|

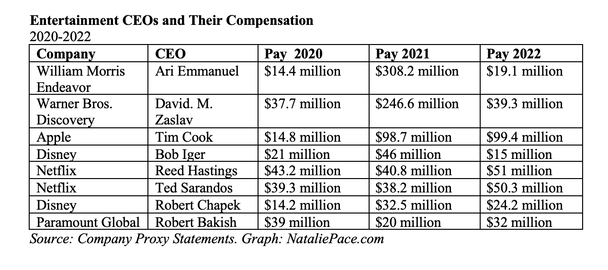

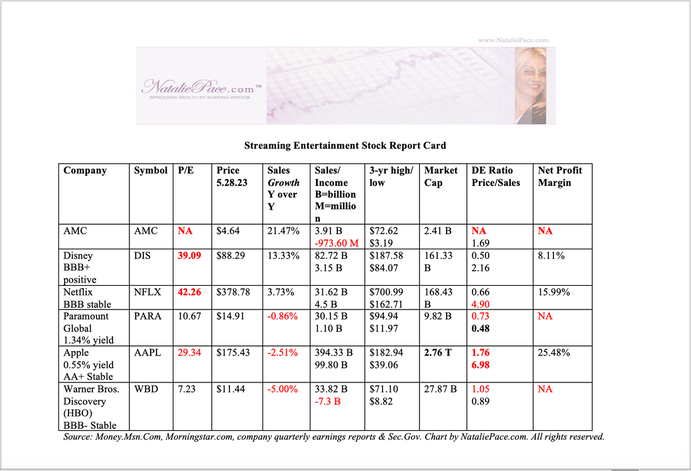

Streaming CEOs Rake in Record Compensation. Writers Strike. Recently, I saw a story by Alec Baldwin, saying that he thought there might’ve been an entertainment executive who got paid $240 million in one year alone. A quarter of a billion dollar payday sounded outlandish, so he wanted someone to verify it. Well, the number is right. In 2022, Warner Bros. Discovery CEO David. M. Zaslav received total compensation of $246.6 million, which probably played into the boos he received at the Boston University Commencement on May 21, 2023. What’s even more interesting is that Warner Brothers Discovery went on to lose -$7.3 billion in 2022. Ari Emmanuel, the CEO of William Morris Endeavor received even more, with total compensation ringing up to a staggering $308.2 million. Here’s a summary of what 8 different CEOs were compensated over the last three years. CEO Salary Has Skyrocketed According to the Economic Policy Institute, CEO pay has “skyrocketed” by 1,322% since 1978. Over the same period, minimum wage went from $3.10/hour to $7.25/hour (DOL.gov). Some cities, like Los Angeles, California, have a minimum wage of $15/hour. According to MIT, a livable wage in LA starts at $21/hour. So should CEOs be compensated at rates that are so much higher than the talent that gives them the content? How much does Jason Sudeikis make for Ted Lasso? How much did Jim Cameron make for Avatar? Those two are some of the top earners in terms of writing. So, how do regular writers fair in the equation? And how will the Writer’s Strike impact the earnings at the studios? Average Compensation for Writers According to the Writers Guild of America, writers make a median amount of about $250,000 for a first draft. At the same time, there is a wide disparity between the pay rate of the superstars and the crew around the table. According to the Writers Guild, 49% of TV writers are paid the minimum rate, and many members are not making a living wage. It’s also important to understand that many writers are not earning an annual salary. For instance, Jason Sudeikis reportedly got paid $1 million an episode for season three of Ted Lasso. However, it took two years for the season’s 12 episodes to be aired. James Cameron scored a stunning payday for Avatar and Avatar: The Way of Water, reportedly at $350 million and $95 million respectively (with most of the compensation coming on Cameron’s cut of the performance success). Avatar came out in 2009, while the sequel didn’t hit theaters until 2022. If a normal writer has 13 years between projects, that median $250,000 for a script becomes a poverty wage. A gap between gigs could also put your pension and health care at risk. When you consider that a livable wage in Los Angeles would be at least $115,000 a year for someone with two children, if a writer is steadily working, then s/he should be living better than just hand to mouth, but not by a lot. Basic needs would eat up half of the salary, leaving only a little cushion for emergencies, retirement plans, vacations and any type of splurge. Housing alone in Los Angeles can be $25,000 a year. If you have two kids, transportation could cost another $12,000 – more when gas prices soar – with childcare costs above $24,000. Newer writers are receiving $100,000 when their screenplay is sold. Statistics show us that most Millennials and Gen Z are spending 30% or more of their income on housing. Income Disparity, and Wealth Accumulation at the Very Top CEOs are certainly making an outsized salary. However, they are also paying a lower tax rate, as most of their compensation comes in the form of stock, which is taxed at a much lower rate than earned income. Additionally, if we look at the Forbes Billionaire’s List, the top billionaires are all anti-union. A few companies, like Google, Amazon and Microsoft, have recently organized. However, there is a very strong correlation between who makes it to billionaire status, and how little of that trickles down to their employees. When labor costs too much, they move it to a developing world country – if they can. That’s not as easy to do with talent, like writing. Writers and celebrities who produce hits and take something on the backend are the most successful. Michael Jordan owns a piece of the Nike Air Jordan brand. Hopefully Zoe Saldana gets a little something from Avatar, above her $8 million actor’s fee. The Profitability Argument CEOs argue that margins and profitability are lean. As I mentioned at the top of this article, Warner Bros. Discovery lost -$7.3 billion in 2022. However, Disney earned $3 billion and Netflix earned $4.5 billion. Below is a Stock Report Card on some of the top studios. As you can see, no studio comes close to Apple’s 25% profit margins (with iPhone and Apple watch factories in China). With a potential recession in 2023, studios are, sadly, laying people off. Variety reported that Paramount will be laying off 25% of its staff. Paramount isn’t the only studio cutting costs. Disney is laying off 7,000 people in the U.S. Amazon Studios is also trimming back. How Will the Strike Affect the Studios? The studios cannot charge monthly streaming fees for reruns. CEOs will still receive rich compensation packages, in the tens of millions. However, their bonus compensation and stock awards might not be as robust as they were in 2022. The longer the Writers’ Strike extends, the uglier the studio quarterly earnings reports will look in the 2nd half of 2023. Bottom Line Income disparity, wage stagnation and inflation have hit a lot of workers across the land. While A-list writers can afford to live in La La Land, many gig writers have gaps in their employment, and are going to have trouble making ends meet. When life doesn’t add up and employees can’t make a living by working, we end up with lofty levels of people who stop looking for work, a very tight labor market and the potential for social unrest, like strikes. With margins pretty tight, stiff streaming competition and a potential 2023 recession, studios are cutting costs. Will the writers and the studios find common ground soon? It’s in everyone’s best interest, including the overpaid CEOs. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed