|

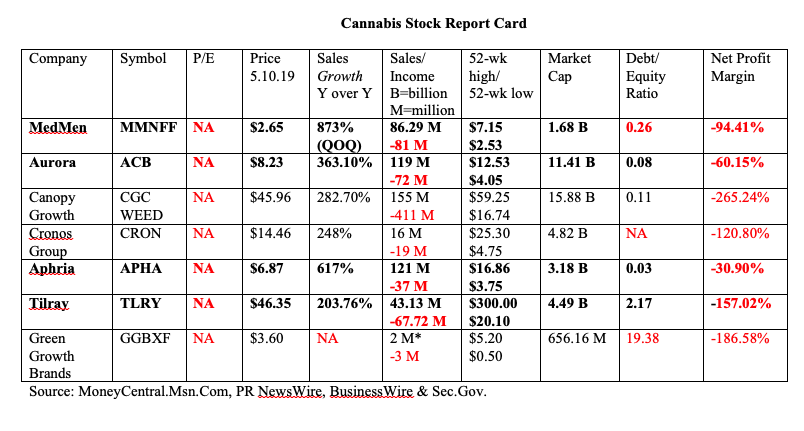

Each time I do an updated blog on cannabis, there’s an impressive newcomer (Green Growth Brands), a new leader (Aphria) and a former unicorn, who is trading for a song (Tilray). The most important thing to remember about investing in the fastest growing industry in the world is that the share price is extremely volatile. This is not due to the future prospects of the industry. It has a lot more to do with valuation, short sellers, and the rollercoaster nature of equities in the late stage of the business cycle. Check out the 52-week highs/lows below. As you can see, MedMen, Aurora Cannabis, Aphria and Tilray are all trading near their 52-week lows, while boasting explosive revenue growth (light years beyond any other industry). So, what’s the story? Why would these unicorns be thrown under the troll bridge? MedMen: The Cool Store Popping Up All Over Town. MedMen has had an executive exodus of late, which is typically a terrible sign. The former CFO filed a lawsuit against the company, and accused the co-founder CEO Adam Bierman and co-founder president Andrew Modlin of egregious behavior, ranging from petty bad language to potentially serious financial accounting policies. Three executives, including the COO, followed the former CFO out the door within a few short months. The executive exodus has killed the share price. However, Medmen’s growth is undeniable. There is a line outside their stores from open to close. Former LA Mayor Antonio Villaraigosa is on the Medmen board, alongside many other seasoned executives. Spike Jones filmed a stunning, poignant mini-film marking the monumental progress from Pot Prohibition and the War on Drugs to legalization. Aphria: Don’t Mess With Whole Foods Aphria has successfully rejected a hostile takeover bid by Green Growth Brands, and will even put a little money in its coffers as a result. Under the leadership of interim CEO Irwin Simon (former chairman and CEO of Hain Celestial) and president Jakob Ripshtein (former CFO of Diageo North America), Aphria is expanding and stabilizing at the speed of light. The company just added former co-CEO of Whole Foods Market Walter Robb to its board. Aphria’s share price took a hit because of a massive loss in the most recent quarter. However, as you can see from the Stock Report Card, most companies are reporting losses as they attempt to expand rapidly enough to meet global demand for products. That’s a good reason to lose money. Tilray: The Wounded Unicorn Tilray’s stock dropped to its 52-week lows in mid-April. As with the volatility in other companies, Tilray’s poor performance has a lot to do with short sellers and lofty valuations. The company is having difficulty meeting demand, but has recently addressed that issue with a spate of acquisitions and expansion plans. Tilray is set to report earnings on May 14, 2019 (after the market close). That report may not look as impressive as it could, due to the supply chain issues. However, the price is already reflecting this. Tilray’s executive team and board of directors are some of the most impressive in the industry. The advisory board includes Governor Howard Dean, the former Vice Chancellor of Germany and other global government leaders. Tilray recently inked a deal with celebrity brand marquise company Authentic Brands Group… Green Growth Brands: The New Secret On the Block Victoria’s Secret executives think cannabis is sexy. The Green Growth Brands team, which is made up of former Victoria Secret executives, made strong moves very fast, including a hostile takeover bid for Aphria, which failed. That was an expensive lesson, which will likely show up in the 4th quarter fiscal earnings report in late summer/early fall. (The next earnings release at the end of May will report earnings through March 31, 2019, and thus miss the Aphria takeover expiration.) Despite that setback, the acquisitions continue, and the Green Growth Brands website makes cannabis consumption look heavenly. Will an angelic catwalk be in the company’s future? The truth is that the cannabis industry is so hot that most of these companies are going to see splashy headlines in the months and years to come. However, with such volatility in share prices and the lofty valuations already in play for many of these companies, you’ll be best served to follow the age-old adage Buy Low, Sell High on auto-pilot (with limit orders). Many investors have enjoyed massive returns over the past year using that strategy! The returns on these cannabis companies will get you high, as long as you don’t crash hard when short sellers end the party… Also, be careful of penny pot stock scams that are still being heavily marketed by social media scam artists. If you don’t know how to use the Stock Report Card and 4 Questions to evaluate which companies are legit and which are pump-and-dump schemes, then your next move must be education. If you’d like to learn more about these strategies firsthand, join me at my Oct. 19-21, 2019 Retreat. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 18/2/2022 04:05:01 am

Excellent article! Your post is essential today. Thanks for sharing, by the way. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed