|

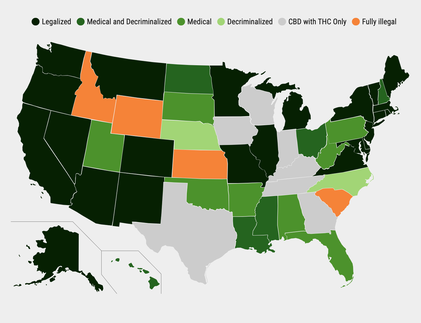

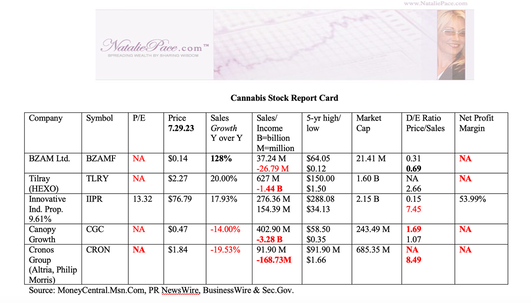

What Happened to Cannabis? If we want to know why a company is in trouble, all we have to do is ask the customers. Since I don’t smoke weed, but had the opportunity of having lunch with someone who does, I asked his opinion. If weed is becoming more legal every day, dispensaries are on every corner in major cities, and states are decriminalizing or legalizing at a noteworthy pace, why are cannabis companies trading in the penny stock range, down 95% or more from their highs of 2018? As you might guess, weed is still very popular. However, what I learned from my friend is that you will pay twice as much and get carded at a dispensary… or you can have it delivered, pay half the retail price and remain anonymous. The black market is the biggest competition to cannabis brands. They know this. Cannabis Companies Scramble to Stay Alive When valuations soared and capital was easy to access and cheap, cannabis companies went on a buying spree. Over the past year, the elusive “pathway to profitability” became the only way to raise funds to survive. HEXO, the number one cannabis brand in Canada, was rescued (purchased) by Tilray. Tilray has also invested a 65% stake in MedMen. The company is expanding into craft beer and spirits. Sweetwater Brewing, Montauk Brewing and Breckenridge Distillery are all in the Tilray tribe. Manitoba Harvest is offering Hemp Yeah! Granola at Whole Foods. As CEO Irwin Simon said in the company’s July 26, 2023 earnings call: Tilray is not building its entire business model around the eventual promise of legalization. But, rather unlike others in our sector, we are diversifying beyond cannabis by building a strong balanced portfolio consisting of successful, profitable stand-alone beverage alcohol and wellness brands in the US, along with a strategic distribution business in Europe, each with high growth opportunities in their own right. Legalization will happen one day, but we're not waiting for it. We're not dependent upon it. Canopy Growth was attempting a similar strategy with their BioSteel sports nutrition unit. However, in their June 22, 2023 earnings release, the company revealed that Biosteel had been overstating revenue and paying bonuses to insiders based upon those erroneous numbers. With an annual loss of -$3.3 billion in fiscal year 2023 and fuzzy math with self-dealings in one of their major brands, Canopy Growth is in a restructuring mode, trying to conserve their $783 million in cash and short-term investments (as of March 31, 2023). Revenue was down -21% in FY2023 from the prior year. Canopy will report their earnings for the quarter ending June 30, 2023 on August 9, 2023 at 5:30 ET. Meme Stocks, YOLO and Shoot the Moon Cannabis stocks have enjoyed Shoot the Moon meme stock YOLO rocket ship rides, once in September 2018 before Canada legalized weed, again in early 2019, and then once more in January of 2021, after the U.S. House of Representatives voted to decriminalize cannabis on Dec. 4, 2020. (The MORE Act stalled out in the Senate and was never signed into law.) Tilray traded as high as $300/share in September of 2018. Shares are currently at $2.37. In between these headline-driven events, pot stocks crash and burn. When a major country looks like it’s going to legalize weed, everyone jumps in and pushes the price far above rational valuations. The spreads between the top and the bottom are just too severe to use limit orders. (The brokerages won’t let you put the price high enough to capture a Shoot the Moon launch.) Investors have to keep their radar up for major news, have a stock app on their smart phone, consider price alerts and move quickly when the run-up begins. There is a lot of work involved in profiting on YOLOs like cannabis (and crypto), and one must endure long winters of discontent before halcyon days arrive again. Both the U.S. and Germany have flirted with legalization, and both countries are stalled out in the politics of the matter. Germany is moving forward with a plan to legalize for personal use, and there might be news on that in 2023. Meanwhile, states keep decriminalizing, Tilray keeps selling beer, whiskey and hemp granola, and the black market dealers rake in more profits than the dispensaries… Current Valuations Since most of these companies are still cash negative, a price/sales ratio can be a helpful valuation tool. BZAM (formerly The Green Organic Dutchman) has a very low price/sales ratio, while Tilray’s is reasonably low, when considering their expected growth in sales this year. BZAM’s year-over-year revenue growth is outstanding, at 128%. However, the company’s C-Suite struggles, cash burn and penny stock status make it very high risk. Innovative Industrial Properties and Cronos are very expensive when using the price to sales valuation tool, at 7 and 8, respectively. Canopy Growth could be a bargain. However, given its struggles to restructure, the Biosteel debacle and the skin-singeing cash burn, the company is not winning the war against the black market, or winning over the sports nutrition customer. Meme Stock Strategies It’s tough to catch a shooting star. By the time you see it, it’s already fizzled out over the horizon. It’s a reminder that individual companies, and certainly meme stocks, are casino bets, not a nest egg strategy. We should gamble with money we’re willing to lose. Also, they require babysitting, and a knowledge of what makes them take off in the first place, so you’re in the right place at the launch. For cannabis, launches tend to coincide with big news on country legalization – something that hasn’t happened since the failed U.S. attempt in late 2020. Also, meme stocks are definitely not HODL (Hold on for Dear Life), nor is Buy & Hope a good nest egg strategy. In today’s world, it’s important to take profits early and often in individual companies – to adhere to the tried and true Buy Low/Sell High mantra. Buy & Hope in our nest egg strategy only works in a bull market. When recessions hit, everything can tank by 50% or more overnight, and take years to crawl back to even. (Stocks dropped over -35% between Feb. 19 and March 23, 2020. The Dow Jones Industrial Average plunged 55% in the Great Recession; while the NASDAQ sank an astonishing 78% in the Dot Com Recession and took 15 years to recover.) So, with our nest egg, apply Modern Portfolio Theory, regular rebalancing and a Capture Gains mindset (something we teach at our Financial Freedom Retreats). Since there isn’t a cannabis fund offered by a fund company with a stellar credit rating, and we therefore must pick individual companies, we have to adopt a hybrid approach when including cannabis in our plan. Bottom Line Tilray is attracting a lot of bullish posts on Reddit and X (Twitter) – much more than Canopy Growth, BZAM (formerly The Green Organic Dutchman) or Cronos. However, there has been so much shorting action on the stock, that it hasn’t been able to break out. In addition to being the favorite on the bulletin boards, it’s also the best-looking company on the Stock Report Card (although the longshot, off the boards penny stock BZAM has much higher year-over-year revenue growth). The management team at Tilray seems to be making all the right moves with its M&A strategy (unlike Canopy Growth). At some point, any of the Tilray brands could start making headlines, or perhaps Germany will move forward with its plan for legalized personal use of cannabis this year. Either way, it appears that Tilray’s future is starting to look brighter, and is well-positioned should that supernova event occur. Full disclosure: I own Tilray and BZAM stock. Join us for our October 7-9, 2023 online Financial Empowerment Retreat. Register with friends and family to receive the best price. If you’re interested in private coaching or an unbiased 2nd opinion before then, reach out now. September is often the worst performing month of the year, so it’s a good idea to be ahead of the headlines. Again, feel free to email [email protected] or call 310-430-2397. Our unbiased 2nd opinion details exactly what you own, with color codes to show you what’s toxic in your portfolio, what’s great, and what should be better diversified. You will have a blueprint of how to get safe, protected, hot and diversified. Why is it unbiased? We don’t sell financial products. We have no incentive to sell you something that might lose money or that you don’t need. Our business model is financial education, providing the news, information, and education that Main Street investors need to thrive and live a richer life.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed