|

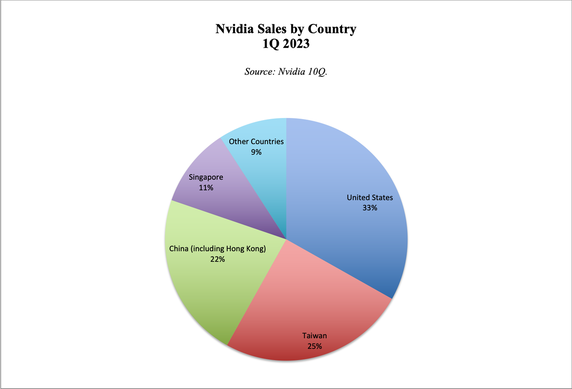

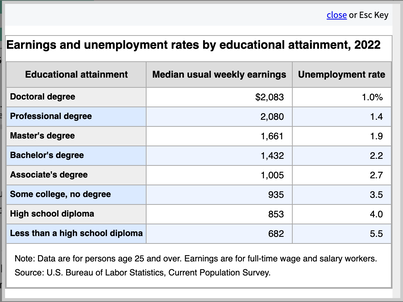

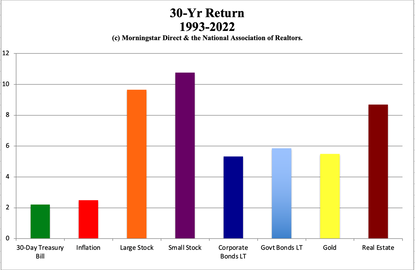

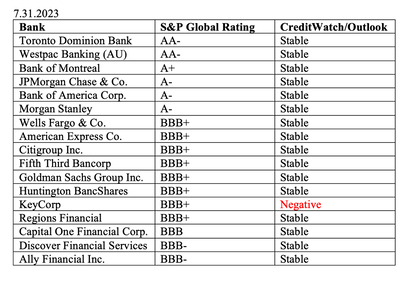

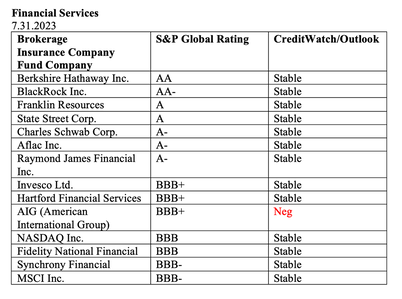

Artificial Intelligence and Nvidia’s Blockbuster Earnings Report. A new computing era has begun. Nvidia just had a blockbuster earnings report. You would have to be living under a rock not to have heard about it. However, before you jump in to AI-mania, there are quite a number of things that you want to be informed about, including the best way to capitalize on this exciting industry. Nvidia has become the poster child for AI, but it certainly is not the only company that has exciting prospects in this game-changing technological frontier. Below are a few of the things I will cover in this blog. All of them are essential to investing success in artificial intelligence. The Market Partners and Competition The China/U.S. Chip War Supply Chain Constraints Valuation Artificial Intelligence ETFs Opportunistic Marketers Who Prey on Popular YOLOs Pre-IPO Artificial Intelligence Unicorns to Keep on Our Radar And here are more details on each point. The Market Perhaps Judson Althoff, Microsoft’s EVP and Chief Commercial Officer, said it best when he described artificial intelligence’s role in technology as “remodeling every room in the house.” Satya Nadella, Microsoft’s CEO, said in the company’s 2Q 2023 earnings call, “Every customer I speak with is asking not only how, but also how fast, they can apply next-generation AI to address the biggest opportunities and challenges they face and to do so safely and responsibly.” Theoretically, AI pays for itself with the efficiency gains. Although many AI startup CEOs are complaining about the high price of GPUs that are in very short supply. Partners and Competition Sundar Pichai, the CEO of Alphabet and Google, mentioned Nvidia twice in the company’s 2Q 2023 earnings call. Nvidia definitely has a competitive lead in GPUs, which are getting a lot of publicity because of the GPU shortage happening right now. However, CPUs and TPUs are key as well, something that AMD, Google Cloud and Intel have a solid foot in. Both AMD and Intel plan to have a larger presence in GPUs. AI is rolling out across every nook and cranny of business, and you’re likely to hear the term multiple times in most company’s earnings calls, even those that are not in the technology industry. AI companies specialize in various different niches, from Veritone’s leadership on facial recognition and law enforcement, to Ambarella’s role in the advanced driver assistance system. The GPU shortage has got Silicon Valley on its head. Innovation typically comes from the small companies. However, AI startups are having difficulty getting GPUs at a price they can afford. Even the big technology companies, such as Microsoft, Google, Meta, and AWS, are having to find workarounds. Wired is reporting that Microsoft is offering financial incentives to customers who aren’t using GPUs they reserved. Nvidia is the clear GPU market leader, with 60-70% of the current market. However, Nvidia’s chips are made in China, and more than half of Nvidia‘s revenue comes from Asia. In the 2nd quarter, the company was successful in ramping up supply to start meeting the surging demand. Nvidia’s record 2Q 2023 revenue of $13.51 billion was more than double the revenue from last year. However, the China/U.S. Chip War has been escalating, and Nvidia’s CFO is warning that the situation could have a negative impact “over time.” The China/U.S. Chip War Taiwan Semiconductor makes the chips that Nvidia sells. (The Netherlands company ASML makes the machine that can manufacture wafers with imaging at small resolution.) However, the interconnected global economy of the early 21st Century is unraveling. The U.S. has banned the export of certain U.S. semiconductors, alleging national security reasons. China banned the U.S.-based semiconductor company Micron Technology citing the same concern (and in retaliation). Supply Chain Constraints China has imposed export controls on gallium and germanium, and there is a fear that rare Earth minerals could be next on the chopping block. On July 23, 2023, the Semiconductor Industry Association released a statement calling “on both governments to ease tensions and seek solutions through dialogue, not further escalation.” The SIA also urged the White House “to refrain from further restrictions until it engages more extensively with industry and experts to assess the impact of current and potential restrictions to determine whether they are narrow and clearly defined, consistently applied, and fully coordinated with allies.” Nvidia is forecasting another blockbuster earnings report for the 3rd quarter of 2023, with $16 billion in revenue (compared to $5.93 billion last year). However, the restrictions on exports to China are important, even if the impact isn’t in the near term, because investors have valued Nvidia based on what they think the company will be worth in a few years rather than what the current revenue and net income support. (A lot of analysts’ questions in the 2Q 2023 earnings call were centered on the outlook, drilling down deep to see if the company can really support the current Shoot the Moon market valuation.) Valuation Nvidia‘s net income was only $4.4 billion last year. The company is valued at $1.14 trillion. Part of the reason the share price keeps rising is that the company is buying back its own stock. Nvidia spent $3.4 billion in share repurchases and dividends in the 2Q 2023. Nvidia still has $29 billion authorized to spend on buybacks. There is no doubt that artificial intelligence has sparked a new computing era, and that Nvidia is in a great seat to capitalize on this. At some point in the future, Nvidia’s sales and net income may justify a trillion dollar valuation. However, there will be a great deal of obstacles to get through between now and a few years from now, including fierce competition, the chip wars, global tensions and wars, a potential economic slowdown (or even recession), export restrictions, supply chain disruptions and more. Having said that, there is a way to invest in artificial intelligence and Nvidia that tempers out the volatility of investing in any one stock. Artificial Intelligence ETFs iShares offers an artificial intelligence ETF (symbol: IRBO). This fund invests in Nvidia, AMD, Intel, Google, Microsoft, Ambarella, and dozens of other artificial intelligence companies. While Nvidia is the leader in GPUs, it is also one of the most overvalued companies in the fund. Other companies serve different markets, and offer a better valuation. The fund levels out the risk and the volatility – something that is very important if you don’t want to be babysitting an individual company in your portfolio. If you do not have artificial intelligence in your wealth plan yet, you might consider taking a dollar cost averaging approach over the next year for filling up a slice or two. The reason for that has to do with macro concerns (recession, supply chain disruption, chip wars) and overvaluation of the companies themselves. The potential for this industry now and in the coming years is definitely the hottest on Wall Street. If you’d like to receive an updated Artificial Intelligence Stock Report Card, just email [email protected] with Artificial Intelligence Stock Report Card in the subject line. Opportunistic Marketers Who Prey on Popular YOLOs Whenever something is making headlines, you have to have your guard up to fend off opportunistic, marketing predators, who prey on YOLOs. Over the past few decades, I have seen a great deal of stock scams, riding the waves of crypto-mania, cannabis, Gamestop and more. We’re starting to see a large number of AI snares right now. I’ll be discussing one in particular in my videoconference on Tuesday. Be sure to tune in. Email [email protected] with Videocon in the subject line, if you’d like to join us live. Otherwise, you can watch it back at Youtube.com/NataliePace. Pre-IPO AI Unicorns to Keep on Our Radar While I was researching this article, the names of these pre-IPO AI companies came up: Cohere, Jasper, Typeface, CoreWeave, Clearview AI, Modular. During disruption periods, such as we’re seeing with AI today, there can be a plethora of companies that crop up. Many bite the dust within a few years. However, the few that survive tend to become the multinational giants of tomorrow. Bottom Line Artificial intelligence is hot, hot hot (and can be at least one hot slice in our wealth plan). However, most of the popular names that you’ve heard about, including Nvidia and ASML, are already trading at very elevated prices. Buying high, hoping to sell higher (or hold for a few years while the company tries to live up to its potential) can be a losing plan for years, if not decades. We’ve seen Tesla sink from a trillion dollar valuation to $325 billion over the 12 months. (The company is currently valued at $757 billion, still down -25% from the trillion dollar valuation.) Any one of the risk drivers outlined above could cause that to happen to Nvidia. An easier way to invest in Artificial Intelligence is to purchase a fund like IRBO as one or two hot slices of your well-diversified plan. You can, of course, purchase a hot company like Nvidia. However, it’s important to have an exit strategy, and to observe the tried and true, “Buy low, sell high,” mantra. Join us at our October 7-9, 2023 Financial Freedom Retreat to learn more about what a well-diversified plan looks like, and how to develop your entry and exit strategies for hot individual companies, like Nvidia. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com. FYI: We are currently hosting our Summer Sweepstakes. The grand prize is a seat at a retreat (value $895). We are also offering coaching and other prizes. Everyone who enters can receive a gift of the free video coaching series of their choice: debt reduction, The Thrive Budget or 21 Days or Prosperity Coaching. Entering is as easy as emailing [email protected] with Sweepstakes in the subject line. Sweepstakes ends 8.31.2023. Submissions must be received no later than midnight ET 8.31.2023. Winners must use their gifts by 12.31.2025. Winners will be notified on or before Oct. 31, 2023.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Biotech in a Post-Pandemic World In 2020, the pandemic put a halo over a great deal of biotechnology companies, particularly those that were racing to find a vaccine. Moderna was the most exciting company in that period, with sales that jumped from $60 million in 2019, to $803 million in 2020, and then soared to $18.47 billion in 2021. Last year was just as robust for Moderna with revenue of $19.26 billion, as the vaccine continued to be distributed around the world, and boosters were administered. Today, however, we are all weary of the pandemic. Whereas a great deal of us took the vaccine and the first few boosters, today, fewer of us are interested in getting jabbed, when the virus keeps mutating and vaccine efficacy can be questionable. (Moderna has some good news on this front. Keep reading.) Not surprisingly, Moderna and other pandemic stocks’ earnings have been negatively impacted. Share prices are down. What lies ahead for biotech? Which companies are doing well? Is there hope for any of the pandemic high-flyers to soar again? A Biotechnology Fund Before we dive into the details of a few individual companies, let’s discuss the safest way to play this industry – with an ETF. The benefit of a fund is that you have exposure to the biotechnology industry without the volatility of investing in individual companies. As we stress in our books and retreats, individual companies require babysitting. You must buy low and sell high. You must understand how to be forward thinking and how to evaluate what’s going to happen rather than trade on the headline of something that has already occurred. (When you wait for the headlines, you’re late. Professional investors, who drive the market, are forward-thinking.) With the biotechnology fund, it can be more of a “money while you sleep” approach, which is not a Buy & Hope strategy as you do have to wake up at least once a year. Our pie chart system with regular rebalancing (1-3 times a year) prompts us to capture gains when biotechnology shoots the moon, and add more at a lower price when the fund price plunges down to Earth again. This system works in bull and bear markets, particularly when you are properly diversified and know what is safe in a Debt World (all things we teach at our online Financial Freedom Retreat). The iShares Biotechnology ETF (symbol: IBB) hit a high of $173 on August 31 of 2021. Since then it has dropped as low as $113 and is currently trading at $125. This is still relatively high on the 10-year price chart, especially as we head into what is traditionally the worst performing month of the year, September. Therefore, rather than just filling up the entire slice, we might take a dollar-cost-averaging approach. Think of it as a Stock Layaway Plan that takes about 18 months to completely fill in. We discuss this and more in greater detail at our online Financial Freedom Retreat, which is scheduled for October 7-9, 2023. Biotechnology: Pandemic vs. Endemic If we look at the Biotechnology Stock Report Card, it’s really a tale of pandemic vs. endemic. Almost all companies that soared during the pandemic, whether it was a vaccine, booster or a COVID test, are down in year-over-year sales and share price, as well. (Regeneron is still doing pretty well, with sales growth of about 11% year over year. However, the share price is high.) The pandemic companies are all switching focus to chronic disease treatments and/or a flu vaccine. A lot of the treatments are in trials, with the goal of getting an FDA approval as quickly as possible. Companies such as Gilead, Johnson and Johnson, and Inari Medical, that specialized in endemic treatments, are faring better. However, most of these companies are trading at expensive prices. Johnson and Johnson has a price-earnings ratio of 35, which is far too rich for sales growth in the single digits. Inari is still cash negative and early-stage. Its price to sales ratio is 7.5, which is extremely high. This is another reason to go easy on filling up our biotechnology slice, rather than just buying the entire amount immediately. The Volatility of Biotechnology Should biotechnology be one of your hot slices? Biotechnology is inherently a boom and bust industry. Companies will soar on an FDA approval, and sink or drown if their drug is found to cause terrible outcomes. Diversified biotechnology companies can survive. As just one example, in 2006, Merck’s Vioxx drug was costing the company billions in class action lawsuits. (Merck eventually settled the lawsuits for about $5 billion.) In May of 2006, Merck was successful in getting the FDA to approve Gardasil, an HPV vaccine for adolescents and teens. Merck began a very aggressive marketing and lobbying campaign, trying to make that vaccine mandatory and to convince parents to immunize their kids immediately. (The company has come under scrutiny for the campaign.) Here again is where a fund can level out the risk. Smaller companies, such as Moderna was in 2019, tend to have the most exciting breakthroughs and upside potential. They carry much more risk, due to their more limited pipeline and government access. Large caps like Amgen stabilize the fund. The IBB ETF features almost all of the companies listed on our Biotechnology Stock Report Card, including some innovative small caps. (Email [email protected] if you’d like us to email the Biotechnology Stock Report Card to you.) Pandemic Biotechs So is there any hope that these pandemic biotechnology companies have other applications for their patents or FDA approvals in the pipeline? Vir Biotechnology Vir is working towards a world without infectious disease. Their board is impressive with directors who include Janet Napolitano, and executives from Biogen, Bayer, Harvard, Johnson and Johnson, Bristol-Myers Squibb, the Bill and Melinda Gates foundation, MIT, and Amgen, as well as some Venture Capital board seats. Vir has trials going for hepatitis, influenza, HIV, COVID-19, RSV and HPV lesions. With the exception of their COVID-19 treatment Sotrovimab, which was initially authorized on an emergency basis for high-risk patients of Covid-19, the other treatments are still in phase 2 or earlier. The problem with Sotrovimab was that on April 5, 2022, the U.S. CDC determined that the drug would not be effective against the Omicron variant, and therefore rescinded its emergency authorization. Vir had yet another setback last month, when its trial for prevention of Influenza A didn’t pan out. Despite the Sotrovimab and flu setbacks (which can happen in this volatile industry),Vir has had a very important and swift track record with its antibody treatments, with both Ebola and Covid. As with all biotechnology companies, an FDA approval on one of its drugs could send the stock to the moon, just as the FDA revoking the emergency authorization for Sotrovimab sank the stock. Vir Biotechnology had $1.9 billion in cash and cash equivalents as of June 30, 2023. Moderna Moderna is still producing COVID vaccines for new variants. However, the company is also pivoting to flu vaccines, RSV and therapies for cancer, melanoma and other illnesses. Many of these are in Phase 3 trials, with updates expected soon. In the Q2 2023 earnings call on August 3, 2023, the Moderna executives projected that full year product sales would be in the range of $6-8 billion, which is about 60-70% lower than 2022 revenue. Fortunately, the most recent trial data is showing a “robust immune response” for the most widely circulating variants of the COVID virus. While this is unlikely to bring sales anywhere close to the 2022 revenue of $19.26 billion, it could help the company meet or exceed the upper bound of its forecast. Investors will be focused on an update of its Influenza B flu vaccine, which is projected to happen between now and the end of September. The Phase 3 trials have begun. Lessons Learned On May 18, 2021, we named Moderna the 2021 Company of the Year. At the time the company was trading at $150/share. In that blog, we stressed that biotechnology is a very volatile industry, and that whenever we invest in any individual company, it is very important to buy low and sell high. By September 10, 2021, Moderna was trading at $500 a share, for a return of over three times the investment. That was an excellent ROI for anybody following the Buy Low, Sell High system that is important to use for individual companies. We sent out an email alerting those on our mailing list of these gains. On November 10, 2021. We warned on Twitter that Moderna was going to have some noteworthy challenges going forward. At that point, the share price was still showing a 57% return, at $235/share. There are many traps that can trip investors up. If someone read the blog late and invested at a price that was higher than it was when we featured the company, then they might be missing the “buy low” part of the equation. (Always check the date of the blog, and the price at the time it was published. Price matters!) When a stock soars, if you don’t already have an exit strategy, then it’s easy to think that it will just keep going higher and higher. Then on Nov. 10th, even with great gains of 57%, because it is no longer the eyepopping return of September 10th, some investors ignored the warning and thought they would just hang on for the next run (rather than looking at the drivers that will determine the share price, which we were warning about!). What some people learn is that investing in individual companies requires more time and energy than they wish to spend, and that funds are a better match. Setting up your wealth plan with 10 diversified funds and rebalancing once a year works great, and requires very little time to do. (A lot of our volunteers do their rebalancing at a retreat.) Daily Money Tips and Updates It used to be that my daily money tips were best accessed on Twitter. Twitter has become a lot more glitchy recently. We are more active on Instagram these days, though we still update both channels, as well as LinkedIn and Facebook. Be sure to subscribe to our YouTube.com/NataliePace channel as well, where all of my free videoconferences and video coaching series are hosted. Bottom Line Biotechnology is a volatile sector. This industry was very popular with investors when the price was high, during the pandemic. Today, there isn’t as much interest, even though the price is trading at a discount of -28%. However, the flu, cancer, Hepatitis, HIV and other viral and immune-compromised diseases aren’t going away. When one or more of the biotechnology companies develops a winning treatment that is in high demand, investors pile in in droves. We want to be early investors, in order to capitalize on that headline and wave. It’s important to have a rebalancing plan that isn’t riding on emotions, but is instead prompting us to do what we should do – to buy low and sell high. If you already have a hot slice of biotechnology, then our pie-chart strategy with regular rebalancing does that for us. If you’d like to add a slice of biotech, then consider using our Stock Layaway Plan. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com. FYI: We are currently hosting our Summer Sweepstakes. The grand prize is a seat at a retreat (value $895). We are also offering coaching and other prizes. Everyone who enters can receive a gift of the free video coaching series of their choice: debt reduction, The Thrive Budget or 21 Days or Prosperity Coaching. Entering is as easy as emailing [email protected] with Sweepstakes in the subject line. Sweepstakes ends 8.31.2023. Submissions must be received no later than midnight ET 8.31.2023. Winners must use their gifts by 12.31.2025. Winners will be notified on or before Oct. 31, 2023.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Win a Seat at the Retreat Everyone is a winner in our 2023 Summer Sweepstakes. (See the full list of prizes below.) The Grand prize is a complimentary seat at an Online Financial Empowerment Retreat, valued at $895. Simply email [email protected] with the subject line Enter Me in the Summer Sweepstakes! You will be automatically entered to win. If you’d like to up your odds, then write a review of Natalie new book, The Power of 8 Billion: It’s Up to Us. Send us a link to your review on Amazon, and we’ll enter you 10 more times in the Sweepstakes. The Kindle version is available for just $2.99. The print edition can be purchased for $11.99. Act now. Your email and/or book review must be received by August 31, 2023. Winners will be notified on or before Oct. 31, 2023. List of Prizes Retreat Seat (value up to $895). ½ off Retreat Seat (value $447.50). 2nd opinion on your current budgeting and investing plan (value $1,800) Three 50-minute private prosperity coaching sessions (value $1,500). 50-minute private prosperity coaching session (value $600). Autographed print edition of The Power of 8 Billion: It's Up to Us Everyone is a Winner Every person who enters the sweepstakes can choose to receive: 1. A complimentary 21-day prosperity video coaching program: 21 days to a healthier, wealthier, more beautiful you, or 2. A 21-Day Sustainability Videoconference series, where you can learn how to save thousands of dollars annually with smarter big-ticket choices, or 3. A 12-Day Thrive Budget Videoconference series, or 4. A 7-Day Debt Reduction Videoconference series. Simply tell us which Free Gift you wish to receive. It’s that easy. Thank You! Your presence in our community, with a dedication to financial literacy and sustainability, means the world to us. We work hard to keep you informed and empowered, and you help us to spread the word of this important information. Thank you so much for your review of The Power of 8 Billion: It’s Up to Us! Follow Natalie on Instagram, Youtube, Spotify, Substack, Facebook and LinkedIn to stay informed and for daily money tips. Sustainability Adventures If you want to take your prosperity, abundance and sustainability training to a much richer level, join Natalie Pace at an exclusive adventure in a royal manor house in Cornwall, England. Learn more at the flyer (link below). The cost is much more affordable than you might imagine, while the experience itself will be life-transformational. FYI: Some of our best testimonials come from sweepstakes winners! Melanee won a seat at a retreat, and within just a few years after attending and playing the Billionaire Game on the beach, found herself taking pictures with Bill Gates at a Berkshire Hathaway meeting. Imagine what magic can happen if you join us at the Royal Manor House Retreat! Sweepstakes ends 8.31.2023. Submissions must be received no later than midnight ET 8.31.2023. Winners must use their gifts by 12.31.2025. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The rules are definitely stacked in the favor of those who are at the top. People don’t get rich or stay rich by accident. Most of them employ the legal means and wealth secrets listed below -- which anyone of us can adopt to live a richer life. While some nouveau riche (particularly athletes and lottery winners) fly high and crash, others can completely transform the trajectory of generations to come. (A focus on education has made Asian Americans the top U.S. household income earners.) And that brings me to Wealth Secrets #1: Education is the Highest Correlating Factor with Income. Here are the 10 Secrets We’ll Cover: Wealth Secrets #1: Education is the Highest Correlating Factor with Income. Wealth Secrets #2: Investing is the Key to Wealth. Wealth Secrets #3: Never Confuse a Bull Market With Wisdom. Wealth Secrets #4: Stop Making Everyone Else Rich. Wealth Secrets #5: Royals Don’t Buy Their Own Castles. Wealth Secrets #6: Lower Your Tax Burden. Wealth Secrets #7: Billionaires Sell Insurance. Wealth Secrets #8: Stop Making Exxon Mobil and the Automakers Rich. Wealth Secrets #9: Sustainability. Wealth Secrets #10: Protect Your Wealth From Financial Predators. And here is additional information on each secret. Wealth Secrets #1: Education is the Highest Correlating Factor with Income. As you can see in the Education Pays graph above, higher education almost guarantees employment at the highest income level. However, college isn’t for everyone. And if you graduate with an unemployable degree (absenteeism, basket weaving) and a boatload of debt, then the college experience that we dream of will turn into a nightmare of indentured servitude. In The ABCs of Money for College, you’ll learn how to: * Get a better degree for up to half the cost, * Guide (without wrangling) your child toward the career that is right for her, and * How to save and invest to cover the costs of education, trade school or even your kid’s 1st home. Parents: start the process when your kids are born. Money and mindset both compound. Wealth Secrets #2: Investing is the Key to Wealth. Earned Income is Taxed at a Higher Rate Than Passive Income You’ll never get rich at the day job, even if you’re saving. As you can see in the chart below, investing, not just saving, is the pathway to wealth. If you put 10% of your income into tax-protected retirement accounts and that earns a 10% gain, you’ll become a millionaire, even if you only earn $40,000/year. If you only save and get almost no return, then you’ll never get there. Also, rich people don’t put their money in jars. They max out their tax-protected retirement plans, including their employer 401k or RSP, their personal IRA or TSFA and their Health Savings Account. (There are advantages to having your own IRA and HSA, in addition to your employer-based retirement plan.) People who master life math, including budgeting and investing, are going to be more successful than those who have blind faith that someone else is doing everything for them. Why? Because managed wealth plans do what the market does. Additionally, almost everything that we invest in is sold to us by a commission-based broker, who can make money even if the asset isn’t right for us (or loses money). We’ve been in a secular bull market for so long (since March of 2009) that most people are not aware of Money Secret #3. Wealth Secrets #3: Never Confuse a Bull Market With Wisdom. As of August 12, 2023, stocks had made a decent recovery from the 2022 losses of -20% in the S&P500. When stocks are high, it’s easy to be complacent. Most people don’t check their statements regularly enough to be aware of the losses in bonds – the “safe” side of our wealth plan, which is supposed to keep our principal intact. (Long-term government bonds lost even more than stock last year, at -26%.) Why is it important to know what we own now – near the market high for stocks? Because 21st Century recessions have cost most investors more than half of their wealth, and then take years to crawl back to even. Using a bull market to recover losses is riding a Wall Street rollercoaster. As we get closer to retirement, we can’t afford to take on that kind of risk. A simple plan of proper diversification, based upon our age, and rebalancing at least once a year to capture gains and reallocate/align our plan is as easy as a pie chart. This plan earned gains in the Great Recession and the Dot Com Recession, when most people lost more than half of their wealth. That is why Nobel Prize winning economist Gary S. Becker wrote the forward to my 1st book, writing, "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Our next online Financial Freedom Retreat is Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 now to register for this life-transformational weekend. Wealth Secrets #4: Stop Making Everyone Else Rich. The very wealthy people I know have the “stop making everyone else rich” mantra on auto-pilot for almost everything they do. They never finance anything, unless it is in their best interests. As an example, Wall Street was on a borrowing spree from 2009 through 2021, when interest rates were so low that borrowing felt almost free. Many firms, including a lot of banks, borrowed so much that their credit score fell to the lowest rung of investment grade, and they could still borrow at 5% interest or less. As a result, more than half of the S&P500 is at or near junk bond status. That is very different from the average American who has no access to the capital markets and borrows on a credit card, at 25% or higher interest, when they can’t tap their home equity. However, there are many other ways that very wealthy people keep the money in the family instead of making the landlord, the debt collector, the utility company, the insurance salesman, the gas station, the automakers, etc., rich at their own expense. Many of them are outlined in the Wealth Secrets below. Wealth Secrets #5: Royals Don’t Buy Their Own Castles. The Prince and Princess of Wales’ official residence is Kensington Palace, which has been in the Royal Family since 1689. Of course, most of us don’t have castles lying around to give each child to live in. However, think of how much money is flying out of the family wealth when every adult lives in their own apartment or small house. Getting a bigger place typically means much larger common areas and more luxurious boudoirs, with a lower cost per occupant. There can be additional savings on utilities, WIFI, streaming services and even childcare. Lots of folks in the U.S. have gotten this memo… Multigenerational housing is more widespread today than it was in the Great Depression. 25% of U.S. adults ages 25 to 34 reside in a multigenerational household, up from 9% in 1971 (source: Pew Research). Of course, this was prompted by $1.6 trillion in student loan debt and housing that is largely unaffordable. However, it is also a wealth secret that we should always be mindful of. Wealth Secrets #6: Lower Your Tax Burden. There are many tax benefits and policies that wealthy people all over the world are aware of. Though the rules are different in each country, there are typically work-arounds that put more profits in our corner, and less in the government’s kitty. In general, here are some of the areas that you want to investigate in your area…

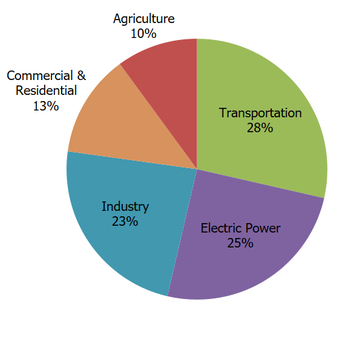

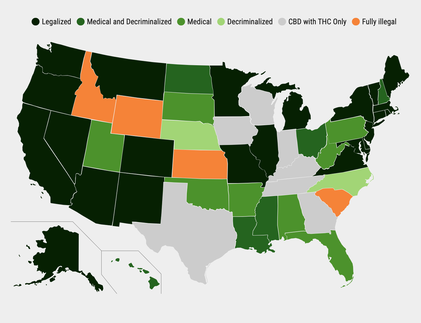

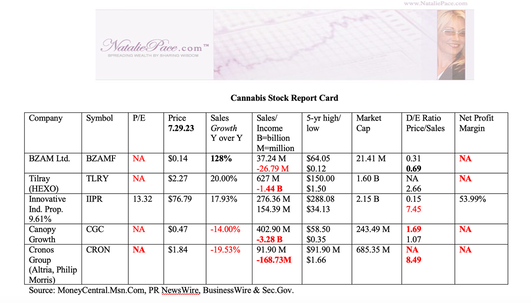

Wealth Secrets #7: Billionaires Sell Insurance. Warren Buffett doesn’t buy insurance. He sells it. As we age, the policy terms out, or becomes more expensive with a lower payout. Also, it’s like renting. If you quit paying, you get evicted. Money you invest in owning your own home could mean that you have lodging free and clear when you retire, while your retirement plans can offer income (instead of being another bill to pay in desperation to try and keep a hoped-for payday alive). Your HSA can pay for medical costs not covered by your Medicare. One of the best things you can ever do for your kids is to fund their college dream or start their Dependent IRA early (when they get their 1st job). Sadly, I’ve known a lot more people who lost their insurance policies after decades of faithful payments, or who paid double or triple what the policies were ultimately worth, than those who became rich when a loved one died. Healthy Americans who are paying an arm and a leg for health insurance can save thousands annually with a Health Savings Plan and high-deductible insurance plan. The HSA is there if something terrible happens, and you get an annual tax credit for contributing to it. If you don’t use the money in your HSA, you can start investing it, and it acts like a retirement plan. HSAs are a great long-term health care strategy because health care costs are the biggest expense in retirement in the U.S. If we don’t have to purchase supplemental medical insurance, but instead have that covered in our personal HSA, we’ll be in a better position when we go on a fixed income, which is often much lower than we earned in our career. Check the details on the deductions that are being taken out of your wages. You might be spending a lot more on a low-deductible health insurance plan than you realize. Wealth Secrets #8: Stop Making Exxon Mobil and the Automakers Rich. The average person spends $8000 or more on transportation each year – on each car. That includes the car payment, insurance, fuel and maintenance. You can cut the fuel costs in half with an EV (more if you power with your own solar), while almost eliminating the maintenance costs. Some families find that switching out a bike for the car saves even more – even considering that you might occasionally rent a car or take a ride-share. Cities, like Amsterdam, have eliminated traffic jams, congestion, pollution and CO2 by favoring bikes over cars. In general, most Europeans have a CO2 footprint that is about 1/3 of what Americans, Canadians, Australians and those in the Middle East have – largely due to single-occupancy vehicles being predominant in the latter, while subways and shared roads are more normal in Europe. As a former Mercedes owner in a car-centric city (Santa Monica), I know that giving up a car can feel vulnerable. However, as Santa Monica Mayor Ted Winterer told me in 2019, his family of four adults has only one car and five bikes. In 2017, he and his wife spent about $2000 on ride-shares, as compared to the $7,500 or more average annual cost per car. Remember: getting rid of your car actually equates to a better lifestyle. If you’re riding a bike or walking more, you’re promoting personal health! Wealth Secrets #9: Sustainability Sustainability is fundamental to sustained success – monetization, as well as conservation and preservation. Alnwick Castle is better known as Hogwarts. Millions of Harry Potter fans visit each summer. You can have champagne high tea at Highgrove Gardens, a private home of King Charles III. In addition to earning income on their land, regenerative agriculture, clean energy, shared roads and lowered CO2 footprints are equally emphasized in the Royal Family. Poundbury, an urban extension to Dorchester, in Dorset, England, was designed to be bike/pedestrian friendly, and is powered by anaerobic digestion. The Prince of Wales is carrying on his father’s (King Charles III) commitment to healing our planet with The Earth Shot Prize. Wealth Secrets #10: Protect Your Wealth From Financial Predators Did you get the memo that Virgin Orbit ceased operations on April 4, 2023? Yet Forbes still estimates Richard Branson’s worth to be $3 billion. One of the biggest mistakes Main Street entrepreneurs make is not properly protecting their wealth from their business ventures. Maxing out our retirement plans is key, as that money is protected from almost everything – including personal bankruptcy, home foreclosure and business creditors. However, setting up the proper business accounts is also important – and keeping those accounts separate from our personal wealth. The business should stand on its own, rather than draining the wallets of the founder or Friends and Family. (Many people launch their businesses on credit cards. Some cross-collateralize their homes, or make ill-advised promises to potential investors.) According to BLS.gov, 18% of small businesses fail within their 1st year, 50% within 5 years and 65% by their 10th year in business. While being optimistic and continuously solving problems are essential to launching a business, it is also important to set things up so that if the statistics prove right, we don’t lose our home. Richard Branson didn’t. Many successful business and political leaders have had multiple business failures throughout their careers. Bottom Line Now that you know a few wealth secrets, it’s time to be brave enough to kick old habits and embrace a better plan. My complimentary prosperity coaching series can help, as can reading my books (access links on the home page at NataliePace.com). Email [email protected] to receive your 21-day video coaching program free. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. What Happened to Cannabis? If we want to know why a company is in trouble, all we have to do is ask the customers. Since I don’t smoke weed, but had the opportunity of having lunch with someone who does, I asked his opinion. If weed is becoming more legal every day, dispensaries are on every corner in major cities, and states are decriminalizing or legalizing at a noteworthy pace, why are cannabis companies trading in the penny stock range, down 95% or more from their highs of 2018? As you might guess, weed is still very popular. However, what I learned from my friend is that you will pay twice as much and get carded at a dispensary… or you can have it delivered, pay half the retail price and remain anonymous. The black market is the biggest competition to cannabis brands. They know this. Cannabis Companies Scramble to Stay Alive When valuations soared and capital was easy to access and cheap, cannabis companies went on a buying spree. Over the past year, the elusive “pathway to profitability” became the only way to raise funds to survive. HEXO, the number one cannabis brand in Canada, was rescued (purchased) by Tilray. Tilray has also invested a 65% stake in MedMen. The company is expanding into craft beer and spirits. Sweetwater Brewing, Montauk Brewing and Breckenridge Distillery are all in the Tilray tribe. Manitoba Harvest is offering Hemp Yeah! Granola at Whole Foods. As CEO Irwin Simon said in the company’s July 26, 2023 earnings call: Tilray is not building its entire business model around the eventual promise of legalization. But, rather unlike others in our sector, we are diversifying beyond cannabis by building a strong balanced portfolio consisting of successful, profitable stand-alone beverage alcohol and wellness brands in the US, along with a strategic distribution business in Europe, each with high growth opportunities in their own right. Legalization will happen one day, but we're not waiting for it. We're not dependent upon it. Canopy Growth was attempting a similar strategy with their BioSteel sports nutrition unit. However, in their June 22, 2023 earnings release, the company revealed that Biosteel had been overstating revenue and paying bonuses to insiders based upon those erroneous numbers. With an annual loss of -$3.3 billion in fiscal year 2023 and fuzzy math with self-dealings in one of their major brands, Canopy Growth is in a restructuring mode, trying to conserve their $783 million in cash and short-term investments (as of March 31, 2023). Revenue was down -21% in FY2023 from the prior year. Canopy will report their earnings for the quarter ending June 30, 2023 on August 9, 2023 at 5:30 ET. Meme Stocks, YOLO and Shoot the Moon Cannabis stocks have enjoyed Shoot the Moon meme stock YOLO rocket ship rides, once in September 2018 before Canada legalized weed, again in early 2019, and then once more in January of 2021, after the U.S. House of Representatives voted to decriminalize cannabis on Dec. 4, 2020. (The MORE Act stalled out in the Senate and was never signed into law.) Tilray traded as high as $300/share in September of 2018. Shares are currently at $2.37. In between these headline-driven events, pot stocks crash and burn. When a major country looks like it’s going to legalize weed, everyone jumps in and pushes the price far above rational valuations. The spreads between the top and the bottom are just too severe to use limit orders. (The brokerages won’t let you put the price high enough to capture a Shoot the Moon launch.) Investors have to keep their radar up for major news, have a stock app on their smart phone, consider price alerts and move quickly when the run-up begins. There is a lot of work involved in profiting on YOLOs like cannabis (and crypto), and one must endure long winters of discontent before halcyon days arrive again. Both the U.S. and Germany have flirted with legalization, and both countries are stalled out in the politics of the matter. Germany is moving forward with a plan to legalize for personal use, and there might be news on that in 2023. Meanwhile, states keep decriminalizing, Tilray keeps selling beer, whiskey and hemp granola, and the black market dealers rake in more profits than the dispensaries… Current Valuations Since most of these companies are still cash negative, a price/sales ratio can be a helpful valuation tool. BZAM (formerly The Green Organic Dutchman) has a very low price/sales ratio, while Tilray’s is reasonably low, when considering their expected growth in sales this year. BZAM’s year-over-year revenue growth is outstanding, at 128%. However, the company’s C-Suite struggles, cash burn and penny stock status make it very high risk. Innovative Industrial Properties and Cronos are very expensive when using the price to sales valuation tool, at 7 and 8, respectively. Canopy Growth could be a bargain. However, given its struggles to restructure, the Biosteel debacle and the skin-singeing cash burn, the company is not winning the war against the black market, or winning over the sports nutrition customer. Meme Stock Strategies It’s tough to catch a shooting star. By the time you see it, it’s already fizzled out over the horizon. It’s a reminder that individual companies, and certainly meme stocks, are casino bets, not a nest egg strategy. We should gamble with money we’re willing to lose. Also, they require babysitting, and a knowledge of what makes them take off in the first place, so you’re in the right place at the launch. For cannabis, launches tend to coincide with big news on country legalization – something that hasn’t happened since the failed U.S. attempt in late 2020. Also, meme stocks are definitely not HODL (Hold on for Dear Life), nor is Buy & Hope a good nest egg strategy. In today’s world, it’s important to take profits early and often in individual companies – to adhere to the tried and true Buy Low/Sell High mantra. Buy & Hope in our nest egg strategy only works in a bull market. When recessions hit, everything can tank by 50% or more overnight, and take years to crawl back to even. (Stocks dropped over -35% between Feb. 19 and March 23, 2020. The Dow Jones Industrial Average plunged 55% in the Great Recession; while the NASDAQ sank an astonishing 78% in the Dot Com Recession and took 15 years to recover.) So, with our nest egg, apply Modern Portfolio Theory, regular rebalancing and a Capture Gains mindset (something we teach at our Financial Freedom Retreats). Since there isn’t a cannabis fund offered by a fund company with a stellar credit rating, and we therefore must pick individual companies, we have to adopt a hybrid approach when including cannabis in our plan. Bottom Line Tilray is attracting a lot of bullish posts on Reddit and X (Twitter) – much more than Canopy Growth, BZAM (formerly The Green Organic Dutchman) or Cronos. However, there has been so much shorting action on the stock, that it hasn’t been able to break out. In addition to being the favorite on the bulletin boards, it’s also the best-looking company on the Stock Report Card (although the longshot, off the boards penny stock BZAM has much higher year-over-year revenue growth). The management team at Tilray seems to be making all the right moves with its M&A strategy (unlike Canopy Growth). At some point, any of the Tilray brands could start making headlines, or perhaps Germany will move forward with its plan for legalized personal use of cannabis this year. Either way, it appears that Tilray’s future is starting to look brighter, and is well-positioned should that supernova event occur. Full disclosure: I own Tilray and BZAM stock. Join us for our October 7-9, 2023 online Financial Empowerment Retreat. Register with friends and family to receive the best price. If you’re interested in private coaching or an unbiased 2nd opinion before then, reach out now. September is often the worst performing month of the year, so it’s a good idea to be ahead of the headlines. Again, feel free to email [email protected] or call 310-430-2397. Our unbiased 2nd opinion details exactly what you own, with color codes to show you what’s toxic in your portfolio, what’s great, and what should be better diversified. You will have a blueprint of how to get safe, protected, hot and diversified. Why is it unbiased? We don’t sell financial products. We have no incentive to sell you something that might lose money or that you don’t need. Our business model is financial education, providing the news, information, and education that Main Street investors need to thrive and live a richer life.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed