|

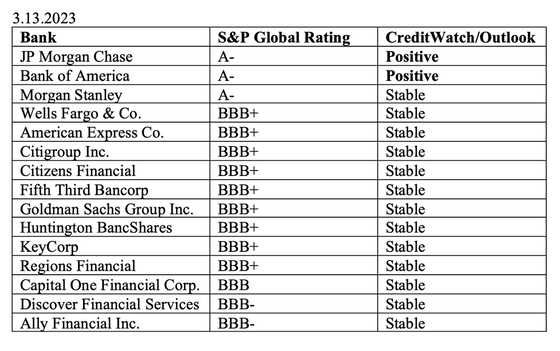

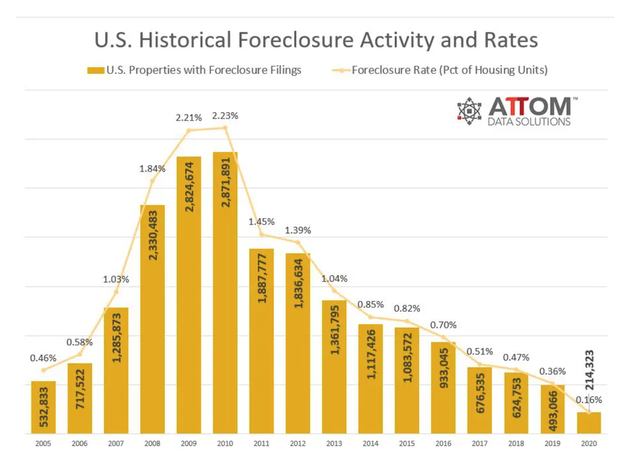

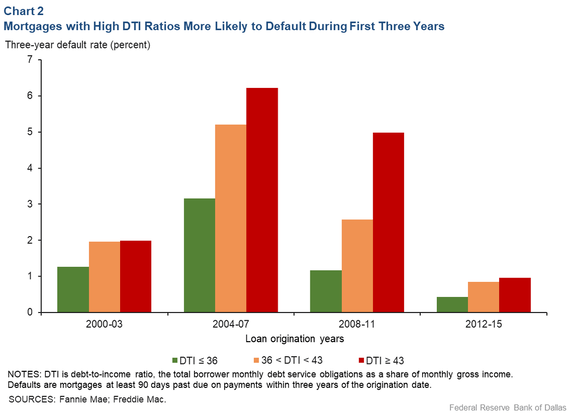

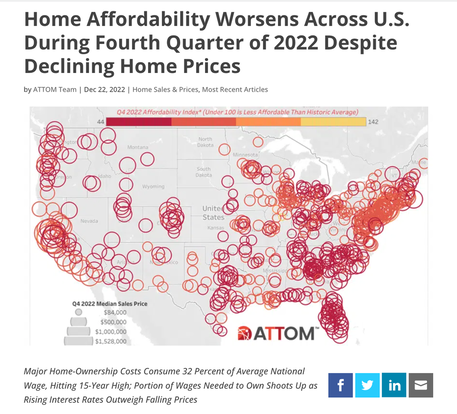

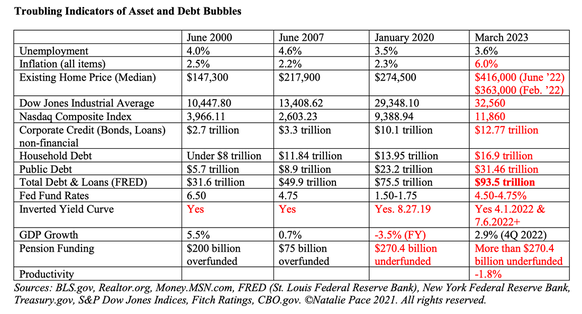

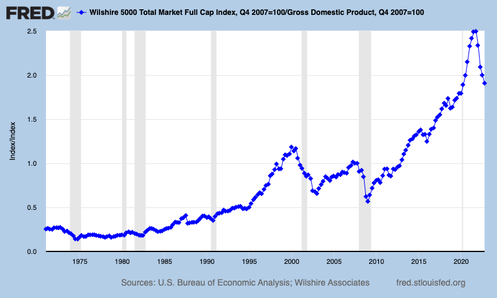

The Feds Meet Today. 8 Fires They Need to Put Out. At 2 pm ET, the FOMC will release their statement advising the world whether or not they have raised interest rates by another 25 basis points. Before the Silicon Valley Bank crash, Wall Street expected this. Since then, some economists, including Sheila Bair (former FDIC chairman), are calling for a pause. It is unlikely that the Feds will cut rates. Here’s why. If they cut, they will be perceived as flip-flopping or being too soft on inflation. The February Consumer Price Index was still running too hot – at 6% year over year. Worse, if inflation catches fire, it could be far more difficult to put out without employing Volcker moves. (For an informative economics lesson, Google how Paul Volcker handled inflation in the late 1970s and 1980s.) This means there will be a lot of pressure to keep raising rates this year, even if they pause tomorrow, with almost no upside to cutting rates until inflation is “well-anchored” at 2% or below. Larry Summers and Mohamed El-Erian, the chief economic adviser at Allianz, believe the inflation fight isn’t over yet, and rates should continue to rise. What Will The Federal Reserve Board Do About… Weakness in the Banking Industry. Inflation. Bond Losses. Rising Interest Rates. Depleted Savings. Stalled Out Housing Market. Recession? Debt Ceiling… First Republic Bank is still in trouble, even with $30 billion of support from J.P. Morgan Chase, Wells Fargo, Bank of America, Citigroup and more. The company’s stock dropped from $115/share on March 8, 2023 to just $16 today. Over half of the S&P500 is at or near junk bond status. Keeping interest rates too low for so long encouraged companies to borrow lots of money at very low interest rates. Silicon Valley Bank was one of those companies. However, it is not the only bank with a BBB rating. 8 Fires The Feds Need to Put Out. With ways that we can protect our wealth now before the next unpleasant event. Bank Failures: Win and Defend Like Giannis Bank Stress Test Results Announced End of June Debt Ceiling End of May Inflation & Quantitative Tightening Rising Interest Rates. Bond Losses, Bank Failures and the Fed’s New Funding Facility Housing & Depleted Savings Recession? And here is more color on each point… Bank Failures: Win and Defend Like Giannis It has been reported that the star player of the Milwaukee bucks, Giannis Antetokounmpo, at one time had been putting his money in 50 banks, with no single account holding more than $250,000, to ensure that all of his cash was FDIC-insured. You’re going to start seeing a lot of pundits prognosticating that there’s no need for that, as the Feds, Treasury and FDIC are going to bail everyone out, even uninsured depositors. However, the FDIC limit remains $250,000, and if you read the FDIC statement from when the Silicon Valley Bank failed, you’ll see that there can be restrictions placed on withdrawing amounts that are above the FDIC-insured limit. It specifically reads that “Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds.” While the government agencies are promising that all depositors will get their SVB money back, there is a question of when they might have access to all of the funds. On March 13, 2023, I outlined seven strategies to enact now to protect your cash, so that you can win and defend like Giannis, instead of hoping for access to your money or counting on the FDIC to change the rules or raise the limit. Click to access that blog. Bank Stress Test Results Announced End of June Banks are currently conducting their stress tests. As I mentioned above, the Federal Reserve Board is offering a funding facility that should make it much easier for the mega banks to pass this stress test, even though most of them are at the lowest rung of investment grade. If a bank does not pass, they may be required to cut their dividend, as Wells Fargo had to do in the pandemic. The financial industry slowed their share repurchases in 2022, dropping from $62 billion in Q3 2021 to $23 billion in Q3 2022. $22.5 billion worth of shares were repurchased by the financial industry in the 4th quarter of 2022. The financial industry (not just banks) is vulnerable to continued weakness. We’ve been underweighting this industry for over a year, with the most recent blog warning against banks on Feb. 10, 2023 – one month before the SVB Bank failure. The stress tests apply to the largest banks, and are not required from the regional and smaller banks, like Silicon Valley and Signature banks, or from insurance companies or those involved in shadow banking. As I mentioned in my blog on the Silicon Valley Bank failure, Silicon Valley Bank was rated at BBB two days before it failed. Creditworthiness counts. Not only do we want to do a forensic review of the banks, brokerages, credit unions and insurance companies that we do business with, we must also be mindful of the loopholes of brokerages that claim our cash is FDIC-insured. It’s very important to be completely cognizant of the fine print now. (Our team can help with an unbiased 2nd opinion. Email [email protected] for pricing and information.) Debt Ceiling The collapse of Silicon Valley Bank, Signature Bank, and Credit Suisse Bank have captured the headlines. Few people are remembering that Congress is still wrangling over when and how to raise the Debt Ceiling, and that we are currently using extraordinary measures to pay our bills. X date, when we can no longer pay our bills, is expected in early June. So this important Act of Congress is going to start making headlines again in April, and could become a crisis if it’s not resolved before the end of May. Waiting until the last minute to strike a deal, which is what is expected to happen, will prevent a default, but could still have negative consequences. It is important to remember that waiting until the last minute cost the US its AAA rating with S&P Global on August 5, 2011. After that downgrade, gold and silver soared to their all-time highs. When investors lose faith in stocks and the dollar, safe havens become very popular. Bitcoin was selling for $19,500 before the SVB failure, and is currently at $28,202, up 42.6%. Silver has rallied 12% since March 10, 2023, while gold is up 6.6%. Inflation, Quantitative Tightening Inflation is still well above the 2% target of the Federal Reserve Board. At Jerome Powell‘s testimony to Congress on March 7, 2023, he indicated that rates are going to have to go higher than expected. Powell said, “The process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy. As I mentioned, the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.” We will know more about where interest rates and economic indicators stand on Wednesday after the meeting. However, persistent inflation creates a strong need for interest rate hikes and quantitative tightening to continue. It’s a delicate dance. Rising Interest Rates Low interest rates are intended to boost economic growth when recessions occur. However, the U.S. has had a low interest-rate policy since 2008. While this did help the economy rise out of the Great Recession and prevented a crisis during the COVID19 pandemic, it is also well known to cause inflation and asset bubbles, which are the bugaboos the economy now has to deal with. (The PBS Frontline documentary Age of Easy Money explains this well.) Low interest rates promote speculation and leverage, widen the gap between the rich and the poor, reward risk-takers and punish the prudent and the savers. “He’s your guy when stocks are high, but beware when they start to descend,” from “Diamonds are a Girl’s Best Friend.” To prevent a further crisis in shelter inflation and other US basic living essentials, the Federal Reserve is in a position of being forced to raise interest rates. They could surprise us on Wednesday and decide to pause the rate hike. However, given the pressures to abate inflation, any pause is likely to be temporary. Bond Losses, Bank Failures and the Fed’s New Funding Facility We’ve been warning about mid- and long-term bonds since at least 2012. They’ve been losing money and have had severe liquidity problems. Even the U.S. Central Bank began losing money in September 2022. Last year long-term government bonds lost -26%, which is more than the S&P500. So, it’s a very good idea to take a look at our portfolio and know exactly what we own and why, rather than having blind faith that someone is protecting our wealth, or throwing our hands up and thinking there is nothing we can do with our retirement plans (there are options). The SVB, Signature and Credit Suisse bank failures illuminate that even the professionals are having troubles with bonds. I’ll be addressing where to stash your cash in my video conference on March 30, 2023. If you’re not already signed up to receive the logon information, email [email protected] with VIDEOCON in the subject line. As I mentioned above, the Feds have set up a new funding facility for “eligible” banks, which will allow some to receive funds in exchange for their bond portfolio, where the collateral is valued at par. This is going to be very helpful for banks that qualify. However, there are a number of corporations and nonbank financial services that are also very heavily indebted and are exposed to bonds that are losing value, which are going to have more difficulty borrowing in a higher interest-rate environment than they did when money was free and easy. So, we may experience a more challenging recession this year than Wall Street has been factoring in, and there are likely to be more corporations in crisis. Housing & Depleted Savings The housing market has been a bright spot since the Great Recession, so even those who lost a home or two in the Great Recession are having trouble remembering just how bad it was then. Over 20 million homes were foreclosed on. However, with savings depleted, interest rates at a much higher level and real estate prices still very close to their all-time highs, very few people qualify for a mortgage at this time. Also a new hurdle has emerged that was previously suspended. The Consumer Financial Protection Bureau has a rule that borrowers of qualified mortgages cannot have a debt to income ratio above 43%. This rule was suspended during the pandemic, but it is now back into play for any loans that are guaranteed by Fannie Mae or Freddie Mac. DTIs have been running hot of late, as you can see in the chart below. High DTI ratios are correlated with recessions and outsized drops in values of real estate. Anyone who purchased a home between 2009 and 2013 has seen the value of their home double or, in some places, even triple or quadruple. However, it’s important not to confuse a bull market with wisdom. The factors that determine what happens tomorrow include all of the things listed above and more. One of the other headwinds against home price increases is that 99% of counties in the U.S. are unaffordable to the people who live there (source: AttomData). If you own a home that you can afford, in a place you want to live for the next decade, that you purchased before 2016, you should be in a good seat. If any one of those factors is missing, it’s a good idea to conduct a review of your housing plan. There is an entire section of Real Estate in The ABCs of Money 5th edition. Read that, or email [email protected] if you’d like an unbiased 2nd opinion with important data and information to factor into your decision-making. Home prices have started to slide. Nationwide, prices are down by -13% percent since the highs in June of 2022, from a median price of $416,000 then to $363,000 in January of 2023 (source: The National Association of Realtors). The places that went up the fastest are the ones that are dropping the most: Idaho, Arizona, Nevada, Washington and Oregon. Recession 2023? The U.S. defied economic expectations in 2022 with GDP rising 2.1%, but it had a lot to do with a one-off inventory increase. The first quarter of 2023 is expected to do pretty well, too. GDPNow predicts the economy will expand at 3.2%, while the more skeptical Conference Board is even forecasting 1% growth. The US economy is predicted to contract for three consecutive quarters starting in the second quarter of 2023. We will know how the economy fared for the first quarter of 2023 on April 27, 2023, when the advance numbers are released. Again, this could be a decent showing, with things starting to look more bleak over the summer, with the 2nd quarter reported on July 27, 2023. Bottom Line The world has never seen this much debt. Stocks have never been this expensive, even with the pullback in 2022. Many banks have allowed their credit rating to fall to the lowest run of investment grade. We must read the fine print. We must know the risks. We must understand how to protect our wealth and our future. There are ways to do all of this by taking a holistic approach to our budget, our investments, our cash, and our bills. It’s time to be the boss of our money and to have a plan that can navigate the previously unchartered risk that is currently present. Our easy-as-a-pie-chart nest egg strategies and Thrive Budget earned gains during the Dot Com and the Great Recessions. This is just the life math that we all should have received in high school. You can read about this system in our bestselling books. You can learn and implement the strategies in our 3-day life transformational retreats. The next one is April 22-24, 2023 online, so you can attend in your pajamas. Or you can reach out to me for an unbiased second opinion, where you will know exactly what you currently own. You will be provided with a pie chart of what a better plan looks like, and you will receive step-by-step instructions on how to better diversify your wealth and protect your future. For busy professionals, this is a very good first step toward being the boss of our money, rather than having blind faith that a broker/salesman is protecting our future for us. Email [email protected] for pricing and information. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 7 Ways to Stash Your Cash Now The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed