Inflation. Café Lattes are Getting More Expensive. So Are Labor, Trees, Housing and Stock Prices.31/10/2021

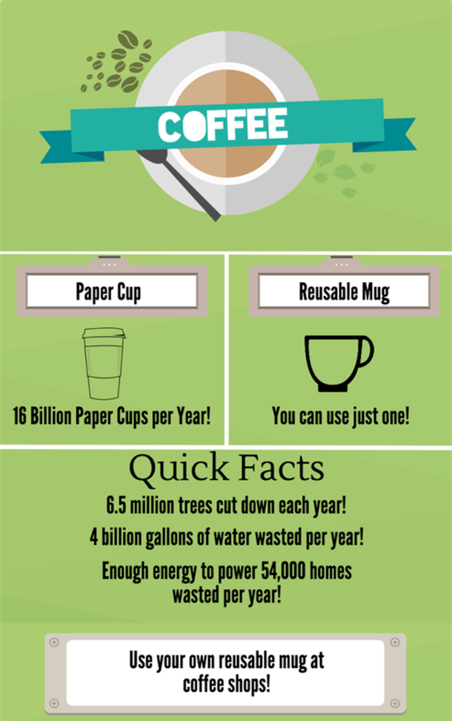

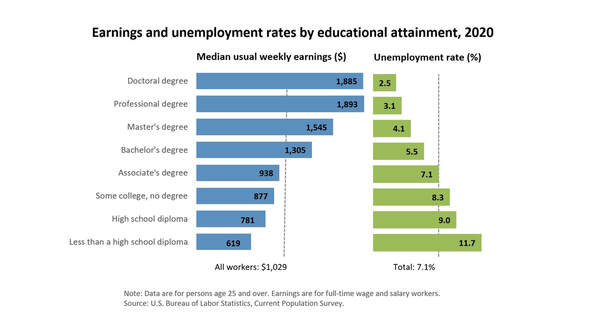

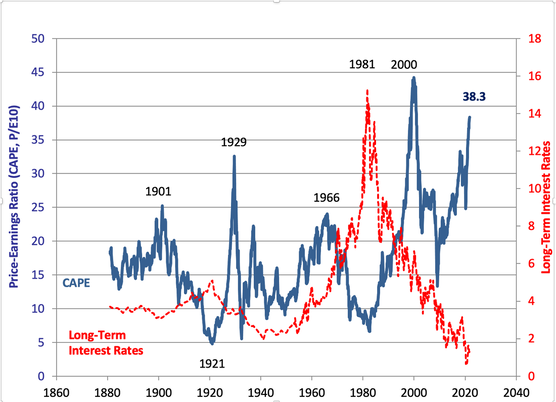

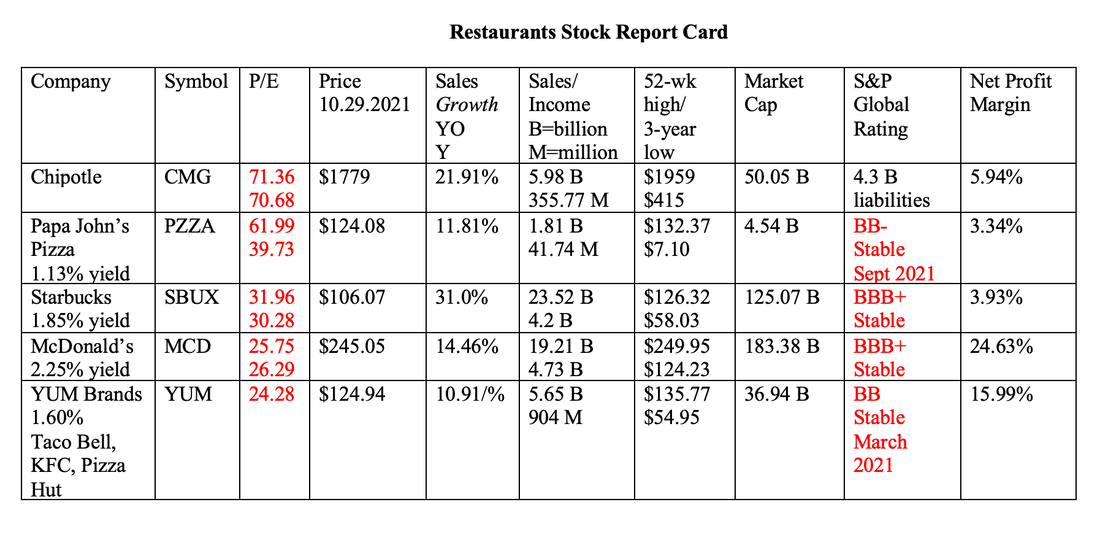

Inflation is affecting everything these days. Whether it’s buying gas or food, chances are you’re spending more at the pump and register. Labor shortages are forcing companies to raise their minimum wage in order to attract team talent. Housing is astronomical and unaffordable in half of the U.S., according to Attomdata. There’s one very expensive thing going on, however, that a lot of people are not factoring in. That is the cost of trees. How many trees do you drink and toss, or flush down the toilet, every year? What happens if we keep razing our rain forests for convenient coffee on the go? Are we factoring in the very real costs of calamities that are associated with climate change, increasingly intense weather events, desertification, oceanic acidification and global warming into our inflation assumptions and how we live our lives? Inflation We are keenly aware of how inflation is hitting gas and oil prices. Since coffee only goes up a few cents here and there, we might not be as aware of escalation. Housing is widely acknowledged as a crisis. But, how many of us are putting two and two together and acknowledging the drain that unaffordable housing has on the labor shortage? If we’re making $17 an hour, which equates to about $2946 a month before taxes, how can we afford to live in most cities in the U.S.? Renting and buying are completely out of reach for the lowest-paid workers in the U.S. This explains why we have more intergenerational homes today than in the Great Depression. It also prompts labor-strapped companies to replace workers with automation (self-ordering has become hugely popular) and to reduce hours of operation. Take a look at the unemployment rate for people without a high school education. It’s quadruple that of those with a Ph.D. Labor Shortages Businesses, particularly hospitality and entertainment that rely upon lower income staff, have been forced to streamline, automate, reduce operating hours and rely upon self-service. Chipotle has Chipotlane where you can pick up an order that you complete on an app rather than through a human-staffed order window. You can do the same thing at many Starbucks and Macdonald’s these days. In the MacDonald’s 3Q 2021 earning call, CEO Chris Kempczinski said the company is leaning into the three D’s for sustained growth and profitability: digital, delivery and drive-thru. The company wants to create “contactless channels” and “digital experiences that are seamless personalized and easy to use.” Supply Chain Bottlenecks Starbucks CEO Kevin Johnson assured analysts on the company’s 3Q 2021 earnings call that he has enough coffee to last for a few months, and prices locked in for more than a year. That ensures for a pretty risk-free holiday season. However, labor shortages are affecting factories and deliveries, while commodity prices are escalating. That is leading companies to raise prices incrementally. McDonald’s raised prices about 6%. Starbucks CEO Kevin Johnson believes there is still room to raise prices (again) if the company needs to. He told analysts that Starbucks has a “world-class pricing team backed up by world-class analytics and insight.” One of the commodities both companies are keeping their eyes on is the cost of paper, since fast food restaurants are still largely steeped in the convenience of single-use, disposable packaging, despite any claims to be socially-conscious and concerned about ESG (environmental, social & governance). Trees and Paper Goods Millennials and Gen Z are target markets of all casual dining and fast-food chains. These population cohorts place a strong emphasis on climate responsibility and sustainability. Somehow, they’ve missed the memo on how disposable paper goods are responsible for approximately 16 billion cups being trashed and 6.5 million trees being razed every year. Trees are the lungs of our planet and have a strategic capability of reducing carbon in the atmosphere and sequestering it in the soil. As Kathleen Rogers, the president of EARTHDAY.ORG told me in our interview for Earth Day, “Vegetation gives us the oxygen we breathe. We cannot solve climate change by planting trees, but we can push it way off down the field, if we do.” (Click to access the full interview.) What happens when consumers understand that the cup in their hand was sourced from an old-growth rainforest? Starbucks will put your personalized macchiato into your own reusable mug, as long as local mandates allow it (given the pandemic). I rarely see anyone (other than me) with a reusable mug at Starbucks. I’ve never seen anyone with a reusable container at MacDonald’s. This isn’t a contactless experience. It requires manual labor to take your cup and pour a drink into it, which spins us back into unaffordable housing and the labor crunch. It is also not as fast and convenient as coffee junkies would like. Will preserving our carbon-sequestration forests become more important than the current method of drinking our Morning Joe? One thing we’ve seen in 2021 with meme stocks and Reddit is that sentiment and campaigns can burgeon out of nowhere to become the norm. Expensive Stock Prices Another area of elevated prices are stock prices. The price-earnings ratios of the most popular casual dining and fast-food brands are astronomical. In general, U.S. companies are trading at speculative valuations not seen since The Dot Com Recession, and much higher than the Great Depression in 1929. Take a look below at the price-earnings ratios of five different brands. The historical average PE is about 17.5. Should a company like Chipotle that had under $400 million in net income last year be worth over $50 billion? Should MacDonald’s and Starbucks be worth $183 billion and $125 billion, respectively, when their net income is under $5 billion? Debt and Leverage Most of the companies listed above have a credit rating of the lowest rung of investment grade (BBB or higher) or are at speculative (junk) status (BB or lower). Debt and leverage in the U.S. today have become astronomical. We hear about the $29 trillion public debt frequently. Few of us are aware that the total U.S. debt and loans is above $85 trillion – a number never seen in our history. Economists have pointed out that the 21st-century has been characterized with wealth flowing to the investor class at the expense of workers. This is what happens when interest rates remain low for an extended period. Low interest rates create asset bubbles. Companies are willing to borrow money, letting their own credit rating fall to the lowest rung of investment grade, because they can do so and still borrow at under 5% in a low interest-rate world. They then use that borrowed money to buy back their own stock, rewarding investors with higher share prices and lower price-earnings ratios. Money flows to the top of the income ladder, rather than through to the team members or invested in R&D. Chipotle, Starbucks and MacDonald’s have each announced that they will repurchase their company shares. Yes, these companies are all increasing their minimum wage a little. At the same time, they are also automating more and reducing store hours, which results in a smaller workforce that is needed. Investors remain invested for the small amount of “income” they are making. Most are not aware that they are one credit downgrade from losing a chunk of their principal. When companies get cut to junk status from investment grade, their stock sinks. Bottom Line If you care about sustainability and ESG investing, it’s important to reduce the amount that you’re eating from these drink and toss dining options. With elevated price-earnings ratios, which is similar to paying $15 or more for an avocado, there is also the looming possibility that prices will decline rapidly and suddenly without notice, and before you can protect your wealth. According to the most recent Federal Reserve Financial Stability Report, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” For this reason, and others that are outlined in my What’s Safe in a Debt World blog and videoconference, we are using value replacements in our nest egg pie chart strategy. Email [email protected] or call 310-430-2397 to learn more now. If you'd like to learn how to learn how to invest in ESG companies including our 2021 Company of the Year (which tripled in share price), how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Call 310-430-2397 or email [email protected] to learn more. Register by Nov. 1, 2021 to receive a complimentary private, prosperity coaching session (value $300) and the best price. Click for testimonials & details. Other Blogs of Interest The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed