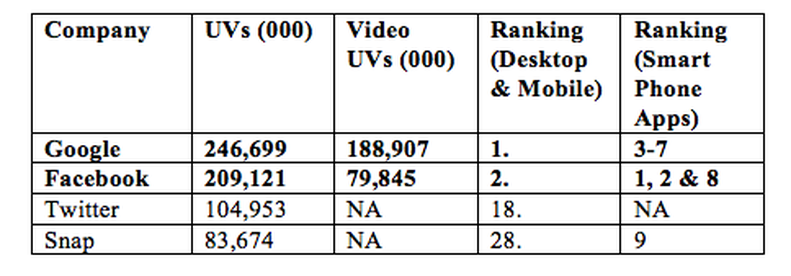

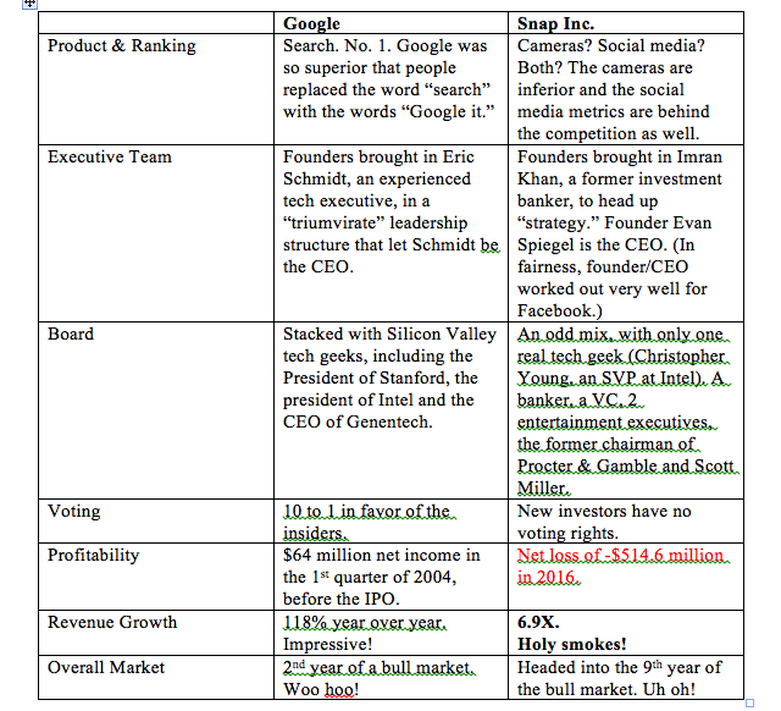

Will the Snap Inc. IPO be a spectacle, or will the disappearing app offer a disappearing IPO? To put the Snap IPO into better perspective, I lined up some of the key metrics alongside the uber-successful Google IPO on August 19 of 2004. The next gen social media platform Snapchat is now known as Snap Inc., a camera company. Snap Inc. intends to reinvent the camera because, according to the IPO filing, it is their “greatest opportunity to improve the way people live and communicate.” Hmmm. With that being said, you’d expect their first camera product to be drop-dead impressive. The attractive models wearing the new Snap Inc. Spectacles video recorder sunglasses are definitely eye candy. But a tech company has to be far more than skin deep. Twitter has proven that even when a tech company offers something unique and does it well (and is the 45th President’s favorite late-night toy), they need to be cash positive to catch an investor’s eye. Snap is struggling in both areas. Unique they have in spades. It’s the technology and cash burn that are of concern. Spectacles are fashion-forward sunglasses with a video recorder that gives a unique “first-person shooter” perspective. Spectacles started out as one of the hottest tech products of the year, going for as high as $1000/pair on eBay in November 2016. Since then, however, in only three months, the average sales price on eBay has dropped down to retail – at $130/pair. You can easily purchase your own Spectacles at Spectacles.com. When it comes to actual performance, the reviews of Spectacles fall flat. They look good. They’re fun. But the novelty wears off rather quickly. According to Avery Hartmans of Business Insider, “If you're buying them for everyday use, you might be disappointed… The camera is below-average.” Problems include that the camera doesn’t record well in low-light situations. HD is an option, but requires a lot of extra work. The social media side is stronger than the actual video capability, i.e. you might want to Snap Video a concert or a goofy stunt, but probably not a scenic landscape. Sometimes your hair flies in front of the camera. Who would dream of surfing or skydiving with Spectacles for their videos? The reviews and user experience of Spectacles is very different from the launch of, say, the iPhone. The novelty of smart phone technology is still jaw-dropping a decade later. So, does this doom the Snap Inc. IPO, which is scheduled to price on March 1, 2017 (Wednesday) after the markets close? Will investors want to court a company when their premiere product is more of a beautiful one-night stand? Snap Inc. revised their projections downward for the IPO on Feb. 17, 2017, according to Reuters, but still believes the market value of the company will come in at $19.5-$22.3 billion. Is Snap Inc. worth twice as much as Twitter and $20 billion more than GoPro? Below is where Snap lines up with users, compared to Twitter, Facebook and Google. As you can see by the media metrics, most Millennials are more active on Google, Facebook and Twitter. FYI: Facebook’s video/photo app Instagram is included with the parent company metrics. Comscore.com December 2016 Snap has one very attractive asset, which might seduce investors – revenue growth. In 2015, revenue was about $58.7 million. Last year, the company brought in $404.5 million – a jump of about 6.9 times. That is drop-dead impressive. If you go to the Snap app, there are actually more ads now than status updates. The ads are inviting, rather than offensive, on first look. Snap’s chief strategy officer Imran Khan boasts that Snap lets users "play with brands." Of course, that assumes that customers actually want to be sold stuff while they’re being entertained – a premise that users have been trying to escape for the past century. I, for one, didn’t stick around to play. When I found myself bombarded with ads, after I tried to look at some behind-the-scenes video of the Oscars Best Picture debacle, I ended my search abruptly and have been reticent to try checking out other updates since. To put the Snap IPO into better perspective, I lined up some of the key metrics alongside the Google IPO on August 19 of 2004. Data Crunch by Natalie Pace.

The problem with novelty products is that the shine can fade fast. The issue with companies that are having difficulty defining themselves, and are being forced to monetize quickly, so that the insiders can turn their paper profits into houses and cars, is that the customers may feel sold out. Since the chief camera product is not impressive – though it looks cool – and the main monetization plan is still advertising, it seems like a major misstep for Snap to be redefining itself as a camera company right before the IPO. Even a popular camera company like GoPro is only valued at $1.4 billion – not $20 billion. Snap is hot and perceived as a very innovative company, so it could get a bump from chatter on the investor boards. However, whereas Google took off like a rocket and has rewarded investors with a 10 times return on investment, Snap could easily be more like the Groupon IPO, which roared onto the scene and then lost 80% of its value over the coming year, and has been at the bottom of its trading range ever since. Whether Snap remains a “camera company” or returns to social media, it has little hope of competing with Facebook and Twitter (or even GoPro) without major technology innovation. Can a group led by entertainment executives and bankers hope to compete with tech giants backed by Andreessen Horowitz and Facebook? MySpace tried that route back in 2006, and it wasn’t a happy ending. Perhaps the best move that Mark Zuckerberg made was to uproot himself from Harvard and plant himself in Silicon Valley. The laid-back, look-cool Southern California vibe will only work if the executives discover the next Satoshi Nakamoto to run technology and innovation, and that’s less likely to happen on Venice Beach than it is in Palo Alto. In short, I’d let tomorrow’s Snap Inc. IPO update disappear, and check back later in the year (late September) to see if goofy and cool has become something more substantive, at a better valuation and price. Cut Your Tax Bill in Half! 8 Tips.

A lot of you have heard me say, “Stop making everyone else rich, including the tax man, the debt collector, the landlord, the gas station, the utility company, the insurance salesman, etc.” Tax season is the perfect time to start keeping more of your dough and living a richer life as a result. Below are 8 tips to cut your tax bill in half (or more). 8 Tips to Stop Making Everyone Else Rich! These tips will help you put your best leg forward on the path to financial freedom. See the list below for what applies to you, and then details on each tax credit/deduction below the list. Go to IRS.gov for additional information. 1. Health Savings Accounts. 2. IRA Contributions. 3. Mortgage Interest Deduction. 4. Student Loan Interest Deduction. 5. Qualified Education Expenses. 6. EVs, Energy Efficiency and Clean Power Tax Credits. 7. Charitable Contributions. 8. Refund Delays. 1. Health Savings Accounts. Here’s another way to increase your assets and beautify your bottom line, while giving less to Uncle Sam AND the insurance company, for a triple tax benefit. Health Savings Accounts work best for healthy people. An HSA, combined with a high deductible health insurance plan, could save you thousands of dollars in insurance premiums each year, offers a tax credit of $3,350 for individuals (and $6,750 for families) and can be invested for tax-free gains. There is no penalty if you need to withdraw for medical expenses, and the money grows each year, becoming your best long-term health plan. Opening an HSA with a brokerage will offer you more investment options than opening the account with an insurance company or bank. 2. IRA Contributions: You can still contribute to your IRA and receive credit for 2016, up until April 18, 2017. (Roth IRAs are not tax deductible.) Should you opt for Roth or traditional? Most people earn more in their working years – when they can most benefit from the tax credit – and less in their retirement years. According to the IRS, “Amounts in your traditional IRA, including earnings, generally are not taxed until distributed to you.” The IRA contribution helps in at least four ways. It’s a tax credit. Increasing your own assets increases your FICO score, which allows you to borrow at a lower interest rate. Gains made in your IRA are not taxed. (Brokerage account gains not in a qualified retirement plan are). When you invest 10% of your income in a tax-protected retirement account, and it earns a 10% gain (what stocks have done over the past 30 years), you have more money in your account than you earn within 7 ½ years and your money makes more than you do in 25 years. This is your ticket to financial freedom. 3. Mortgage Interest Deduction. Mortgage interest paid on a qualified first and second home can be deducted. This is a massive tax deduction, since the majority of your mortgage payment is interest, one that many Millennials are missing out on, one that allows you to stop making the landlord and the taxman rich. Home prices on a nationwide basis are back above what they were before the real estate crash and the Great Recession, so it’s not a great idea to just race out and purchase. (Many who did that in 2005-2007 have had a terrible decade.) However, there are opportunities for smart buyers to rethink their housing, purchase in the shadow inventory and create a win-win-win for themselves. These are some of the strategies that I teach in my Investor Educational Retreats. 4. Student Loan Interest Deduction. If you earned less than $80,000 in MAGI (modified adjusted gross income) in 2016, and you paid on a student loan, you could deduct up to $2,500 of the interest you paid. 5. Qualified Education Expenses. You may be able to deduct education costs for yourself and/or a student in your immediate family. You may also be able to take an early distribution from an IRA without paying the early distribution penalty and additional taxes, if the withdrawal was made to cover a qualified education expense. If the education is work-related, you may qualify for a business deduction. 6. EVs, Clean Power & Energy Efficiency Credits. If you purchased an electric vehicle, installed solar panels, or insulated your home, you could qualify for a generous tax credit. EV credits are between $2,500-$7,500 and wind/solar power product and labor credits can be as high as 30 percent of the purchase price. 2016 was the last year to take advantage of tax credits for Energy Star appliances, skylights, windows and doors. The tax credits for solar are good to go through Dec. 31, 2019, at which point they will begin being phased out. Proper insulation can reduce your heating/cooling bill by 80%. EVs can cut your gasoline costs by half or more. Solar panel costs have dropped so that the payback is 3-5 years if you live in a sunny state. 7. Charitable Contributions. Your charitable contribution is tax deductible, provided it is made to a qualified 501c3. In addition to deducting your cash contributions, you generally can deduct the fair market value of any property you donate to qualified organizations. 8. Refund Delays. On December 8, 2016, the IRS issued a press release saying that there will be a delay on refunds for anyone who is claiming the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC). While the rationale is reasonable, the delays are a bit suspect. For instance, it doesn’t take two weeks for money to transfer from the federal government to a bank (something the press release is saying might happen). Your best defense here is to file as early as possible, so that you’re not caught in the gaping hole of whatever is really going on (a public debt of $20 trillion, say?), including “dealing with resource limitations.” Another Helpful Tax Tip Facing an Audit or Penalty? Hire an experienced, qualified accountant to review your case and communicate with the IRS on your behalf. As Wayne Layton, CPA, reminds us, “Most taxpayers become fearful upon receiving these letters as some of them even refer to liens and levies. There are many times that, on behalf of my clients, I write a letter disagreeing with the IRS’s position, attaching proof of why the taxpayer does not owe the additional tax, and the additional tax assessed is either reduced or the balance is adjusted to zero.” It’s a good idea to discuss your options with a qualified Certified Public Accountant before simply writing the check. One More Important Consideration As we enter the 9th year of the current bull market, the most important consideration is to make sure that your assets are safe and protected. The last two times that we went 8 years without a correction in stocks the economy crashed. Most people lost 55% in stocks and real estate in the Great Recession. If you lost that (or more) and you haven’t made any changes, you are just as vulnerable now as you were then. You can’t afford to lose half every eight years, as happened in 2000 and 2008. Also, the recent drop in the euro, pound and Canadian dollar, and the bankruptcies/bailouts of Greece, Detroit and more remind us that currency fluctuations and credit crises are dramatic and happen overnight. Bonds and cash can be vulnerable to losses. Wisdom is the cure! Call 310-430-2397 to register for my May 20-22, 2017 Investor Educational Retreat at the beautiful beachfront Cocoa Beach, Florida Hilton. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed