|

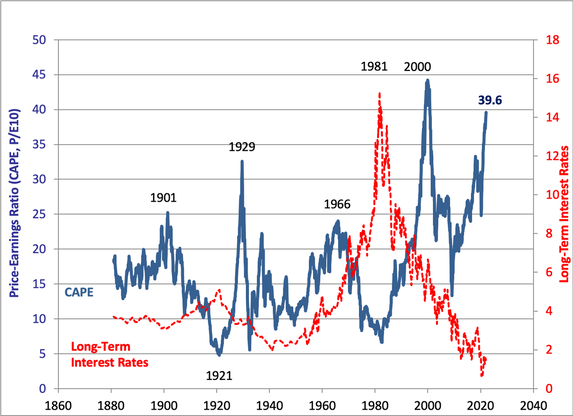

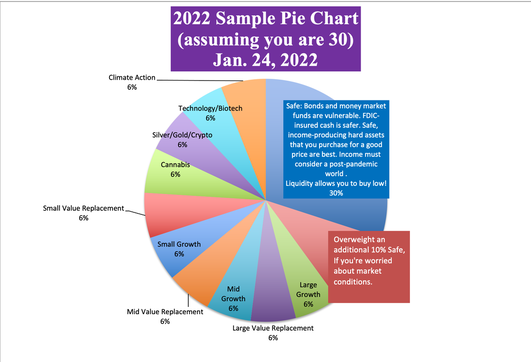

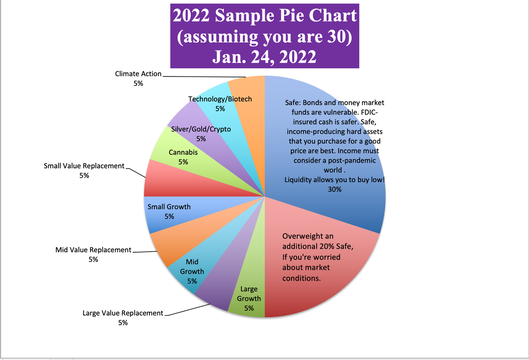

The NASDAQ Composite Index was down -15.1% from its 52-week-high (set on Nov. 19, 2021) and -12% since Jan. 1, 2022, as of Friday, Jan. 21, 2022. The S&P500 sank -10.7% on the year today (Jan. 24, 2022). Is this the beginning of another plunge a la Feb. 19-March 23, 2020 (-38% in the S&P500), or Oct. 2007-Oct. 2009 (-55% in the Dow Jones Industrial Average), or March 2000-October 2002 (-78% in the NASDAQ Composite)? What’s your best plan? Will stocks recover or continue to sink? Stocks in 2022: Churn As Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab, told me in an interview on Thursday, the current weakness in the indexes is something that has been happening under the surface all last year on the individual company level. More than 90% of the NASDAQ Composite Index endured a correction of at least 10% in 2021, and almost half lost 50%. Of course, that’s an average. Some stocks had far wilder gyrations, while others were in a more limited range. The smaller the company, the more likely it was to experience rapid-fire, extreme volatility. Who’s Doing the Selling? According to Howard Silverblatt, the Senior Index Analyst of the S&P 500®, it appears that the selling is institutional. That means the big money is making the move. That is often the case early in a correction. It was institutional money that initiated all the selling that happened between February 19 and March 23 of 2020. The real question now is… Will Stocks Recover or Continue to Sink? There’s a lot of pressure on stocks these days. Equities are very overvalued. You can look at Professor Robert Shiller’s CAPE ratio below, or link to the Buffett Indicator in Liz Ann Sonders’ Market Outlook from Nov. 29, 2021. According to the Federal Reserve Financial Stability Report, when asset prices become elevated (as they are today), the correction can be swift and severe, and other financial risks become elevated. On Nov. 8, 2021, the report warned: Elevated valuation pressures tend to be associated with excessive borrowing by businesses and households because both borrowers and lenders are more willing to accept higher degrees of risk and leverage when asset prices are appreciating rapidly. The associated debt and leverage, in turn, make the risk of outsized declines in asset prices more likely and more damaging. What other headwinds are on stocks? Rising interest rates will slow the economy, as will the sunset of government programs. Inflation can be negative for stocks. The University of Michigan consumer sentiment survey indicates that the high prices of homes, cars and other consumer goods has tanked buyer intentions. With almost 70% of GDP linked to consumer spending, GDP will slow. It is predicted to still be relatively strong, at 4.0% in the U.S. (and 4.8% in China). However, the outlook might change if the headwinds get stronger. In fact, another way to look at the institutional selling could be a signal to Washington and the Feds that the economy and the consumer still need more support. What Could Help Stocks to Rise Again? The Federal Reserve Board has certainly been a friend to the stock market under Jerome Powell. However, the last meeting minutes indicated that the FOMC members were committed to stopping their purchase of assets, to rolling down their massive $8.9 trillion balance sheet and to raising interest rates. Interest rates are expected to climb to almost 1% this year and 1.75% by 2023. When money gets tighter, Wall Street gains are muted. It’s rare for a recession to occur in the first year of the tightening. Of course, with so much leverage and debt in the world and the elevated asset prices (on average, not on all stocks), there is always a more heightened risk of that “outsized decline.” In my Crystal Ball videoconference from last Thursday, I warned that there are many indicators that 2022 would be in the low single-digits for gains – far from the 26.6% S&P500 scorecard of 2021. The Feds are keenly aware of their influence on stock market movements. So, the Jan. 25-26, 2022 FOMC meeting will be a lively discussion. Inflation is forcing their hand to raise interest rates. Having too much on the balance sheet has definitely got them interested in reducing that. We’ll see whether or not the January plunge of stocks will inspire them to stay on course with their deleveraging and interest rate hikes, or offer language and a slower trajectory that calms the markets. If they decide to slow down their action to settle stocks, it may well do so. If they stay on course, it’s possible that the Taper Tantrum will continue. So, there will be a lot riding on the press release that comes out at 2 PM ET this Wednesday. Corporate Buybacks The large corporations have a lot of cash. 2021 set records for corporate buybacks, with about $850 billion of stock repurchased. Apple alone repurchased $92.5 billion of their own stock over the 12-month period (3Q 2021 – 3Q 2022). Corporate buybacks are a driver of market gains. According to Howard Silverblatt, corporations are expected to continue their buybacks in 2022. Speaking of buybacks, the last major downturn (outside of the pandemic recession between Feb. and March of 2020) in Dec. of 2018 had a lot to do with Apple stopping their repurchase plan that December. The company dropped from an average $20 billion a quarter in purchases to $10.1 billion for the 4th quarter in 2018, with almost no purchases in December. That resulted in the worst December on Wall Street since the Great Depression. 2019 then went on to rack up 28.9% gains, with Apple back on track for their quarterly $20 billion repurchases. There has been a high correlation between Apple’s purchases and general index performance over the last few years. Churn In 2021, we saw a substantial amount of churn. Moderna, with outstanding sales growth of over 3000% in the 3rd quarter of 2021, rocketed from $150/share to almost $500/share and then dropped back down to $160. Tilray is trading at $5.60 but soared to $67 in February 2021. The volatility has been more prevalent in smaller companies than larger companies, with micro caps suffering the most. Hedge funds and hot money adore volatility. If you’re going to own individual companies, particularly if they are in the small or midcap range, you have to babysit them. If you get lucky enough to shoot the moon, you have to have a strategy for taking your profits swiftly. Liz Ann Sonders phrase, “Add low, trim high” is applicable for a company you believe in that is experiencing extreme volatility (and also in your nest egg strategy). It doesn’t have to be all or nothing. Market timing just doesn’t work. What’s Your Best Plan? Early in 2021, when it was clear the year would be on fire, we took off the overweight safe on our pie charts, which had been in place in early 2019 (before the pandemic). With all of the volatility and market headwinds, it’s a good idea to overweight safe again in 2022. See below for what a 30-year-old overweighting 10% and 20% safe, with proper diversification, would look like. What does overweighting safe mean? You should always start your plan by keeping a percentage equal to your age out of stocks, and in a place that won’t lose principal. It’s very important to know what is safe in a Debt World. That’s tricky. Because in your retirement plan, if you overweight safe you might be in a money market fund. Money market funds can lose value. They have redemption gates and liquidity fees. They are not federally insured. Bonds are illiquid, highly leveraged and negative-yielding. Your best plan is knowing how to properly diversify and how to get as safe as you possibly can in a world where that is difficult. By 2023, yields may be high enough that you can take on a midterm creditworthy bond that pays you a nice dividend of at least 5% or 6%. If you try to get a 5%-6% yield in today’s world, you have to go into junk bond territory, where your principal is at risk. You can read about our time-proven 21st-century strategies in The ABCs of Money, or you can learn and implement this time-proven plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed