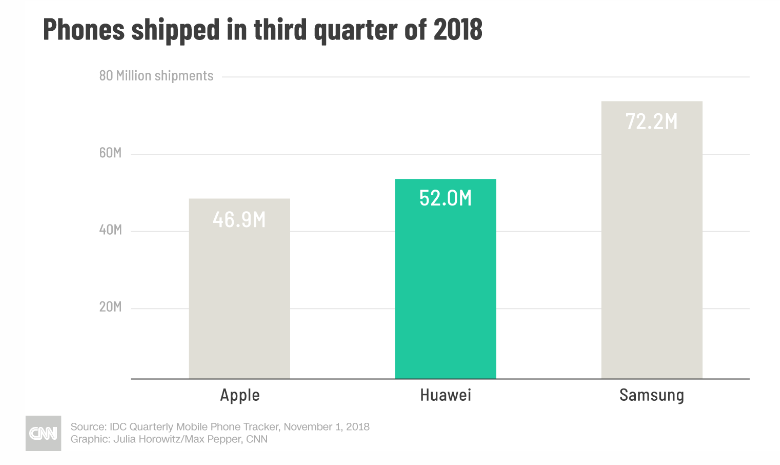

Meng Wanzhou (Sabrina Meng) is the deputy chairwoman and CFO of Huawei. She was arrested in Canada on December 5, 2018 and is awaiting extradition to the U.S. Details of the charges are not available at this time, at the request of her legal team. However, many news outlets are reporting that she is accused of Iran sanctions violations. Surviving the Plunge. Stocks dropped over 800 points again yesterday. The Dow Jones Industrial Average survived the plunge, however, settling in for losses of 78 by the end of the trading day (on Thursday, December 6, 2018). That dive exacerbated Tuesday’s Dow drop of 799, which came on the heels of a week-long rally of over 1500 points (between November 23, 2018 and December 3, 2018). If you’re getting a bit dizzy, welcome to the club. Stocks have been on a rollercoaster, and are flat on the year. Bonds have lost money. What’s Going On This Time? The overriding challenges faced by the U.S. economy were outlined in the Financial Stability Report that was released by the Federal Reserve Board on November 28, 2018. Click to access the 12-points of concern that were outlined in that report, which include over-leverage and asset bubbles. In short, there is too much leverage in the world, and low-interest rates create asset bubbles. Rising interest rates will start affecting rate-sensitive industries and assets first, such as corporations with too much debt and real estate. Retail was already in trouble. The California wildfires didn’t help. Tariffs increased costs in an already troubled and over-leveraged U.S. legacy auto industry. This winter, there were a few more challenges that were thrown in the mix. 1. The U.S. trade deficit hit highs not seen since the George W. Bush years, and is the highest ever recorded with China. In October 2018, the U.S. trade deficit in goods and services hit $55.5 billion, and is on track for over $600 billion in deficit for 2018. Tariffs have resulted in a worse trade deficit with China, as you can see by linking to the historical data. 2. Meng Wanzhou, the CFO and vice chairwoman of Huawei, was arrested in Canada, and is expected to be extradited to the U.S. This is huge because Huawei is actually bigger than Apple in terms of global smart phone sales. Imagine China arresting Steve Jobs! (Meng Wanzhou is the daughter of Huawei’s founder and CEO Ren Zhengfei.) Markets around the world dropped the day of her arrest. China has called for her release. Hope of a trade deal between the U.S. and China just evanesced with this arrest. 3. General Motors’ closure of 5 plants continues to make headlines. GM CEO Mary Barra is closing down plants that are underperforming, so that the focus can be on meeting consumer demand – away from sedans and toward SUVs, crossovers and trucks. She’s also doubling engineering resources in electric and autonomous vehicles. The restructuring charges will come in at $3.0 - $3.8 billion. GM’s loss was $3.9 billion in 2017. So, the 2018 restructuring and plant closures are not making investors or Congress very happy, even though the overriding GM vision and business plan appear to be sound, given the challenges the company faces. 4. PG&E and So Cal Edison are being investigated for the November 2018 California fires that wiped out Paradise, California and burned up at least 670 structures in Malibu (including over 400 homes), respectively. PG&E has lost half of its share price value since the fire. How Can You Protect Yourself? At minimum, you need to: 1. Know What You Own. 2. Rebalance at Least Once a Year. 3. Put a Better Plan in Place. Know What You Own. Not one financial plan that I’ve reviewed this year is properly diversified. Most people, even if they have pages and pages of holdings and funds, basically have large caps and bonds. All of them are at risk of losing half of their retirement (or more) – just as they did in the last two recessions. By contrast, the easy-as-a-pie-chart nest egg strategies that I developed in 1999 earned gains in the last two recessions and have outperformed the bull markets in between. Click to access a video of Nilo Bolden talking about just how easy this strategy is. If you start by knowing what you own, then you can compare that to my sample nest egg pie charts to get safe, protected and hot before the next correction. Call 310-430-2397 or email [email protected] to receive links to my free web apps, where you can personalize your own sample nest egg pie chart. If you’d like help knowing what you own, then ask for an unbiased second opinion. We’re here to help. Now is the time to be the boss of your money. Blind faith and hope are not good strategies. Rebalance at Least Once a Year. Annual rebalancing is key! It puts you on an automated buy low/sell high schedule for your diversified nest egg. This works far better than losing more than half every 8-10 years, and then taking the next decade to crawl back to even, which is what Buy and Hope investors are experiencing. How Can You Put a Better Plan in Place? Here’s a To-Do Check List.

The Bottom Line The average person loses money in a flat market, due to the fees. (In other words, you’ve likely lost money this year.) In the last two downturns, most developed world denizens lost more than half of their retirement. So, knowing what you own and understanding how to get safe, diversified, protected and hot now, should be priority one. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Click to read my blog on why you should get safe in December (this month). If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest

Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed