|

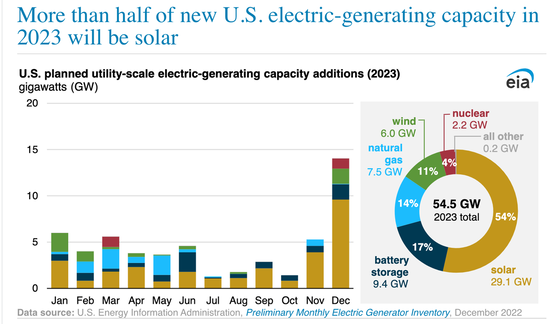

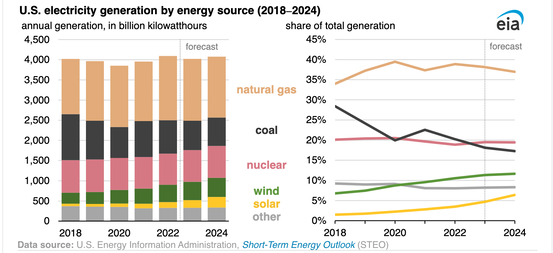

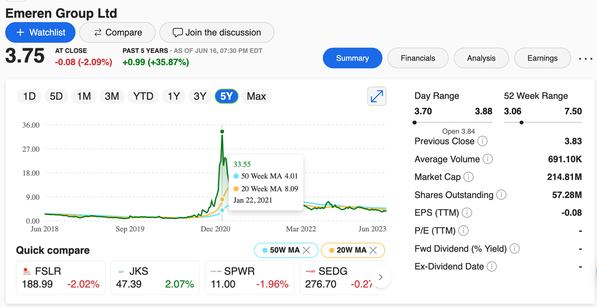

Company of the Year: Emeren I’m a little reticent to name a Company of the Year when a recession is forecasted for the 2nd half of 2023. When the general market weakens, even companies with great prospects can see their share prices sink, particularly microcaps. That makes the window of opportunity tight, or nonexistent – something to keep in mind when developing your exit strategy. Company of the Year: Emeren Emeren (previously Renesola) is a global solar company specializing in global solar projects in North America, Europe and Asia. Emeren has solar projects in Minnesota, North Carolina, Pennsylvania, California, Ontario, the United Kingdom, Poland, Italy and China. In the 1st quarter of 2023, Emeren’s revenue hit $12.9 million, a pop of 266% over the $3.5 million the company brought in during the 1st quarter of 2022. The 2nd quarter is expected to have $38-$40 million in revenue, up three times sequentially and 4.75 times higher than the 2nd quarter of 2022, which came in below their guidance, at $8.2 million. The 2023 full year revenue is projected to be $154-$174 million revenue with net income of $22-$26 million – more than double 2022 revenue and a fourfold increase in the net profit. Here are a few of the considerations for this exciting investment, which also has elevated risk, due to it being a microcap, and due to the macro conditions. The Solar Industry is Hot Flying Under the Radar of Reddit Strong Board of Directors Whale of an Investor Liquidity Concerns? Is Emeren a Good Price? And here is more color on each point. The Solar Industry is Hot The solar industry is benefitting from increasing demand, higher Power Purchase Agreements and favorable government policies. More than half of the new power generation in 2023 in the U.S. will be solar, at 29.1 GW. According to the Energy Information Administration (EIA.gov), the U.S. electric grid operated with 74 gigawatts (GW) of solar photovoltaic capacity at the end of 2022. That is expected to increase by another 63 GW (+84%) by the end of 2024. While the growth is strong and steady in solar, sun power generation will only be 6% of the U.S. grid by 2024 (up from 3% in 2022). If the commitment to power with renewables remains strong going forward, there is a lot of runway left for the industry. Flying Under the Radar of Reddit Emeren benefits from having an easy ticker on the New York Stock Exchange (symbol: SOL). Sadly, however, that is the same as Solana’s crypto call letters (SOL). (Read my FTX blog for more information on why Solana is trading at an all-time low.) Emeren is only covered by a handful of analysts, who all recommend purchasing Emeren. Two recommendations are a strong buy and two are a buy. Things can heat up quickly, particularly if a company hits the technical charts with a bullet. Emeren (formerly Renesola) has been a Meme Stock Darling in the past, hitting a high of almost $36 on Jan. 22, 2021. At its current price of $3.75, if it manages to shoot that high again, that would be a gain of over 9-fold. It’s more difficult to Shoot the Moon in a slow-growth or recessionary year (although that didn’t stop Stimmy Check funded flights in 2020). We certainly have seen rapid-fire runups this year in companies like Nvidia and Tesla – on news that was positive, but not nearly as noteworthy as the revenue growth of Emeren. The NASDAQ Composite Index is up 32% so far in 2023. However, as you can see in the chart above, outsized run-ups tend to reverse themselves quite rapidly, particularly with small and micro cap stocks. So, it’s a good idea to have Emeren (SOL) on a stock app on our smart phone, with price alerts, and every other bell and whistle we can think of to help us to sell high if it soars to lofty levels. Strong Board of Directors CEO and board director Yumin Liu came from Canadian Solar. Martin Bloom, who has been a board director since 2006, has 40 years of experience leading strategic partnerships between Europe, the U.S. and China. In 2005, Mr. Bloom was appointed to serve as the UK chairman of the China-UK Venture Capital Joint Working Group, launched by the then-Chancellor of the United Kingdom, Gordon Brown. Whale of an Investor Emeren’s chairman of the board, Himanshu H. Shah, owns over 27% of the company. His bio names him a “long-term investor.” However, whenever a whale slaps his tail in the water, waves ripple throughout the ocean. And if he decides to breach, smaller fish will drown. Mr. Shau joined the board in March of 2022 (with 22% ownership) and became Chairman of the Board on Nov. 22, 2022. Liquidity Concerns? We’ve seen small companies get destroyed due to liquidity concerns over the past two years. Tight credit conditions and higher interest rates elevate the risk for any company that might need to borrow money – particularly a microcap company. Emeren had $66.7 million cash on hand at the end of the 1st quarter of 2023. They burned through $40.4 million in the 1st quarter, which would seem as though they are flying too close to the trees. However, as outlined above in their 1st quarter 2023 Shareholder Letter, the company is expecting robust revenue growth and a net income of $22-$26 million. These forecasts are reliant upon “the expected closures of over 300 MW of project sales in Europe and U.S.” As long as things run on track, investors should be pleased with the results. Emeren is so confident in their cash position that the company has a share repurchase plan in place. They repurchased $13.2 million of their shares in the 1st quarter and have $17 million left available for more purchases. They plan to continue the buybacks, according to the 1Q 2023 Shareholder Letter. Is Emeren a Good Price? Currently Emeren’s Price/Earnings ratio is 35.53, due to having only a small amount of net profit in 2022, at $5.9 million. However, if the company hits their 2023 net profit target of $22-$26 million, then their forward P/E becomes quite a bargain, at under 10. There is a similar issue with the Price/Sales. 2022 was a disappointing year for a lot of solar companies, including Emeren, which saw its annual revenue slump to $61.3 million in 2022, from almost $80 million in 2021. According to EIA.gov, the U.S. solar capacity declined by 23% in 2022 from 2021, due to pandemic-related challenges, including supply chain disruptions. With delayed 2022 projects coming online in 2023, the EIA is projecting to install 29.1 GW of solar power in the U.S., the highest ever, beating 13.4 GW in 2021. Emeren’s forecast of $154-$174 million in 2023 revenue brings the Price/Sales ratio down to an appetizing 1.28 (in the mid-range of the projection). Emeren was trading near an all-time low, at $3.75 at the market close on Friday, June 16, 2023. If you'd like a copy of our Solar Stock Report Card, email [email protected]. Bottom Line There is a robust solar industry tailwind that is underpinning the expected impressive revenue growth of Emeren. At the same time, the macro considerations (a potential recession in the 2nd half of 2023) are meaningful. There are no guarantees which way the wind will blow. The predictions are bright for solar and Emeren. If we buy into this Company of the Year pick, we’re purchasing near an all-time low, with high expectations of what might happen if SOL becomes a Meme Stock Darling again. At the same time, it’s a good idea to factor in the amount of babysitting required for small caps these days, and determine if you’re really interested in keeping tabs on whether or not Emeren hits its targets, and how quickly we must capture gains before the recession kicks in and potentially drags all share prices down. Full disclosure: I plan to purchase shares of Emeren on Tuesday, June 20, 2023, four days after this blog was published. (The markets are closed on Monday, June 19, 2023.) Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress. We also host sustainability adventures, where we walk in royal footsteps toward a richer life, all while living in greater harmony, by design. Click to learn more.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] to learn more. Register by June 30, 2023 to receive the best price and a complimentary private prosperity coaching session (value over $400). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want! This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed