|

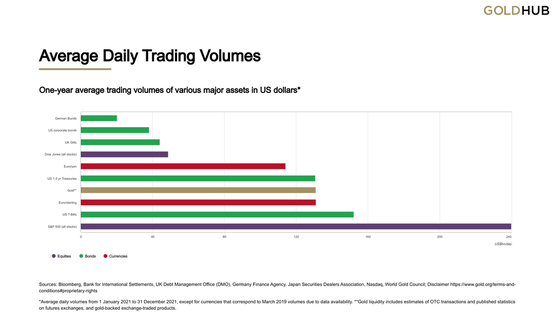

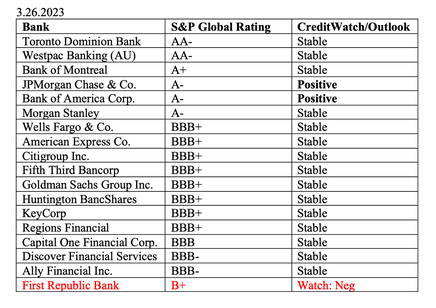

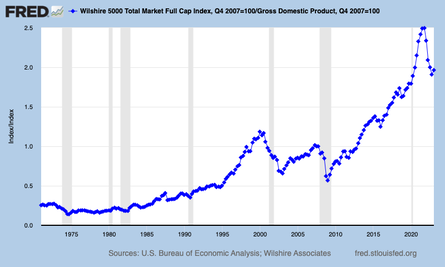

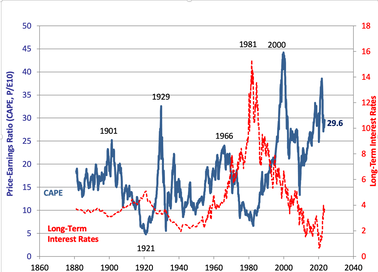

Should We Sell in May and Go Away? (OK… June.) “Sell in May and go away” is a common Wall Street aphorism. I prefer to say, “Rebalance in May, so that we have a good holiday.” If you haven’t rebalanced yet in 2023, then now is a great time to do so. Read on for why… Today’s FOMC Board Meeting As expected, the Feds paused their interest rates hikes today, even though inflation is still double from where they want it to be. About 2/3rds of Wall Street insiders surveyed expect a rate hike of 25 basis points at the FOMC meeting on July 26, 2023. As long as things go as expected, there shouldn’t be any market tantrums. However, given that part of the recent strength is due to share repurchases (companies buying back their own stock), there could be weaker performance in the months ahead, particularly if the companies get taxed on buybacks, or need to preserve capital for other reasons. That is most likely in the banking industry, which was #1 on the share buyback list for 1Q 2023. Things are Bright, Right? Everything is looking pretty sunny… on the surface. At 4,369, the S&P500 is back to the levels we enjoyed in April of 2022, and only slightly down from the high of 4,818.62 set on Jan. 4, 2022. We haven’t heard about any more bank problems since the failure of First Republic Bank on May 1, 2023. However, regional banks like Pacwest, Western Alliance, Zion and Truist are still trading at prices that are -52% to -82% from those enjoyed in January of 2022. (These and other regional banks experienced multi billions in withdrawals from depositors in the 1st quarter of this year.) According to S&P Dow Jones Indices, financials repurchased their own stock on a mad buying spree in the 1Q of 2023 of $46.9 billion, beating out technology’s buybacks of $45.9 billion (the #1 and #2 industries). Berkshire Hathaway, Wells Fargo, Goldman Sachs, Charles Schwab, JPMorgan Chase and Bank of America were in the top 25 share repurchasers in Q1 2023, with $2.2 billion (BofA) to $4.45 billion (Berkshire) in buybacks. With the bank stress tests happening this month and the markets stabilized from the bank failures, there could be fewer share repurchases by the financial industry in the coming months. The bank stress tests should be reported at the end of June. Why Rebalance Now? Despite the impressive Spring Rally that saw a 10% rise on Wall Street over the past three months, there are more than a few economic storms on the horizon. It’s always a great idea to fix the roof while the sun is still shining. When we wait for the headlines that a disaster has occurred, it’s too late to protect our wealth. Below are just a few of the conditions that are worthy of being monitored. What could possibly happen while we’re on vacation? Recession? A recession is forecast for the US in the 2nd half of 2023. While everyone hopes it will be mild, there are more than a few areas of vulnerability that could cause financial instability. If there is a recession, Main Street won’t get the first headline of negative growth before the end of October, and the first official declaration of a recession won’t happen until early 2024. However, it’s important to remember that the whales move Wall Street, and are always first to respond – well before the headlines. Market timing, or trying to jump all in or all out, is never a good idea. However, proper diversification with 1-3 times a year rebalancing has worked brilliantly in the 21st century, at a time when recessions typically cost equity investors more than half of their wealth. Financial Services Companies Don’t Do Well in Recessions Almost 500 banks failed between 2008 and 2013 (source: FDIC). Many brokerages and insurance companies were bailed out, were forced into a merger or went bankrupt. (You might remember AIG, the largest insurance and annuity provider, was bailed out big-time in 2008.) In a press release from May 3, 2023, Lawrence Yun, the chief economist of the National Association of Realtors, had a very stern condemnation of the Federal Reserve’s rapid-fire raising of interest rates. He wrote that it was “unnecessary and harmful,” and that the “fast rate hikes by the Fed have upended the balance sheets of many small regional banks. They are becoming zombie-like banks, unable to lend even to good businesses, as they are more concerned with balance sheet shuffling for survival.” Bank earnings are going to look prettier than they actually are, thanks to financial engineering and the Fed Fund facility that allows qualified banks to not have to declare the losses in their bond portfolio on their quarterly earnings reports. However, as you can see in the chart below, long-term government bonds lost -26% last year. According to the May 2023 Financial Stability Report, “by the end of 2022, banks had declines* in fair value of $277 billion in AFS* portfolios and $341 billion in HTM* portfolios.” *Declines: losses. AFS: Assets for Sale. HTM: Held to Maturity In the liquidity chart below, you’ll find that corporate bonds are very illiquid (meaning you can't sell them). (They’ve been illiquid since before the pandemic.) If you have long-term corporate bonds, they have lost a lot of value, will be difficult to unload without taking a loss and were riskier when you purchased them than most investors realized. Holding these bonds to term might not be possible due to debt restructuring, liquidity needs or the fact that some have terms longer than most of us will live. These are some of the most important reasons why it’s very important to do a rebalancing now, and understand everything we own, even things that we’ve been told are safe. (You might want to check out our Ask Natalie blog on the person who lost $100,000…) Bonds aren’t the only problem for banks. There are also issues with mortgage originations, commercial real estate and loans. Banks are suffering from a frozen real estate market and the loss of mortgage origination revenue. Commercial real estate, particularly empty office buildings and malls with high vacancies, are problems that are waiting in the wings and have a potential to escalate into a crisis rather rapidly. While rising interest rates are a positive for banks in their floating-rate portfolios, most mortgages are fixed-rates. Read my blog on the risks that Empty Office Buildings pose for financial institutions, including insurance companies. You should also check out the Financial Stability Report that was released in May of 2023. If you’d like an unbiased opinion on your current wealth plan, email [email protected] for pricing and information. Once you know what you own, how much you have at risk, and what a better plan looks like, it’s easier to protect your wealth. Over Half of the S&P 500 is At or Near Junk Bond Status The weakness in banks is unlikely to be over. It has a lot to do with the weakness in bonds, and also the poor credit quality of so many U.S. corporations, including banks. Over half of the S&P500 is at or near junk bond status. August: Toxic Dumping Ground It’s very common for bad news to occur in the summer, on the weekend, after hours or a combination of all of the above. Lehman brothers declared bankruptcy in August of 2008. The debt ceiling showdown that resulted in the first ever U.S. credit downgrade (by S&P Global) happened in August of 2011. Why can summer be surprisingly toxic? Because no investment banker wants to be in New York City (Wall Street) in August. That’s the month that they all run off to their yachts in the French Riviera, which is likely a factor in September being the worst performing month of the year, historically. The theory is that if you dump bad news on the weekend, after hours or while everyone is on a vacation, people will have time to digest it before reacting... Even though summer has lower trading volumes and can be up and down. It’s always a good idea to protect your wealth before the headlines occur (now). When you wait for the headlines, it’s too late. September: the Worst Performing Month of the Year I use the phrase “Back to School stock sales” to characterize September. However, I’m referring to the opportunities that often present themselves toward the end of the month. If there is a recession in 2023, it won’t be announced officially until at least end of January 2024, and likely later. However, institutional investors and hedge fund managers are forward thinking. The big money makes its moves long before the recession is officially announced. The Great Recession didn’t become official until October of 2008, after losses of over 45% in the Dow Jones Industrial Average. (Our warning came in December of 2007; the market high was October of 2007.) With the money so hot and fast on Wall Street these days, our best strategy is to use the pie chart system and rebalance once, twice or three times a year. Knowing what is safe at a time when long-term bonds are losing more than stocks is essential as well. I prefer rebalancing at the end of April, after the Spring Rally. However, if that didn’t occur, then now is a good time to batten down the hatches of our financial home before we go on vacation. A 2nd rebalancing might occur at the end of September and before the Santa Rally, in case there are any funds or stocks that are on sale. Another rebalancing at the end of December helps us to capture any gains we’ve earned during the Santa Rally. Expensive Equities Stock prices are very expensive. According to the Buffet Indicator, stocks haven’t been this expensive in over half a century. The trend line for overvalued equities typically has swift and severe corrections. As one example, the S&P500 lost almost 40% between February 19 and March 23, 2020, during the pandemic. According to the Cape Ratio chart (below), the only time stocks were more expensive than today was during the Dot Com Recession and the Great Depression. In the Dot Com Recession, the NASDAQ Composite Index plunged 78%, and took 15 years to crawl back to even. We all know what happened in the Great Depression. We’ve made it through the Debt Ceiling crisis, the first round of bank failures and the 2022 bear market. However, we still have the bank stress tests (end of this month), inflation, quantitative tightening, rising interest rates, bond losses, more weakness in financial services (potentially in insurance companies), depleted savings in households, too many Americans living paycheck-to-paycheck and a potential recession in the 2nd half of 2023. For additional information on the Fires the Fed still needs to put out, read my blog (click to access). Bottom Line A lot of people are simply not aware of how the massive amount of debt, leverage and high prices effect the stock market. Market timing isn’t a good strategy. However, our easy-as-a-pie-chart nest egg strategies with regular rebalancing earned gains in the Dot Com and Great Recessions and outperformed the bull markets in between. So, rebalance in May (or now, in mid-June), so that you can have a good holiday. Be the boss of your money, rather than having blind faith that someone else is protecting your future. If you have never really known what it is that you own in your retirement accounts or managed brokerage accounts, now is the time to learn the life math that we all should have received in high school. You can start by asking your financial planner for a performance chart of your portfolio compared to the S&P500 for the last 20 years. (You need to see a chart that goes back to 2006, so that you can see what happened in the Great Recession.) If your portfolio just shadows what the S&P500 does, then you are at an elevated risk of losing a lot of money. It’s important to remember again what kind of losses that 21st-century recessions have cost investors. As we get closer to retirement, we can’t afford to lose so much, and then hope and pray to crawl back to even before we stop working. Wisdom and time-proven systems are the cure. The time is now. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] to learn more. Register by June 30, 2023 to receive the best price and a complimentary private prosperity coaching session (value over $400). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want! This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed