|

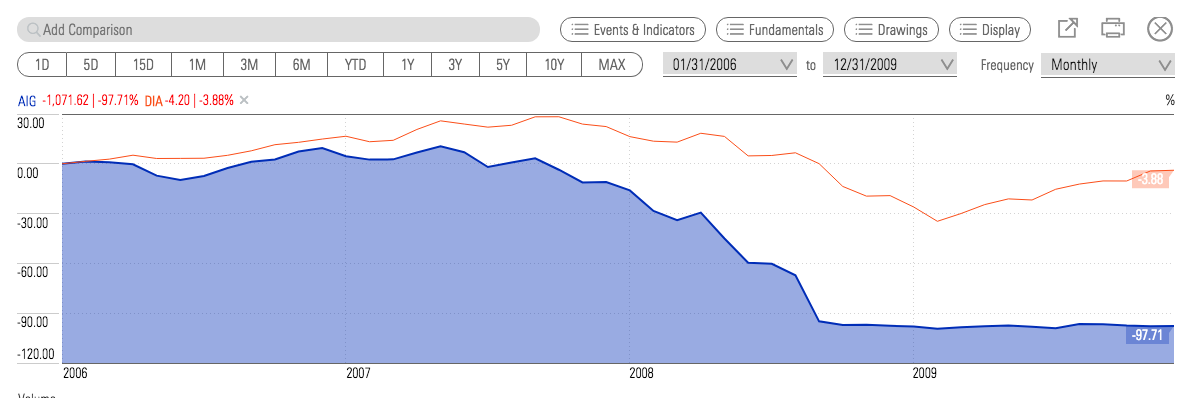

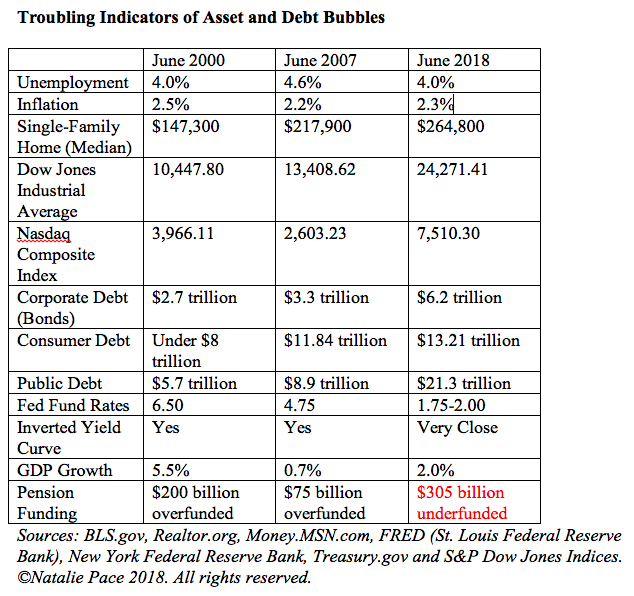

Dear Beefed, I can understand your frustration because there is a lot of noise out there and a lot of Madoff-types making promises of easy returns without any risk. There are also a lot of commission-based salesman passing themselves off as informed advisors. Trust Results You wouldn’t expect a failed musician to teach you music, so hold your financial team to the same test. The proof of whether or not they have a plan worth listening to and adopting is easily visible in the results test. Simply ask for a graph of the returns of the financial plan compared to the S&P500 for the past 10 years, and the past 15 years. The first chart shows you how well the plan did in the bull market. The 15-year chart will show you how the proposed investment strategy fared in the Great Recession. Most plans underperform the bull markets, due to fees, and drop precipitously during bear markets because they are not properly diversified. If the plan performed at or below the market, then you’re signing up to ride the Wall Street rollercoaster. Clearly, it’s not a good idea to lose more than half of your retirement every 8-10 years, and then just crawl back to even, only to be crushed again. If the strategy is an annuity or a high-yield REIT (Real Estate Investment Trust), then you can easily construct the chart yourself on Money.MSN.com (as long as the company is publicly traded). Since you are being asked to place your full faith in the company itself, without any backstop, it would be important to know how well that company fared in the last recession. If the business isn’t publicly traded then your risk level is much higher. AIG Compared to the Dow Jones Industrial Average January 2006-December 2009 What Worked in 2000 and 2008? Buy and Hold worked in the wake of World War II because the United States was in an expansionary period and our dollar had just become the world’s reserve currency. Performance of the Dow Jones Industrial Average Index 1940-2000 Since 2000, the U.S. (and most of the developed world) has been engaged in financial engineering to boost growth. Low interest rates create bubbles, which is why 2000 and 2008 losses were devastating, with investors losing up to 78% of their NASDAQ holdings in 2000-2002 and up to 55% of their Dow Jones Industrial Average positions in 2008. Bubbles are the reason that Wall Street has been a rollercoaster in the New Millennium. In 2000, it was the Dot Com Bubble. In 2008, it was the real estate bubble. What bubbles exist in 2018? An Easy Plan With a Ph.D. in Results There is a simple plan that worked great in both recessions – being properly diversified, with annual rebalancing. As for the results test, this easy-as-a-pie-chart nest egg strategy earned gains in the recessions and outperformed the bull markets in between. See Nilo Bolden’s testimonial for a real-world example of someone who trusted results before the Great Recession and is very happy that she did! In both 2000 and 2008, simply keeping a percentage equal to your age safe, and overweighting up to 20% safe due to the perilous market conditions, combined with the tried-and-true annual rebalancing, limited losses on the “at-risk” stock side and earned gains on the “fixed-income” bond side. That’s how Nilo and many others earned gains in the Great Recession – by having an age-appropriate, balanced and diversified plan. Bonds Earned Gains in 2008, When The DJIA Dropped by More Than Half Getting Safe in 2019 Getting safe now is trickier because bonds are vulnerable and losing money. As interest rates rise, as is predicted to happen over the next two years, bonds will continue to be under attack. Meanwhile, stocks are overleveraged, too, and are vulnerable to a correction. Diversification, annual rebalancing, avoiding the leverage, adding in hot industries and knowing what is safe in a world where bonds are losing money is important. That may sound complicated, but it is in fact easy as a pie chart (alongside a few other important details). Many, but not all, of the financial products that are readily available to you are overleveraged and overpriced today, meaning you are vulnerable to capital loss. Don’t let yourself succumb to disillusionment, befuddlement, blind faith or complacency. You have far too much at stake. Make it a priority to learn the ABCs of Money that we all should have received in high school. Be The Boss of Your Money Yes, you can be the boss of your money. No, it doesn’t mean that you have to take on another job, anymore than being the boss of your home means that you have to fix every little thing that needs to be repaired. There are certain times when protecting what you have is the most important financial move you can make. Now is that time. If blind faith cost you more than a third of your nest egg in 2008, then you have all the proof you need that your current plan needs a second opinion. Now. When you are disillusioned and befuddled, the right answer is to become informed and clear-headed. Wisdom and right action are always the best strategy, especially in tough times. Who can you trust to help you learn? Trust results. They will reveal who is the shaman and who is the snake-oil salesman. When someone says, "Let me do it for you," prepare to be oppressed. When someone says, "Let me teach you how," prepare to fly. I’ll be discussing 5 High-Risk Investments that are being sold as safe, and 5 Red Flags that you’re dealing with a salesman (rather than someone who is protecting you) in my November teleconference this Thursday (Nov. 8, 2018) at 9 am PT (noon ET). Call into: (347) 215-7305. Listen back 24/7 on demand at BlogTalkRadio.com/NataliePace. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed