|

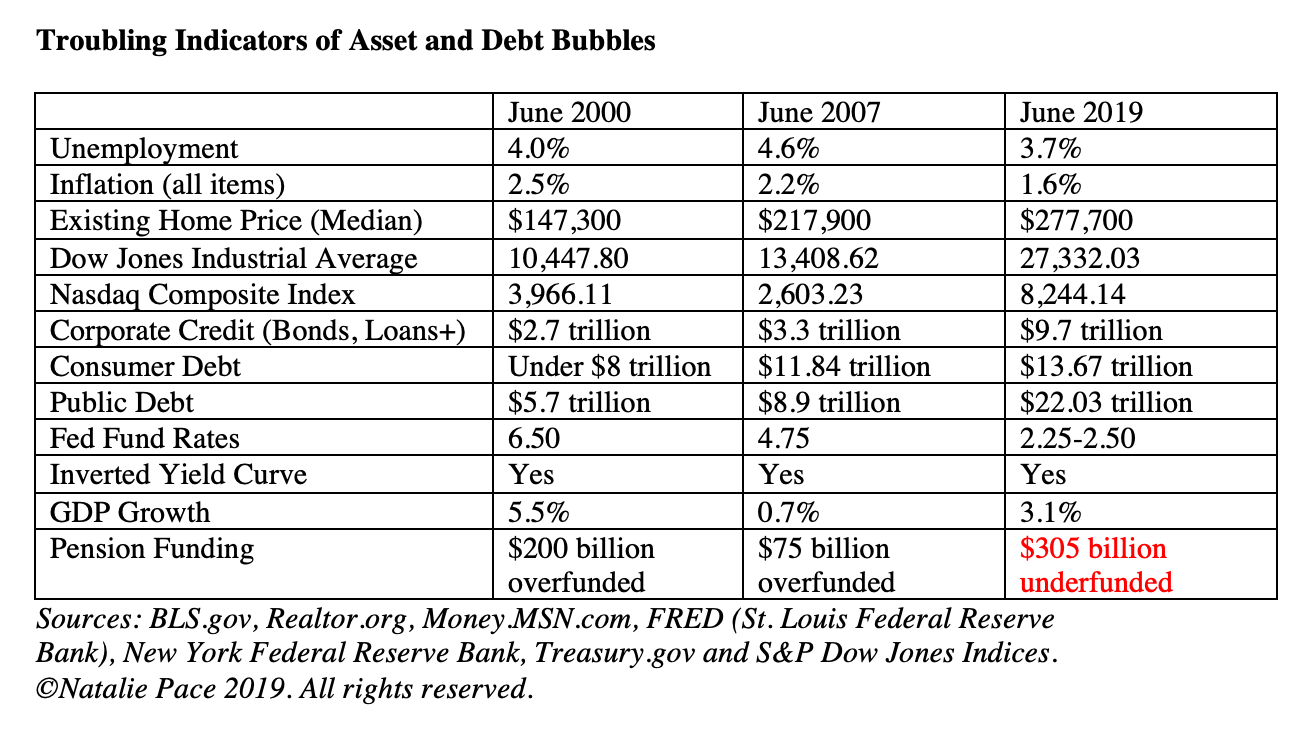

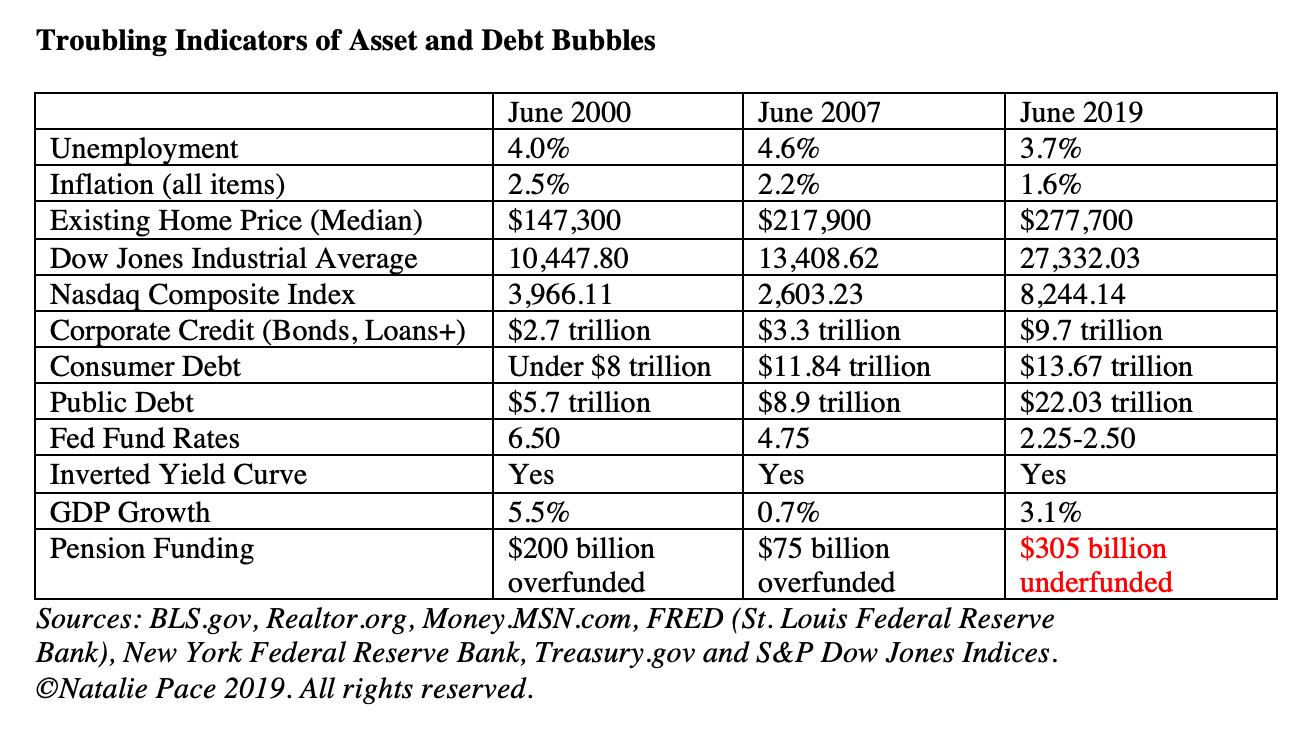

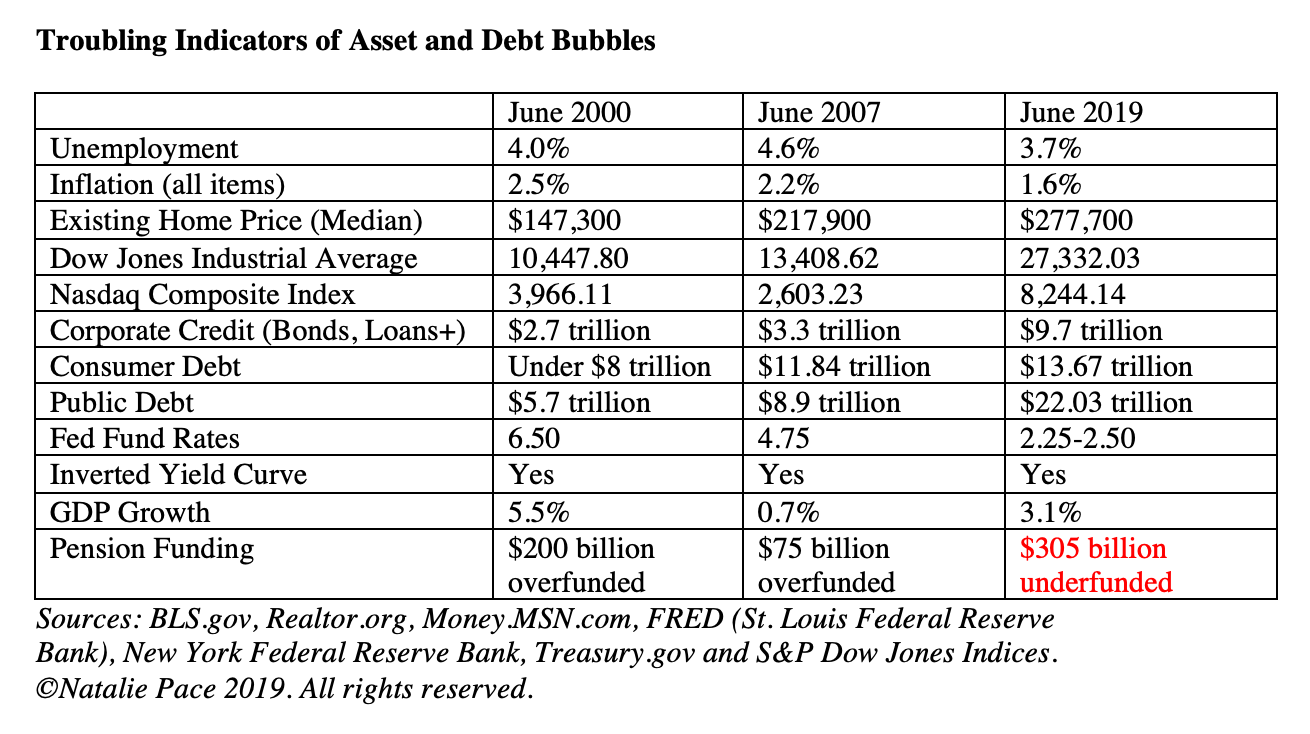

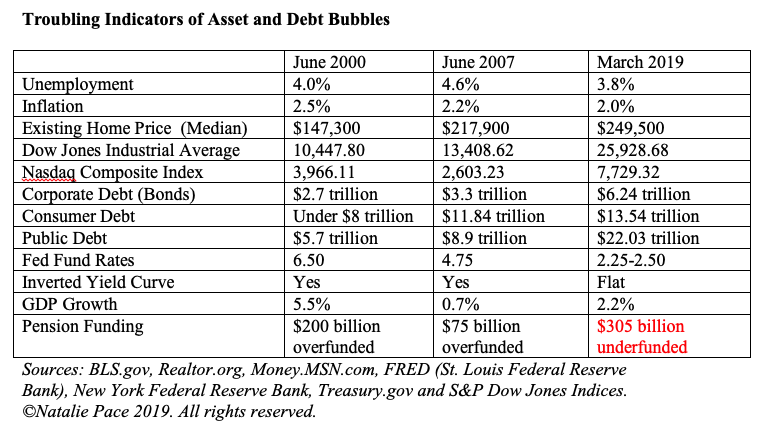

The numbers you need to know about what’s really going on. A check up on the latest indicators, and a sobering look at what is really driving the market, and emerging industries, like cryptocurrency, cannabis and the gold rally. The Federal Reserve Board is widely predicted to lower interest rates by 25 basis points today at 2:00 p.m. ET. However, it’s important to remember that even though the White House and Wall Street are pressuring the Feds to act early, that doesn’t mean they will. December 2018’s rate hike is proof of that. A slight majority of governors on the federal reserve board are keenly aware that pervasive low interest rates have created financial imbalances, overleverage and asset bubbles. Actually, all of them are aware of this. However, Randy Quarles, one of the current Administration’s recent additions to the board, believes “monetary policy should be guided primarily by the outlook for unemployment and inflation and not by the state of financial vulnerabilities.” (It’s hard to imagine a board governor actually saying this a mere 12 years after the worst bank meltdown the world has seen since the Great Depression.) Lowering interest rates at this time should keep unemployment low and inflation from sinking further. However, this is a risky move due to the level of leverage (which is eyepopping astronomical) and because the U.S. is already too close to zero to really get help from lower interest rates when the economic storms start swirling. What financial vulnerabilities? Which Feds are more hawkish? Check out my blog on these subjects by clicking on the blue highlight. See the data below for yourself. Below is what I’ll cover… Slow Growth

Astronomical Debt

Market Highs and Elevated Risk

Emerging Industries

And here’s the data on each point. Slow Growth

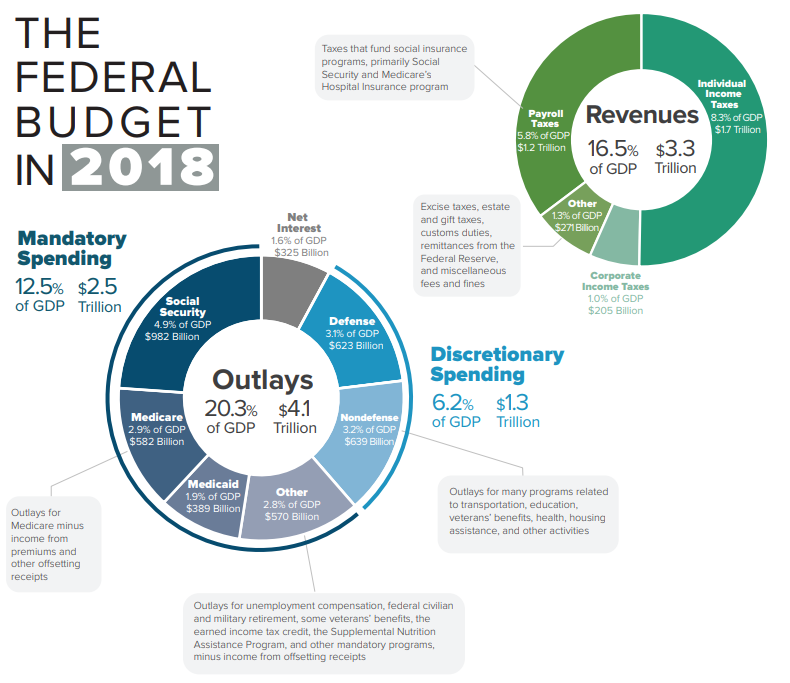

Everyone loves lower taxes. However, in your own home, if you reduce your income, you know you had better cut your costs. Otherwise, you might lose your home or end up in bankruptcy court. The same holds true with the Federal government. The tax cuts dramatically reduced the income of the federal government. This was not made up for in economic growth, as the American people were promised. And now, debt and deficits have soared to all-time, perilous highs.

Elevated valuation pressures tend to be associated with excessive borrowing by businesses and households because both borrowers and lenders are more willing to accept higher degrees of risk and leverage when asset prices are appreciating rapidly. The associated debt and leverage, in turn, make the risk of outsized declines in asset prices more likely and more damaging. Similarly, the risk of a run on a financial institution and the consequent fire sales of assets are greatly amplified when there is significant leverage involved. In other words, the economy today looks a lot like it did in 2008, when we had to bail out the banks. Next time, however, the banks will resort to a bail-in program – on your dime. (Keep reading.)

Market Highs and Asset Risks.

Emerging Industries Libra & Cryptocurrency. Facebook’s Libra cryptocurrency has a vision to create a more globally inclusive currency, based in block-chain and backed by a basket of assets (unlike most cryptocurrency that have no asset backing). The obstacles include a pervasive, inherent lack of trust that users have about Facebook. Additionally, government entities, like Congress and the Federal Reserve Board, want a thorough examination of Libra before it is allowed to infiltrate the monetary system. As for Bitcoin, Ethereum, Litecoin and others, these are mostly trading platforms. Very little actual consumption purchases are happening with the coins themselves simply because you can’t have a currency that is valued at $20,000/coin on one day and $6,000 just a few months later.

If the Feds cut interest rates, that, historically, kicks Wall Street back into gear. However, the “smart money” knows that the cut is coming due to economic weakness. Additionally, a rate cut is already built into the current record-highs. If the Feds don’t cut interest rates, something that few on Wall Street are expecting to happen, it’s because they are concerned about financial stability. The “smart money” will understand quite clearly that the Feds are deliberately taking away the punch bowl of this bull market, which has been largely built upon businesses and consumers borrowing from Peter to pay Paul. In this case, we may see another Wall Street tantrum, such as we saw in December of 2018, when the Federal Reserve Board dared to defy the White House and raised interest rates. Stocks sank 10%, for the worst performing December since the Great Depression. In either scenario, it seems very clear that we are in the latter days of this business cycle. That’s not what you’re going to hear from your broker-salesman. They will tell you how great your investments are doing (now that stocks, real estate, etc. are at an all-time high). That is why you have to be the boss of your money, and adopt a time-proven plan that doesn’t have a leaky roof that floods your financial home when economic storms hit. I’ll offer comments on the Fed decision on my Twitter feed around 2:00 p.m. ET today. You can access it on the home page at NataliePace.com. Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Boeing 2Q 2019 earnings report was, as expected, pretty ugly. As the company admitted in the press release, revenue was down 35%, to $15.75 billion from $24.3 billion last year. The net loss was $2.94 billion, compared to net income of $2.2 billion in 2Q 2018. The 737 Max remains grounded. According to the earnings press release, “Disciplined development and testing is underway and we will submit the final software package to the FAA once we have satisfied all of their certification requirements.” Chairman, president and CEO Dennis Muilenburg stated in the press release that “During these challenging times, teams across our enterprise continue to perform at a high level while delivering on commitments and capturing new opportunities driven by strong, long-term fundamentals.” However, the devil is in the details. Below are a few operational red flags that are listed in the fine print of the earnings report (and elsewhere), but certainly not highlighted in the press release. Red Flags in the 2Q 2019 Boeing Earnings Report

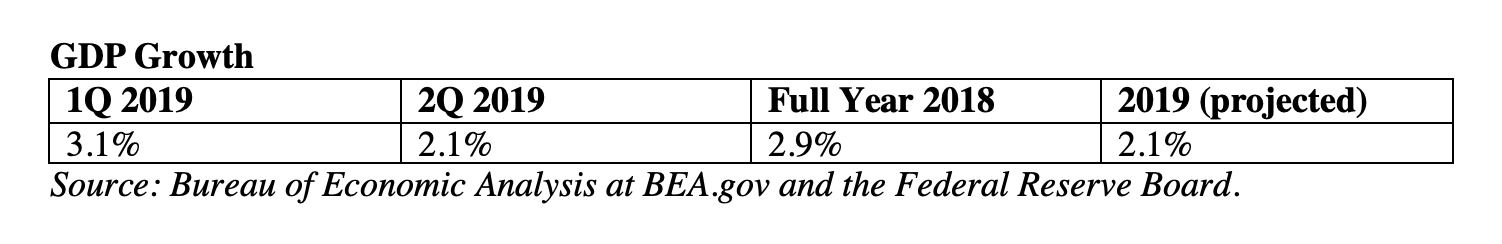

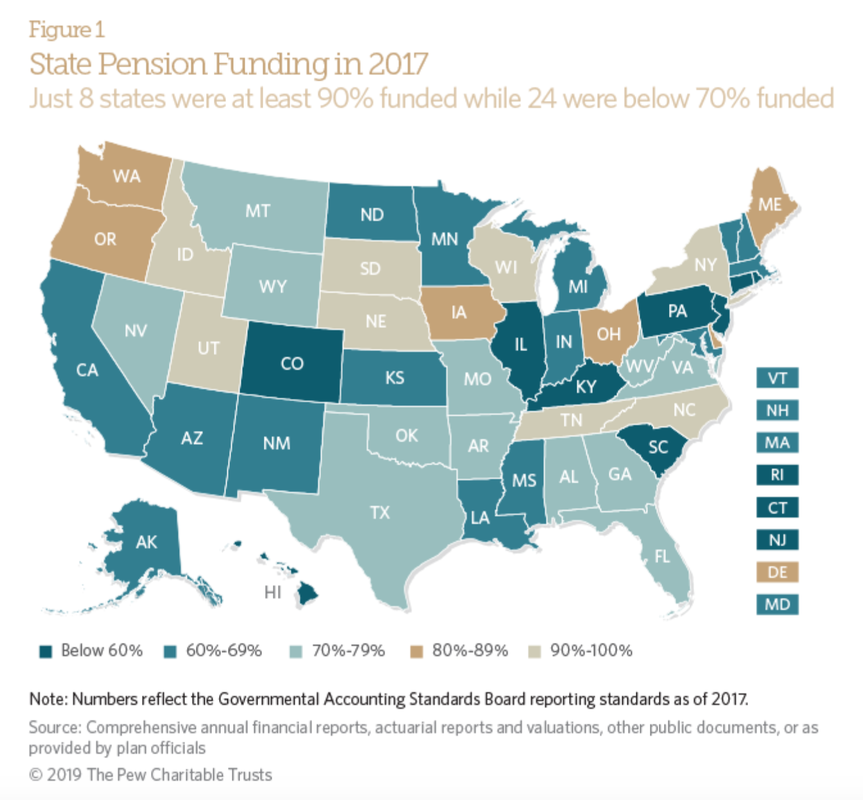

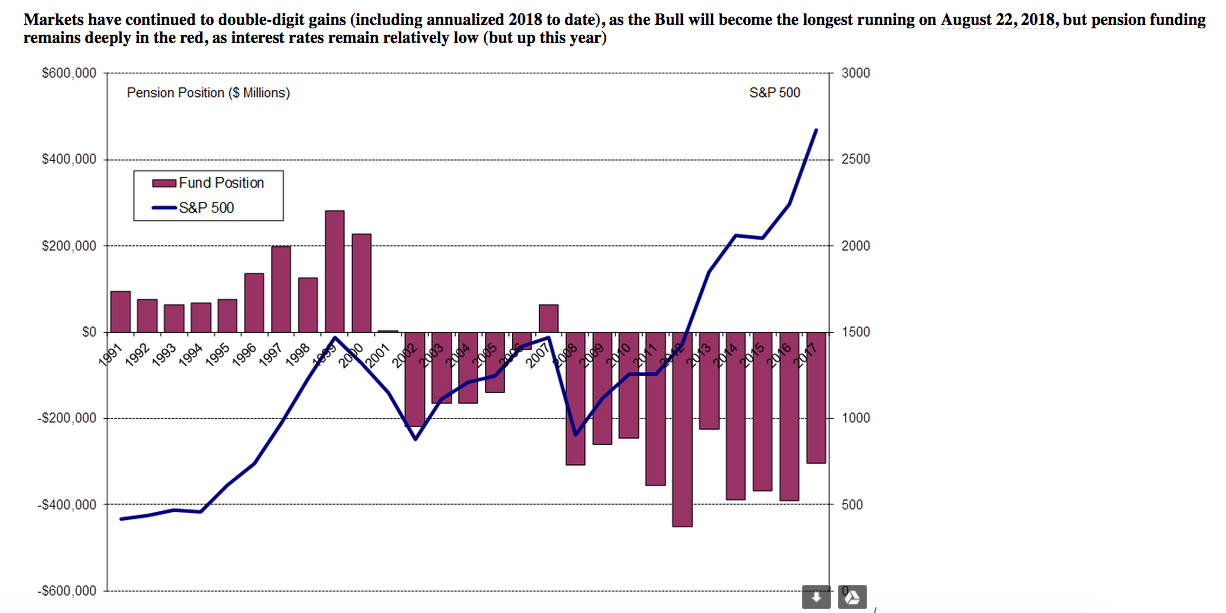

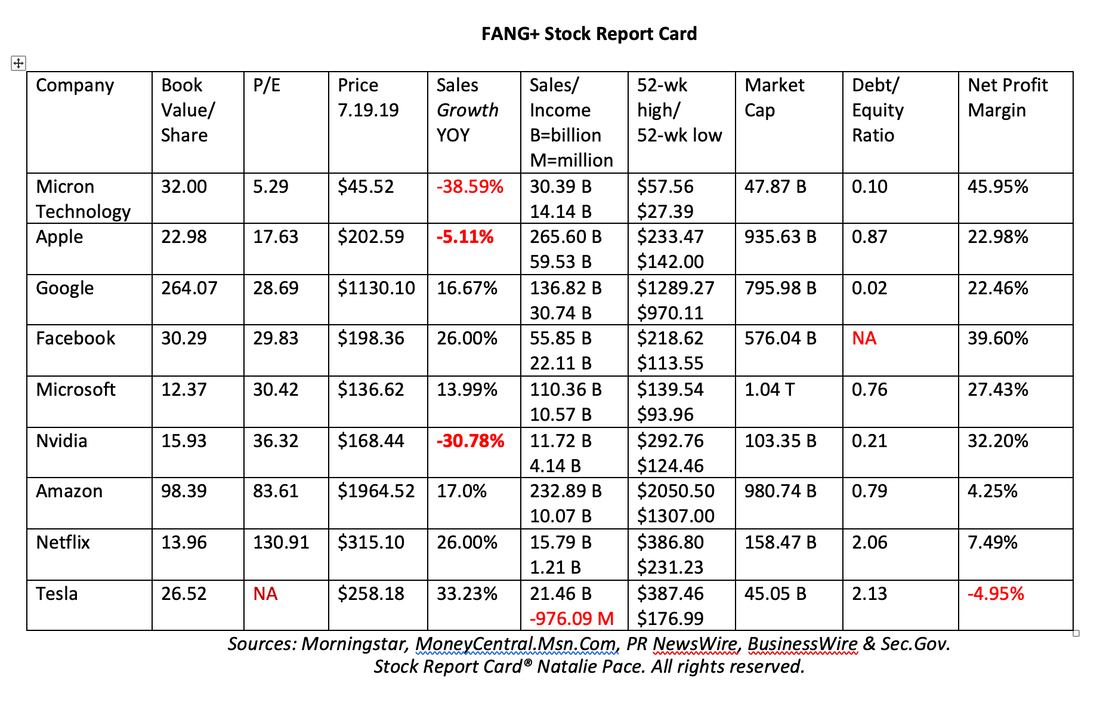

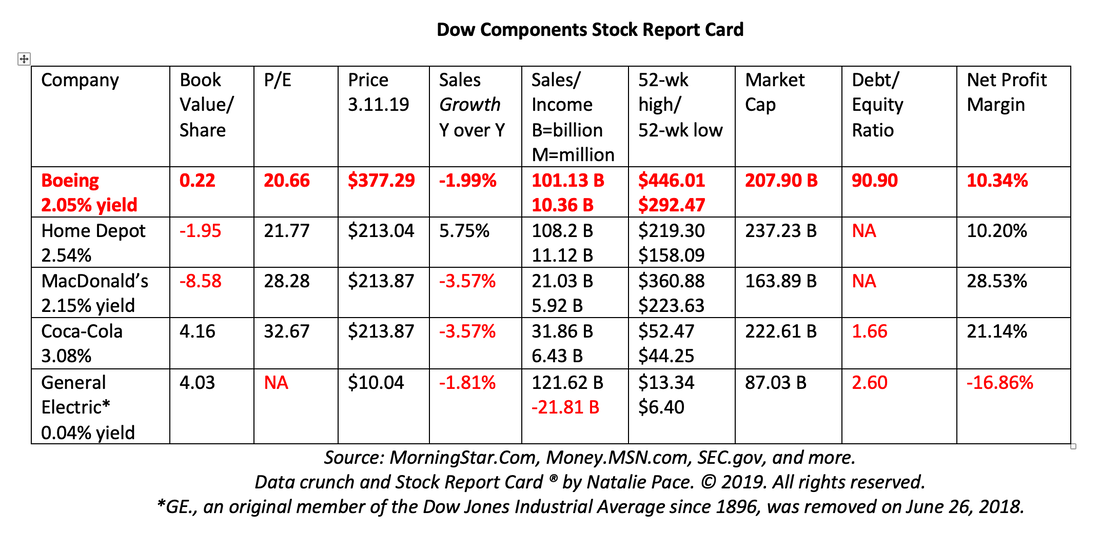

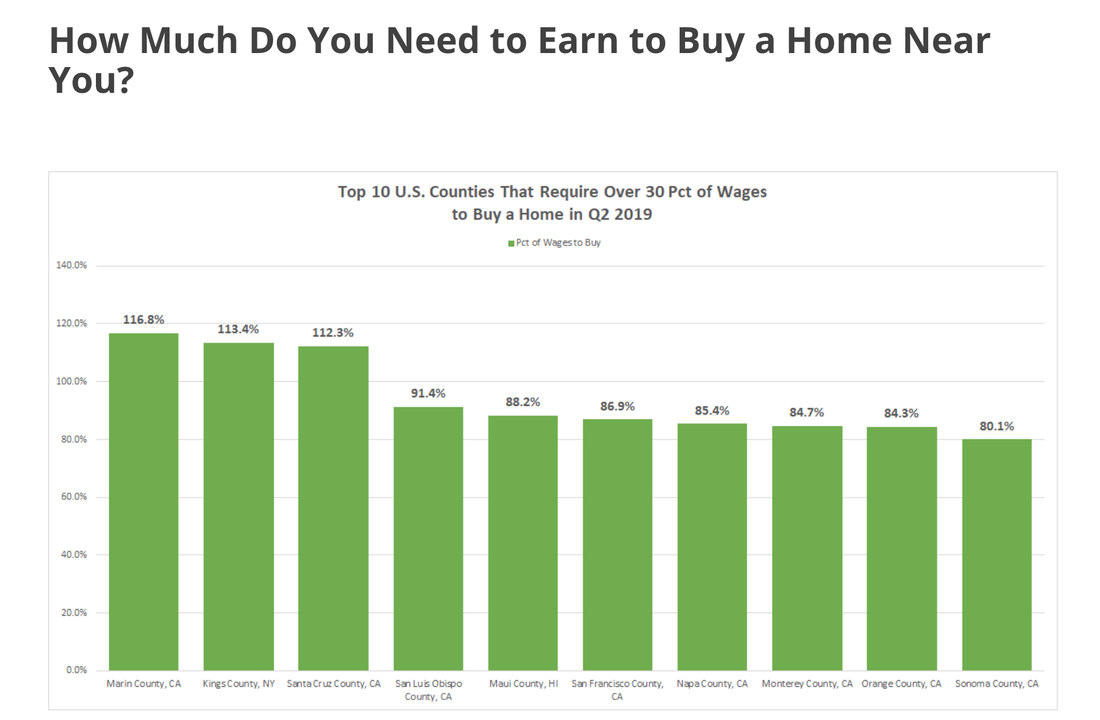

And here are the details behind each point. 1. Corporate Buybacks Boeing repurchased $2.65 billion of its shares in the 2nd quarter of 2019. In 1Q, Boeing repurchased $2.574 billion. $9.257 in shares were repurchased in 2018. 2. Increased Dividends Boeing paid $1.2 billion in dividends in the 2nd quarter. That’s 20% higher than last year. 3. Borrowed Money Boeing borrowed $4.5 billion in the quarter. Cash and marketable securities are now $9.6 billion. Total liabilities and equity, including pensions and other post-employment benefits, total $126.2 billion. FYI: The last casualty to borrow in bonds to repurchase stock and pay dividends on such a level was General Electric. As you’re likely aware, the GE dividend is now just 4 cents, and the share price has imploded by 70% from its 2017 highs. 4. Insider Selling So, why is Boeing so intent on buying back its own shares, instead of keeping the borrowed money to shore up operations, and perhaps hire more engineers and specialists, to return the 737 Max to operations? (The costs of products and services were lower this quarter than last year.) It’s clearly to keep the share price shored up and keep investors from selling the stock, by baiting them with a 2.2% yield on their dividend. Insiders at Boeing, however, have already dumped $30 million of shares since the first Lion Air crash on Oct. 29, 2018. The selling began on the exact day of the crash. 5. Pensions and OPEBs Boeing was $22.3 billion underfunded on its pensions and other post-employment benefits, as of 2017. From the 2Q 2019 earnings report, it does not look like the company used any capital to reduce this underfunding level. (We’ll get the full 2018 funding status by S&P Dow Jones Indices shortly.) In past market rallies, corporations were overfunded on their pensions. However, this time around, even with markets at an all-time high, pensions remain severely underfunded, as you can see in the chart below. 6. Price to Earnings Ratio The forward price to earnings ratio of Boeing is 28.27 – very high for a company that is losing so much money. So far, Boeing’s 3Q is not shaping up much better than 2Q was. 7. Book Value Boeing’s book value per share is now just 22 cents. Economist Benjamin Graham is signaling caution to investors from his grave. Will Boeing Pull Through? Just as General Electric is still in business, Boeing is going to pull through this. However, that doesn’t mean that there won’t be investor casualties along the way. By many value measures, Boeing is overpriced. If you’re being lured in by the dividends, it pays to remember the age-old market aphorism – “Never reach for yield.” If you’re a pensioner, and you’re being offered a buy-out, then it’s worth considering. The current underfunding status, and the apparent lack of commitment by the company to fix it while the sun is still shining, is of great concern. In the next downturn, the underfunding status will likely increase, and there will be fewer resources available to address it. That can mean a forced hair cut on pensioners, as it has for other companies faced with legacy costs, such as Boeing has. What Lies Ahead? On Friday at 8:30 am ET, the Bureau of Economic Analysis will release the 2Q 2019 GDP growth report. Current estimates have it coming in at 1.4-1.6% growth. That is far below 1Q’s 3.2%. Investors are not likely to be happy. So, making sure that your portfolio is properly protected and diversified, and that you know what’s safe in a world where both stocks and bonds lost money in 2018, is a top priority. Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. So, the markets are rallying because the economy is weakening… Hmmm… What might we be missing here? Tune into my free July 2019 Teleconference for additional information. (Click to access.) The economy is weakening by more than a few economic indicators, which has prompted Wall Street to believe there will be an interest rate cut on July 31, 2019 from the Federal Reserve Board. The cut excites everyone because low interest rates mean you can borrow money very cheaply. Err. That is if you are a corporation or you have an outstanding credit score. Main Street folks are borrowing on credit cards and paying 28% interest. Many banks have even stopped making mortgages because of the inverted yield curve. (The secondary market, like Quicken Loans, are lending like crazy.) How does a weaker economy translate into higher stock prices? Is that a good thing, or is it a short-term high with long-term consequences? What should you do? Buy? Sell? Hold? Below we’ll discuss: 1. Signs of a Weakening Economy 2. The 2Q 2019 GDP Report 3. The Shocking 36% Drop in Foreign Investment in U.S. Real Estate 4. The U.S. Budget Deficit and Skyrocketing Public Debt 5. The Federal Reserve Board Meeting on July 30-31, 2019 6. Financial Stability and Asset Bubbles 7. What You Should Do. And here is additional information on each subject. 1. Signs of a Weakening Economy The 2Q 2019 Corporate Earnings Decline (happening now). The benefits of last year’s tax cut are last year’s news, and now corporations must return to selling more product (or buying back their own stock) to increase their earnings per share. So, which companies are hot, and which are using financial engineering? Wall Street continues to be a tale of two cities. The newer growth companies, like FANG, are reporting strong (real) sales growth, but are overpriced. As you can see in the Stock Report Card below, valuations are lofty. You can also see that stocks that miss the growth boat are punished pretty heavily. Micron is down 26% from its 2018 high. Nvidia is down 40%. Apple repurchased $28 billion in buybacks to keep its stock price up. And this is at a time when the general market is back near its all-time high. The old-school blue chips have high debt, slow or negative growth, and are also overpriced. As you can see from the Stock Report Card above, many of the Dow Jones Industrial Average components have a negative book value, meaning that their debts are far above their assets. I’ve included General Electric because even though GE’s implosion was in 2017, few have learned the lesson. (GE was a Dow component since the beginning of the index through June 26, 2018.) GE was borrowing cheap money, repurchasing its own stock and paying dividends, instead of fixing its systemic issues – something that other Blue Chips, including Boeing, are doing. That burned through a lot of cash, but kept the share price high for years – until the banks put too many conditions on the borrowing, and the company had to slash its dividend first by half, and then to almost nothing. The GE share price dropped by 50% overnight and is still down almost 70% off of its 2017 high of $31.60. Buybacks are set to hit another all-time high in 2019. Last century’s name brands don’t appear to be as over-priced as the hot 21st century disrupters because buybacks are at an all-time high. Corporate buybacks take earnings per share higher (by reducing the share count), which then takes the price to earnings ratio lower. Apple tops with the list of corporate buybacks in the 1st quarter of 2019 with $23.8 billion shares repurchased, with Microsoft in the top 10 as well, with $4.8 billion in buybacks. Boeing is another top repurchaser of its own stock, along with Pfizer, Cisco, JP Morgan, Wells Fargo, UnitedHealth and Walgreen’s (and others). Meanwhile, the Retail Apocalypse continues, with J.C. Penney seeking help from restructuring experts (i.e. bankruptcy). The company’s stock (symbol: JCP) dropped under a dollar today, making Penney’s a penny stock. More Earnings Boeing announces 2Q 2019 earnings on July 24, 2019 at 10:30 ET, about an hour after the markets open. On July 18, 2019, after the markets closed, Boeing announced a $4.9 billion charge ($8.74 per share) + increased costs of $1.7 billion. In other words, the 2Q 2019 earnings report should be ugly. This is something that investors should have seen coming. Learn more in my Boeing blog from 4.8.19. (Click to access.) So, why did Boeing stock go up on July 19th, after the warning? The company is likely using buybacks to keep the stock afloat. Boeing repurchased $2.6 billion of its own stock in the 1st quarter of 2019. Netflix saw sales growth of 26% this quarter and is projecting year over year revenue growth of 31.3% in the next week. That’s pretty amazing. However, the subscriber count came in lower than projections, so the stock went down. With Netflix it is largely a case of being overpriced. The company is outstanding. But the price to earnings ratio is 131. Tesla’s 2Q 2019 earnings report on July 24, 2019 after the markets close should be stellar. In the 2nd quarter Tesla delivered 95,200 vehicles, compared to just 63,000 in Q1. That is an increase of 51%. This could make for a record earnings quarter. Tesla’s share price has already rallied 43% from its June 3rd 2019 low (when I published a blog predicting this stellar quarter). The only thing standing in the way of additional gains is the 2nd Quarter 2019 GDP report, which will be released on July 26, 2019 at 8:30 am ET. 2. The 2Q 2019 GDP Report (advance) will be released at 8:30 am ET on July 26, 2019. Just how weak will it be? Estimates are at 1.5-2.1%. Significantly lower than the 1st quarter. Full year 2019 GDP is predicted to slow to just 2.1%, compared to 2.9% in 2018. By comparison, China’s GDP this year should be 6.2%. 3. Foreign Purchases of U.S. Existing Homes Sank by an astonishing 36% over the last 12 months. What happened? It’s largely a story of unaffordability – something I wrote about in a blog earlier this month. In the U.S., 74% of people cannot afford to buy a home in their city. According to Lawrence Yun, the National Association of Realtors chief economist, “A confluence of many factors – slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale – contributed to the pullback of foreign buyers. However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.” (That’s his way of saying that home prices are too high, and the international community isn’t taking the bait anymore.) What does this mean for U.S. buyers and sellers? Certainly, it's important to remember that one of the most important considerations for successful real estate investing and home ownership is the price itself. If you’re thinking of buying, the price is too high, and unaffordable, in most U.S. markets. If you’re thinking of selling, your buying pool just got significantly smaller. If your home isn’t snatched up right away, your price may be too lofty. 4. U.S. Budget and $22 Trillion Public Debt. The U.S. is currently using extraordinary means to pay bills. Congress needs to raise the Debt Ceiling before we run out of money now. There is talk that the House will vote on a deal on July 26, 2019, so that the Senate can pass it before the August break. According to Paul Ashworth of Capital Economics, a research group, “The Federal government ran a deficit of $215bn in August last year which, if repeated this year, would leave it with zero cash going into September.” Chairman of the Federal Reserve Board Jerome Powell believes, as do most economists, analysts and rating agencies, that the Debt Ceiling will be raised before we run out of money. In Powell’s testimony before the House of Representatives on July 10, 2019, Powell said, “I assume that the Debt Ceiling will be raised in a timely fashion. Any other outcome is unthinkable. I wouldn’t be able to capture the range of negative outcomes.” At the same hearing, Jerome Powell also expressed grave concern about the budget deficit and ballooning public debt, of $22 trillion and counting. (This will increase again once the Debt Ceiling is raised.) Powell said, “The U.S. budget is on an unsustainable path. We’ll wind up spending more on interest than on educating our grandchildren. Our generation should be paying for it rather than passing the bills onto the next generation.” 5. Will the Feds Cut Rates on July 31, 2019? There are a slight majority of Federal Reserve Board Governors who are concerned about financial stability and asset bubbles, who have been reticent to cut rates too soon. (See my analytical blog for details on which board governors lean this way.) However, the rate cut might happen for many reasons. The housing report was astonishing low. The GDP growth is predicted to be much weaker than 1Q. Earnings are slowing. And Wall Street is expecting a rate cut. The Feds don’t want another sell-off like December of 2018 (the worst December since the Great Depression). A 10% rise in stocks = 1% rise in GDP, according to Alan Greenspan. So, that might be what the Feds (and certainly the White House) want. The Real Question is whether a rate cut will send the market higher or not. It could this summer because volume is low and novices are playing. However, once the professionals return in September, it could be a different story. Wall Street pros know that the cut was due to worries about the economy. They know that there is a slowdown in sales, too much leverage and that the prices are too high. Leverage might even be too high to support continued borrowing to repurchase shares. Just as happened with GE, when a firm is over-leveraged and needs more dough, the banks will add conditions that prevent them from repurchasing stock or paying dividends. So, fall isn't looking good for stocks this year. 6. Financial Stability and Asset Bubbles. Low interest rates create bubbles. Today’s bubbles are more troubling than they were before the Great Recession or the Dot Com Recession. See the Asset Bubble chart directly below. The media, and politicians, are encouraging investors to grade the economy on low unemployment, low inflation and high stock prices. However, bubbles pop. 74% of Americans cannot afford to purchase a home in their home town. Over 50% of the corporations that are investment grade are at the lowest rung, just above junk bond status. Additionally, according to Robert Shiller, a Nobel Prize winning economist and Yale’s professor of economics, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000.We are at a high level, and its concerning. People should be cautious now.” Learn more in my blogs, “Wall Street Secrets Your Broker Isn’t Sharing With You,” “Financial Engineering is Not Real Growth,” and “The Gold Rally Has Begun.” 7. What Should You Do? Buy? Sell? Hold? You should:

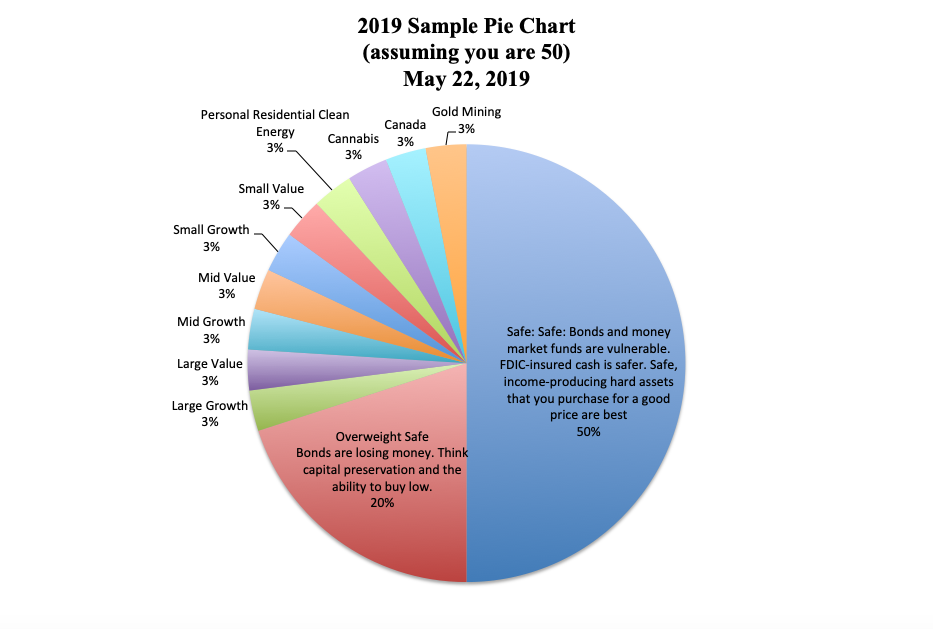

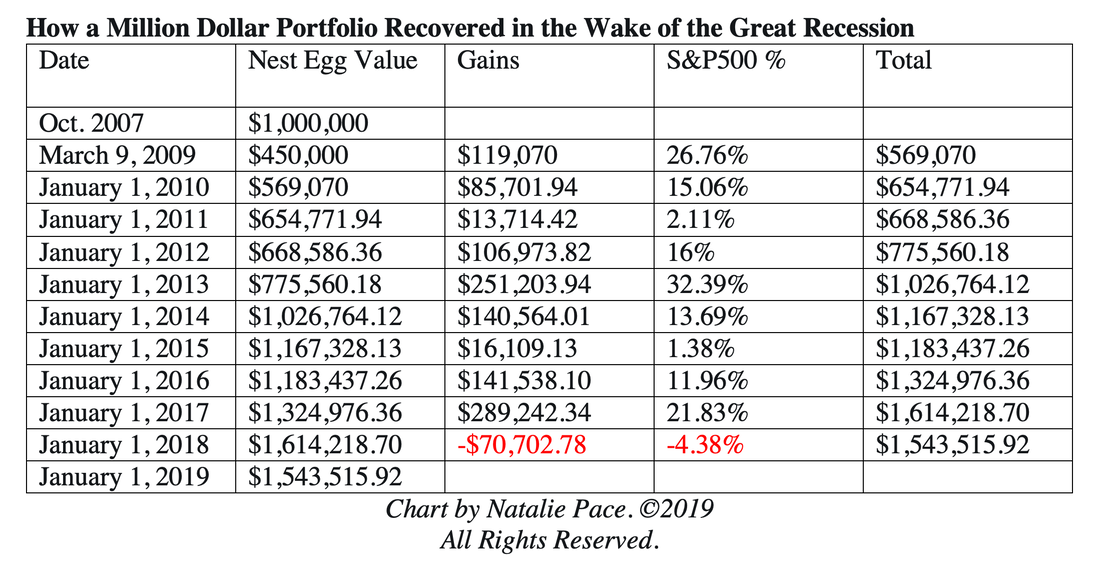

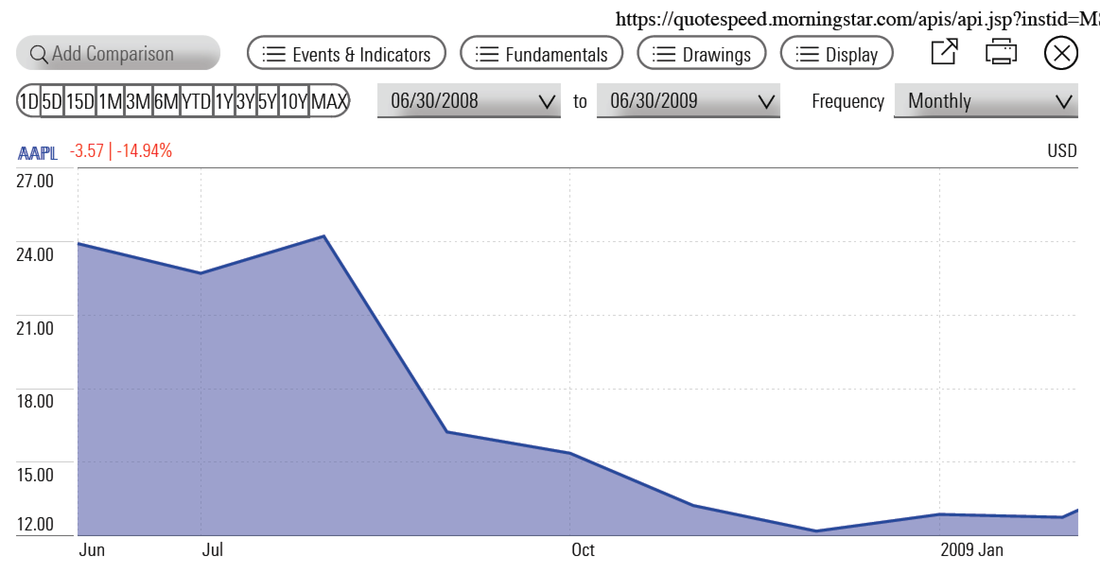

This may sound complicated, but it is easy-as-a-pie-chart, once you learn the ABCs of Money that we all should have received in high school. Getting safe now should be your number one priority. Don’t rely on your financial advisor to do this for you, in a world where almost everything that a financial services company can sell you is highly leveraged and overpriced. Listen back to my free July teleconference on BlogTalkRadio.com/NataliePace, where you can get additional information on each topic. You can also hear my answer to a caller’s question, “Is gold a good place to get safe now?” Our team opens up the line for questions in the second part of the call (usually about 20-25 minutes into the call). Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  One of the most common questions I get asked by investors is, "Should I set stop losses to limit my losses?" My answer? " Why not set capture gains to score wins instead?" In your nest egg, if you’re properly diversified, protected and capturing gains through your annual rebalancing, then you might even earn gains in a downturn (as Nilo Bolden did). That is going to be harder to do in the next pullback because bonds are vulnerable. So, you have to know what’s safe in a world where both stocks and bonds lost money last year. If you have a stop loss strategy that first locks in your losses and then automatically transfers your equities to fixed income or a money market fund, you could lose there as well. With the amount of risky leverage going on, you really have to know what you own. In your individual trading, if you’ve done your research upfront and have made an investment that you are confident was purchased at a bargain, then if the price drops, the right answer is to buy more lower. This takes wisdom and training. If you rely on what you feel like doing when a price goes down, then you’ll be simply selling low. A Capture Gains Strategy for Your Nest Egg A time-proven nest egg strategy requires annual rebalancing to be successful. In your nest egg, you should rebalance once a year. (Click to learn more in my Rebalancing Blog.) This is a Buy Low, Sell High system on auto-pilot. When the price goes down, you buy more lower. When gains are piling up, it’s time to trim the fat slice back to where it should be, i.e. selling high. Keeping enough safe, and knowing what’s safe in a world where stocks and bonds are in a bubble, is a better strategy than selling low. In your trading, you always need an exit strategy, but that exit strategy shouldn’t be based on locking in losses. You should be confident that there is a window of opportunity for you to earn gains before clicking the Buy button. The Stock Report Card and 4 Questions for picking a leader can help you to make better choices in your trading portfolio. (I teach these strategies on Day 2 of my Investor Educational Retreats.) If you are just going on a hot tip or an article that’s like trying to guess what a 100-piece puzzle is while turning over only one tile. When you have a Capture Gains mindset, volatility means that you might be able to trade around the core – buying low and selling high again and again and again. The Wall Street rollercoaster becomes your joy ride. Performance of the S&P500 July 2017-July, 2019 When volatility is the name of the game (like it is in today's market), it is very important to use winning tools, strategies and mindsets. Stop losses is a sabotage mindset that will have you losing over and over again in today’s world where market and company volatility are commonplace. (Meanwhile, the brokerage earns gains on the trading fees.) So, think like a "winner" instead of a stop loser. No one likes to think of themselves as a loser, but if you are worried about losses instead of committed to capturing gains, then you have a losing mindset, even if you don't admit it. The first thing most of us need to change to be more successful in investing is our mindset. Of course, you need a skill set and a tool kit to match that. So, how do you activate Score Gains Thinking? Below are six tips that start you on the path. (You still need to learn the pie charts, annual rebalancing and smart strategies for successful trading. Call 310-430-2397 or email info @ NataliePace.com for additional resources.) 1. Pick a Winning Team 2. Employ a Winning Game Plan 3. Be a Patient Buyer 4. Capture Your Gains Early and Often 5. Limit Orders: The Key to Profitability in Volatile Markets. 6. Use Special Teams Strategically And here are the details... 1. Pick a Winning Team. A big component of a winning team is making sure that you have the right athletes on the field. You don't want your kicker playing linebacker, or your quarterback on defense. Go to your accountant for tax tips (not investment tips). Most brokers are salesmen, so you must be the boss of your money, rather than letting someone else make all of your decisions. Never invest based solely upon an article you read, without doing full and complete analysis. Grade your guru with a results test before taking any investment advice from her. 2. Employ a Winning Game Plan A great nest egg strategy includes the following: 1. Keeping a percentage equal to your age safe. 2. Overweighting safe in volatile times. 3. Knowing what is safe. 4. Diversifying your "at risk" assets by size and style. 5. Adding in hot industries. 6. Avoiding the bailouts. 7. Rebalancing at least once a year -- preferably using limit orders. To learn more about this formula, read The ABCs of Money. 3. Be a Patient Buyer Never buy high in the 11th year of the bull market. 4. Capture Your Gains Early and Often Adopt a strategy of taking your profits early and often in your Stocks on Steroids trading portfolio, as we are in the late stage of the business cycle. Rebalance your nest egg at least once a year. 5. Limit Orders: The Key to Profitability in Volatile Markets. One of the best ways to ensure that you are buying low and selling high is to employ limit orders. Once you own something, determine your exit strategy and let the limit order do the work for you. This is more reliable than keeping your ear to the ground. 6. Use Special Teams Strategically. Just as older football players are more prone to injury, New Chips are Safer than Blue Chips. Small caps tend to move more quickly than large caps. Understanding the difference can improve your investing results tremendously. If this terminology is confusing, then that’s a clue that it’s time to invest in learning. Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Dear Natalie, The Dow Jones Industrial Average return was 7.0% since January 2000 with dividends reinvested, or 197% total return. So, Buy and Hold did work. It was just gut-wrenching. Is there something that I’m missing here? I had a hard time with the markets for too many years which ultimately affected my current financial position. And although I understand "the markets" and the whole financial system way better now, I remain .... Gun Shy Dear Smart to Be Gun Shy, You can still ride a horse from LA to NYC. However, that doesn't mean that it "works." It's not just gut-wrenching when you lose more than half of your assets. It can wipe you out, prevent you from retiring, throw your credit score in the toilet, make you borrow at higher interest rates and affect your health. When someone loses more than half of their assets and retirement, this is not a math problem. It’s a life problem. I have seen far too many foreclosures, short sales, bankruptcies, deaths and even suicides to believe that you should buy into this very misleading statistic. When you lose 55% of your retirement (as the Dow Jones Industrial Average did during the Great Recession), it doesn’t recover at the same rate as the market. When you lose more than half, you are now earning gains on that much lower amount. Between 2009 and 2018, the S&P500 rose to 2,506.35, from 903.25 (with a low of 676.53 on March 9, 2009). That equals a gain of 277% total, or 27.7% annualized over the 10-year period. This is just the gain of the market, not including dividends. However, the gain of your nest egg over that same 10-year period, including dividends, is still only 54.4%. That equals a gain of 5.44% annualized. Most of that decade would have been hell, and you’d be lucky to still own your own home. So, the annualized gain of the market does not come close to reflecting the real world. “Lies, damned lies and statistics,” Mark Twain. It took the NASDAQ Composite Index 15 years to crawl back to even. The Dow did fare better in that recession. However, as is human nature, there were a lot of people buying into the “New Economy” who were overweighted in Dot Com stocks. They watched in horror as the index lost 78% of its value between 2000 and 2000. Most Americans (and Canadians) have only slightly more money in retirement today using Buy & Hold than they did in 2000. Most of the increases would be contributions. On the other hand. If you were using my pie chart system, your losses could have been limited to 25% or less. On Dec. 24, 2007, I warned investors that the coming downturn was going to be nasty, and suggested overweighting 20% safe. So, the average 50 year-old would have had 30% at risk and would have lost about 17%. Again, many people were so horrified at the losses in 2009 that they sold low and went to cash at the bottom. No one who used my pie chart system was tempted to make that colossal mistake. In fact, our office received quite a large number of messages of gratitude. Click to watch Nilo Bolden's testimonial. What lies, damned lies and statistics are people buying into today? Actually, a lot of people are twice burned and wise. The real reason that the Dow Jones Industrial Average is trading so high is due to corporate buybacks. Companies can borrow money very cheaply, repurchase their own stock and make their earnings per share look stronger than it really is. It’s like bait in the water that the unsuspecting are supposed to snatch up. However, most of us live in the real world and we can see very clearly that no one in our circle of friends is better off financially today than they were twenty years ago. One other problem with Buy & Hold is that the closer you get to retirement, the less you are able to wait out a decade of hell. In theory, that is easily solved by keeping enough safe in bonds. However, there are many problems with that idea in today’s world. I’ve included just a few below. The Difficulty of Getting Safe in an Over-Leveraged World

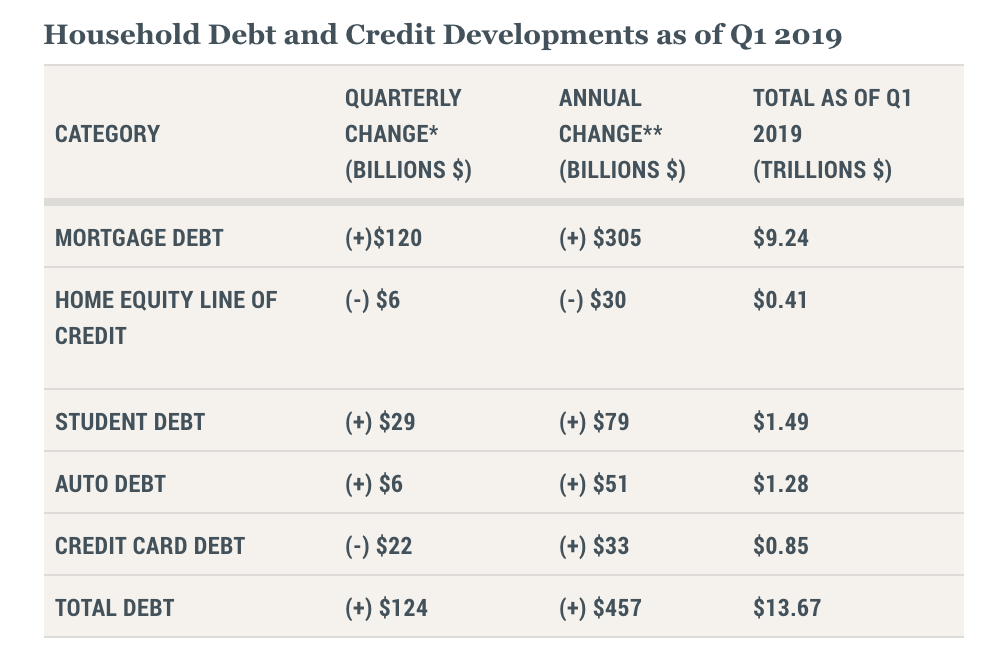

The Bottom Line Buy and Hold worked just fine between 1970 and 2000. However, since 2000, we've had two recessions that look more like Great Depressions. The world is over-leveraged, drowning in debt, and using low interest rates to create asset bubbles. Buy and Hold does not work in a stagflation economy. Modern Portfolio Theory with Annual Rebalancing works great, provided you know what's safe in a world where stocks, bonds and real estate are all in bubbles. Getting your financial plan from a salesman is as bad an idea as…

Wisdom is the cure. It’s time to learn and master the ABCs of Money that we all should have received in high school. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. In the late stage of the business cycle, you’ll start hearing a lot of jargon that doesn’t quite add up to the rosy headlines. For instance, on June 25, 2019, Federal Reserve chairman Jerome Powell said, “Proximity to the ELB [effective lower bound] poses new problems to central banks and calls for new ideas. The questions we are confronting about monetary policymaking and communication, particularly those relating to the ELB, are difficult ones that have grown in urgency over the past two decades.” Powell closed his speech with what might have been considered a fairly benign statement in normal times, saying, “We are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment.” Wall Street responded by selling off 200 points on the Dow Jones Industrial Average. What in the world was Powell saying? Who understands this language, and why weren’t they happy with his speech? It certainly is different from what you hear from the White House, which is basically, the U.S. is on a tear, doing great and you’re insane if you don’t buy stocks and real estate. If you think there’s something going on behind the scenes, you’re absolutely right. If you are formulating your financial plan based upon the headlines, then you’re on a buy high, sell low rollercoaster. There are time-proven solutions that work much better. Let’s start with a few Wall Street secrets that your broker isn’t sharing with you. 13 Wall Street Secrets and Sayings 1. Never confuse a bull market with wisdom. 2. Never reach for yield. 3. The higher the dividend, the higher the risk. 4. Bulls make money. Bears make money. Pigs get slaughtered. 5. A rising tide lifts all ships. 6. Late stage of the business cycle. 7. Financial imbalances. 8. Overleveraged. 9. Investment grade. 10. Effective lower bound interest-rate. 11. Accommodative policy. 12. Modern Portfolio Theory. 13. What's Safe? (It's not what your broker is selling you.) And here’s what they mean. 1. Never confuse a bull market with wisdom. There are times when even a monkey throwing darts at a wall full of stocks could make a killing, i.e. a bull market. The share prices go up because stocks are in a bull market, and everything is rallying. There are also times when even experienced investors go belly-up, i.e. a bear market. A sound nest egg strategy is designed to protect your assets from downturns, capitalize on rallies and is never over-leveraged on a bad idea. Buy and Hold is not a strategy that works in today’s world. (If you think it is, keep reading.) 2. Never reach for yield. When you are getting paid nothing in your savings, it’s very tempting to get sold into high-risk bonds, money market funds and CDs that are not FDIC-insured. The salesman will convince you that you are going to earn a solid XYZ yield and that income will set you up! What s/he doesn’t say is just how risky the company you are investing really is. Highly leveraged companies still have access to bank capital at 5% (sometimes even lower). So, if they are borrowing from you at higher than that, it tells you everything you need to know. They are borrowing from you because they can’t borrow from a bank. Oftentimes, these risky, junk bonds or junk dividend-paying stocks pay the highest commission to the salesman that is advising you. As Roy Rogers was fond of saying, “I’m more concerned with the return of my money than the return on my money.” 3. The higher the dividend the higher the risk. GE isn’t the only highly-leveraged company that is borrowing from bond investors to pay dividends to stock investors, i.e. borrowing from Peter to pay Paul. Investors were livid when they discovered that GE was buying back its own stock and paying high dividends to keep its share price inflated and make earnings look stronger than they really were (so that it could continue to borrow). When a company cuts its dividend, as GE did, the share price drops like a knife. GE’s share price dropped to half on the news, and is currently trading at less than 1/3 of its price just two years ago. If you wait for the headlines that a company is in trouble, it’s too late to protect yourself. (Warren Buffett managed to sell all of his GE stocks a couple of months before the dividend cut.) A 5% dividend isn’t enough to pay for losing half of your principal. If you don’t know how to evaluate the debt load of the company, without having blind faith in your broker-salesman’s assurances, then you should underweight dividend-paying stocks in 2019. More than half of the investment grade companies are at the lowest rung – just one downgrade away from junk bond status. 4. Bulls make money. Bears make money. Pigs get slaughtered. Although this aphorism is obvious, the employment of its wisdom does elude a lot of people. When the safe money is earning zero, and you’re reaching for 5% or higher return on your stocks or bonds, you’re falling into the porcine category. If you’re all in on stocks right now because the markets are at an all-time high and Wall Street is in party mode, you’re more likely to end up in the pig sty than the castle. A well-designed, time-proven plan doesn’t just earn money in good times. It also protects your assets from the downturns. 5. A rising tide lifts all ships. This secret is right in alignment with “Don’t confuse a bull market with wisdom.” Bull markets lift all stocks. However, as Warren Buffett says, when the tide goes out, you’ll see who has been swimming naked. Bear markets can sink the share price of even robust companies with hot new products. Apple lost half of its share price value in the Great Recession, even though the smart phone was a market disrupter that would later take the company on to a trillion-dollar valuation. 6. Late stage of the business cycle. The economy is cyclical. There are good times and there are tough times. Economists call this the business cycle. So, if you’re translating what the late stage of the business cycle means, you might say that the economy is on recession watch. Things are closer to a correction than they are to continued growth and share price gains. In fact, the second quarter of 2019 is ushering in an earnings recession, where many S&P500 companies are expecting lower earnings for the first time in years. Part of this is due to the one-year bump everyone received from the tax cut in 2018. However, another piece is that the economy is slowing. In 2018, GDP growth was 2.9%. In 2019, it’s predicted to fall to 2.1%. 7. Financial Imbalances. Normal folk would call this “bubbles.” Warren Buffett has admitted to having $100 billion on the sidelines, due to the overpricing of stocks and bonds. Alan Greenspan has said that stocks and bonds are in a bubble. Robert Shiller (Nobel Prize winning economist) warns that the last two times when stocks were this overpriced was before the Dot Com Recession and the Great Depression. Real estate is unaffordable in 74% of U.S. communities. Bubbles. Low interest rates create bubbles. This is something we’ve seen for the past two decades. In the Dot Com Recession the bubble was in Internet stocks. In the Great Recession, the bubble was real estate. Today, it’s stocks, bonds and real estate, which puts the economy on much more perilous footing than it was on in 2000 or 2008. (See chart below.) One of the biggest problems is that there just isn’t enough room to cut interest rates to really goose economic growth. However, the banks have a new Bank Bail-In program, using your money… Something that I’ll address in an upcoming blog. 8. Overleveraged. The total private nonfinancial credit is currently over $30.9 trillion. $15.6 trillion of that is consumer debt, of which $1.6 trillion is student loans. $15.2 trillion is concentrated in the business sector. This is much higher than it was before the Great Recession. As the Federal Reserve Board indicated in their most recent Financial Stability Report, “Although debt-financing costs are low, the elevated level of debt could leave the business sector vulnerable to a downturn in economic activity or a tightening in financial conditions.” At the same time, the Feds are aware that if they cut rates, then corporations may be tempted to continue to borrow, putting their firms at even greater risk. Business debt is “historically high” and risky debt has increased. Firms with low credit scores and/or very high debt are still borrowing. The leverage has increased above the levels of 2007 (before the Great Recession). 9. Investment grade. Any corporate bond rated AAA, AA, A or BBB is considered investment grade, with anything lower entering into “speculative” or junk bond status. The problem is that you might own a bond or a bond fund that you believe is investment grade, which is more speculative than you might realize. ½ of all investment grade bonds are BBB (one hairs breadth above junk status). Additionally, many investment grade bond funds can actually invest 20% (or more) in junk bonds. So, it’s time to review the bonds and bond funds in your nest egg. 10. Effective lower bound interest-rate. The problem with the ELB being at zero is that there isn’t any room for a rate cut to help an economy that has entered a recession. If you take a look at the Bubble Chart above, you’ll see that the Feds had plenty of room to cut rates in the Dot Com Recession. In fact, bonds were earning up to 25% in 2001, as a result of rate cuts! There was ample room in the Great Recession, though the Feds also had to rely upon quantitative easing to get the economy rolling again. This time around, the Feds are still highly leveraged and rates are only at 2.25-2.5%. This could make for policy impotence, and is one of the reasons why the Feds are not going to be hasty about a rate cut. This also means that bonds won’t help your nest egg in the next recession – unless a miracle happens and the Feds are able to increase rates before the next downturn. That means you have to learn what’s safe in a world where both stocks and bonds are in a bubble and vulnerable to the next recession. 11. Accommodative Policy. This is the longest expansion in history. However, the Feds have had to keep rates near zero in order to achieve it. An “accommodative policy” that makes money free to borrow (for corporations, not for consumers) creates bubbles. As the economy heats up and moves on its own, the Feds typically raise interest rates to stop the speculation. That didn’t happen in this expansion. However, under Jerome Powell, the language and messaging has indicated that the Federal Reserve is very concerned about keeping the free punch bowl (cheap, easy money) available to Wall Street. Wall Street is expecting a rate cut at the Fed meeting July 30-31, 2019. Since the July 26, 2019 GDP report is likely to be quite weak (potentially as low as 1.3%), and the earnings recession will have been recorded by many S&P500 companies, there’s a chance that the Feds might cut rates. However, that isn’t a given, as I indicated in my analysis of the board governor’s speeches over the last few weeks. If the Feds do cut rates, the Street will know it is because the economy is weak – meaning that will not necessarily translate into a stock rally. 12. Modern Portfolio Theory. MPT is a simple idea. Keep enough safe and diversify the rest. Any good broker-salesman will tell their client that they use MPT, even if the plan they design is nothing of the kind. In fact, I’ve been doing a lot of second opinions of managed portfolios lately, and I have yet to find one person who was properly diversified, with enough safe. MPT with annual rebalancing earned gains in the last two recessions and outperformed the bull market in between. Buy & Hope lost 78% in the NASDAQ during the Dot Com Recession and 55% in the Dow Jones Industrial Average in the Great Recession. You can’t afford to lose more than half of your assets every 8-10 years. So, you must be the boss of your money and learn the basics of investing (they are easy), in order to be sure that you are protected from the next downturn. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Housing is Unaffordable in 74% of the U.S. On Thursday, AttomData.com released a report outlining the stark reality of today – that the average wage earner cannot afford to buy a home in 74% of U.S. housing markets. The most unaffordable markets are in California (8 of the Top 10), with Maui, HI and Kings County, NY (Brooklyn) rounding out the Top 10. Cook County, IL (Chicago) and Maricopa County, AZ (Phoenix) were also near the top of the list. Meanwhile, if you want to live in Houston, Detroit, Cleveland or Columbus, you’re likely to find something that you can afford. Essentially, if you live in a place that’s teaming with jobs and cutting-edge technology, you might have to live in your car. What’s almost as astonishing and heartbreaking as unaffordability, given that real estate prices are at an all-time high, is that there are still 5.2 million U.S. properties that are seriously underwater. This number is up from last year, even while real estate prices have continued to increase. How is that even possible? Well, the banks have taken to giving loan mods where a ton of interest and penalties are tacked on. They then give the homeowner a payment they can afford and a low, often fixed, interest rate, with a total amount due (not including the interest earned over the decades) that is above the price of the home. For some reason, the homeowner thinks this is a good idea, even though they now owe 25% or more than the home is worth. If you are one of the unlucky ones who owe more than the value of your home, it’s time to look into a few options that are not going to be offered by your bank. If you are locked into a low-interest rate loan that is far above the value of your home, particularly if you are struggling to make the payments, it’s time to get a new plan. Even if the loan mod puts payment within reach, it is likely a terrible idea to accept the deal of paying more for your home than it is worth, when markets are at an all-time high. If real estate values drop, then you’ll be even more locked in and more seriously underwater, with few options on how to sell, move or escape. (Call our office at 310-430-2397 for resources.) Will Housing Unaffordability Tear Down the Economy? The crystal ball on the economy, provided by the Federal Reserve Board, forecasts that GDP growth will slide down to 2.1% growth in 2019, from the 3.1% growth we enjoyed in the 1st quarter. We should start seeing that slowdown in the 2nd quarter 2019 GDP. The advance report will be released on July 26, 2019 at 8:30 am ET by the Bureau of Economic Analysis (BEA.gov). High real estate prices affect everything. It makes it harder for mom-and-pop shops to stay in business, weighs down a retail sector that is already struggling to catch up to Amazon (and from financial predators who take advantage of their need to access debt) and gobbles up most of the budget of the Middle class. If you want to buy a home in Marin County, you’d need to hand over more than you earn (on average). Of course, this is impossible and you’d never qualify for a mortgage, which is why the PHSI is down 3.1% year over year in the West and the MidWest, where home prices tend to be more affordable, has become the market leader. The high cost of housing has contributed to consumer debt soaring to an all-time high – above where it was before the Great Recession. Household debt is now $13.67 trillion. Public debt is $22 trillion. As Alan Greenspan warned in an interview in April of this year, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized.” How Unaffordability is Already Impacting the Economy