|

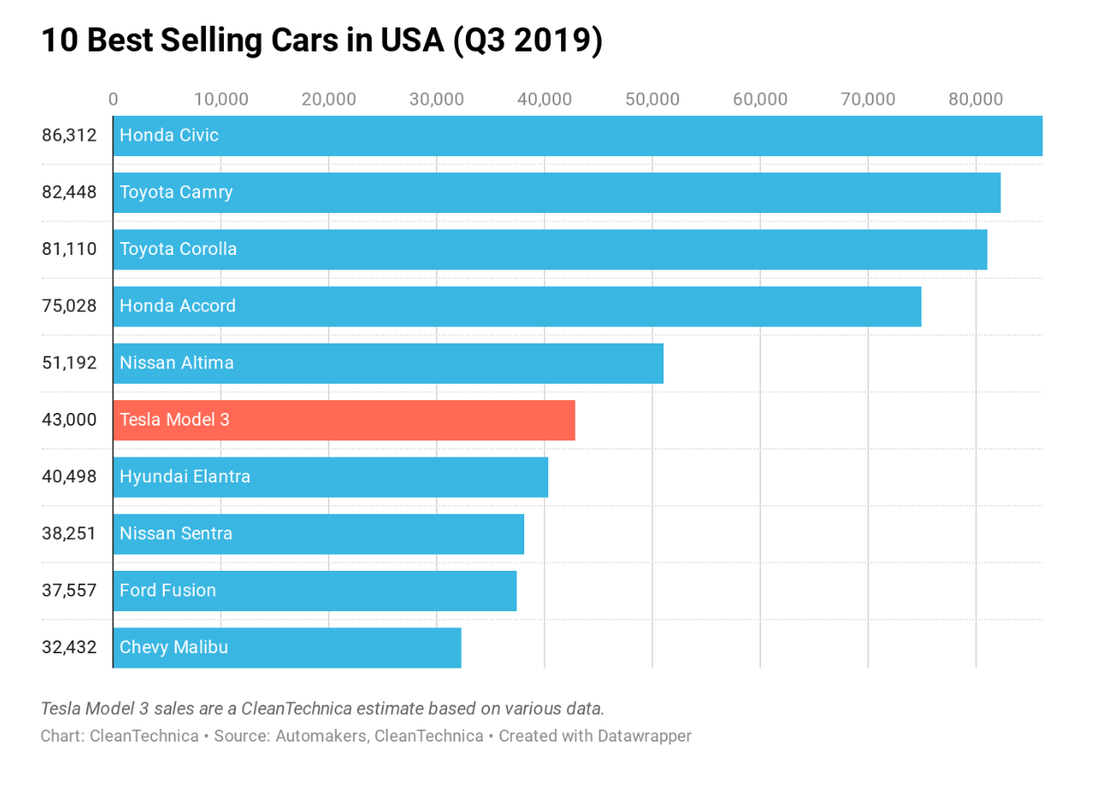

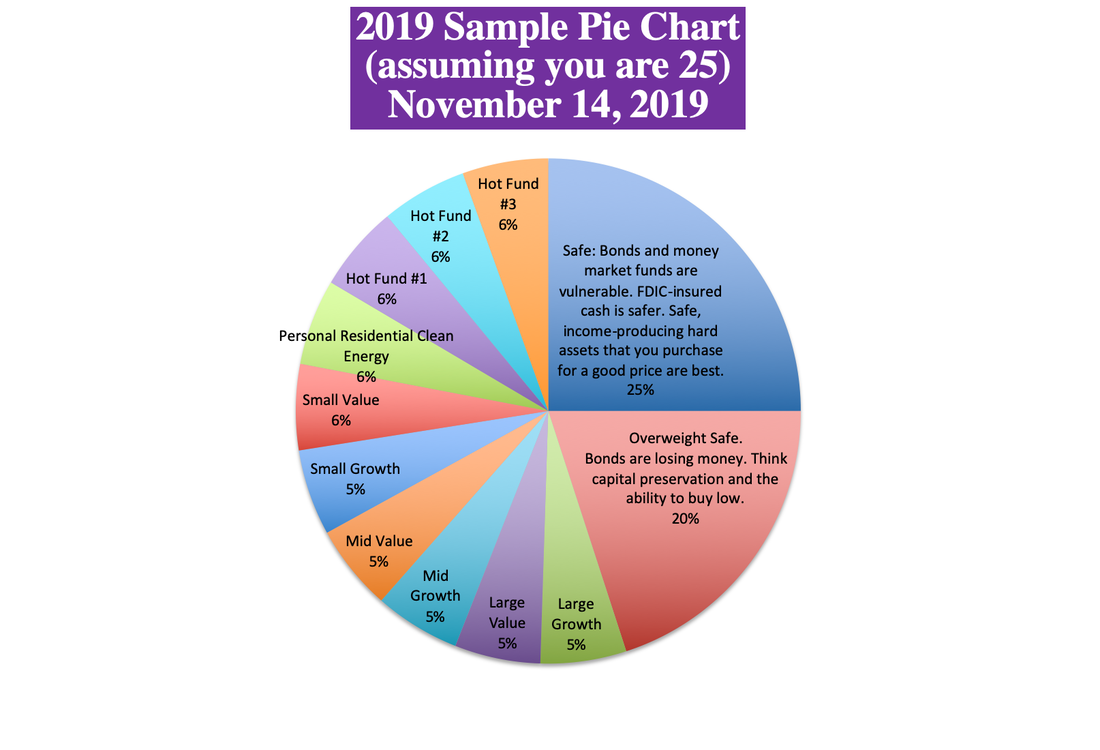

Hong Kong slid into a recession in the 3rd quarter of 2019, according to the government’s advance estimates. The city’s economy shrank 3.2% from the 2nd quarter, while the 2nd quarter slowed -0.5% from the prior quarter. (A recession is defined by two quarters of negative growth.) What’s to blame? The U.S./China Trade War and the Hong Kong protests, according to Reuters. However, in real terms, the decline was sparked by consumers. Instead of spending, Hong Kong citizens were protesting in targeted malls and other areas of commerce. Tourists steered clear of the tension. Shopkeepers lost sales, as did restaurants and any industry or service that is reliant upon tourism spending. China’s economic growth is still faster than the rest of the world, at 3.9% sequentially in the 3rd quarter of 2019 and 6.0% annualized. However, that is down from the astonishing pace that the country has maintained for most of the New Millennium. The U.S. economy slowed to 1.9% in the 3rd quarter, according to advance estimates. The 2019 GDP growth is forecast to come in at 2.2%. In stark contrast to Hong Kong, the U.S. consumer is one of the bright spots of the economy. Personal Consumption Expenditure makes up 62% of the U.S. economy. The increase in August PCE was largely due to car buying and medical care. So, the Hong Kong protests are a stark reminder of the price of political unrest, and just how quickly things can escalate and change. Read my interview with Nobel Prize winning economist Robert Shiller for details on how we can talk ourselves into a recession – or strike ourselves there, as is happening in Hong Kong. Will the Hong Kong Recession Spill Over Into the Rest of the World? The trade war between China and the U.S. has already caused damage to both economies. Companies like General Motors, General Electric and Ford are reporting lower sales and earnings in 2019, and robust cutbacks on their capital expenditures to improve performance. In the 3rd quarter 2019 earnings call on October 29, 2019, GM CEO Mary Barra’s tone was one of resignation that the challenges and costs are here to stay. Barra said, “The team continues to focus on accelerating cost reduction initiatives to improve performance, given the business environment.” In Federal Reserve Board Chair Jerome Powell’s testimony to Congress on November 13, 2019, he noted that “weakness in business investment… is being restrained by sluggish growth abroad and trade developments.” Protecting Yourself from a Global Economic Slowdown Your best protection is to have enough safe in your savings and retirement plans, and to know what’s safe in a world where Ford bonds were just downgraded to junk and over 50% of corporate bonds are at the lowest rung, just above junk bond status. The Cliff Notes on that are that bonds won’t save the day in the next recession. In fact, they might cause it. According to Charles Schwab’s Chief Investment Strategist Liz Ann Sonders, “This highly indebted, weak component of the corporate sphere will mark the end of this cycle in some way.” Another important consideration is that money market funds now have redemption gates and liquidity fees. Many Certificates of Deposit are no longer FDIC-insured. Annuities and life insurance were never FDIC-insured. So, you must read the fine-print on all of your bank, retirement and brokerage products. Personalize Your Pie Chart in Our Free Web Apps. If you’d like to know what a diversified, overweighted safe plan that is personalized for you looks like, click through to our free Easy-as-a-Pie-Chart Nest Egg web app. This pie chart shows you what you should have. The key is learning what you do have, so that you can compare apples to apples. The easiest way to do that is to receive an unbiased 2nd opinion from our office. Call 310-430-2397 for pricing and information. You can also attend an Investor Educational Retreat, where you can learn the ABCs of Money that we all should have received in high school, and implement the time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between. Knowing what you own and why you own it is important to do now before the global economies weaken further. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. General Electric gave no warning before they cut their dividend in half, and their stock dropped by more than 2/3rds. The warnings that Ford bonds were in danger of being downgraded to junk status were fleeting and few. (Click to access my warning in 2018.) If your financial plan is longer than just a few pages, or if you lost more than 30% in the Great Recession, these are red flags. However, even a formerly resilient plan could be vulnerable due to the over-leverage in bonds. Underweight Hong Kong Given the recession in Hong Kong, it’s a sound policy to underweight your exposure there. The iShares Hong Kong ETF EWH is still trading near an all-time high, so now might be an excellent time to consider a different choice. About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She is the co-creator of the Earth Gratitude Project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her easy as a pie chart nest egg strategies earned gains during the last two recessions and have outperformed the bull markets in between. The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 2nd edition of The ABCs of Money was released in 2018. Other Blogs of Interest They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed