|

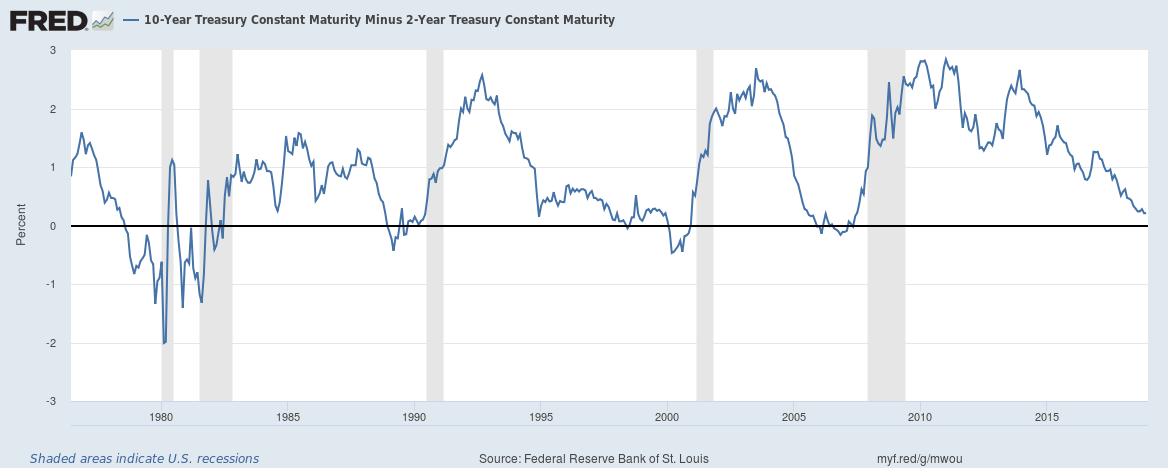

Wonder what 2019 has in store for you, your home, your nest egg, your wallet, your fiscal health and living a rich life? Let’s peer into the facts, data, statistics and correlations to see what the Crystal Ball for 2019 portends for: Stocks Bonds Real Estate Gold Cryptocurrency Cannabis Banks Insurance Companies & Annuities And Beyond Stocks: Bad Santa When the Santa Rally sucks, the next year is even worse 2/3rds of the time. The last two times that October through December offered up coal for Christmas were in 2007 and 2000. 2008 saw losses of 38% in the S&P500, while in 2001, the index dropped 13%. You have to go all the way back to 1978 for a bad Santa Rally before that. As of December 28, 2018, the S&P500 is down -15%, making 2018 the worst December ever. The 2nd place year of the Bad Santa December was 1931, when the index dropped -14.53% (source: S&P Dow Jones Indices). The Bad Santa Rally Phenomenon is merely a symptom of far greater dis-ease in the economic system these days, including massive leverage, asset bubbles, a slow-down in GDP growth, the flat yield curve and other harbingers of recessions. Click on the blue-highlighted words for additional information. I’m also including a list of blogs at the end of this blog, where you can get better informed about what is really going on in the economy. Crystal Ball 2019: Stocks The prognosis for Stocks isn’t good. It usually takes about 18 months for a correction to hit rock bottom. Below are the charts for the Great Recession and the Dot Com Recession. Bad news comes in waves, where the indices drop and then stabilize at a new low, only to be hit again with something worse, until the final recovery can begin. In other words, just at the moment that you are wiped out, fed up and ready to throw in the towel, that’s the point when a prudent investor would be buying low. One final point: everyone knows that buying low and selling high is the key to successful investing. The reason most people can’t buy low is that they’ve suffered too many losses, and must now recover. (You might remember this from 2009.) The reason most people don’t sell high is that they are hopeful the value will go even higher, even when the trend has started to reverse itself. (You might be feeling this way now.) Bonds Rising interest rates mean that current bonds lose value. If you have a short-term bond backed by an income-source that is recession-proof and creditworthy, then odds are decent that you’ll get your yield and the return of your money on redemption day. However, most people are not aware that over half of the companies in the U.S. are at the lowest rung of investment grade, or that many of these highly leveraged companies have been borrowing to buy back their own stock and dividends. The worst examples of what can happen to over-leveraged bonds include: Greece, Stockton, General Motors, the entire airline industry, retail and other industries that have slow growth and have massive pension and other post employment benefit obligations (OPEBs). If you aren’t aware of the interest rate risk and credit risk in bonds, then you can read up on the fate of MF Global, Detroit and GM, or ask any pilot who had a United Airlines pension in 2001 to start your education process. Crystal Ball 2019: Bonds Bonds lost money in 2018. 2019 is expected to see two rate hikes, with one in 2020. That means more bad news for bonds, and that is just the interest rate risk. The credit risk means that we could see some bad news, in the form of restructuring debt, for some of these over-leveraged companies. A bear market in bonds is particularly problematic because the last two recessions benefited from a bull market in bonds. In the Dot Com Recession, bonds were getting up to 25% above their face value, while in the great recession bonds earned 10% on average. This is because interest rates were high enough to be cut before the correction started. That’s not the case today, which is one of the reasons why the Federal Reserve Board continues to hike rates. Getting safe, and understanding what’s safe in a world where bonds are losing money, is so important that I spend one full day on this at my Investor Educational Retreats. Real Estate Real estate is very sensitive to interest rate hikes. When interest rates rise, it squeezes the buyer pool. Owning a home is out-of-reach for the denizens of many cities, particularly folks under 40. Rising interest rates make something that is already unaffordable more expensive. That puts pressure on real estate prices to drop – unless there is a massive amount of new supply coming on the market, or a massive amount of new demand. Real estate is local. So if there is some compelling reason why your particular town or city will buck the national downtrend, pay attention to that. However, knowing the general macro trends will serve you well. Remember that few industries hire in recessions, and many lay-off workers. So, counting on a robust influx of workers next year, in most cases, is not a sound bet. REITs. Private placement Real Estate Investment Trusts have become very popular for broker/salesmen because they pay an outstanding commission. However, many have never recovered from the Great Recession and have been cash negative for years. There are many risks associated with this product that the enlightened investor must learn before writing the check. Here’s an SEC Investor Alert on the topic. The Cliff Notes on REITs are that you are buying stock in a company that owns real estate. You don’t own the real estate yourself. If the company hits trouble, and is forced to restructure their debt and business, your stock in the company becomes toilet paper. Gold Gold should be in a bull market in 2019. Television pundits have begun touting the precious metal, which typically means that the asset’s popularity with Main Street investors soars. Gold soars when stocks or the U.S. dollar swoon. Gold prices go up when oil prices spike. All of those things are could happen in 2019. Of course, once we know that we are in a recession, oil prices will abate again (2020?). Cryptocurrency Cryptocurrency is still the Wild, Wild West. There is promise here, however it is not fully realized. You cannot have Bitcoin valued at $20,000 last December and only $3000 today. That’s not currency. That is speculation. Over 90% of cryptocurrency is speculative trading, trying to get rich quick, rather than it being used as currency. Additionally, there are so many scams in this space that it is absolutely heartbreaking. Be very, very careful that you are not drawn into a cryptocurrency MLM scam. Be sure to read my 12 Red Flags of a Scam blog before investing. Cannabis Cannabis is the booming industry of 2019. The growth rates are off the chart. The interesting thing about cannabis stocks is that the bubble on the pricing has popped. Many are trading near a 52-week low – down by half or more in the last few months. I’m seeing 100% to 400% and more revenue growth year over year in a lot of these companies. Here’s a blog that I wrote on Cannabis in September, the month before Canada legalized recreational use of cannabis products. There are also a lot of scams in this space, and companies trading off the boards with questionable business models and liquidity. So, be sure to read my Penny Pot Stock Scams blog, as well. One more tip on cannabis. It’s a better idea to pick a few winning companies that are publicly traded than to invest in a new cannabis fund that is offered by a company you are unfamiliar with. Banks As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab Inc. explained in my interview that was published on October 22, 2018, “We have taken financials from an outperform down to a neutral. They are only profitable if they can earn the spread between short-term interest rates, which they borrow at, and long-term rates, which they lend at. The reason why the inverted yield curve has almost always brought on a recession is the crush that causes for the financial sector, and the implication that has more broadly.” The yield curve is flat. Each interest rate hike has the potential to take it negative. However, even at a flat yield curve, banks are squeezed. Click to read my blog interview with Liz Ann from October of this year. Insurance Companies and Annuities According to the Financial Stability Report that was released by the Federal Reserve on November 27, 2018, life insurers have been shifting their portfolios toward less liquid assets, weakening their liquidity positions. What That Means. Are you aware that insurance companies are not FDIC-insured and that if the U.S. had not bailed out AIG in 2008 over 50 million policyholders would have been without much of a backstop? Just how safe and protected is your annuity? And Beyond It’s a good idea to harken back to life in 2009, and take steps to make sure that you keep what you have and that you are not over-spending on basic needs or struggling to pay your bills. Most people need to act now to get defensive before the next downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Crystal Ball 2019 was the subject of my free January 2019 Teleconference. Click to listen back 24/7 on demand. If you wish to be notified of an upcoming teleconference, email [email protected] and ask to be added to our email list, or check my home page at NataliePace.com frequently, or follow me on Twitter or Facebook. Other Blogs of Interest

2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed