press release, Hall believes that the Very Good Food Company has a good shot at being the plant-based food’s “thought leader.” He stated, “We have a great brand, fantastic products, engaged customers, and some very dedicated and talented people.” So, why isn’t that very good product selling and why did the first quarter revenue implode? VGFC stopped their eCommerce marketing spend, largely because the coffers were bare. The company has only $3.3 million in cash, with current liabilities of $6.7 million. If they don't raise money in the next 30 days, it could be restructuring time. That bad news was another grenade to their share price. While there are no guarantees that VGFC will be able to continue without restructuring, having a seasoned executive at the helm improves the odds measurably. Oatly Oatly is also trading down -86% from its 3-year high of $29.00/share, despite increasing revenue almost 19% in the 1st quarter of 2022. Oatly expects to increase revenue by 37-43% in 2022, to $880-$920 million. It was the staggering net loss of -$87.5 million in the 1st quarter that put the company out of favor with its shareholders. With only $219 million cash on hand, combined with higher interest rates, a resurgence of COVID in China and the tightening of money supply, Oatly is starting to fly too close to the trees. If Oatly manages to increase operating margins, raise more cash and meet or exceed projections, investors should become interested again. However, having been burned so badly by VGFC, Beyond Meat and Oatly, plant-based protein investors have become stunned and disgusted. While YOLO and Shoot the Moon memes were plentiful for Oatly, VGFC and Beyond Meat in the past, there is a lot more DD (due diligence) going on, including valuation. Valuation The traditional food companies like Tyson, Kellogg and Conagra have lower valuations. However, they also have lower revenue growth. Many of the plant-based protein companies are younger with much higher growth potential. The companies featured in this blog are all still operating cash-negative, and are reinvesting their cash in new production to meet high demand. Using a price-sales ratio, Beyond Meat, Oatly and The Very Good Food Company valuations are higher than the traditional food companies. However, if these companies can get through the near-term rough patch and start living up to their potential, now could prove to be a great time to pick up more Oatly, Very Good Food Company and Beyond Meat – unless the overall economy takes a deep dive south. Recession? Are we in a recession? That is the topic of my webinar to be held on Wednesday, June 1, 2022 at 5 pm PT. The podcast will be available on my Spotify page, while the webinar itself can be found on YouTube.com/NataliePace. Given that the 1Q 2022 GDP was a contraction, it’s a good idea to get informed on what the future has in store for investors. This is key for trading, as well as protecting your wealth and retirement plans. Bottom Line The projections for the growth of plant-based food range wildly from a tepid 3% CAGR to an eye popping 33.6% annualized. Meatless Mondays are becoming de rigueur. As we’ve seen over the past three years, the pandemic, war, economic uncertainty and general mayhem have the ability to upend even the most sound data projections. As we’ve also seen, when meat runs expensive or scarce, plant-based protein has a golden moment. The volatility of companies like Beyond Meat, The Very Good Food Company, Oatly and many others is one of the reasons why regular rebalancing is a key part of any investing strategy (something we emphasize repeatedly at our Investor Educational Retreats and in my books). It’s difficult to want to buy low when a company’s stock tanks, or to sell high when it soars. On the one hand, you’re worried it might stay low forever (or go out of business), and when the party rages, FOMO (Fear of Missing Out) keeps you dancing and drinking in your dreams of gains long after they evanesce… Rebalancing, particularly within our nest egg pie chart system, takes the emotions out of it and prompts you to stay on the right side of the trade. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the downturn from a No. 1 stock picker, join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed