|

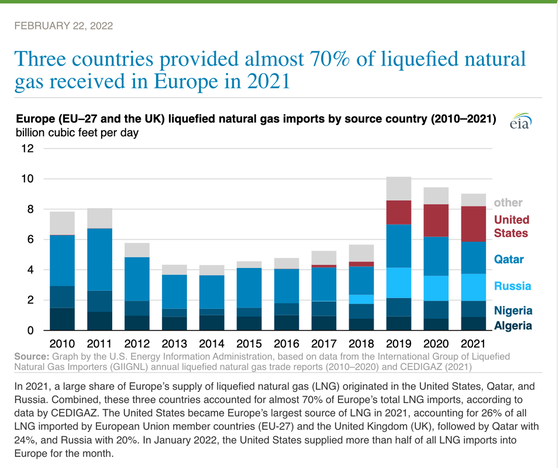

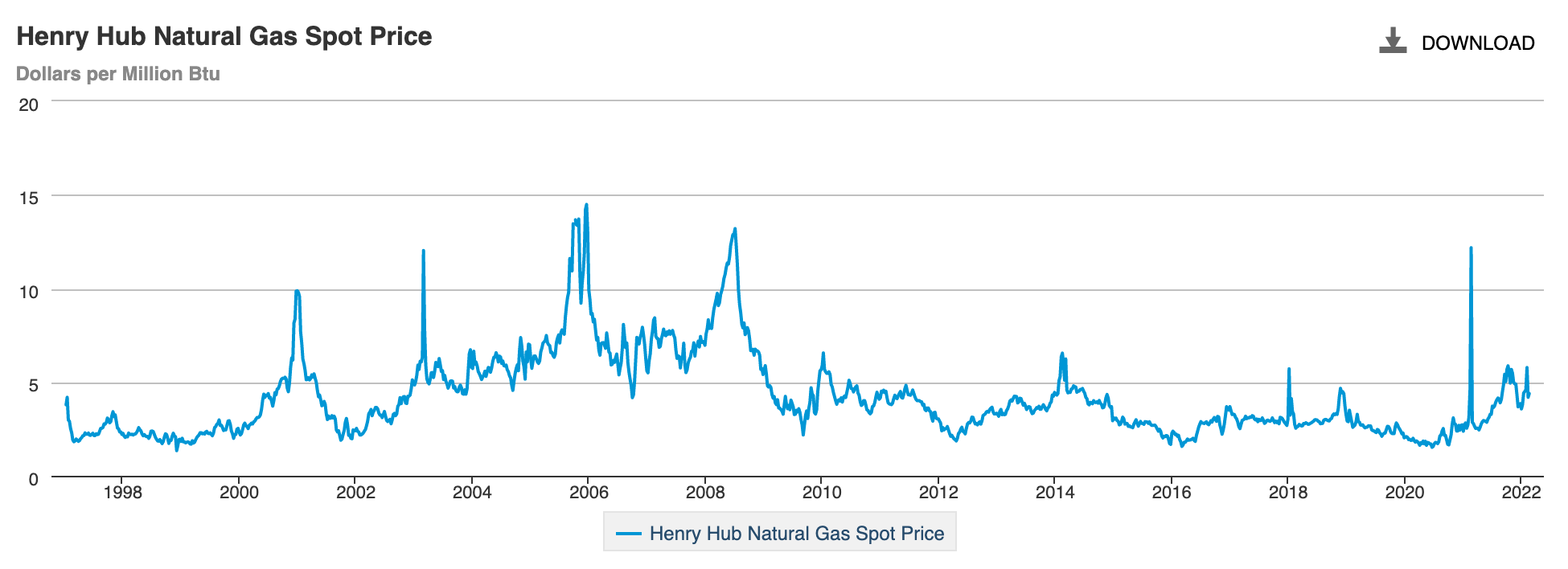

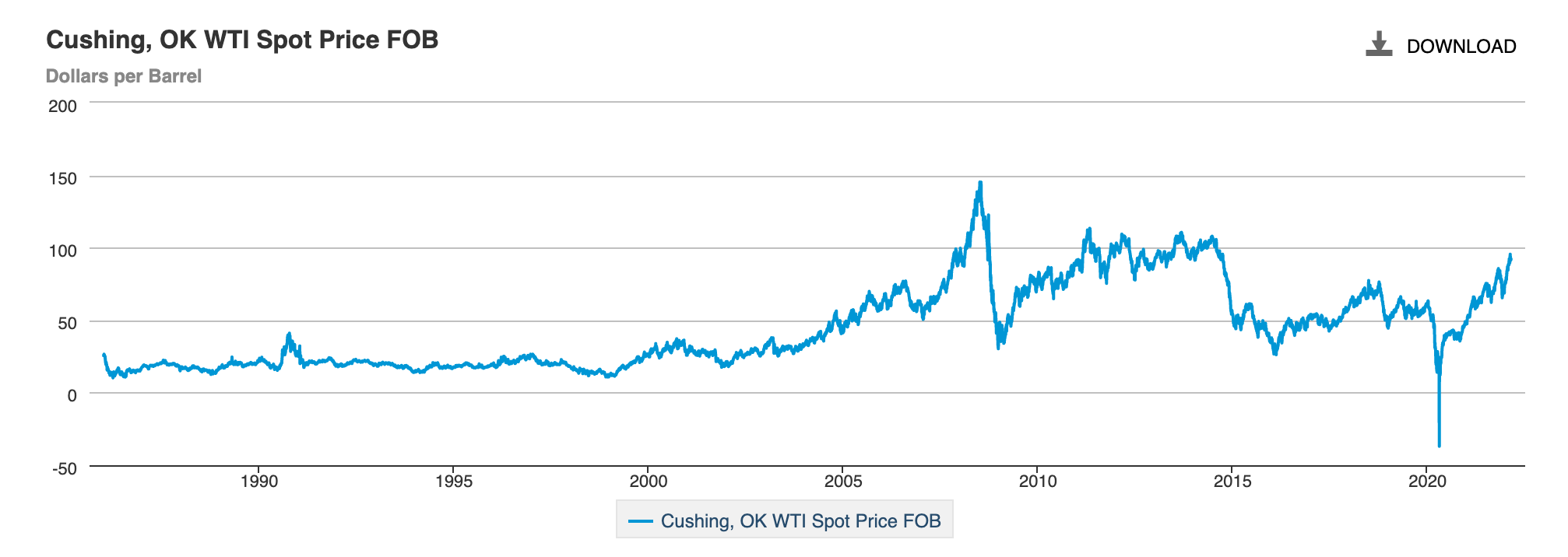

Corporate Boycotts of Putin’s War With a Special Analysis of Oil & Gas Trends Sports Clubs Were the First to Act The German football club FC Schalke 04 removed Gazprom (a Russian natural gas company) from their jerseys on February 25, 2022, the day after Putin’s invasion of Ukraine. The Poland, Czech Republic and Swedish soccer clubs announced that they will not participate in World Cup qualifiers scheduled to take place in Russia in March. Despite the rather cryptic tweet by Gazprom on February 19, 2022 (above) and social media pressure, it doesn’t appear that JP Morgan has taken any steps to limit their banking and capital funding relationships with Gazprom. However, BP became one of the first multi-national corporation to censure Putin’s invasion of Ukraine. Today, two BP representatives, Bob Dudley and Bernard Looney, resigned from the board of the Russian oil company Rosneft effective immediately. BP vows to “exit” its 19.75% stake in the company and take a “material non-cash charge” in the first quarter of 2022. That report is expected in May. S&P Global Ratings cut Russia’s sovereign rating to junk on Saturday, writing that the international sanctions imposed on Russia could have “significant direct and second-round effects on economic and foreign trade activity, domestic resident confidence, and financial stability,” which could weigh on growth. The Conference Board expected Russia’s GDP growth to be a rather tepid 2.0% in 2022 before the conflict, compared to 5.1% in China, 4.4% in the United Kingdom, 4.0% in Europe and 3.7% in the United States. Will Europe Boycott Russian Natural Gas? Over the last 5 years, Russia has supplied around 40% of European natural gas. Some countries are more exposed than others. Italy is the most exposed, since 50% of its electricity comes from natural gas and 95% of that amount is imported. This is why none of the sanctions (so far) include what would hurt Russia the most – a boycott of oil and gas. Will Russia retaliate against NATO nations’ sanctions and withhold oil and gas from Europe – cutting off its most important source of income? That’s equally difficult to imagine, as Russia needs riches to fund its military aggression. So, investing in natural gas expecting it to spike in price isn’t a guarantee. In the event of a severance in the natural gas relationship between supplier (Russia) and customer (Europe), the U.S., Qatar and Nigeria might benefit, as you can see in the chart below. Will Natural Gas Prices Soar? The peaks and valleys of natural gas prices reflect both supply and demand side shocks. In December 2000, natural gas prices soared to $8.90 per mmBtu, almost quadrupling from the start of the year, when gas prices were at $2.36. It was an abnormally cold winter, and there was an increase in demand for natural gas for heating (source: GAO.gov). This occurred at a time when supplies by both utilities and marketers were unusually low. With increased demand and higher prices, gas companies increased production. By the end of October 2001, prices were back down to $2.46 mmBtu. In October of 2005, gas prices soared again, spiking from $6.35 in October 2004 to $13.42. This time, it was an unexpected drop in supply that was the culprit. Hurricanes Rita and Katrina disrupted production and delivery from the Gulf of Mexico. By September 2006, prices were back down to the $4.90 mmBtu range. And those are where prices are again today, after a knife-like slice just before the Russian invasion of Ukraine. As of February 23, 2022, natural gas prices are $4.59. If prices spike, it’s important to remember that they can also plunge. In anticipation of the U.S. Invasion of Iraq (March of 2003), natural gas prices doubled to $12.03 at the end of February 2003, and then plunged back to $5 by the end of March, only a month later. Supply Side Disruptions If the report from Gazprom is accurate, then Europe and the Ukraine have dangerously low gas inventories. The EIA.gov reports that the U.S. storage is on the low end, based upon 5-year averages, at just 1782 Bcf. Without sanctions, boycotts or withholding, prices could remain fairly stable. However, whether it is a decision made by a government or multiple Ukrainian pipelines destroyed by Russian missiles, there could easily be a supply-side disruption that factors into already low storage. (Ukraine lies between Russia and Europe so destroying the pipelines that funnel Russian gas into that region would be counterproductive.) Any severe supply side disruption would cause gas prices to soar in the near-term (2-12 months). In the past, high prices prompt an increase in production, which floods the market with supply, bringing prices back down again. The higher the price, the more swift and severe the decline. Demand The only good news is that February is the last winter month in Europe. Demand for heating could abate in the coming weeks. However, if summer is as hot as it was last year, then demand for natural gas to power air conditioners will be high. Prices of Natural Gas and Oil As we’ve seen in the chart above, natural gas price summits tend to be rather short-lived. On the other hand, oil prices can stay elevated during prolonged periods of conflict. War requires a lot more gasoline than peace does. ESG Considerations Many people are not aware that just 20 fossil fuel companies are responsible for over 1/3 of CO2 emissions since 1965 (source: ClimateAccountability.org). BP is 3rd on that list, behind Chevron (#1) and ExxonMobil (#2). If we care about the environment and are committed to climate action, then it’s essential to make sure that we are not profiting from polluters, particularly in our 401k, mutual funds or managed brokerage account. It’s also critical to decrease our oil addiction. These companies are simply supplying the fuel that we power our cars and lives with. I’ll be outlining easy ways we can power green and reduce our carbon footprint in my new book The Power of 8 Billion, which will be released in the coming month. Email [email protected] with The Power of 8 Billion in the subject line to be notified if its release. Bottom Line Be careful betting on natural gas at this time. While supply side constraints could push gas prices up quickly, the fall can be just as fast. Oil prices, on the other hand, could remain elevated in 2022, as a flight to the suburbs increases gasoline consumption. The trend for electric vehicles is positive for natural gas and negative for oil companies in 2025 and beyond. Many electric grids around the world are still powered 60% or more by fossil fuels (mostly natural gas), so this isn’t as clean of an alternative as many drivers might think. In 2020, EV sales were 3 million – about 4.1% of total car sales (source: IEA.og). If you’d like an Oil or Gas Stock Report Card, just email [email protected]. If you’d like to divest your portfolio of oil and gas investments, you can learn how at our Investor Empowerment Retreats. The next one is March 18-20, 2022. Early Bird pricing ends on Feb. 28, 2022 (Monday). Our easy-as-a-pie-chart investing, with regular rebalancing, earned gains in the Dot Com and the Great Recessions and has outperformed the bull markets in between. So, if you are a Buy & Hope investor, it’s important to read between the lines of rhetoric, understand the true trends, and consider adopting a strategy that works in a 21st Century world marked by overvalued equities, unprecedented leverage and deep downturns. If you’d like to see the charts of past war-time shocks to the stock market, lined up with the average P/E of the day, just email [email protected]. You can watch my videoconference on the Ukrainian Crisis, which features 5 things every Buy & Hold investor must do now and 3 essential strategies for Pie Chart Investors, at YouTube.com/NataliePace. (If you don't know the difference, you'll learn in the free videoconference.)  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Monday, February 28, 2022, to receive the best price. Click for testimonials & details. Other Blogs of Interest Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed