|

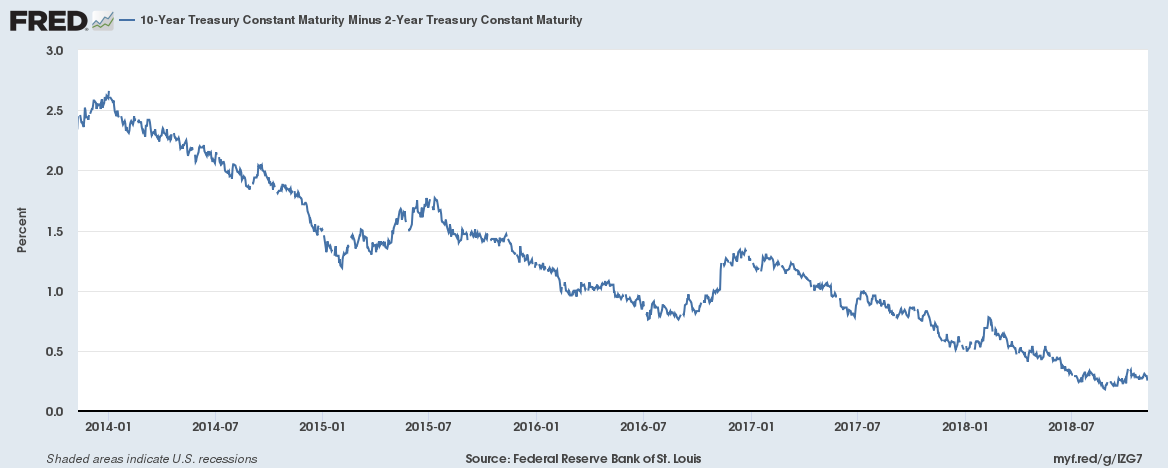

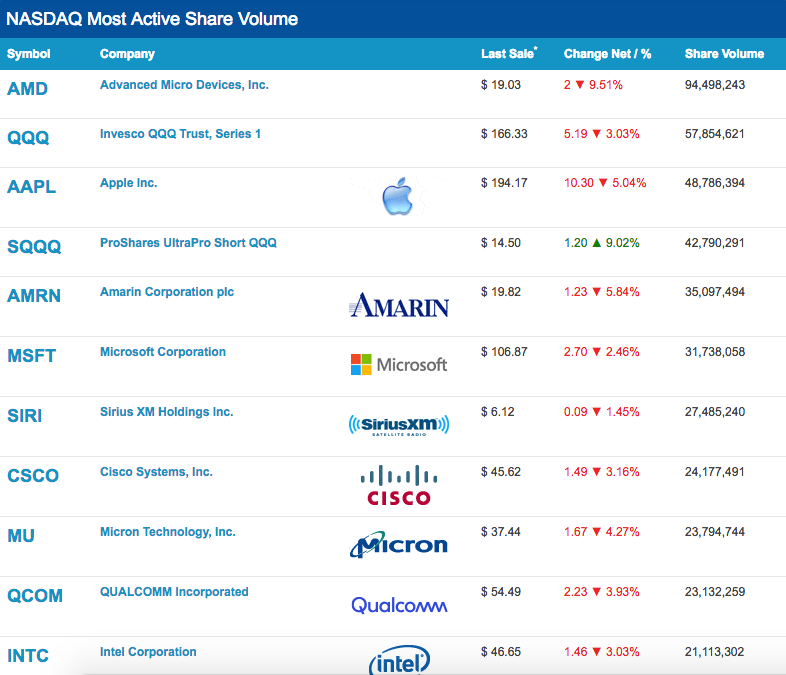

The Real Reason Stocks Fell 600 Points on Veteran’s Day. On Veteran’s Day, November 12, 2018, the Dow Jones Industrial gave up 602 points. Was it for political reasons? If not, why are investors skittish when unemployment is low and GDP growth rang in at 3.5% in the 3rd quarter? Are there other financial phantoms looming in the shadows? In order to answer how politics affect the markets, I looked at history. We’ve had two impeachment proceedings in the recent past, one with President Clinton (Democrat) and one with President Nixon (Republican). How did Wall Street react before, during and after each? Turns out that Wall Street enjoyed one of the strongest Santa Rallies of our generation during the Clinton Impeachment hearings. The Dow Jones Industrial Average soared 21% between September 1998 and February 12, 1999. The impeachment began October 8, 1998 and ended February 12, 1999, when President Clinton was acquitted by the Senate on both counts of impeachment. Of course, that wasn’t because investors were excited about the salacious tales of a White House intern and her lying boss. It was all about the money. The 3rd quarter GDP growth of 3.9% was officially released on November 24, 1998. However, the market is forward-looking, and the big money was expecting a solid number, after the rather tepid 2nd quarter growth of 1.6%. In 1973, GDP growth was 5.6%. Impeachment proceedings began on February 6, 1974 against Richard Nixon. Nixon resigned on August 9, 1974. The Dow Jones Industrial Average sank from 957 on Oct. 31, 1973 to 608 on September 30, 1974, for losses of 36.5%. However, Watergate wasn’t the cause of the Wall Street rout. It was the First Oil Shock. In October of 1973, the members of the Organization of Arab Petroleum Exporting Countries called for an oil embargo against the United States and other nations that supported Israel (including the UK and Canada). Global oil prices quadrupled, from $3/barrel to $12/barrel between October 1973 and March 1974. Oil was rationed. American consumers were asked to conserve gas and could only fill up their tanks on certain days. Unemployment jumped from 4.9% to 7.2%. 1974 was a recession year because oil prices squeezed our economy. The U.S. was very reliant on foreign oil in 1973, producing only 16.5% of global output. However, since 2009, the U.S. has been the world’s top natural gas producer, toppling Russia from the top spot. The U.S. became the No. 1 petroleum hydrocarbon producer in 2013, when it replaced Saudi Arabia (source: EIA.gov) So, why is there so much volatility in the stock market this year? Wall Street follows the economic indicators – the money. Though investors and business leaders care about policy (lower taxes, business-friendly rules), they are not invested in the individual who sits in the Oval Office. We don’t have an oil embargo to deal with, and the 2nd quarter GDP was actually quite good, at 3.5%. So, why did the market really drop? Here are 7 Real Concerns that Have Kept Stocks on a Rollercoaster This Year 1. Interest Rates. The Federal Reserve Board is predicted to raise interest rates again at their Dec. 18-19, 2018 meeting. Rising interest rates put pressure on housing, real estate and any corporation, individual or nation that has a lot of debt. Over half of the investment grade corporations in the U.S. are at the lowest rung, just one spot above junk bond status, according to Collin Martin, a fixed income strategist at the Schwab Center for Financial Research. The costs of servicing the U.S. debt is going up as well, adding to an already ballooning $21.7 trillion public debt. 2. The Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Every rate hike takes the data closer to an inversion. Learn more about yield curves in my blog, “5 Warning Signs of Recessions.” 3. Valuations (Bubbles) Alan Greenspan, Warren Buffett and Nobel Prize winning economist Robert Shiller have all been saying for over a year that stocks and bonds are in a bubble. Real estate prices are unaffordable in many U.S. cities to the denizens who live there. When prices outpace prospective buyers, they have to come down to attract an audience again. 4. Speculation. High frequency trading. Trading around the core. On Oct. 24, 2018, when the NASDAQ Composite Index dropped 4.4%, the second most active sell was the 3X NASDAQ bull fund. Yesterday, on November 12, 2018, the second most active sell was a NASDAQ index fund. The top-seller on both days was Advanced Micro Devices, a company that many traders have been using for fast profits due to the predictable volatility in the share price. This kind of speculation is called trading around the core. Apple was also one of the top trades on 11.12.18. Insider selling at Apple is in the hundreds of millions range. 5. Tariffs As Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab, told me in an interview last month, “Trade Wars almost always raise inflation and lower growth.” Click to read more of Liz Ann’s wisdom in my blog on ThriveGlobal. 6. Tax Cuts Boosted Earnings in 2018, But Won't in 2019. In 2018, most corporations were able to boost earnings with the tax cut. However, it will be more difficult to keep that growth apace in 2019, when there isn’t another stimulus to goose earnings. 7. GDP Growth GDP growth was 3.5% in the 3rd quarter, however 4th quarter 2018 GDP growth is predicted to be back in the high 2% range. Crystal Ball 2019 We won’t get the 4th quarter GDP growth results until January 30, 2019. Between now and then, there will be a lot of headlines about the great 3.5% GDP growth, which will allow the big money and the speculators to profit on those who are led by headlines. In other words, rollercoaster volatility is expected to continue, with dramatic run-ups and pullbacks. There could be more dramatic selling in January and February 2019 for a few reasons. One is that corporations don’t buy back their own stock in the two-week period before they release earnings. This quiet period has been when the markets have experienced the most dramatic downturns and selling. Valuation remains a problem for the “smart” money. Finally, corporations buying back their own stock has fueled this entire bull market. As interest rates rise, it becomes more expensive for corporations to do that. Considering the cost of money (higher borrowing costs) with the inflated stock prices (buying high), you have a proposal on the table that reasonable board members can no longer support. Don't be caught unaware. Don't be complacent. Don't rely upon others to do it for you. It's time to know what you own and be the boss of your money. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed