|

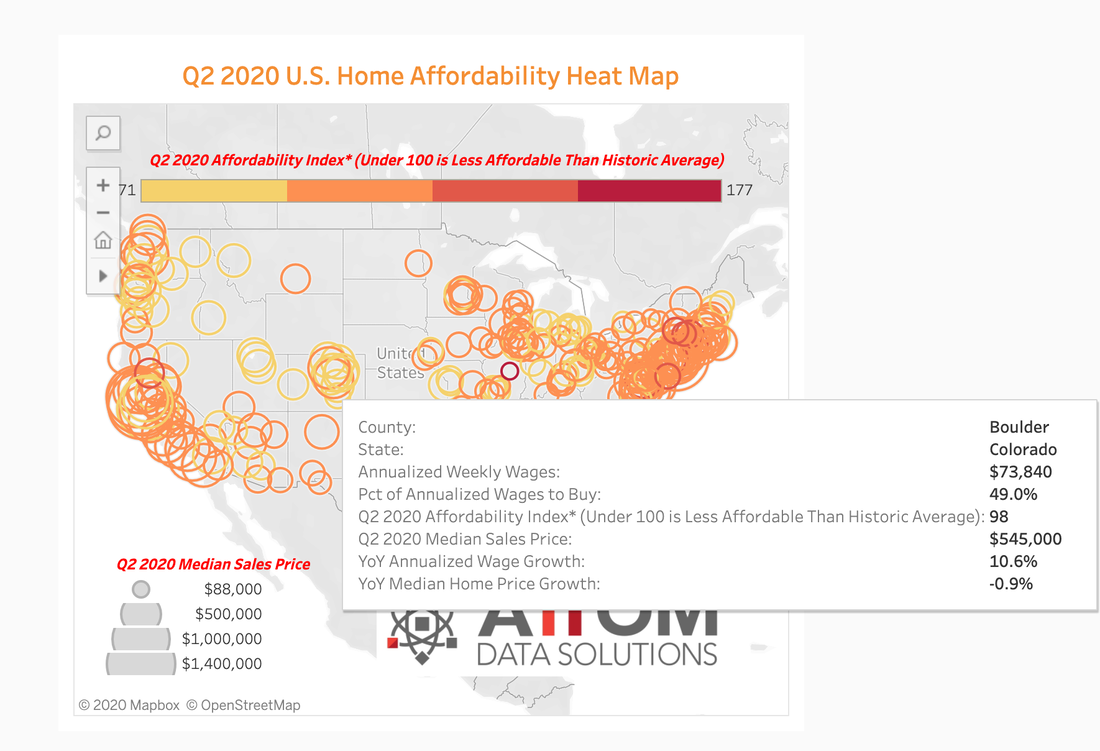

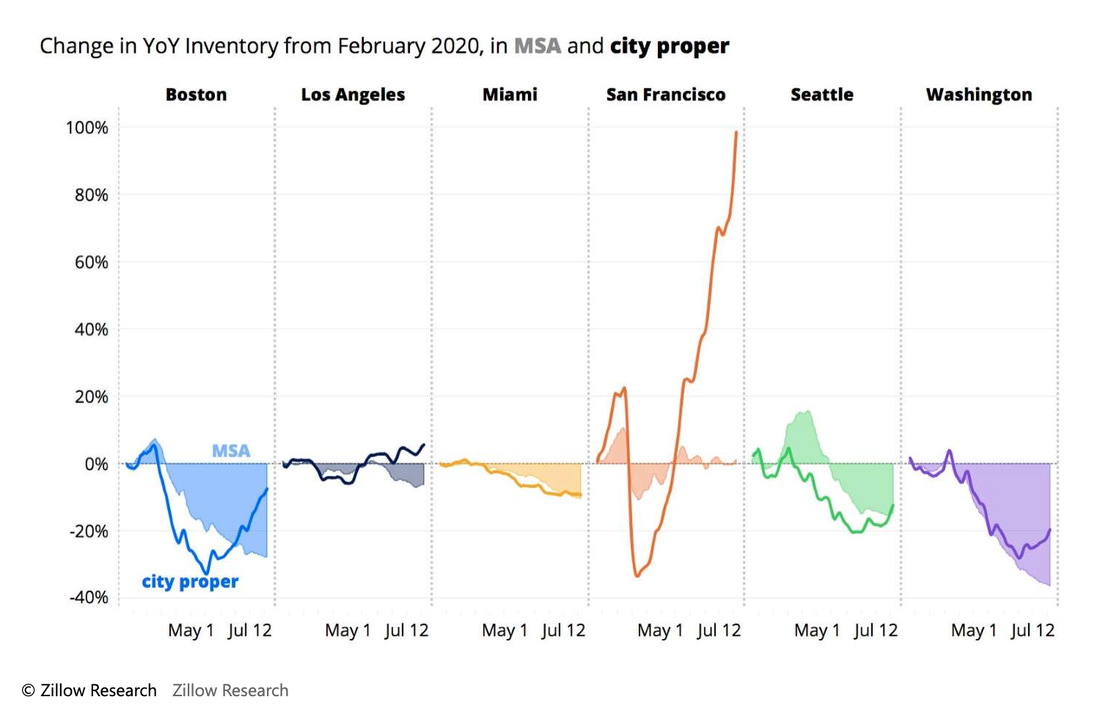

I recently saw an ad that was paid for by a mortgage broker-salesman. It read, “Why are you still renting, when you don’t have to put anything down to buy a home and interest rates are historically low?” This is a prime example of: “Grade your guru before you listen to anything she says.” The mortgage salesman wants you to buy a home, so that she can sell you a mortgage. The same thing happened in 2006 and 2007, and we all know how that story ended (in the Great Recession). If low interest rates and no-down home purchases were the only considerations, then of course, you should run out and buy a home now – particularly if your mortgage is lower than your rent. However, those aren’t the only factors to successful home ownership. And if you fall for the bait, then you could be in serious financial trouble – a debtor’s prison of sorts – for the next decade. So, be sure to apply the seven additional home purchase criteria below before jumping in. 7 Considerations that You Should Also Factor in Before You Buy a Home in 2020 Never Buy High Mortgage Delinquencies Portend a Drop in Prices Home Price Trends in Recessions The Thrive Budget The 4 D’s The Shadow Inventory Interest Rates And here is a little color on each point. Never Buy High Real estate prices are higher than ever, and unaffordable (i.e. costs more than 30% of your income) in 68% of U.S. cities. If you buy high and the price drops, you have trouble on several fronts. Your FICO score drops because your debt now exceeds your asset. Your ability to sell is wiped out, which means you’re locked into where you are, even if a better or more affordable opportunity, including a better career, arises elsewhere. You can’t refinance or get a HELOC, and are hampered on receiving any funds for other needs or ventures, due to owing more than your home is worth. This means you’ll have to borrow on credit cards, at usurious rates, until that last line of credit sinks under a mountain of debt. As you can see in the chart below, if you live in Boulder, you’d need to devote half of your salary to your home purchase. That’s unsustainable. In places like Los Angeles, New York City and San Francisco, housing unaffordability is absolutely eye-popping, costing the average worker 73-110% of her salary (source: AttomData). Mortgage Delinquencies Portend a Drop in Prices The FHA delinquency rate just hit the highest it has ever been since the surveys began in 1979, at 15.65%. This is with a moratorium on foreclosures and evictions. However, the freeze-out will not last forever. High unemployment makes it difficult for people to pay their rent and mortgages. Many people are solving that problem with intergenerational housing. If you buy now, and a boatload of your neighbors lose or give up their homes, then the home prices in your area will fall. As Rick Sharga, the executive vice president at RealtyTrac said in a press release on August 13, 2020, “It’s inevitable that there will be a significant increase in foreclosures once these moratoria have expired, although it’s unlikely that we’ll see default rates reach the levels we saw during the Great Recession.” Home prices are already dropping in San Francisco (4.9%) and New York (4.2%) (source: Zillow). San Francisco has a flood of new listings, putting inventory up 96% year over year. Home Price Trends in Recessions In 2006, the national median existing home sales price hit an all-time high of $221,900. By 2011, it had dropped by 25% to $166,100. Those cities with the greatest speculation and price increases, like Las Vegas, Stockton, Miami and Phoenix, saw their home prices implode by half or more. The largest drop was between 2006 and 2009. However, the low wasn’t hit until 2011. FYI: In June of this year (2020), home prices were back to a median nationwide high of $295,300 (source: The National Association of Realtors). Wages have not kept apace with housing costs, which is why unaffordability has become a buzz word all over the land. The Thrive Budget The mortgage and real estate broker-dealers are not looking out for your ability to stay in your home. They need the sale (particularly in a recession), and will figure out creative solutions to any money challenge that presents the sale – even if it is ultimately toxic for your financial health. Earlier this month, I received seven phone calls from a mortgage broker-salesman in one day! (We saw this in spades in pre-Great Recession.) It is your responsibility to make sure that you purchase a home you can afford (at a reasonable price). If you want to thrive, you’ll need to adopt a budget that allows you room for things other than just basic needs. Basically, you must purchase a home that you can easily afford, and amounts to less than 30% of your income. Being property rich and cash poor is not just a drudge. It is also perilous. Any unpredictable expense could be the tipping point that puts everything you own at risk. Read the Thrive Budget section of The ABCs of Money for additional information. Visit the home page at NataliePace.com to personalize your own Thrive Budget using our free web apps. The 4 D’s Death. Divorce. Disaster. Depression. These are the 4-D’s that you always want to be aware of in real estate. They make a seller desperate, which creates opportunities for the buyer. Two of these D’s – disaster and depression – are already in play. It’s early in the recession, with the foreclosure and eviction moratoria in play until the end of the year. So, you might not be hearing much about just how precarious the economy is – particularly if you are swimming in the news of the S&P500 hitting a new high. However, as elevated levels of unemployment and underemployment continue, and once the bailout and freeze-out are lifted (or the landlords go under and banks start reporting losses), the false veneer that everything is okay will crumble. Therein lies disaster for the person who hasn’t been paying their rent or mortgage, and opportunity for the buyer who wishes to own their own home at a more affordable price. The Shadow Inventory As I mentioned above, it typically takes years for real estate prices to bottom out. However, if you are willing to shop in the shadow inventory, then you might start finding some bargains earlier. The shadow inventory can often offer up to a 30% discount off of the MLS (multiple listing services). So, what is shadow inventory? Most homes that are bank-owned, pre-foreclosure, foreclosed on or up for auction are not listed on the MLS. I would also include the 3.4 million homes that are currently severely underwater (i.e. where the home mortgage is 25% or more than the value of the home) in the shadow inventory. Any homeowner who has a mortgage that is substantially higher than the value of their home right now is in a very bad spot if real estate prices weaken. By educating yourself and the underwater homeowner about possible exit routes and a better plan going forward, you might help them to save their lifeboat – their retirement plans. Without a good strategy, the underwater homeowner is at high risk of draining their retirement plans and then getting foreclosed on any way. Interest Rates Interest rates are at a historic low, and they are predicted to stay at zero for at least two years. According to the Federal Reserve Board’s financial projections, the Fed Fund rate should remain at or near zero through 2022. The longer run projection for the rate is 2.5%. As the FOMC wrote in a press release on July 29, 2020, “The Committee expects to maintain this target range [of 0 to 1/4 percent] until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” Inflation could change the game on this. However, so far there are few signs of distress. So, there doesn’t have to be an interest rate risk rush to buy high right now, just to catch historically low interest rates. Bottom Line Being upside down on the mortgage and owing more for your home then it is worth can present a decade of financial hell for you. On the other hand, if you happen to find yourself on the right side of all of the above considerations, then now could be an excellent time to buy. In most markets, prices are at or near all-time highs and are unaffordable to the people who live in the area. The patient buyer will be happy she practiced wisdom and a solid strategy, and waited for (or created) the right opportunity, rather than taking the bait of the real estate or mortgage broker-salesmen and buying at an all-time high. If you're interested in investing in real estate or in buying a new home, learn essential investing tools at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed