|

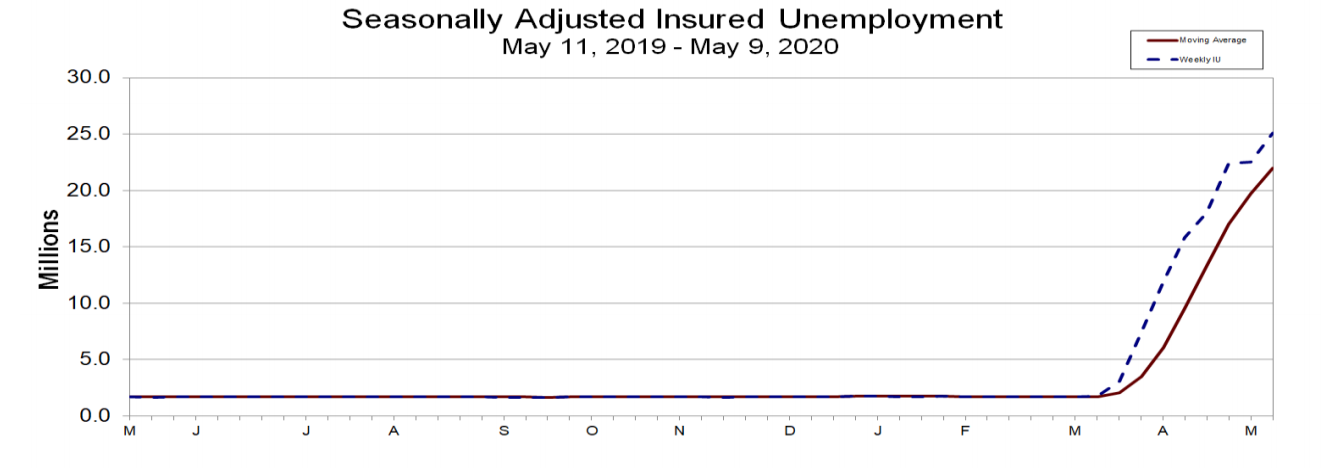

Overnight, the pandemic upended our lives. Take a walk down 6th Avenue in New York, or Main Street in Los Angeles, or even your own neighborhood. From sitting elbow to elbow in restaurants, movie theaters, casinos and on planes, we now walk at least 6 feet apart, wear makeshift masks and work from home. Early in the pandemic, we might have thought things would blow over, and we’d soon be back to our normal routine. However, concerts and sporting events are pushed out to 2021. Over the last few weeks, there have been a slew of announcements from technology CEOs that Work from Home will be the new normal for the rest of the year, at minimum. Commercial Real Estate: What to Do With All of That Empty Office Space? Twitter’s CEO Jack Dorsey will let Twitter and Square employees work from home permanently, unless their job requires them to be physically present. 95% or more of Facebook is currently working remotely. With an aggressive remote hiring plan in place, Mark Zuckerberg predicts that half of Facebook’s staff could be working remotely in the next 5-10 years. Google’s Work from Home mandate has extended through the end of 2020. However, CEO Sundar Pichai remains excited about some of Google’s campus projects that are in the works, and believes there is still a need for “physical spaces for people to get together.” Logistics are forcing corporations to seriously consider Work from Home. Social distancing requirements mean that capacity might be limited to 25% of what it was previously. The cost of increasing office space fourfold, when everyone is right-sizing and conserving their cash, is a pipe dream. In our interview last Thursday, Howard Silverblatt noted that the expected wait time to get into his office building was at least 45 minutes, even with people using different doors to enter. Adding that to an already burdensome commute is unrealistic. Commercial real estate developers like Hudson Pacific Properties, Boston Properties, CBRE and more will likely take a revenue hit on the retail side and on the office leasing side in the 2nd quarter of 2020, as clients scramble to figure out work solutions in a pandemic. In Hudson Pacific Properties 1Q 2020 earnings call, CFO Harout Diramerian admitted that “Companies are taking a little bit longer to make decisions on their future space needs.” However, he also held out the belief (hope?) that storefront retail would recover once office buildings become occupied again. Hudson Pacific Properties clients include a Who’s Who of marquise and infamous tech companies, including Google, Netflix and WeWork. Malls Were Already in Trouble from the Retail Apocalypse A few years ago, some malls began transitioning away from retail and into commercial real estate projects. The Westside Pavilion in West Los Angeles was slated to open as a Google campus in 2021. Now those projects are threatened. Not surprisingly, REITs like Simon Property Group, Taubman and Macerich have each lost 62%, 27% and 73%, respectively, from their February 2020 share price highs. Apartment Buildings However, it’s not just commercial real estate that is empty. Certain “dorm” apartment buildings, where Millennials and Gen Z would room together to try and afford something in expensive urban cities (where the jobs are, and where they could at least ditch the cost of owning a car), have high vacancies, too. Why should young professionals spend 40% of their income on rent, when it no longer matters where they live or work from? House-Share Airbnb landlords, who considered hospitality at home their job, are slashing their prices, or listing privately to avoid paying the small percentage that Airbnb takes. Many rooms and bungalows that were operating at full capacity are now fortunate to fill half the time – at a reduced rate. Hotels Better call ahead to see if the hotel is even open! Some are operating, while others are closed. Many have state mandated rules for self-quarantining, if you are coming from a “hot spot.” All of this means that boutique hotels, especially those that were purchased recently, could be in trouble from an operational standpoint, as well as losing value on the property itself. Many hotel chains are still trading very low from where they were in mid-February 2020, with Marriott down -41%, Hilton down -32% and Wynn Resorts down by 49%. Homeowners 8.16% of mortgage loans are in forbearance, with 4.1 million homeowners in a forbearance plan as of May 10, 2020 (according to the Mortgage Bankers Association). The concentration is among FHA and VA borrowers, with 11% of Ginnie Mae loans in forbearance. The hope is that “if the economy continues to gradually reopen, the situation could stabilize,” according to Adam Fratantoni, MBA’s SVP and chief economist. AttomData points out another sobering statistic that complicates that sunny outlook. 3.6 million homes in the U.S. (1 in 15) are seriously underwater – and that is with prices at an all-time high! Existing home sales dropped -17.8% in April (source: National Association of Realtors). Prices were up, however, as there were fewer homes on the market to choose from. If you’re thinking of buying, you might want to consider that it took four years for the housing market to bottom out in the Great Recession. The current price for single-family existing homes, all types, is $286,800 – an all-time high. The price bottomed out in 2011 at just $166,100. The industry economists all point out that there is not enough supply, which will keep prices high, by their estimation. However, they aren’t factoring in the growing trend toward Intergenerational Housing, or giving enough weight to the unemployment rate. Add to that a shadow inventory that few economists are mentioning, and the underwater mortgages (which likely make up a good deal of those in forbearance), and you have a very dirty martini – one that can leave homeowners with quite a hangover. One thing that is for sure is that real estate is changing rapidly. Yes, our home is becoming everything to us. But we are also realizing that breaking our budget to stay in an unaffordable abode, whether it is a dorm rental or an underwater mortgage, is too risky. While experts tout that there just isn’t enough supply, which they claim will keep prices buoyant, consumers and the pandemic are creating new rules around how to work and live. According to AttomData, home prices were unaffordable in 66% of the U.S. counties analyzed in the 1st quarter of 2020. With over 20% unemployment, Americans are being forced to find creative housing solutions. Who Wins and Who Loses in a Post-Pandemic World? As the senior index analyst of S&P Dow Jones Indices (the S&P500) Howard Silverblatt noted in our conversation last Thursday, financials, retail and commercial real estate were all performing poorly in the index, while technology was on fire. Go to YouTube.com/NataliePace to listen back to the interview, which includes forecasts on which industries will fare well and which will need to restructure in a post-pandemic world. Whether you are thinking about Intergenerational Housing as a solution to help a friend or family member weather the economic storms, or wondering what you own in your retirement accounts, to make sure that your exposure to stocks and bonds is in your best interest, wisdom and time-proven solutions are the cure to ease your anxiety, stress and concerns. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all vulnerable to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Call 310-430-2397 or email [email protected] to learn more and to register.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Online. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed