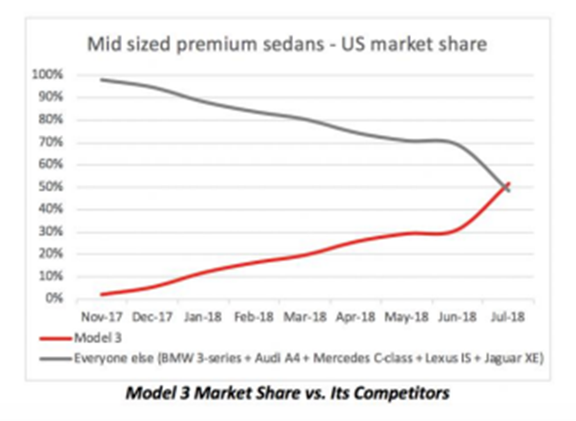

Has Elon Musk Lost It? Dear Natalie: Do you think Tesla is going to rise again? I’m trying to decide whether to buy more, while it’s low, or get out. Elon seems like he’s lost it. Signed Tesla Fan? Dear Tesla Fan: Investing in one individual company is a risky bet. You should not be gambling your nest egg, retirement or future on individual stocks until you get as good at stock picking as Warren Buffett. Invest only fun money that you are willing to lose. That’s the first and most important consideration. When I’m evaluating an individual stock I use three tools. The Three Ingredient Recipe for Cooking Up Profits ® is the template. My Stock Report Card ® and 4 Questions ® help me pick a leader, which is the second ingredient of the recipe. (These strategies are all outlined in my 1st book Put Your Money Where Your Heart Is.) This system works better than reading headlines. If you just read headlines and articles about a company and invest, you’re always going to be late. Also, articles tend to be hyperfocused on one newsworthy event, rather than taking that event and putting it into context. The endless rehashing of Elon’s recent attempt to take Tesla private is like looking at one-piece of a 100-piece puzzle. My system turns over the majority of the pieces so you have a better picture of what you’re looking at. When you are just reacting to the news, more often than not, you are on the sell low or buy high side of the equation – in other words a losing strategy. Another problem is that most people buy without ever considering what their exit strategy is, or how the general market place will perform (Ingredient #3 of my recipe). So, here’s a thumbnail analysis of Tesla using my system. The 3-Ingredient Recipe for Cooking Up Profits. 1. Start with what you know and love. What do you really know about Tesla products? Do you own a Tesla? Have you test driven a Tesla car or done enough research to know what sets Tesla apart from the competition? 2. Pick the leader. Tesla’s revenue jumped 43% year over year in the 2nd quarter. By comparison Ford and GM car sales are down year over year. Tesla is projecting to be cash positive this year. With a 8,000 cars per week being produced (6,000 Model 3 and 2,000 Model S and X), the next two quarters should look spectacular – barring any force majeure (according to the 2nd quarter earnings letter). So, why are Tesla vehicles so popular? Because the car is outstanding, and also because electric cars have become the fastest growing vertical in auto manufacturing. If you haven’t driven a Tesla or freshened up on the cars’ safety ratings, then you need to jump back up to Ingredient #1 and do more research. 3. Buy low; sell high. Tesla’s price on Friday, August 31, 2018 was $300/share. Tesla’s 52-week low is $245/share. In 2013, you could have bought the stock for half that price. The general marketplace is trading at an all-time high in the 10th year of a bull market. So, before you buy more Tesla stock, make sure that you have an exit strategy that can gain before the general market weakens. Successful investing in the 10th year of a bull market means considering what the company can do, and also what the general stock market will do. When Elon announced that Tesla was going private at $420/share that was an easy proposition. However, Tesla announced last week that it would remain public. An outstanding 3rd quarter earnings report in early November could definitely spark the Tesla share price. However, if the general stock market is going down, it tends to drag down the share price of all stocks – even great companies, with rare exception. The U.S. economy will report a second quarter GDP growth report in the range of 4% at the end of September. But the 3rd quarter, which reports on October 26, 2018, is expected to be lower – with the New York Federal Reserve Bank forecasting 1.98% GDP growth. So, the micro analysis of the Tesla company looks very promising, but the macro analysis of stocks is quite problematic. (Read some of my macro economy blogs listed below for additional information.) If you’re interested in purchasing a Tesla vehicle, it pays to buy in 2018. The $7,500 U.S. tax credit will phase out in 2019. If you’d like to research Tesla or any other stock more, then join me at my next Investor Educational Retreat in Arizona in October or www.nataliepace.com/valentine-retreat-2019Santa Monica next February 2019. We spend one full day identifying great companies to invest in, and also noting big losers to be sure to avoid. This can up the performance of your investments significantly. Call 310-430-2397 to learn more about our next retreats. Other Blogs of Interest Should You Buy Tesla Stock? from August 9, 2018 Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Healthcare Costs in Half Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed