|

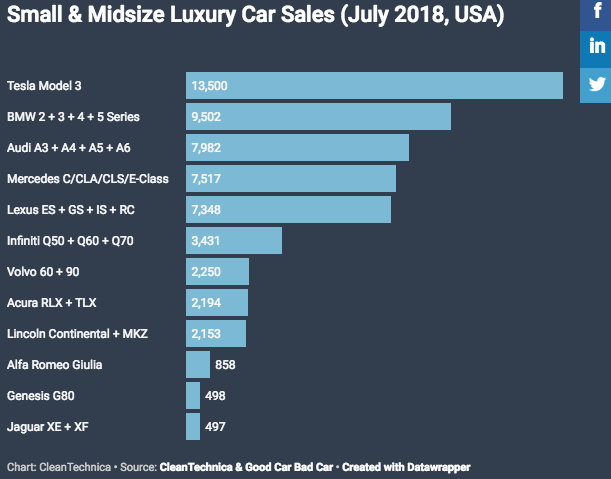

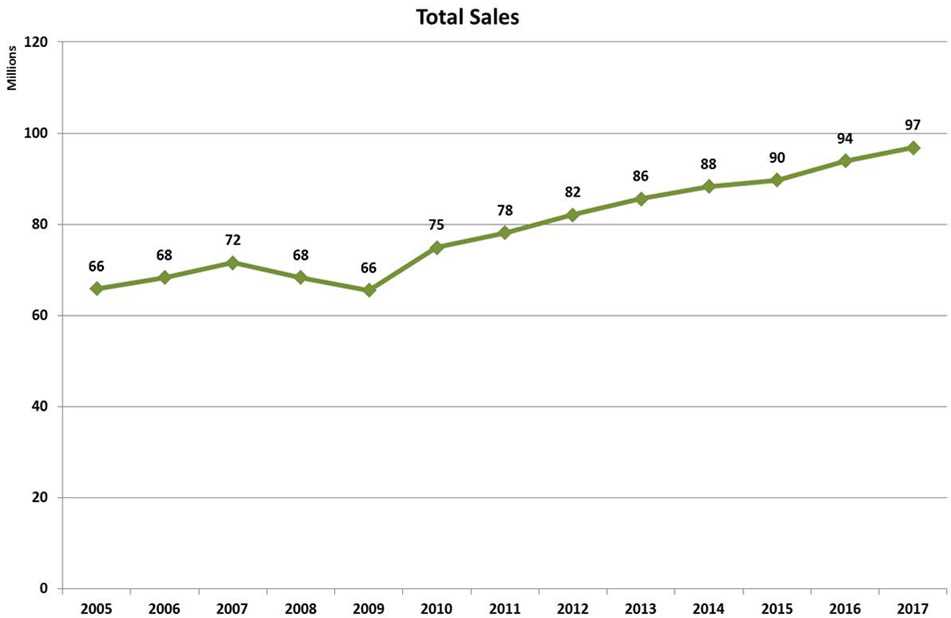

This blog was updated on September 16, 2018. On August 7, 2018 Tesla’s stock soared on a great earnings report, followed by a Tweet from Elon Musk reading that he was considering taking the company private at $420 a share. There were many 420 jokes that circulated, casting a shadow of doubt on the veracity of the Tweet, before Elon followed up his Tweet with an internal email that outlined his rationale and confirmed that the funding had already been secured. Of course, that position was ultimately reversed, with Tesla committing to staying public. So, should you become a Tesla investor? 8 Things to Consider Before Buying Tesla Stock 1. The Rationale 2. The Potential 3. The Marketplace 4. The Competition 5. Other Tesla Products 6. Do You Have the Stomach for it? 7. 2019 Tesla. Tax Credits Are Phasing Out. 8. The Macro Economy And here are additional details on each point. 8 Things to Consider Before Buying Tesla Stock 1. The Rationale Why take Tesla private in the first place? According to Musk, “Basically, I'm trying to accomplish an outcome where Tesla can operate at its best, free from as much distraction and short-term thinking as possible, and where there is as little change for all of our investors, including all of our employees, as possible,” Musk wrote in his internal memo. SpaceX, another company that Elon is the CEO of, has become a leading, privately owned, space launch and exploration company in the U.S. Musk promises investors who stick with the company through the LBO a chance to liquidate once or twice a year. 2. The Potential Electric vehicle sales are increasing by leaps and bounds over gas guzzlers. In July 2018, the Tesla Model 3 became the #1 vehicle in its class, outselling the closest premium sedan (the Lexus IS) by a factor of 3. Tesla’s year over year sales growth was 47% in the 2nd quarter of 2018, compared to flat sales at General Motors and Ford and single-digit growth at Toyota. On September 9, 2018, CleanTechnica reported that the Tesla Model 3 became the top-selling car in the U.S. by revenue in August of 2018, and the 5th topselling car by units. On September 7, 2018, Tesla issued a company update, writing "We are about to have the most amazing quarter in our history, building and delivering more than twice as many cars as we did last quarter." 3. The Marketplace There were 97 million vehicles sold worldwide in 2017, according to the International Organization of Motor Vehicle Manufacturers (OICA.net). Tesla’s is currently producing 7,000 vehicles a week (350,000/year). The next major expansion is into China. According to Tesla’s 2nd Quarter 2018 Update, “Initial capacity is expected to be roughly 250,000 vehicles and battery packs per year, and will grow to 500,000, with the first cars expected to roll off the production line in about three years.” 4. The Competition There is definitely competition in the EV space, with the Nissan Leaf, the Mitsubishi MiEV and more. However, Tesla broke the book on safety and performance. The Tesla S sedan earned the highest safety rating ever, and when the Roadster was first introduced it quite famously beat a Porsche – at a time when most electric vehicles drove like golf carts. Every carmaker has plans for a luxury sedan and SUV EV. However, ramping up production and rolling out infrastructure to recharge the vehicle can take 5-7 years, at which point one can imagine an innovative company like Tesla will already be building the first EV that flies to the moon. 5. Other Tesla Products Tesla is rapidly becoming a vertically integrated company, with an energy storage division and an innovative solar roof design. Tesla’s goal is to triple the energy storage deployments in 2018 over last year, and to market the benefits of an integrated solar/storage solution to existing Tesla vehicle owners through their app to drive growth in solar power generation going forward. 6. Do You Have the Stomach for it? Investing in individual companies is a bit like playing tennis with Roger Federer. You have to know how to compete, otherwise the profits will just whiz by you. The market is moving to electric vehicles and Tesla is the clear winner. However, in the twilight of the bull market, even great companies can have their share price and value impacted negatively. So, when investing in any individual company, you need to understand the macro concerns and have an exit strategy that makes sense in bull and bear markets. 7. 2019 Tesla. Tax Credits Are Phasing Out. If you want to take advantage of the $7,500 tax credit for purchasing a Tesla, then you need to have your car delivered in 2018. Tesla has sold 200,000 cars, so the tax credit will phase out in 2019. See the Tesla company blog for the 2019 phase-out schedule. That means that Teslas will be even more expensive in 2019, or that Tesla will have to reduce prices to remain competitive. Sales could be impacted. 8. The Macro Economy In the 10th year of a bull market that is overpriced according to many economists, all stock investments are more at risk. A rising tide lifts all ships, and a sinking tide grounds them. Tesla makes great cars and has disrupted and transformed an old-school industry. However, even great companies can take a hit in share price in a general market correction. Tesla is now the most valuable car company in the U.S., with a market capitalization of $50+ billion, and the sexiest growth curves in the world. That’s an attractive proposition, when you look at the products and the promise of the Tesla products, and avoid the headlines and noise. On Friday, Sept. 14, 2018, the company was trading at a 24% discount from its all-time high. You can learn the strategies I used to become ranked the #1 stock picker in my 3 bestselling books and at my 3-day Investor Educational Retreats. Call 310-430-2397, email Heather @ NataliePace.com or visit NataliePace.com to learn more. I just revised The ABCs of Money (the 2nd edition) this year. It’s available on Amazon.com now for just $3.99. Other Blogs of Interest Has Elon Musk Lost It? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own shares of Tesla in my investment clubs. 24/1/2019 07:46:50 am

It all depends upon you and your decision! If you think and you feel that you might need to buy Tesla already. then it's okay to reward yourself with the things that will make you happy. Tesla is just new in the industry but has been making huge wave because of its quality. It took over and washed out other high end car brands in an instant; without making so much effort. Well, I don't know if it's a good news or not, but Tesla has been making a good name for itself! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed