Fiat. Crypto. Bank Failures. Gold. BRICS. Real Estate. Private Equity. Alternative Investments.8/5/2023

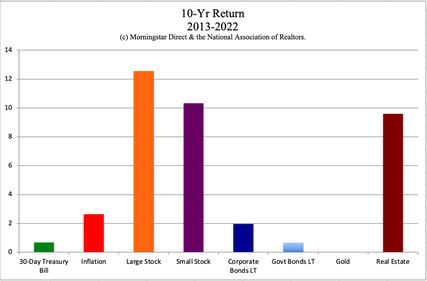

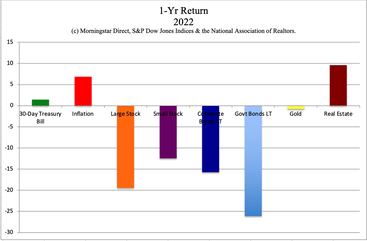

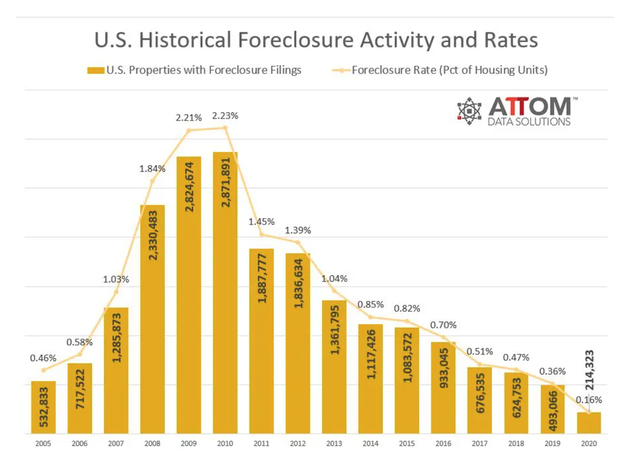

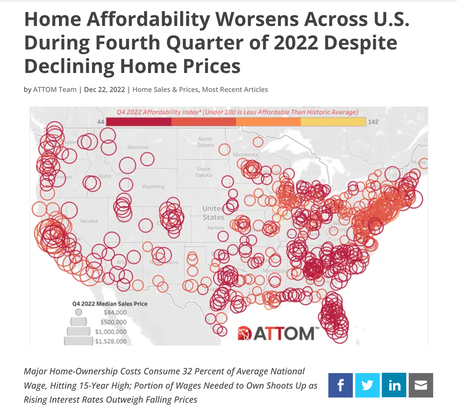

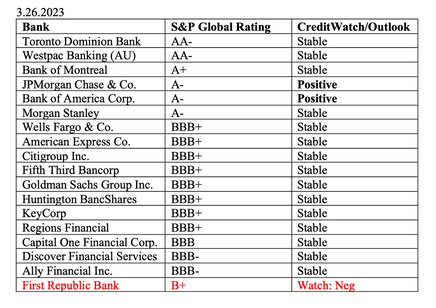

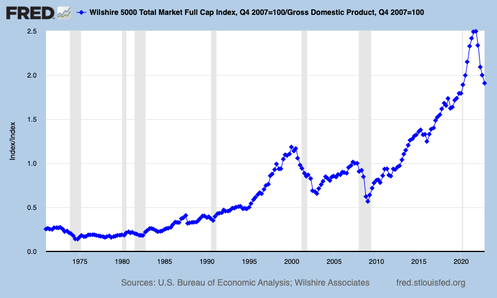

Fiat. Crypto. Bank Failures. Gold. BRICS. Real Estate. Private Equity. Alternative Investments. We are all alarmed about the bank failures, and few of us are reassured that the worst is over. So what is the solution to protect our personal wealth? Should we be withdrawing all of our cash from the banks and putting it into crypto, gold, real estate, BRICS currency or private equity? I will be examining alternative investments in greater detail in my videoconference this Thursday at 5 PM ET. If you’d like to join us, simply email [email protected]. I’ve also outlined a few of the pros and cons of these strategies below. Let’s examine: Crypto Gold and Silver Real Estate Banks and FDIC-insured Cash Private Equity BRICS Economies and GDP Innovation and freedom Debt and Bonds Equity Prices And here are important details to factor into your alternative investing strategy… Currency: Full Faith and Credit When we talk about crypto, fiat currency or any kind of token that we barter with, we’re really talking about faith. We have to believe that the value of that token will not fluctuate dramatically – that it will be worth what we exchanged it for. Of course, we have seen inflation reduce buying power around the world of various currencies. However, while inflation above 5% is considered too hot, we have cryptocurrency fluctuations of that have been coined as Crypto Winters, for the extended period of hibernation and destruction that devotees must endure. Bitcoin hit an all-time high of $69,044 on Nov. 10, 2021. For the past year, cryptocurrency has been trading at less than half that value – in a range of $15,000-$35,000. Bitcoin actually fell below $4,000 in March of 2020, during the pandemic. Imagine if your dollar was worth less than a dime. That’s one of the main reasons why crypto has not been used as a currency (outside of the criminal and shadow markets). You can’t have a currency that’s worth $69,000 one day, and only $15,000 or $4,000 a few months later. Cryptocurrencies are largely a YOLO* platform, where everyone hopes to get rich quick. *You Only Live Once. Whenever you hear someone talking up a coin or ICO or even taking a bet that Bitcoin is going to go to $1 million, it’s tempting to want to buy into that fever. However, we’ve seen time and time again that celebrities are paid massive amounts of money, from hundreds of thousands to hundreds of millions to promote various crypto currencies, many of which have gone completely bankrupt. FTX is one, with paid promoters including Tom Brady, Gisele Bundchen, Stephen Curry and Larry David. Kim Kardashian promoted an EthereumMax pump and dump scheme, and was fined $1.26 million by the SEC. The so-called stablecoin TerraLuna is worthless, after a value of $115 in April 2022. FTX declared bankruptcy on Nov. 11, 2022. FTX’s former CEO is being charged with a 12-count indictment, including fraud, bribery and money laundering. Binance, the largest crypto exchange, has halted Bitcoin withdrawals twice this year. The company and its CEO, Changpeng Zhao, have been charged by the Commodities Futures Trading Commission with dodging regulations, including compliance practices that prevent terrorist financing and money laundering. Voyager Digital promised that depositors were FDIC-insured before the company declared bankruptcy. However, brokerages are not banks, and thus deposits were not protected. In other words, there are quite a few problems and potholes to maneuver if you’re thinking to dump your fiat currency and drive into the sunset with crypto. Here are 6 Red Flags to Heed Before You Invest. What About Gold or Silver? Gold and silver have been the worst performers for the last decade in terms of investments. One might argue that prices have been relatively stable over the last decade, and therefore may be better than fiat currency. However, gold, too, has volatile price swings historically. After hitting a high of $800/ounce in 1980, gold sank to the $250-$350/ounce range, and stayed there for about a quarter of a century. After hitting a high of $48.70 on April 28, 2011, silver slumped and has been trading $18-$28 since. Gold and silver coins tend to be even more problematic than the precious metals themselves. Most coins are marked up well beyond their value in bullion. Often the minute we purchase one of these coins it has to increase in value by 55% or more in order to break even. Real Estate and Shelter Inflation Real estate prices are down -10% nationwide in the United States. (The high was June of 2022.) The areas that went up the fastest are the ones that are plunging the most. However, that compares with long-term government bonds losing -26% in 2022, and the S&P 500 losing -19.44%. In a world where many assets are losing their value, hard assets, like real estate, are holding value better than paper assets are. Whether we are thinking of buying, selling or holding real estate, it’s a very good idea to address the 7 tips and the 10-point Checklist for Homebuyers that I go over in my Real Estate Master Class. Join us on June 3, 2023 online, from wherever you are. Holding real estate can be a great way to build wealth and keep it over the generations. However, since 20 million homes were lost in the Great Recession, it’s also important to get the fundamentals right. One of the big problems with inflation in the United States and in other parts of the world is shelter inflation. Buying or renting a home has become unaffordable. Businesses in expensive cities are having difficulty hiring people, especially for the low-income jobs, largely because no one can afford to live where they work. Unaffordable housing also effects prices. When real estate becomes unaffordable the buying pool is dramatically reduced. This is why it is extremely important to have a multiyear plan rather than a short term fix. It’s a good idea to have a plan for our cash as well because being property rich and cash poor can make us vulnerable. There are expenses that come with being a homeowner and landlord. Banks and FDIC-Insured Cash One of my more recent video conferences was “How to Stash Your Cash.” We also cover this topic for a full day on day three of the Financial Edu Retreat. Our next Financial Empowerment Retreat is June 10-12, 2023 online. Email [email protected] to learn more and to register. Bank failures make it important for us to know our cash is safe and secure. Many banks have allowed their credit rating to fall to the lowest level of investment grade, and have higher risk, particularly for uninsured depositors, than most Americans are aware of. Therefore, in addition to considering FDIC-insured limits, diversifying our cash, and knowing the best strategies for bonds, we also want to know the credit rating of the bank we’re doing business with. At the June Retreat, we’ll also talk about diversifying our at-risk portfolio away from U.S. financials, and into other countries where the credit ratings are higher, and the yield is, as well. Private Equity Private equity placements become tempting when the broker salesman promises that they are safe, and that you’re going to earn a very good income. (The highest risk investments often pay the highest broker commissions.) Sadly, we have seen cases of members of our community who did not do their proper due diligence and lost a lot of money, while investing in something that they were told was safe and would provide them with a high yield. (Click to read one couple’s experience.) With regard to private equity anything, we must do ten times the amount of research, while combing through and understanding P&Ls and other financial documents that you might have difficulty getting access to. There are probably some great opportunities to be had – in a more normal world. However, in a world where so many assets are overvalued, there is elevated risk. BRICS, GDP & Economy There really isn’t a BRICS currency yet. The person touting the development is a friend of the Russian President. The Chinese yuan is still less than 5% of the global reserve currency basket. If you’d like to learn more about BRICS, click to read my blog. In addition to these facts, we might also consider the broader implications of investing in the currency of Brazil, Russia, India, China and South Africa. What natural resources, products and businesses underpin these economies? Do they align with our values? Do we want to get rich on oppressive regimes? The U.S. has a diversified economy. We tend to dream up a lot of the inventions of the world, including leading in Internet technology. Over the past year, the U.S. has been instrumental in selling natural gas to Europe, so those countries could become less reliant on imports from Russia. The Russian economy is heavily tied to its oil and gas exports, and also to its military industrial complex. China is the factory to the world. Brazil exports iron, soybeans, oil products, poultry and beef. China tends to be the top consumer of rainforest beef. However, there have been certain periods when the US imports a lot as well. (Eating local and organic helps to ensure that we’re not contributing to the Dead Zone in the Gulf of Mexico or to the destruction of rainforests in Brazil.) India and China have some of the most polluted cities on the planet. I mention all of this because when we think of a BRICS currency, it’s important to understand what underpins their economies and what we’re supporting, in addition to whether or not we’ll get rich. Do we want to invest in freedom and innovation, or do we want to support oppressive regimes that are harming our planet? Innovation and Freedom Happy people make better products, faster, and cheaper. One of the reasons that the United States is a leading innovator of the world is because of our policies of freedom. We try to make it easy for people to start their own businesses. Our universities are strong and desired around the world. Many are hubs of geographic areas of innovation such a Silicon Valley, with its proximity to Stanford and the University of California, Berkeley. That doesn’t mean that the U.S. is skipping along some golden brick road without any troubles. However, the ideals of freedom, self-determination and innovation are fundamental to the American ethos, and that is not necessarily the case in other countries around the world. Debt and Bonds The United States, like most of the world, has a debt problem. The losses in long-term bonds are central to many of the bank failures. The new Federal Reserve facility allows qualified banks to avoid declaring the losses of their long-term bond portfolio on their financial statements, which means that financial statements and quarterly earnings can be deceiving. We aren’t getting advance notice of trouble before the bank is on the ropes. As just one example, First Republic Bank was rated A- before it got into so much trouble that it was downgraded to junk without warning. There are ways to protect our wealth. However, relying upon the strategies of yesterday, or the verbal promises of the Federal Reserve and Treasury, or the assurances of our financial advisor are risky. History shows us that Main Street is advised of trouble near the bottom, after most of the losses have already occurred. When we wait for the headlines that the U.S. is in a recession, or that the bank failures are endemic and widespread (as they were in the Great Recession), we’ve already been swallowed up and are sinking in our home value and equity portfolio losses. A good strategy protects our wealth before the plunge happens, which is what our easy-as-a-pie-chart nest egg strategies have done in all of the 21st Century recessions – at a time when most investors have lost half or more of their wealth, and then had to hope and pray to earn back losses in the bull market. The world is still reeling from the pandemic, and the colossal debt that was amassed to try to keep the world from plunging into a prolonged depression. Protecting our future requires time-proven solutions, rather than blind faith that someone else is protecting our wealth. Equity prices While fiat versus crypto, gold and silver and other hedges is at the top of everyone’s mind, equity prices should be as well. As you can see in the chart below, which is Warren Buffett’s favorite valuation tool, equity prices today are higher than they’ve been in half a century. When prices soar so high, the crash tends to be more severe and swift. The S&P500 lost -34% between February 19 and March 23, 2020. We got out of that mess by printing out trillions of dollars and giving a little to anything that moved (though most flowed to the wealthy corporations). The current tightening cycle is the opposite of that. Money is harder to access and a lot more expensive to borrow. So, in addition to protecting our cash, it’s also important to know exactly what we own in our retirement accounts, as well as our managed brokerage accounts. This is one reason why I offer an unbiased second opinion. I am able to give my private coaching clients a clear understanding of what they own and what a better plan looks like, so that they can be the boss of their money. It’s important to not just have blind faith that someone else is protecting our future for us, even if the last decade has gone quite well. Never confuse a bull market with wisdom. Most managed plans perform with the market, rising in bull markets and sinking like a rock in recessions. As I mentioned previously, most investors lost more than half of their wealth in the Great and Dot Com Recessions. This time could be as bad or worse, since the “safe” side (bonds) have been losing even more than the at-risk side (stocks and funds). Bottom Line A well-diversified plan can include a hedge against recession, bank failures, a weakness in the dollar, and a plunge in equity prices. However, doing this without taking on the risk of any one of the options mentioned above requires implementing a solid strategy, complete with entry and exit plans. If you would like to learn and implement these strategies now, join us at our June 10-12, 2023 Financial Empowerment Retreat. That will be a complete money makeover in time for you to protect your wealth before you go on vacation. I have included links to various blogs and video conferences on the topics discussed above. Click on the blue highlighted links. I’ll also be hosting a free videoconference this coming Thursday. Watch it back at YouTube.com/NataliePace. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register by May 15, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Pace. Photo by Marie Commiskey. Natalie Pace. Photo by Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed