|

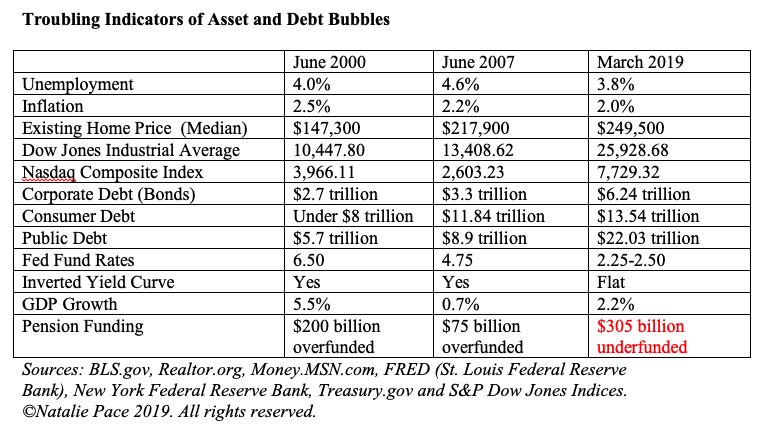

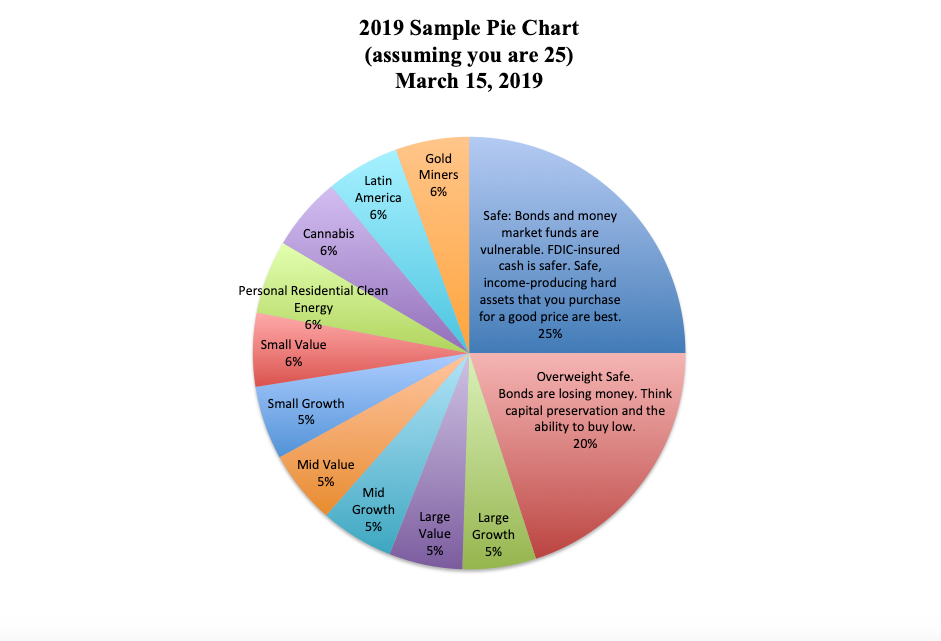

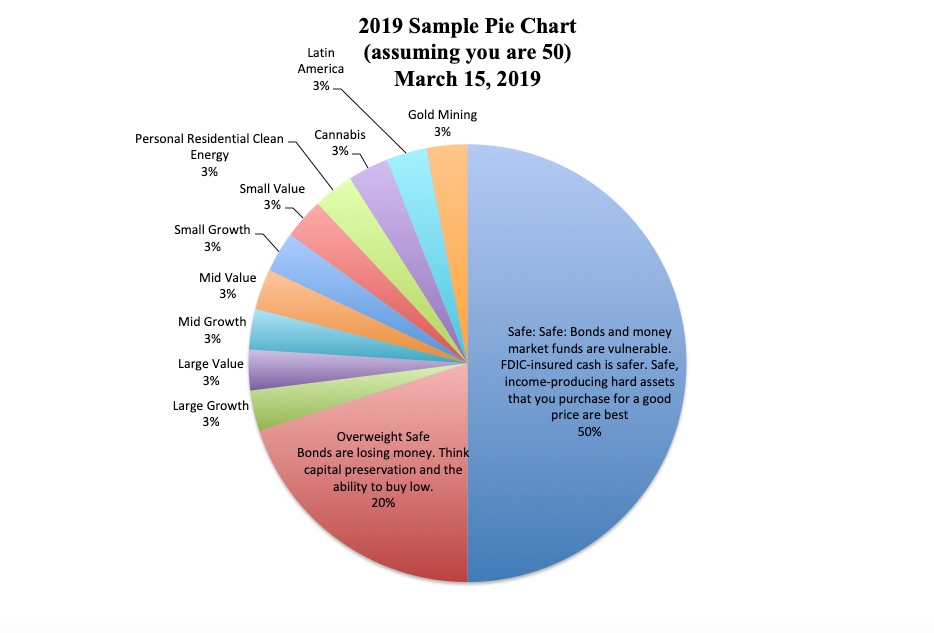

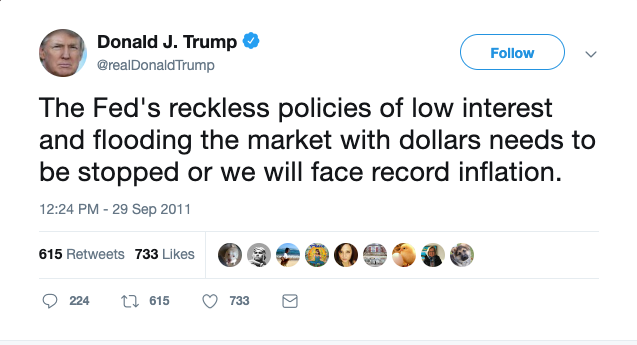

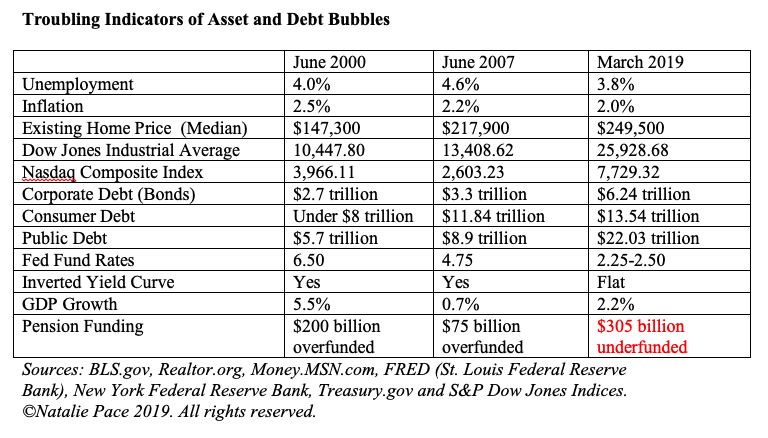

Dear Natalie: It seems that Trump and the Federal Reserve are looking at a reduction in interest rates, which I believe will extend the bull market in both the stock market and real estate. I'm guessing they're going to try to keep it going until after the US elections in fall of 2020, to keep the illusion of a strong economy going, as this is such a cornerstone of Trump's platform. We have moved into a cash position, and are being pressured by financial advisors to take advantage of the year and a half of growth to invest the money for higher returns. We are feeling foolish for being cautious, like maybe we should work with this change. At the same time, it feels like a house of cards and there are so many variables that could knock it down, despite the interest rate issue. How significant is the interest rate benchmark, and are we unnecessarily losing out on growth with them backing off from increasing it? Are we wise or foolish to remain on the sidelines, patiently waiting for things to play out (especially given a short time line to retirement, thus having a short time to grow it)? It is hard to be confident in our choices when things are all so uncertain! Signed, Under Pressure! Dear Step Out of the Show Room: First off, you are quoting a sales pitch as if it were truth, when the truth is that you’re quoting a sales pitch. The Feds and the White House are not colluding to win an election. In fact, if you’ve been paying close attention, then you’ll recall how absolutely apoplectic #45 is that the Feds aren’t playing his game. The Administration has even looked for ways to replace Federal Reserve Chairman Jerome Powell. The truth lies in the Asset Bubble chart below. The Federal Reserve Board governors know that they kept interest rates too low for too long. Low interest rates create bubbles. Now, if the economy weakens, as it is forecast to do this year, the Feds don’t have enough room to lower interest rates sufficiently to help boost economic growth. So, there is a majority on the Federal Reserve Board who are interested in keeping rates as high as they can for as long as they can. That’s why this week has been so weak on Wall Street – because Jerome Powell in his speech on June 25, 2019 said that “Monetary policy should not overreact to any individual data point or short-term swing in sentiment.” As to the other idea that you are missing out on gains, that is why we use a pie chart rather than market timing. You’re never all in or all out of the market. You’re always in at an appropriate level based upon your age. You should also be diversified and have exposure to some hot industries. In a normal world, your safe side would be invested in bonds, and that side would earn a decent return. We’re not in a normal world. We’re in an over-leveraged world. The Bubble Chart above shows you that in black and white. I’m not sure why you have so much cash on the sidelines, however, I’d be more concerned about buying into losses than missing out on gains. As you can see from the charts below, most people lost more than half of their investments in the last two recessions. This was with bonds making money. Bonds lost money in 2018, and due to the amount of high-leverage and low interest rates are too vulnerable to be worth the risk, when you are getting such a low return. 4.5% yield is $4500 on $100,000. If you’d invested in General Electric to get that kind of dividend, you would have lost more than half of your principal. General Electric is not the only company borrowing from Peter to pay Paul. In fact, according to Howard Silverblatt, the senior index analyst at S&P Dow Jones Indices, one out of four S&P500 companies are buying back their own stock to make their earnings look higher and their share price look lower (i.e. financial engineering). Financial engineering is not real growth. Investors were livid when they learned that GE was doing this, but are unaware that it is absolutely rampant on Wall Street these days. Things are always uncertain. The one thing that is certain is that when the markets are at an all-time high, the broker-salesmen get desperate and the sales pitches get more urgent. Your own desires try to push you to believe them because you want to join the party. At the depths of a recession, the broker-salesmen are all jumping ship, and at a loss of what to tell you now that they’ve lost more than half of your assets. The turnover of financial advisors in Great Recessions can be 90%! Your stomach acid is keeping you awake at night. By the time things look the worst, it is usually the time when the economy starts to turn back on track. However, you’re tempted to sell low because you’re not reading data, you’re still reading headlines and looking at a sea of red on your brokerage statements. In other words, listening to salesmen and stomach acid is a losing proposition that tempts you to buy high and sell low. Time-proven systems are always a great plan, and work the best by avoiding losses in recessions and outperforming the bull markets in between. The pie chart system, along with annual rebalancing, pulls the red and green lights out of the planning and encourages you to do what you are supposed to do without the emotional attachment. So, the real question is: why are you listening to salesmen for your information? Isn’t it time to be the boss of your money, and trust data, information and time-proven systems? The Bottom Line If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. The December drop (which was the worst December since the Great Depression) is a warning shot that now is the time to be sure that your exit strategy is based upon a time-proven system and not Buy and Hope. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. How are you setting yourself up for the win? As we enter the 11th year of the current bull market, it’s key to remember that what goes up, can come down – rather rapidly. The 9.2% drop in the S&P500 in December 2018, is a stark warning that when the winds shift it can be too rapidly to properly protect yourself. That is why it is key to have a time-proven plan – one that can withstand financial storms. You don’t want to discover you’ve built your fiscal health with straw, as most people did during the Great Recession, when over 10 million homes were lost and the Dow dropped 55%. So, What’s Your Exit Strategy? How are you setting yourself up for the win? Real Estate Real estate prices are higher than ever, and unaffordable in many cities. This is not a buy and flip environment. And it is definitely not the greatest time to consider buying a new home, even with the massive tax advantages that Americans receive. One of the worst mistakes you can ever make is to buy high in real estate. It can ruin your life for a decade or more. So, if you’re considering buying or selling real estate, you want to learn the most important key to a successful investment. Click to access that blog. Nest Egg Are you suffering from buy high, sell low mentality (click to access that full blog)? Are you tempted to buy stocks now when stocks are back to an all-time high (afraid you’ll miss the party if you don’t)? Did you sell everything in 2009, during the Great Recession? If so, you are letting stomach acid and euphoria – emotions – rule your investing strategy. There is a time-proven, easy system that earned gains in the last two recessions and has outperformed the bull markets in between. Yet most money managers don’t use this system. Why? The status quo just isn’t set up to incentivize that. There are some brokerages moving in this direction. However they will attempt to sell you options trading and other high-risk investments to improve their profitability. That is why it is important to be the boss of your money, even if you have someone on staff to “manage” it. This is much easier than you might think, which is why I encourage you to learn the ABCs of Money that we all should have received in high school now. The basics of a successful nest egg (401K, IRA, HSA, college fund) system are:

Annual rebalancing is one of the most important things that you can do to promote fiscal health. Buy and Hope has been riding the Wall Street rollercoaster, losing more than half in the last two recessions and barely crawling back to even before the next economic storm strikes. Annual rebalancing is a buy low, sell high plan on auto-pilot for your nest egg. Learn more in this blog. If you need help understanding what you own, call 310-430-2397 or email [email protected] to learn more about receiving an unbiased 2nd opinion from me. Trading Trading stocks in the 11th year of the bull market, when stocks are at an all-time high, is like surfing in a hurricane. If you can’t surf ankle slappers, then you shouldn’t be surfing storms. There are times when any yahoo can pick a stock and make money, and other times when even professionals are hard pressed to eke out gains. The wind is in your face right now. Be careful. Successful trading in individual stocks requires employing my 3-Ingredient Recipe for Cooking Up Profits, which includes using the Stock Report Card and 4 Questions for Picking a Winner. These strategies are outlined in my first book Put Your Money Where Your Heart Is, and taught at my Investor Educational Retreats. Call 310-430-2397 to learn more now. In today’s world, with Tariffs, Trade Wars, Volatility, Astronomical Debt and Political Tensions, buying low and selling high require considering 3 factors:

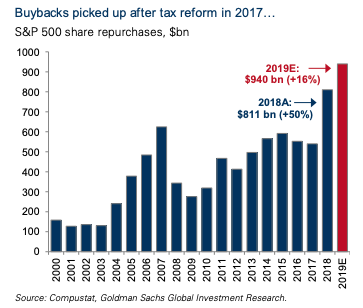

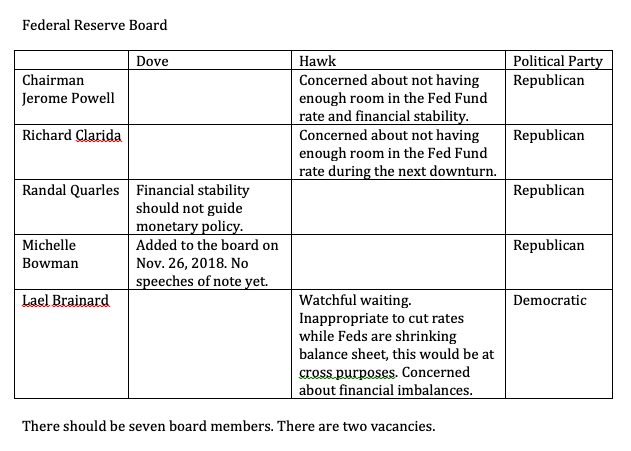

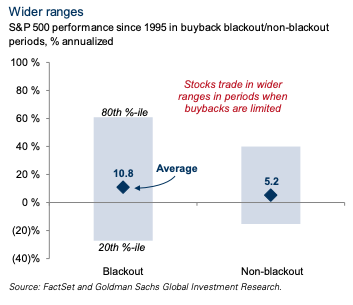

Read more about these factors in my recent blogs on Tesla, cannabis, Zoom, Uber, Boeing, Lyft and Wells Fargo. The Macro Economy On June 19, 2019, the Federal Reserve Board is scheduled to meet, largely to determine whether or not to cut the interest rate. While some will applaud a cut because companies can continue to borrow money very cheaply, others will understand the risk is that Interest Rates Create Bubbles and the over-leverage party is ready to pop. Additionally, a rate cut signals economic weakness – which is never a good sign. In short, the macro economy could be a severe drag on any high performance of a single stock. Even Apple lost value during the Great Recession, when it launched the Smart Phone that changed our lives and disrupted the phone industry. Additionally, it’s important to remember that Financial Engineering is Not Real Growth. Click to read that blog. The Bottom Line If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. The December drop (which was the worst December since the Great Depression) is a warning shot that now is the time to be sure that your exit strategy is based upon a time-proven system and not Buy and Hope. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On Friday, June 7, 2019, the Bureau of Labor Statistics reported that the increase in total nonfarm payroll employment (i.e. jobs) was only 75,000. Although this is bad news because that is less than is needed to employ new Americans entering the work force, the Dow Jones Industrial Average jumped 253 points. Why? Some investors were banking on the Feds lowering interest rates at their next meeting, while others were thrilled that we will not add Mexico to the Tariff List. Why would investors be excited about a rate cut, and are the Feds likely to cut interest rates in 2019? The current stock market rally has been built on corporate buybacks. Companies have been borrowing money very inexpensively, and using those leveraged funds to repurchase their own stock. This has many short-term benefits. It makes the company’s earnings look higher than they are, while pushing the price to earnings ratio down – making the share price look cheaper than it really is. When markets rally, novice investors become more interested. Yes, this really amounts to companies baiting the water so that you’ll jump in and buy. Buybacks are projected to hit an all-time high in 2019. Lower interest rates fuel the buyback fire; higher interest rates make the practice more expensive. So, if the Feds lower the rates, the market rally party might, in theory, continue – even if the economy itself is cooling off. In fact, according to former Federal Reserve Board chairman Alan Greenspan, a 10% rise in stocks equates to a 1% rise in GDP. Clearly business-minded executives will benefit politically and financially if the rally continues, even if, ultimately, borrowing from Peter to pay Paul is not a sound business strategy. The Feds Are Taking Away the Punch Bowl So, why is there still a rate raise projected for 2019 and another for 2020? Why would the Feds want to sober investors up, against the desires of the White House and many corporations, who would like to continue the Buyback Party? There are two main reasons: financial imbalances and the Effective Lower Bound rate. Financial Imbalances Lower interest rates create bubbles. Today, real estate prices are higher than ever, and unaffordable in many major cities to the people who live there. Stocks are near an all-time high. Bonds and loans are highly leveraged, with new money flowing to those companies carrying the highest risk. Over 50% of investment grade companies are at the lowest rung – just one notch above junk bond status. (See the below Asset Bubble Chart.) When bubbles pop, like they did in 2000 and 2008, the downturn can be steep and rapid. As Federal Reserve Board governor Lael Brainard said on March 7, 2019, “Elevated valuations and corporate debt could leave the economy more vulnerable to negative shocks. The market volatility in December is a reminder of how sensitive markets can be to downside surprises.” Federal Policy and Rate Cuts Another problem with persistently low interest rates is that there isn’t enough room for the Feds to cut interest rates to boost economic growth in a recession. Federal Reserve Board Governor Clarida explained this on May 30, 2019, when he said, “A lower neutral rate increases the likelihood that a central bank's policy rate will reach its effective lower bound in a future economic downturn. Such a development, in turn, could make it more difficult during a future downturn for monetary policy to provide sufficient accommodation to rapidly return employment and inflation to mandate-consistent levels.” As you can see in the chart below, interest rates started out much higher before the Dot Com and the Great Recessions. The Feds had plenty of room to cut rates. And still the recessions were devastating, with the stock market losing more than half of its value. With interest rates starting less than half as high as they were in 2007, the Federal Reserve Board will have to resort to other policy tools to stabilize the economy. Will the Feds Cut Interest Rates to Let the Party on Wall Street Continue? Judging from the Federal Reserve Board governors’ own words, there will not be a rate cut on June 19, 2019. However, there could be an abrupt end to the Federal Reserve Board’s deleveraging of its own balance sheet, which is currently scheduled to finish up at the end of September 30, 2019. Governor Randy Quarles, who was appointed by the current President, believes that “monetary policy should be guided primarily by the outlook for unemployment and inflation and not by the state of financial vulnerabilities.” Governor Michelle Bowman, who was appointed on Nov. 26, 2018, might agree with him (and side with the President). However, Governors Brainard and Clarida, along with Federal Reserve Board chairman Jerome Powell, have all gone on record expressing concerns about financial imbalances, financial stability, the Effective Lower Bound interest rate and room to maneuver to boost economic activity in the next downturn. As Chairman Powell summed up on May 20, 2019 in a speech: Business debt is near record levels, and recent issuance has been concentrated in the riskiest segments. As a result, some businesses may come under severe financial strain if the economy deteriorates. A highly leveraged business sector could amplify any economic downturn as companies are forced to lay off workers and cut back on investments. Investors, financial institutions, and regulators need to focus on this risk today, while times are good. Bottom Line The May 2019 jobs report was very weak. However, so was the February jobs report, which prompted the Feds to communicate that they would be patient about rates and would stop deleveraging at the end of September 2019. Prior to that announcement, their economic forecasts were still factoring in getting to a 2.9% Fed Fund Rate in 2019 and 3.1% in 2020. (The current projections are 2.4% in 2019 and 2.6% in 2020.) With 1Q GDP still looking reasonably well, and the 2nd quarter results to be released on July 26, 2019, there can be a lot of reasons to remain “patient” at this meeting. Additionally, even though a mostly Republican Federal Reserve Board would be very interested in keeping the current market rally alive to keep the White House in the next election, the Federal Reserve Board has solid reasons for taking the punch bowl away from the Wall Street party. If the board governors are ruled by the data, and do not succumb to political pressure, then it’s hard to justify letting banks and corporations continue over-leveraging. Forecast 2019 Corporations are still on track to set a buyback record in 2019. This should keep the markets more buoyant than they would otherwise be this late in the business cycle. However, as we saw in December, when companies are too aggressive with their buybacks in the beginning of the year, they find themselves tapped out later on. That is likely what happened in December of 2018, when the S&P500 saw the worst December since the Great Depression. The markets slide at twice the speed when corporations are not buying up their own stock. What Should You Do? The economy is cooling down. That is projected to start showing up in the GDP reports starting on July 26, 2019. Investors are forward looking. So, expect volatility and potential market weakness to show up in advance of that 2nd quarter GDP report. July 2019 could be a very challenging month, unless the corporate CFOs continue their buyback spending spree. What this points to is that now is the time to make sure that you are safe, protected, properly diversified and hot. If your financial plan is longer than just a few pages, if you lost more than 1/3 in the Great Recession and if you haven’t made any changes, then you’re more vulnerable today than you were then. Wisdom is the cure. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed