|

People have been emailing me about cannabis for a couple of years now. I’ve been resistant for a few reasons.

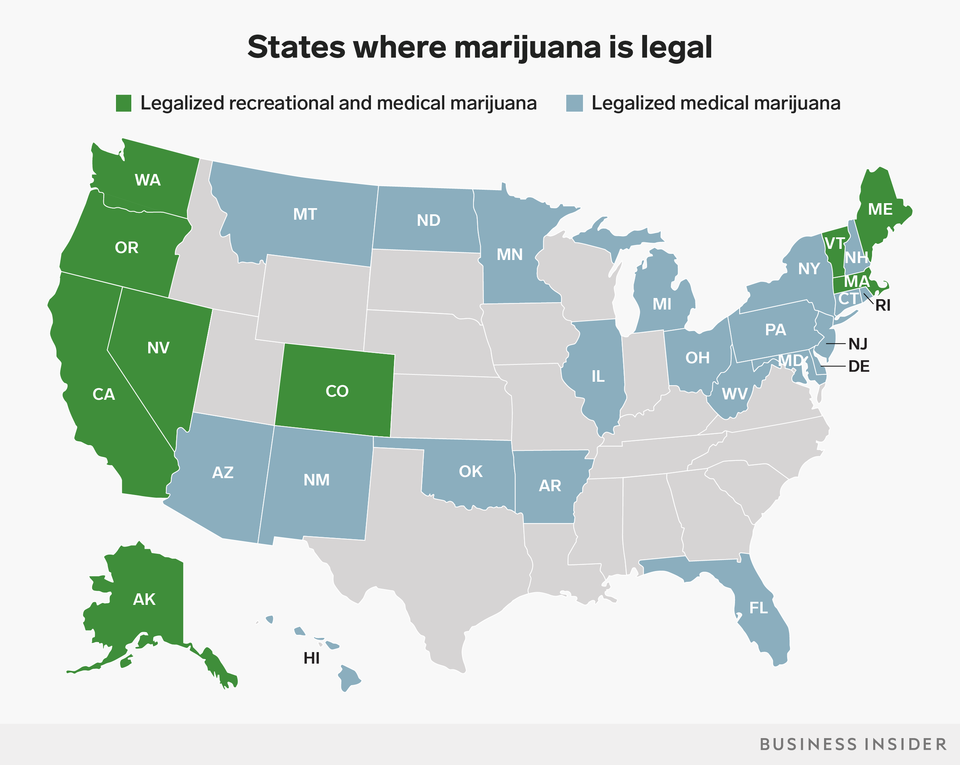

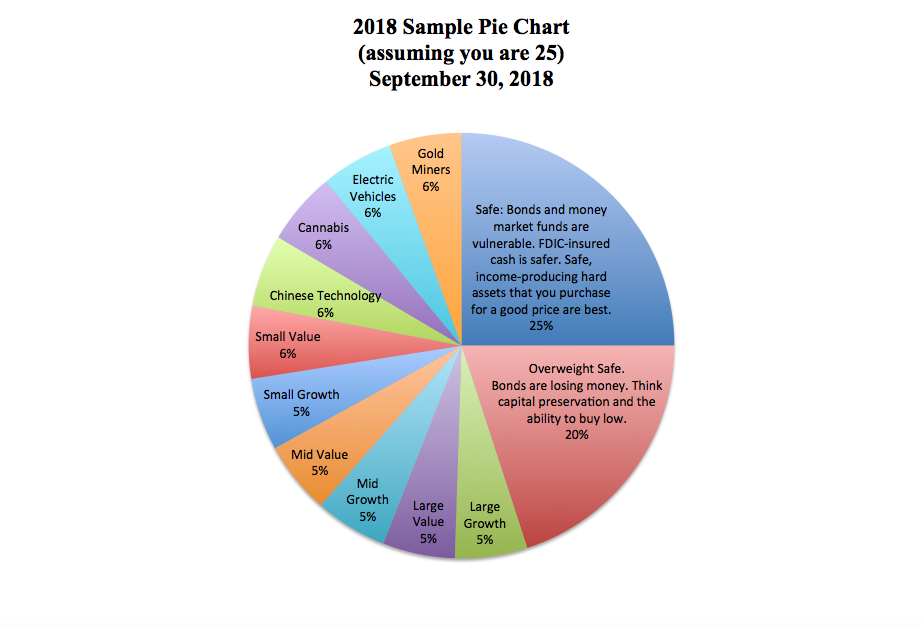

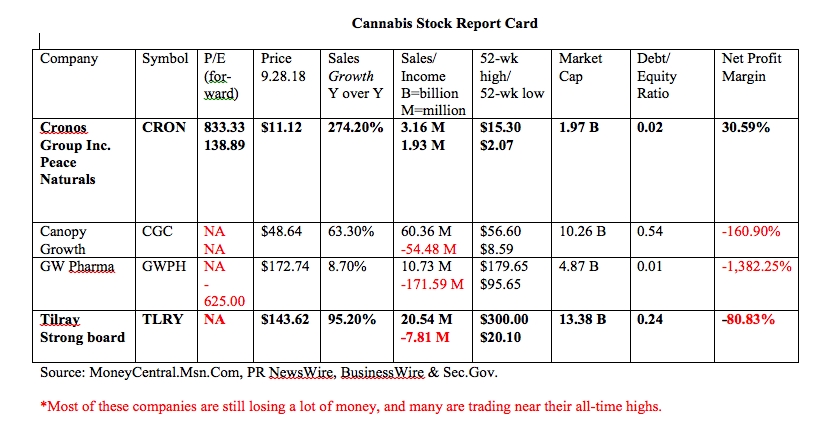

However, with marijuana becoming legal in Canada on October 17, 2018, this is an industry that simply can no longer be ignored (unless you have a moral reason). Here are some very important things to consider before you invest in a marijuana company. 1. The Big Picture 2. Cannabis ETFs 3. Investing in Individual Companies 4. How Much Should You Invest? 5. The 3-Ingredient Recipe for Cooking Up Profits 6. Speculating on New Products and Private Placements 7. Beware of Scam Artists and Social/Email Pump and Dump Schemes 1. The Big Picture It’s important to remember that legal marijuana is a brand new industry – similar to the Internet in the late 90s. (Getting high has been popular for a long time, though criminal.) New industries have a boom period, then a bust, and then a longer period of becoming mainstream. Amazon is worth $2003/share today. However, in between 2000 and 2002, Amazon’s price dropped from $86/share to as low as $6/share. It took almost a decade to crawl back to even. Priceline saw similar price implosions. Many Internet companies, like eToys, disappeared altogether. 2. Cannabis ETFs This is such a new field that your fund choices are very limited. ETF Managers Trust Alternative Harvest Fund (symbol MJ) includes some of the top cannabis companies. However, ETF Manager’s Trust and its CEO Sam Masucci have already seen a slew of lawsuits, which adds to the management costs of the funds. Additionally, Masucci’s last ETF provider, Factor Shares, went belly-up in 2013, when investors were ultimately charged fees of almost 33% (source: Seeking Alpha)! The MJ prospectus includes line items for distribution and service fees and “other” fees, which will be “accrued daily and taken into account for purposes of determining net asset value,” opening the door for unlimited, unexpected costs to own the ETF. Before FactorShares, Masucci was involved in another arbitration and award due to a deal with Bear Stearns in 2000 (source: Bloomberg). So, the top dog at ETF Managers Trust does not have a great track record, which is a huge red flag. 3. Investing in Individual Companies Since the ETF options for cannabis are few and undesirable at this time, you’re left with investing in individual marijuana companies. Most people are not as good at stock-picking as Warren Buffett and should, therefore, limit their gamble to money they are willing to lose. If you do wish to take on the higher risk of investing in a single company, then be sure to learn how to pick a leader, and how to purchase the company for a good price. 4. How Much Should You Invest? For most investors, it is not appropriate to invest any of your retirement in individual companies. You should only invest as much as you are willing to lose (perhaps education or fun money), and never make a Hail Mary gamble. A rule of thumb, if you choose to invest some of your liquid assets, would be to limit your investment to one Hot Slice of your at-risk assets. You can mock up a sample pie chart using my Easy-as-a-Pie-Chart web app (click to access). Here’s a sample pie chart, based upon your age being 25. If your nest egg were $100,000, and you were overweighting 20% safe, then the appropriate hot slice investment would be $5,500. Remember to always keep a percentage equal to your age safe. Overweight up to 20% additional safe due to it being the 10th year of the current bull market. And then divide the remaining at-risk amount by 10. 5. The 3-Ingredient Recipe for Cooking Up Profits 1. Start with what you know. 2. Pick the leader. 3. Buy low and sell high. Learn more about how this recipe works in my first book, Put Your Money Where Your Heart Is. Using a Stock Report Card ® and asking Four Simple Questions ® can help you to determine the winner (both are outlined in detail in my book). Here’s a sample Stock Report Card on a few of the more popular, publicly traded cannabis companies. 6. Speculating on New Products and Private Placements Keith Villa, the brewmaster behind Blue Moon has left MolsonCoors to launch Ceria Beverages, a cannabis-infused, new non-alcoholic brew using the technology of Ebbu. Province Brands, founded by one of the co-founders of Ebbu, is prospecting the cannabis beer space as well. Province Brands just completed a Reverse Takeover, which will allow the company to list on the TSX venture exchange, even though it is only a few months old. http://ceriabeverages.com/ https://www.newswire.ca/news-releases/province-brands-of-canada-announces-reverse-takeover-of-colson-capital-corporation-684565321.html https://realmoney.thestreet.com/articles/07/05/2018/cannabis-beer-giving-investors-fresh-buzz Keith Villa is attributed with creating the fever for craft beer, with Blue Moon. Given the popularity of cannabis and social drinking, Mile-high beer might be the next micro-brewery hit. Still it is very early stage and there will be a lot of startup costs before these companies hit cash-break even. Be sure you’re willing to weather the storms from here to there, and that you aren’t investing in a company that already has too many liabilities to make it. If you don’t understand profit and loss statements, or don’t have access to the financials, then you are investing with blind faith in a very risky endeavor – something that successful venture capitalists would never do. (And you are investing like a VC if you plunk down money in an early-stage, unproven industry.) 7. Beware of Scam Artists There are a lot of bad actors in this space, pretending to be legitimate, who are trying to make a quick buck. It’s important to remember that the titans of the cannabis industry were criminals just a few years ago. Doing your due diligence is key to weeding out the chaff. If the company is not traded on the NASDAQ or New York Stock Exchanges, then it’s a good idea to avoid the investment as a general rule. Pump and Dump schemes abound off the boards. See my Penny Pot Stocks warning of last year for multiple examples of social media scams that were very popular and toxic. If you don’t know how to determine whether or not a company is on the Big Boards, then your next investment should be learning how to invest. (Learn more about my Investor Educational Retreats at NataliePace.com.) Learning how to pick great companies can help you to pick hot industries in your nest egg and avoid the bailouts. As an example, in 2006, I began encouraging investors to overweight the NASDAQ Composite Index and underweight the Dow Jones Industrial Average, particularly overleveraged companies, like General Electric. In the wake of the Great Recession, the NASDAQ doubled the returns of the DJIA. General Electric, which has slashed its dividend in half and lost more than half of its share price in the last year, is not the only overleveraged, problematic Blue Chip. This information is so important that we spend one full day on it at my Investor Educational Retreats. So, if you want to develop your skillset on stock picking, protect your nest egg from the next downturn and even learn how to save thousands annually with smarter choices on your big-ticket bills, then call 310-430-2397 or email info @ NataliePace.com to join me in Arizona Oct. 13-15, 2018 or in Santa Monica, California Feb. 16-18, 2019. Other Blogs of Interest Penny Pot Stocks. Interest Rates Set to Jump 70%. Watch out investors and homeowners! Should I Invest in Ford and General Electric? The Tesla 3 Becomes the Top Selling Car in the U.S. Cryptocurrency Scams and Phishers. Back to School Stock Sales. Gold vs. Facebook. Nike Share Price and the Kaepernick Ad. Important Disclaimers

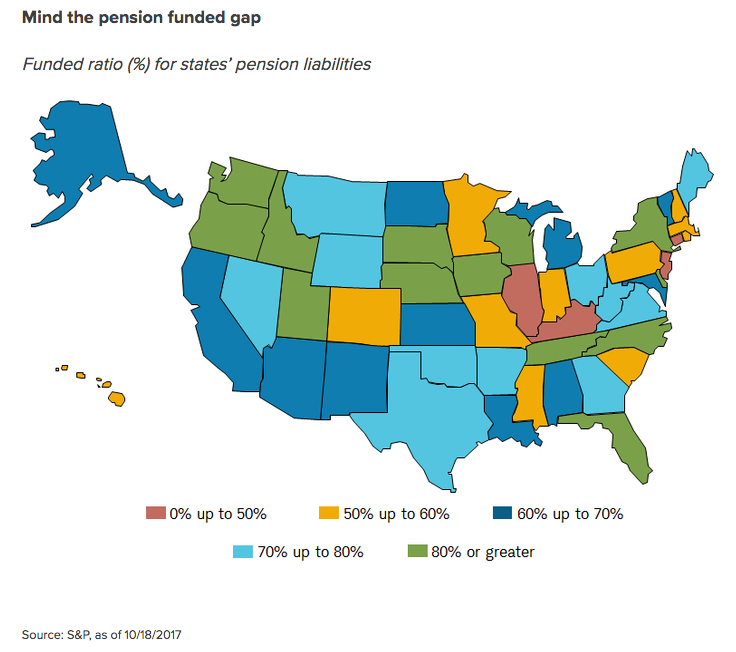

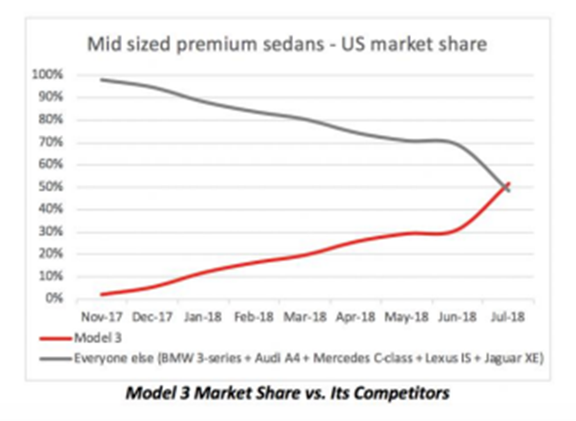

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Disclosure: I own shares in some cannabis companies. I'm sure you've seen the news that the Securities and Exchange Commission has charged Elon Musk with fraud & wants to bar him from serving as an officer or a director of any publicly held company, including Tesla. Elon Musk is calling the action "unjustified," according to TechCrunch. The independent directors of Tesla's board issued a letter of support last month, before the SEC's action. My blog from September 16, 2018 includes key updates on Tesla to factor in the mix, particularly if you are an investor, or are tempted to purchase Tesla shares at the new discounted price (which could conceivably go lower). That blog includes an update on Tesla’s safety ranking, sales ranking, predictions for the 3rd quarter earnings report (due the first week of November), tax credits, other Tesla products and more. One big consideration that most people are not factoring in is that the SEC charges are not an all or nothing proposition. If Tesla investors and Tesla's Board Of Directors want to keep Elon Musk, and the SEC persists in their charges, Tesla can go private. The SEC can't bar him from running the company then. Since this plan was already on the table, it’s still top of mind. If the 3rd quarter earnings report is as outstanding as forecasts predict, then it is hard to imagine that Tesla investors will want Musk ousted. Of course, there are a lot of ifs in that sentence. The situation will certainly become more clear between now and early November. Two things that are sure already, however, are that the Tesla cars are scoring the highest safety ratings ever issued by the National Highway Traffic Safety Administration, and the Tesla 3 just became the bestselling car (by revenue, in August). There are a lot of problems and issues with the other car companies, which never make headlines. General Motors lost almost $4 billion last year, and has lower revenue this year. Ford sales are lower year over year as well. Both GM and Ford have eyepopping exposure to pension and other post employment benefit obligations, in addition to massive debt. Ford’s pensions and OPEBs are underfunded by $13 billion, while GM’s underfunding status is $20.5 billion (at the end of 2017). Tesla benefits from being a newer company, at a time when self-directed 401ks are de rigueur. Pension problems at legacy companies haven't made many headlines. There are a lot of noise, false information and soapbox pundits out there, offering some ill-informed misinformation. This blog, and my blog from Sept. 26, 2018, offer a more complete picture, so that you can make your own judgments. Finally, Tesla's stock is down, but it's not "crashing." In fact for news like this, the stock has held up pretty well. Tesla shares were trading for $307 yesterday and closed at $265 today. Since April of 2018, Tesla shares have been fluctuating between $250/share and $385/share, rising and falling on headlines. Tesla is making the safest cars on the road and the company is growing revenue at a pace of 43% year over year, simply squashing the competition in growth. Learning how to do a Stock Report Card and ask the Four Questions to evaluate your investments can reveal most of the pieces of the 100-piece puzzle that is investing in individual companies. For those of you who have attended my retreats or read my books, what you are experiencing today with Tesla is exactly why it is so hard to “buy low and sell high.” Today, Tesla’s stock is 13% cheaper than it was yesterday. However, everyone thinks it’s crashing. The temptation is to sell low, rather than to buy low. It is the sober analyst who is forecasting possible scenarios, based upon the facts, and coming up with a rational plan that includes buying Tesla stock on sale (or perhaps selling it, even at a loss, if the company is headed into the toilet). We’ll see if the SEC’s rush to judgment stands up, whether the parties settle this empasse or whether Tesla will be forced to go private to protect its visionary chairman and CEO. I’ll be sure to include an update in my October teleconference on Oct. 11, 2018. Be sure to join me. (It’s free.) Click on the link to access the show page, call-in and listen back information. We spend a full day at my Investor Educational Retreats evaluating individual companies, to determine what’s hot and what’s a bailout, which you can use to inform all of your investments and your nest egg strategies. Call 310-430-2397 to learn more and to join me in Arizona mid-October or Santa Monica for Valentine’s Day 2019. Register for the Santa Monica Retreat by Sunday, September 30, 2018 to receive the best price, and while there are still a few seats available. Other Blogs of Interest Should You Buy Tesla Stock? Has Elon Musk Lost It? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own shares of Tesla. On September 26th, 2018, the Federal Reserve Board increased the Fed Funds rate to 2-2 ¼ percent, and indicated that there will be another rate hike before the end of the year. Rates should move up to 3.1% in 2019 and 3.4% in 2020, according to the projections – a 70% increase from today. That’s great for savers, but not so fantastic for anyone holding bonds, as current bond values decline as interest rates rise. To compound matters, in January of this year, Alan Greenspan went on Bloomberg TV and said that bonds are in a bubble (stocks, too). It was a startling statement, however Warren Buffett has been bashing bonds for over a year now. Yet, most Americans own bonds in their retirement plans, whether they know it or not. So, how does one navigate the waters when the safe side of your portfolio – the “fixed income” bond side – could lose money? For answers, I turned to one of the leading bond specialists in the United States, Kathy A. Jones, the Chief Fixed Income Strategist for Charles Schwab Corporation, and a member of her team, Collin Martin. Ms. Jones loves diving into historical data, using her findings to inform her predictions for today. She quite famously and accurately predicted an extended period of very low interest rates back in 2010 – very early in this cycle. Now that interest rates have started to tick up, putting pressure on bonds, what should the Main Street investor do to protect herself? I asked Kathy that and more on Sept. 18, 2018. 9 Bond Tips for 2018 and Beyond. 1. Bond Ladders 2. Know What You Own 3. An Easy Way to Check Your Risk Level 4. Double Check Your Investment Grade Corporate Bonds 5. Underweight Your Exposure to High-Yield 6. Rebalance Quarterly or At Least Annually 7. Look Beyond the Name 8. Muni Maps. Avoid the Hot Spots! 9. The Duration Debate And here’s a little more color on each point. 9 Bond Tips for 2018 and Beyond. 1. Bond Ladders According to Ms. Jones, “Bond ladders are our favorite strategy. You can take advantage of rising yields to generate more income. That is going to offset the price change.“ A bond ladder is simply having bonds with staggered maturities and terms (10 years or less) that you roll into something new at maturity. If you are adding in a new bond each year, as interest rates are rising, then you’ll be capitalizing on higher yields. 2. Know What You Own It’s important for you to be the boss of your money, even if you have a financial planner. Ms. Jones encourages all of us to “know what you own, why you own it and how it might perform given a certain outlook.” Don’t assume that you’re safe. Make sure that you are not over-exposed to high-yield, highly leveraged, or risky bonds, which can become more vulnerable as credit tightens and money becomes more expensive to access. 3. An Easy Way to Check Your Risk Level You might think that getting a Ph.D. in economics would be easier than analyzing your retirement plan. However, Kathy Jones has a simple formula. “If the risk-free rate is 2%, and your fund is offering you 5%, you’re taking on some sort of risk.” Investors tend to think that everything is fine when they are getting a great yield – until something terrible happens, as happened with General Electric last year, when the company slashed its dividend in half and then saw its stock drop by half. 4. Double Check Your Investment Grade Corporate Bonds Corporate bonds are attractive to investors because in a world where Treasury bills are only offering 2%, some investment grade bonds, like Ford Motor Company, are paying 5% or higher. However, as Collin Martin pointed out in our interview, there is over $9 trillion in corporate debt and leveraged loans outstanding in U.S. corporations (public and private). Over half of the investment grade corporations are rated BBB, just one notch above speculative (more commonly called “junk” bonds). “Check to be sure that any bond fund you have has a higher allocation to A or higher rated bonds, and a lower allocation to BBB,” Collin Martin suggested, adding that it’s a good idea to “focus on higher quality.” 5. Underweight Your Exposure to High-Yield Not all bonds and bond funds are created equal! If you see the words “high-yield” or are getting above 4% dividend, you could be taking on more risk than you realize. High-yield bonds can lose money and become illiquid. In the worst-case scenario, the company might have to restructure their debt, as happened with Greek bonds in 2011 and General Motors bonds in 2009. So Ms. Jones and Mr. Martin suggest that you make sure your exposure to high-yield is appropriate to your risk tolerance and financial plan, and limited to a smaller portion of your portfolio. 6. Rebalance Quarterly or At Least Annually This simple nest egg strategy is as close as you can get to buying low and selling high, according to Kathy Jones. If you simply rebalance once or more a year, then you are capturing gains when an industry gets hot, and buying low when prices drop. 7. Look Beyond the Name Many very risky funds have alluring names, like BulletShares, to entice unsuspecting shareholders into a risky investment. Others just make it harder to find out that the holdings are risky. So, be sure to check the holdings and portfolio page of your fund to be sure that your “Income” producing bond fund isn’t stacked with below investment grade corporate bonds. Knowing what you own takes just a few clicks, if you know where to look. 8. Muni Maps. Avoid the Hot Spots! Kathy Jones and her team publish a map of states that are in trouble, making it easier for the Main Street investor to avoid the hot spots, like Illinois, Connecticut, New Jersey, Kentucky, and also cities, like Chicago. According to Ms. Jones, “The pension funding issue is the big one that everyone is concerned about.” While the state GO bonds could get downgraded in the most vulnerable areas, there are revenue bonds, even in troubled states, that Ms. Jones believes would be a “better bet, if you have confidence in the revenue stream, like water, sewer and the essential services.” 9. The Duration Debate Should you own a long-term bond? According to Collin Martin, not yet. Ms. Jones and Mr. Martin are still advising that long-term bonds are make up only a small percentage of your portfolio. The Bottom Line? In a world that is riskier than you might know and more leveraged than ever, your personal plan doesn’t have to be. Knowing what you own, and employing these 9 tips should help you to get safer and more diversified, while capitalizing on a plan that can capture higher yields as interest rates rise. If want to be sure that your current plan doesn't have any hidden time bombs and money pits, schedule an unbiased second opinion with me now. Call 310-430-2397 to learn more. About Kathy A. Jones Kathy A. Jones is responsible for credit-market and interest-rate analysis, as well as fixed income education for investors at Schwab. Important Disclaimers

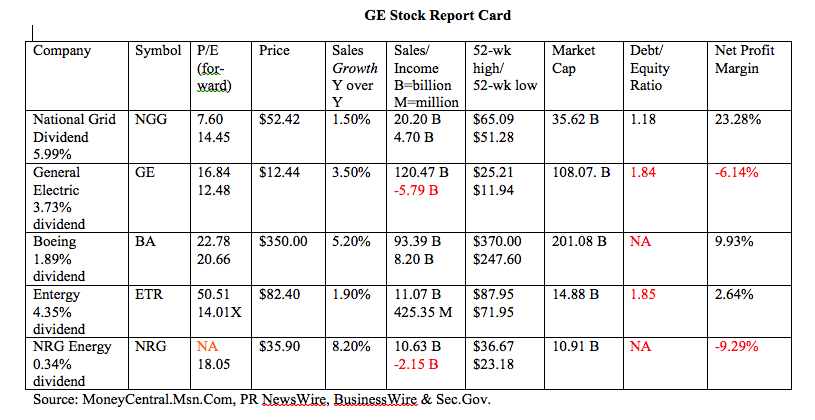

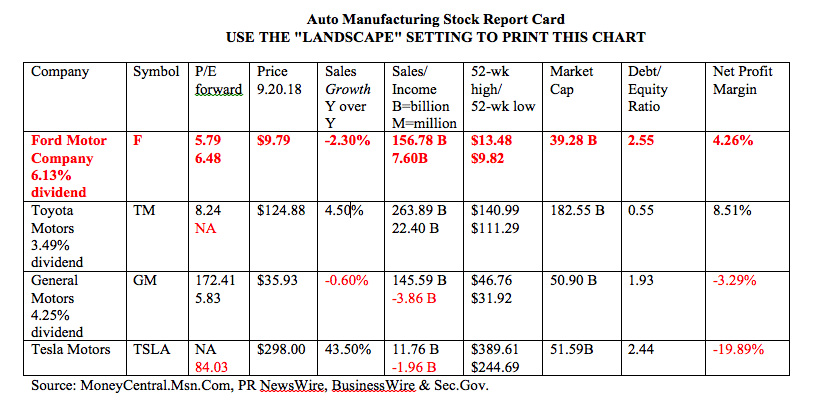

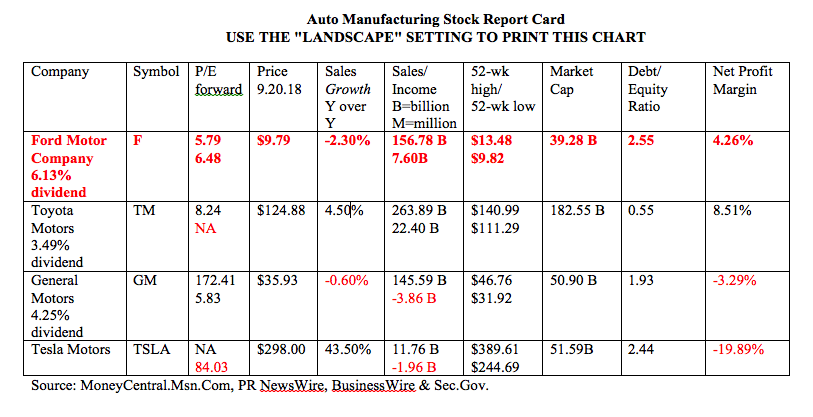

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the U.S. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies.Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Dear Natalie, Should I invest in Ford and General Electric? I’m retired and would like the income. My financial advisor tells me that both companies are bargains right now. Signed, Dividend Lover. Dear Income Lover, Ford and General Electric are in different industries, however, the companies have more in common that you might think. Both are over a century old and have one or more problems in their business, including losing revenue or market share, cash negative operations, very high debt to equity ratios and being very behind on their pension and other post employment benefit obligations (OPEBs). They fall into the category I call Faded Blue Chips. GE lost almost $6 billion last year, and in August of 2018, the Tesla Model 3 became the top-selling car in the U.S. (by revenue). Tesla was the only American car company in the top 5. Perhaps the most important thing to know about these dividend stocks is that the higher the dividend, the higher the risk. Even when the markets were roaring up up up, the issues facing General Electric and Ford Motor Company caused their stock to sink. You might remember that Warren Buffett famously sold all of his General Electric stock in 2017, just a few months before GE cut their dividend in half. The dividend slash prompted investors to dump the stock en masse. The share price lost more than half, too. So, even if you don’t know much about evaluating a company, if you are being offered a dividend of more than 3%, that’s a red flag. There are a few more problems with owning individual companies in your nest egg. The first is that owning one company means you are taking on much higher risk. If you had owned GE stock in 2017, you lost half your investment, and half of your dividend income as well. If you owned a fund that had GE stock in it, alongside 100 other companies, then you’re probably still fat and happy in market returns. Another issue is that financial advisors charge you to trade individual companies (and funds, too). So, owning a lot of individual stocks will cost you a lot in fees. Below are a few questions to ask yourself before you invest in any individual stock. Checklist for Investing in Very Old Legacy Brands Consider The Company’s Potential. Consider the Industry’s Potential. Factor in Debt, Pensions and Other Post Employment Benefits. What’s the Dividend? Factor in What the General Marketplace Is Likely To Do. Are You Willing to Risk Your Principal for a Very Small Dividend? And here’s a little more color on each point… Consider The Company’s Potential. You’ll need to do a Stock Report Card ® and Ask the Four Questions ® before you can be sure that you have picked the leader in the industry*. Then it’s important to apply the rest of the 3-Ingredient Recipe for Cooking Up Profits ® to make sure that you are buying the stock at a bargain*. Never pay retail! Neither General Electric nor Ford Motor Company look very attractive when you line up the competition. Just as you aren’t going to buy rotten fruit just because it’s on sale, you don’t want to invest in a troubled company just because the price is low. A high dividend is designed to lure in unsuspecting investors. However, there is no reason to take the bait, even if the stock is “on sale,” if you see red flags. *The strategies that I used to become a no. 1 stock picker are outlined in my first book, Put Your Money Where Your Heart Is. Consider The Industry’s Potential. The auto manufacturing industry is going to suffer under the steel tariffs. The risk is higher prices, job losses and reduced ability to compete in the global marketplace. This is all outlined in a letter that General Motors wrote to the Department of Commerce in June of this year. General Electric won’t run out of customers for their energy, aerospace or renewables products in the future. However, they might have trouble making money at it. As you can see in the stock report card, GE lost almost $6 billion last year. Another thing most people are not aware of is that there are 21 nuclear power plants decommissioning – which is a risky, costly process that can take up to four decades. Factor in Debt, Pensions and Other Post Employment Benefits. In addition to having high debt to equity ratios, both General Electric and Ford Motor Company are billions behind on their pensions and OPEBs, to the tune of $34 billion and $12.8 billion, respectively. What’s the Dividend? Ford’s dividend yield is currently about 6.13%. GE’s is 3.73%. Believe it or not, in today’s world any return above 2% needs to be looked at forensically to be sure that the company isn’t distressed. Half of all investment grade companies are BBB, and vulnerable to market and industry stresses. Standard & Poor’s gives Ford Motor Co. a BBB rating, with a negative outlook. GE fares slightly better with an A rating and a negative outlook. Factor in What the General Marketplace Is Likely To Do. It’s the 10th year of the current bull market, making this the longest bull market in history. So, by the numbers, the market is very high. We should be closer to a correction point than a rally. Are You Willing to Risk Your Principal for a Very Small Dividend? There are a lot of red flags with investing in either of these companies right now. The stock markets are at an all-time high. The credit outlook for both companies is “negative” according to Standard and Poor’s. Both industries have issues and challenges, ranging from flat or negative revenue growth, negative profit margins, high debt, to underfunded pensions and other post employment benefits – issues that could be compounded by tariffs. Gone are the days that you buy a Blue Chip and hold it to will it to your grandchildren. The Wall Street rollercoaster today is nothing like the days of yore. Individual companies require babysitting in today’s world of wild market swings. And in the 10th year of a bull market, every stock can be vulnerable. So, having a defensive strategy is far more important than getting more in the game. And owning a fund with a lot of companies in it protects you from the volatility of owning just one stock. We all love income. However, I wouldn’t be a dividend lover in a world where the mantra should be “The higher the dividend, the higher the risk.” Roy Rogers said it best, when he wrote, “I’m more concerned with the return of my money than the return on my money.” If you’re not sure about any one of these things that I’ve outlined, then your next investment should be in learning how to invest! You wouldn’t bake bread without a recipe, and it’s not a good idea to try and make some dough in stocks without learning my 3-Ingredient Recipe For Cooking Up Profits. We focus on Hot Stocks (and avoiding the Faded Blue Chips) for one full day of my 3-day Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn more. Do you have a question for me? Please email [email protected], or post it on my Twitter or Facebook pages. Our team will add your question to my Ask Natalie blog topic list for possible inclusion in this ongoing blog series. Other Blogs of Interest

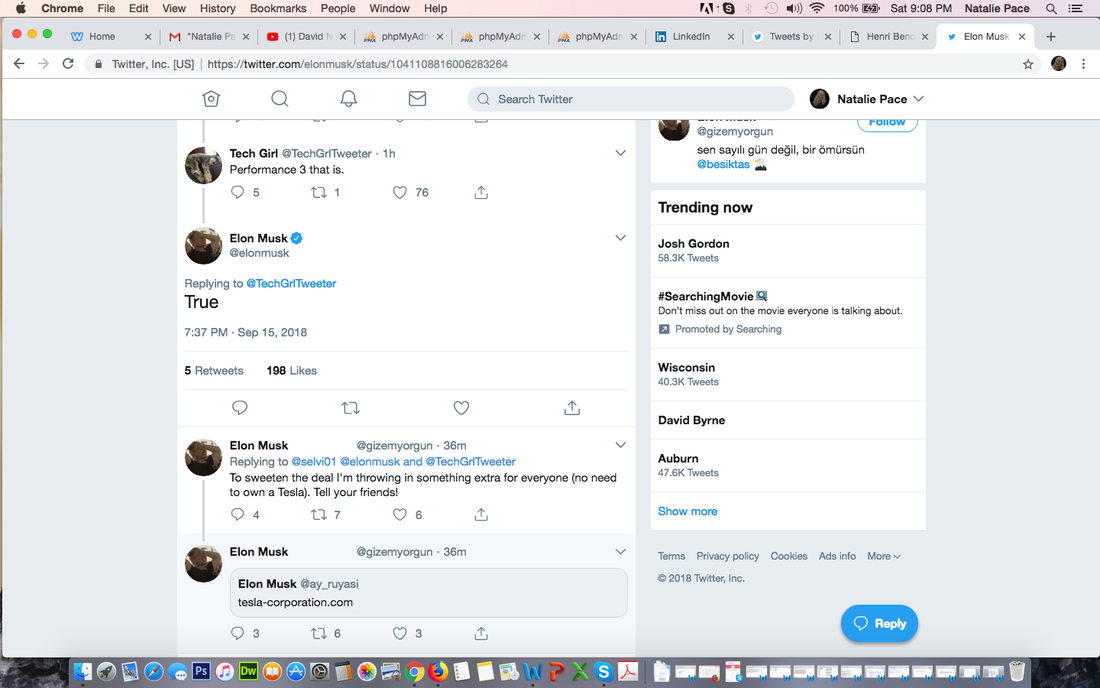

Warren Buffett on the Sidelines. GE Investors Lose Half. The Tesla 3 is No. 1. Should I Invest? Cryptocurrency Scams Posing as Elon Musk, Your Friends/Family and Government Agencies. Back to School Stock Sales. Should You Buy Tesla Stock? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Dear Natalie, I saw the CleanTechnica chart that showed the Tesla 3 becoming the top selling car in the U.S. (by revenue) I have one simple question. Should I invest in Tesla? Signed I.T. Guy Dear IT Guy, Gone are the days that you buy a Blue Chip and hold it to will it to your grandchildren. The Wall Street rollercoaster today is nothing like the days of yore. So, this is not a simple question. However, if your goal is Buy and Forget About It, so you can stay focused on your day job, then investing in any individual company is not a good match for you. Having an Easy-as-a-Pie-Chart Nest Egg Strategy ® that you rebalance once (or more) a year will serve you better. Individual companies require babysitting in today’s world of wild market swings. And in the 10th year of a bull market, every stock can be vulnerable. So, having a defensive strategy is far more important than getting more in the game. However, if you have a little fun money, or if you are passionate about promoting electric cars (with a smaller amount of money), below are a few tips to help you evaluate whether or not investing in Tesla (or any other hot individual company) is right for you. Tesla has promised a spectacular 3rd quarter earnings report, and that often does spark investor buying. The next earnings report should be issued around November 1-2, 2018. Checklist for Investing in Individual Companies Consider The Company’s Potential. Factor in What the General Marketplace Is Likely To Do Are You Willing to Babysit? What’s Your Exit Strategy? And here’s a little more color on each point… Consider The Company’s Potential. You’ll need to do a Stock Report Card ® and Ask the Four Questions ® before you can be sure that you have picked the leader in the industry*. Then you need to apply the rest of the 3-Ingredient Recipe for Cooking Up Profits ® to make sure that you are buying the stock at a bargain*. Never pay retail! Tesla scores very high in revenue growth, and is on the right side of electric vehicles, which are the fastest growing vertical worldwide. No other U.S. car company comes close to Tesla’s growth rate and global expansion plan. So, the only question is price. Today’s price is $299/share. The all-time high was $387/share. Are you willing to purchase near the all-time high, hoping the price goes higher? *The strategies that I used to become a no. 1 stock picker are outlined in my first book, Put Your Money Where Your Heart Is. Factor in What the General Marketplace Is Likely To Do It’s the 10th year of the current bull market, making this the longest bull market in history. So, by the numbers, the market is very high. We should be closer to a correction point than a rally. Are You Willing to Babysit? Last week, CleanTechnica released the news that the Tesla 3 became the top-selling car by revenue. A few days ago, the headlines were about the Justice Department investigating Elon Musks’ personal tweets about the “taking Tesla private” scandal that never played out. In 2019, the Tesla tax credits start phasing out. Will Tesla have to lower its prices to keep sales strong? Additionally, the steel tariffs are predicted to increase the costs of auto manufacturing – further weighing on profitability going forward. The share price has dropped as low as 37% off of its high this year. If you can’t stomach that kind of volatility, and are going to be tempted to trade on every headline, then investing in Tesla is not right for you. What’s Your Exit Strategy? The wiggle room between the 52-week high and low is only about 58%. The wiggle room between today’s price and the high is only 30%. Are you going to capture your gains at 30%? Or are you hoping for an outstanding 3rd quarter earnings report and want to see if the stock shoots the moon? Even great companies are retreating and then rallying on a fairly regular basis this year. So, a smart exit strategy is going to be key to your successful investment. If you’re not sure about any one of these things that I’ve outlined, then your next investment should be in learning how to invest! You wouldn’t bake bread without a recipe, and it’s not a good idea to try and make some dough in stocks without learning my 3-Ingredient Recipe For Cooking Up Profits. We focus on Hot Stocks (and avoiding the Bailouts) for one full day of my 3-day Investor Educational Retreats. Call 310-430-2397 to learn more. Do you have a question for me? Please email [email protected], or post it on my Twitter or Facebook pages. Our team will add your question to my Ask Natalie blog topic list for possible inclusion in this ongoing blog series. Other Blogs of Interest Cryptocurrency Scams Posing as Elon Musk, Your Friends/Family and Government Agencies. Back to School Stock Sales. Should You Buy Tesla Stock? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own shares of Tesla in my investment clubs. Crytpocurrency Scams and Phishers Posing as Elon Musk, SpaceX, Tesla, Your Friends and Family and More. Pages and Profiles Impersonating Elon Musk, SpaceX, Tesla, or a Friend or Family Member Are Offering Free Cryptocurrency, Free Government Money or Threatening You With Fines and Fees. Beware and be informed! Some very aggressive scams are targeting crypto and Elon Musk fans, impersonating Elon, SpaceX and Tesla, and even showing up as a friend or family member. Your best defense is to know the red flags of a scam and avoid the ruse altogether. If you spot a fake page or profile report it immediately to the social network, to the Internet Crime Complaint Center and to the FTC. (Click on the blue-highlighted links to access.) Share this blog with your friends and family members because as soon as one page or profile is reported, another one is created. Below are a few ways to spot scams before you hand over your information. Red Flags of a Scam Very aggressive scams, set up on pages and profiles that look legitimate, are targeting cryptocurrency fans. Phishers and scam artists use all kinds of ruses to lure in unsuspecting victims, including posing as a friend or family member, as your bank, as a lottery win, or as a sure-shot, can’t lose investment. Below are a few questions to ask yourself before you hand over any personal information or money. Most scams are alike in that the devil is in the details. If you look closely enough, the cracks in the façade of the fraud are quite visible. Remember that if it sounds too good to be true, it probably is. Red Flags

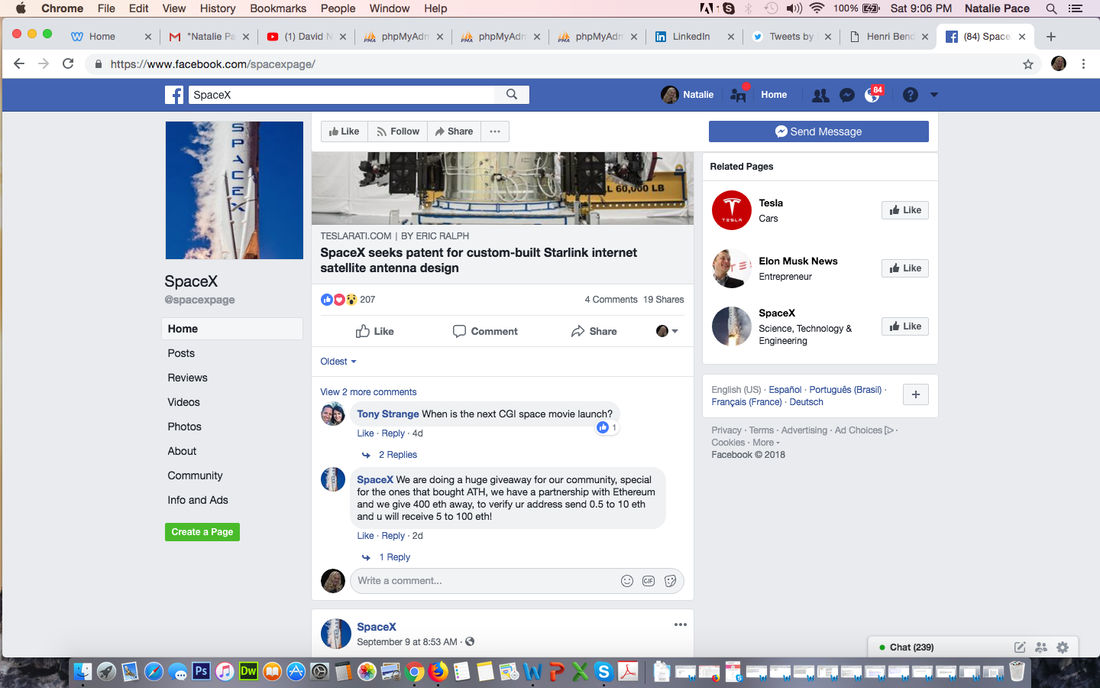

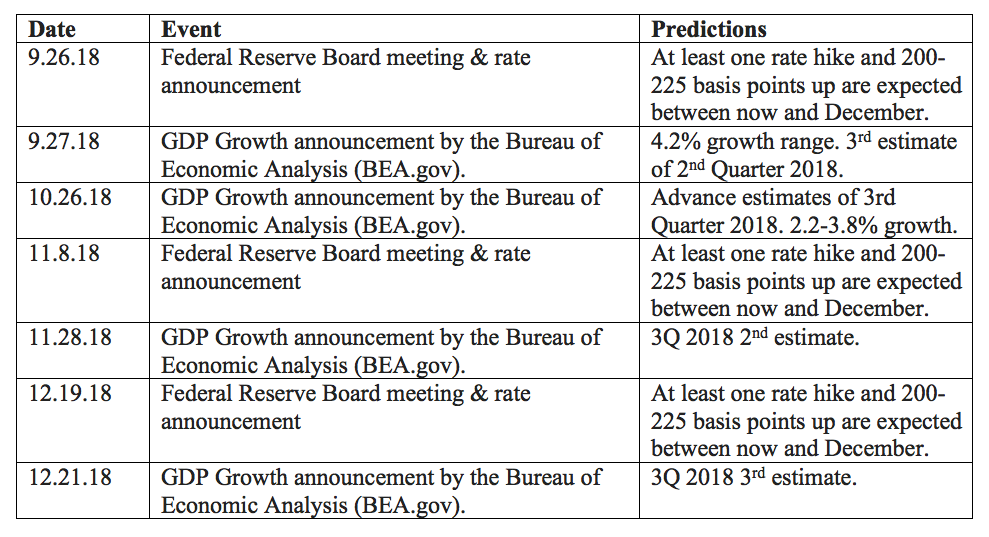

Before buying anything from anyone you don’t know, or sharing any of your personal information, you need to check out a few more things. 1. Find out who owns or leads the company. Read their bio and then Google that person with the phrase “SEC fines lawsuits scams” and see what turns up. 2. Click on the Contact Us link. If you don’t see a physical address and phone number, that is a red flag. If there is only an 800 number and a fill-in the form email submission, the warning bells and whistles should be going off for you. 3. About Us. What do you see on the About Us page? A legitimate corporation will list the executives and their bios. A questionable enterprise will have a video and sales pitch, with stock photos and no mention of who is running the company and how you can get in touch with someone there. 4. Referred by a Friend or Family Member? Sadly, this is the most common way for people to get roped into scams and losses. Many people fell for Madoff in this manner. Below are two screen shots from pages that are impersonating Elon Musk and SpaceX. The Fake Elon Musk Tweet If you look closely on this page, you’ll see that the official Elon Musk account replied to Tech Girl. Right below that a fake account with Elon Musk’s name and the same profile picture replies again offering a sweetened deal. Further in the thread the same scam artist offers free Bitcoin and Ethereum, and even a chance to win a Tesla. However, there is no “official” check mark next to the scam artist’s profile, and the “real name” shows up on the right as GizeMyOrgun. The Fake SpaceX page. If you look in the comments on the screen shot below, you’ll see that there is a “huge giveaway for our community!” The page is set up to look like it is run by SpaceX. However, on the About page, you can see that the page is actually run through a URL m.me/spacexpage. Even the “Official: SpaceX” Facebook page is not really official. Both Facebook and Twitter make it easy to spot verified pages with their blue check marks. If you see the word “official” without the check mark, chances are it is a fraud. Private Message from a Friend or Family Member on Social Last week, someone set up a fake account of my aunt, using her family pictures. They sent me a friend request, which I immediately accepted. Then they sent me a message about something very important that they’ve been wanting to get in touch with me about. The scam artist asked if I had heard of grants from the Health and Human Services. “My aunt” then told me that it was completely legitimate and $100,000 had shown up in her bank account. At that point, I reported the profile to Facebook. I noticed that other relatives had accepted the friend request. Facebook was very quick about deactivating the account (within minutes!). It’s clear that there is a very aggressive campaign of fraud going on right now, through multiple channels. So, protect yourself. Never give out any information to anyone who contacts you online, by phone or through email. If you worry that your bank needs something from you, go visit your local branch. If you are worried about your finances, your budget or your investing strategy, or if you have lost a fortune on cryptocurrency or gold, it pays to get The ABCs of Money that we all should have received in high school. I just published The ABCs of Money, 2nd edition last month on Kindle. It’s updated with 2018 data, statistics and information, and costs only $3.99. If you want to make sure you are safe and protected in your nest egg before the next market correction, call 310-430-2397 or email info @ NataliePace.com to receive an unbiased second opinion on your current strategy. You can learn to save thousands annually in your budget when you stop making the billionaire corporations rich at your own expense. If the myth that you can make ends meet by cutting out café lattes and avocado toast worked, then you wouldn’t still be in debt. It’s the big-ticket bills that are sucking the health out of your husbandry, and there are solutions. Our easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions, at a time when most people lost more than half, and have outperformed the bull markets in between. Call 310-430-2397 to learn more now. Other Blogs of Interest Back to School Stock Sales. Should You Buy Tesla Stock? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Shares and Retweets do not mean that I endorse a product. Ever. I do not receive marketing commissions, so I never have skin in the game. Wall Street is still trading near its all-time high, and gold is near a 9-year low. So, are there any back-to-school stock sales for you to buy before the Santa Rally? Or should you be getting defensive (and getting a second opinion) on your financial plan? I have found a few areas of opportunities that are worth a look, and a few warnings that are worth paying attention to. Here’s What I’ll Cover in this Blog 1. U.S. Stocks 2. Electric Cars 3. Gaming, Artificial Intelligence, Virtual Reality and Autonomous Cars 4. Chinese Technology 5. Gold Miners 6. Lithium 7. Clean Energy (LEDs, solar +) 8. Micro Mobility 9. Facebook, Snap, Weibo and Social Media 10. Red Flag Industries: REITs and Retail And here’s more info on each… Click on the highlighted words to access a longer article on that company or topic. 1. U.S. Stocks U.S. stocks are a tale of two indices. The NASDAQ Composite Index leans toward younger companies with great earnings, that are overpriced. The Dow Jones Industrial Average hosts legacy brands, many of which are weighed down by pension promises, health care costs and debt, but are using financial engineering and cheap, easy, borrowed money to make their earnings look better than they are. They are also overpriced. Companies like Advanced Micro Devices, Facebook, Nvidia have sales growth of 40% or more, with net profit margins of 5%, 39% and 36%, respectively! Turtle Beach’s sales growth was 218% in the last quarter! On the other hand, many of the Dow companies have low or negative growth with high debt and high price to earnings ratios, like American Express (2.67 D/E, 28 P/E), Home Depot (11.60 D/E, 25 P/E) & IBM (2 D/E, 26 P/E). 2. Electric Cars. The Tesla 3 was the #1 selling car in the U.S. in August. Tesla production is expected to double in 3rd quarter over the 2nd quarter. That is great news for Tesla and EVs. The not so good news for Tesla is that the $7500 tax credit per vehicle ends in 2018. How will that impact sales? Will Tesla have to lower its prices next year, and get squeezed on profit margins, just when it is finally making money? The impact of the tax credit won’t start showing up until the 1st quarter 2019 earnings report in late February 2019, however. 3. Gaming, Artificial Intelligence, Virtual Reality, Augmented Reality and Autonomous Cars. Nvidia continues to be a NASDAQ and FAANNG superstar, with 40% sales growth and 36% net profit margin. Turtle Beach keeps revising earnings and profits upward. Nvidia is trading at an all-time high, with a 40 P/E. Turtle Beach’s P/E is 13.55, with a price range of $1.64-$36.50. Today’s price is $22.40. 4. Chinese Technology. Chinese technology is even hotter than U.S. technology, with 68% sales growth & 32% profit margin in Weibo, and 61% growth and 21% profit margins in Alibaba. The issue is the trade war and headlines. Alibaba had $12.2 billion in sales and $1.2 billion in profits in the 2nd quarter of 2018. However, since the net income was half of last year’s, investors gave the stock a beating. Jack Ma announced on Sept. 10, 2018 that he will retire as Alibaba’s chairman in one year, on Sept. 10, 2019 (Alibaba’s 20th anniversary). By the book, Chinese technology is on fire. However, the P/Es reflect their heat, with Alibaba at 50, Weibo at 33 and CTrip at 46. Even with the pullbacks in the share prices of late, many Chinese technology companies are trading near their all-time highs. 5. Gold Miners Gold is trading near a 9-year low. Gold miner ETFs are currently trading at a discount off 70% of their all-time highs. The price of gold is down 37% from its all-time high. Once gold prices start to go up, the miners have more upside potential, due to the sell-off. Gold tends to be a good hedge against a downturn. 6. Lithium With the explosion of electric vehicles, lithium mining companies are doing quite well, which is why FMC is spinning off its lithium division, Livent, into an IPO. Livent’s sales are up 51% year over year in the first 6 months of 2018. Remember that pricing is everything, so don’t buy in just to buy in, without knowing if you are getting a bargain. SQM has a 25 PE, with Albermarle at a 33 PE. 7. Clean Energy. The U.S. solar industry has been heavily impacted by the Chinese tariffs because the silicon ingots and other parts are a global marketplace. It’s something to embrace as a homeowner/consumer if you are living in a sunny state, particularly now when the 30% tax credits are in place. Most homeowners with solar enjoy utility savings of up to 90% on their neighbors. The savings can be even more if you are powering your own EV with solar, and cutting out your gasoline bill. However, as an investor, I’d avoid the solar space for now. LEDs are increasing in popularity, as are electric vehicles. Clean energy ETFs are trading at an all time low. The performance of the solar companies will weigh heavy on the funds, while the growth of LED lighting, lithium and EVs could lift the share prices. 8. Micro Mobility. Companies like Bird and Lime are transforming the last mile in the inner city with electric scooters. Millennials love this easy, affordable solution to expensive parking, cars and gridlock. The companies are still private, but it pays to put this emerging trend on your radar. 9. Facebook, Snap, Weibo and Social Media As I mentioned above, the technology companies in China, like China’s “Twitter” Weibo, have faster sales growth and higher profit margins than the U.S. competition. In the U.S., Facebook (owner of Instagram) is the clear leader. However, even with the Cambridge scandal, the company is still trading near an all-time high. Twitter has finally figured out how to make money ($100 million in the 2nd quarter of 2018), and has sales growth of 24%. But the share price is high (P/E is 95). It was easy to see before Snap Inc.’s IPO that the company hadn’t figured out their product or how to profit from it. (Click to see my blog.) The company lost $3.45 billion in 2017, and just lost a key C-level executive in Imran Khan this week. Facebook and Weibo would be on my Stock Shopping List, waiting for a better bargain. 10. Red Flag Industries: REITs and Retail. Nike is doing great, as are other athleisure brands like Lululemon (but not UnderArmour). However, there have been dozens of retail bankruptcies over the last few years. Unless you are a powerful analyst, retail is a dangerous dark alley to avoid. Most mall owners, like Simon Property, Taubman and Macerich are overleveraged, have expensive share prices, owe a massive amount of money, are losing revenue and many are barely breathing in terms of profits. The mall REITs are keeping investors in with high dividends. However, the adage from Will Rogers is pertinent here: “I’m more concerned about the return of my money, than the return on my money.” Don’t reach for yield! The higher the dividend, the higher the risk. Even a 5% yield is quite risky in today’s world. The over-riding macro sentiment is that stocks are very expensive, and this is the 10th year of the bull market. There are more pressures weighing the macro economy down than there are balloons still lifting stocks. Free, easy, borrowed money, decent (not stellar) GDP reports, low inflation and low unemployment were all present before the Dot Com crash and the Great Recession. What was troubling then were the asset bubbles, which are higher today than ever (and are the reason the Federal Reserve Board is raising interest rates). Earnings support a Santa Rally this year, more in the NASDAQ Composite Index than the Dow Jones Industrial Average, if the interest rate hikes don’t spook investors. There are a lot of ifs in those sentences, so the most important stance for the Santa Rally is a defensive one. Make sure your assets are protected, that you have enough safe and that you know what is safe in a world where bonds are in a bubble. It’s never a matter of jumping all in or all out. My time-proven easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. Call 310-430-2397 or email info @ NataliePace.com to learn how to get safe and protected, and to get a second opinion on your current plan to see exactly where you stand. Most people are far more at risk than they realize. If you lost 1/3 or more in the Great Recession, and you haven’t made any changes, then it would be smart to learn more now. I’ll address the Santa Rally in my October 2018 monthly teleconference. Be sure to tune into that teleconference on Oct. 11, 2018 (Thursday) at 9:00 am PT (noon ET). Click here for the call-in phone number and to listen back 24/7 on demand. If you’d like to listen to further commentary on the Back to School Stock Sales, listen to my September 13, 2018 teleconference at BlogTalkRadio.com/NataliePace. Here’s a calendar of the major events coming up. Other Blogs of Interest

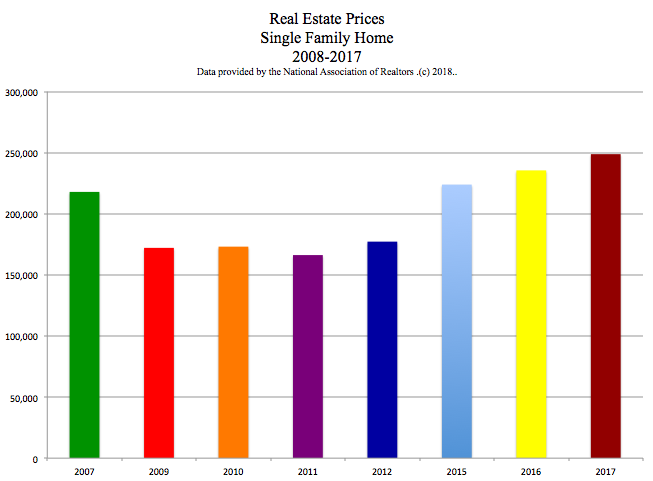

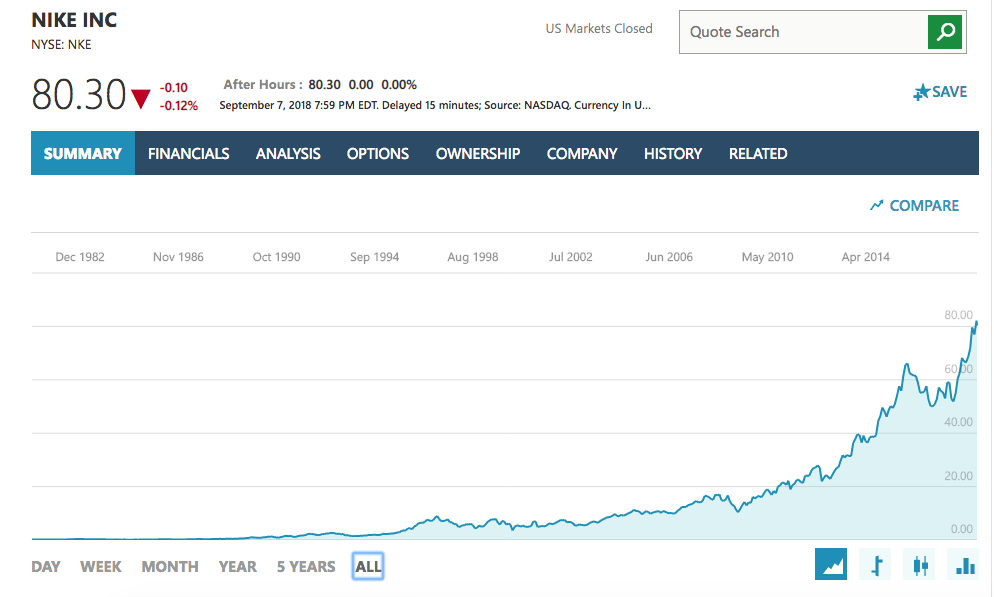

Should You Buy Tesla Stock? from August 9, 2018 Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own some, but not all, of the stocks mentioned in this blog.  Dear Natalie: I Sold My Facebook and Bought Gold. Signed, What a Waste! Dear What a …! Successful investing is never about looking backwards, and is always about diversification, asset allocation, balance and using data, statistics and time-proven systems to determine what the best return on investment will be going forward. That may sound like a lot, but, it’s actually easy as a pie-chart. You’ll also need to think more like an Olympian. Champions focus on winning. Obstacles are part of the game. Show me an investor who claims to have never been “down,” and I’ll show you Bernie Madoff. It’s what your aggregate overall return is that counts. That and sticking to a winning game plan, using a time-proven system, and not veering off with wild abandon every time there is a move up or down, which happens frequently in today’s volatile market place. If you let your fear (or irrational exuberance) do your trading, you’ll regret it. I was chugging along at 4.5% in Certificates of Deposit for most of 2000 and 2001. I wasn’t interested in buying stocks at the top of an overvalued market. Cash turned out to be the top performing asset in 2000. Then, I almost tripled my money in three short months at the end of 2001. (Yes, right after 9/11.) If you look at your entire investment strategy, you’ve been doing quite well in returns, too. If you have been following the pie chart faithfully since you first came to my Investor Educational Retreat in 2011, then you actually have been invested in Facebook – in your nest egg large cap growth funds. By leaning into technology and NASDAQ (i.e. getting hot and avoiding the bailouts), you have tripled your money in the NASDAQ Composite Index (the exchange where Facebook is traded) since you 2011. The Dow Jones Industrial Average performed well, too, but was completely dusted by the NASDAQ. Here are just a few ways that I would reframe my thinking from “What a Waste” into “What an Opportunity,” “What a Lesson,” and even “Congratulations.” What an Opportunity. If you believe in a company or an asset, and the price goes down, that’s an opportunity to buy low. So, if you were rebalancing your nest egg right now, the massively large slice of your large cap growth stocks is telling you to trim back and sell high. The slimmer slice of gold could be telling you to buy low, unless you believe that gold has had its day and will never come back. What a Lesson. It’s never all or nothing. Market timing just doesn’t work. Hail Mary investments, going all on in what you have been sold as a sure shot, more often crash and burn. In truth, if you were following my pie chart system to a Tee, you have been very invested in Facebook and have benefitted over the last decade from the Facebook run-up safely – in funds, along with over great performers, like Amazon, Google and Nvidia. You have also limited your exposure to gold to just a slice of your portfolio. What a Growth Experience You are now feeling in spades what I’ve been telling you for years. It takes time, experience, wisdom and discipline to get to the point where buying low is your first, and pleasurable, thought. Most people freak out and sell low. You’ll never become a champion investor unless you lean into wisdom and time-proven systems and stop whining about market volatility, which isn’t going away. Exercise your emotional investment muscles! You’ll become a much stronger investor if you do. Celebrate Your Victories. Before the PIIGS bond crises, I talked about safe, income-producing hard assets that you purchase for a good price as holding their value better than bonds. Real estate was still selling near ten-year lows from 2009-2012. You heeded that and purchased a home, which has likely increased in value tremendously. Many homes have doubled in value since the real estate lows in 2009, particularly those along the coasts and other cities with job growth. (The chart below is a nationwide average.) Conversely, between 2005 and 2008, I was screaming from the rooftops not to buy real estate – something that I’m back to bellowing again. Over 10 million homes went to auction in the wake of the Great Recession. Real Estate prices are higher than ever today, and unaffordable to the majority of denizens in many cities. Rising interest rates will limit the buying pool even further. So, home buyer be aware! Counting your victories is important because it helps you to douse the stomach acid and apply reason to whether or not you should be buying more gold at a lower price, waiting for it to increase in value or getting out, even at a loss. There are a few blogs below that might help you to use data, statistics and probability to inform your decision. Work Out and Get Stronger If you expect your investments to increase in value 100% of the time, then you’re setting yourself up for a lot of anger. The markets are volatile. No one is perfect and no one bats a thousand. That’s why you diversify, keep enough safe and rebalance annually in your nest egg, instead of stewing over it all the time. (How many superstar athletes spend a great deal of time complaining and worrying about a loss?) A good plan protects you from downturns, avoids the bailouts, keeps you hot, and earns gains when most people are losing more than half of their retirement. Stick to your game plan, and work out your emotions to become a stronger investor athlete. Let smart discipline be your investment strategy, and you will be a lot more successful than if you succumb to anger, sadness, regret, stomach acid or euphoria, or if you let any hormone color your focus. In the short run, Wall Street is a popularity contest. But in the long run, it’s always back to fundamentals. There is a lot more volatility today, due to the influence of high frequency traders and hedge funds. So, today’s vanquish can turn to tomorrow’s victory more rapidly than you might think. In that scenario, any moment wasted on worry is just that, a waste. Lastly, I want to thank you for volunteering at the retreats so many times. Your presence in the room is always welcome. We love having you there! If you'd like to learn these easy-as-a-pie-chart nest egg strategies, how to protect your assets, earn gains in recessions (like Nilo Bolden did), reduce debt faster than any other fix and even learn to save thousands of dollars every year in our Stop Making the Billionaires Rich at your own expense plan, then call 310-430-2397. We've got two retreats coming up. The sooner you get this information, the faster your life transforms. Click to see Nilo Bolden's testimonial. Click on the flyers below to learn the 15+ things you'll learn, check out pricing and see even more testimonials. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Did Nike Drop From $500 to $80/Share on the Kaepernick Ad? Investors Ask Natalie. Dear Natalie: A friend is suggesting that I buy Nike stock, which he says has fallen from $500 to $80 because of the ad featuring Colin Kaepernick. What do you think? Signed, A Little Help from My Friends Dear Friend, Wow. This is the best example of why you should never act on a hot tip from a friend that I’ve ever seen! As you can see in the chart below, Nike stock is trading at an all-time high at $80/share! I have no idea what your friend’s motivation is in trying to get you to buy Nike right now, but I can tell you that she’s no Warren Buffett! If this was a tip from a financial planner, then she has just tipped her hand that she's a salesman after her own interests above yours. In that situation, it's time to get an unbiased second opinion on your entire financial plan as soon as possible. (Call 310-430-2397 to learn more about how to receive my unbiased second opinion.) On September 4, 2018, Nike stock dropped about $2/share, but it’s still very pricey. I don’t see any compelling reason to jump in at a 68.50 price to earnings ratio, in the 10th year of the bull market. If you like the ad, a better investment would be to support the company’s controversial decision by buying Nike’s shoes and clothes… I’d wait for a truly (not hearsay) better price before buying the stock. If you'd like to learn how to access this simple data, and use the tools for evaluating investments that earned me the ranking of #1 stock picker, join me at one of my Investor Educational Retreats. Call 310-430-2397 to learn more. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Has Elon Musk Lost It? Dear Natalie: Do you think Tesla is going to rise again? I’m trying to decide whether to buy more, while it’s low, or get out. Elon seems like he’s lost it. Signed Tesla Fan? Dear Tesla Fan: Investing in one individual company is a risky bet. You should not be gambling your nest egg, retirement or future on individual stocks until you get as good at stock picking as Warren Buffett. Invest only fun money that you are willing to lose. That’s the first and most important consideration. When I’m evaluating an individual stock I use three tools. The Three Ingredient Recipe for Cooking Up Profits ® is the template. My Stock Report Card ® and 4 Questions ® help me pick a leader, which is the second ingredient of the recipe. (These strategies are all outlined in my 1st book Put Your Money Where Your Heart Is.) This system works better than reading headlines. If you just read headlines and articles about a company and invest, you’re always going to be late. Also, articles tend to be hyperfocused on one newsworthy event, rather than taking that event and putting it into context. The endless rehashing of Elon’s recent attempt to take Tesla private is like looking at one-piece of a 100-piece puzzle. My system turns over the majority of the pieces so you have a better picture of what you’re looking at. When you are just reacting to the news, more often than not, you are on the sell low or buy high side of the equation – in other words a losing strategy. Another problem is that most people buy without ever considering what their exit strategy is, or how the general market place will perform (Ingredient #3 of my recipe). So, here’s a thumbnail analysis of Tesla using my system. The 3-Ingredient Recipe for Cooking Up Profits. 1. Start with what you know and love. What do you really know about Tesla products? Do you own a Tesla? Have you test driven a Tesla car or done enough research to know what sets Tesla apart from the competition? 2. Pick the leader. Tesla’s revenue jumped 43% year over year in the 2nd quarter. By comparison Ford and GM car sales are down year over year. Tesla is projecting to be cash positive this year. With a 8,000 cars per week being produced (6,000 Model 3 and 2,000 Model S and X), the next two quarters should look spectacular – barring any force majeure (according to the 2nd quarter earnings letter). So, why are Tesla vehicles so popular? Because the car is outstanding, and also because electric cars have become the fastest growing vertical in auto manufacturing. If you haven’t driven a Tesla or freshened up on the cars’ safety ratings, then you need to jump back up to Ingredient #1 and do more research. 3. Buy low; sell high. Tesla’s price on Friday, August 31, 2018 was $300/share. Tesla’s 52-week low is $245/share. In 2013, you could have bought the stock for half that price. The general marketplace is trading at an all-time high in the 10th year of a bull market. So, before you buy more Tesla stock, make sure that you have an exit strategy that can gain before the general market weakens. Successful investing in the 10th year of a bull market means considering what the company can do, and also what the general stock market will do. When Elon announced that Tesla was going private at $420/share that was an easy proposition. However, Tesla announced last week that it would remain public. An outstanding 3rd quarter earnings report in early November could definitely spark the Tesla share price. However, if the general stock market is going down, it tends to drag down the share price of all stocks – even great companies, with rare exception. The U.S. economy will report a second quarter GDP growth report in the range of 4% at the end of September. But the 3rd quarter, which reports on October 26, 2018, is expected to be lower – with the New York Federal Reserve Bank forecasting 1.98% GDP growth. So, the micro analysis of the Tesla company looks very promising, but the macro analysis of stocks is quite problematic. (Read some of my macro economy blogs listed below for additional information.) If you’re interested in purchasing a Tesla vehicle, it pays to buy in 2018. The $7,500 U.S. tax credit will phase out in 2019. If you’d like to research Tesla or any other stock more, then join me at my next Investor Educational Retreat in Arizona in October or www.nataliepace.com/valentine-retreat-2019Santa Monica next February 2019. We spend one full day identifying great companies to invest in, and also noting big losers to be sure to avoid. This can up the performance of your investments significantly. Call 310-430-2397 to learn more about our next retreats. Other Blogs of Interest Should You Buy Tesla Stock? from August 9, 2018 Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Healthcare Costs in Half Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed