|

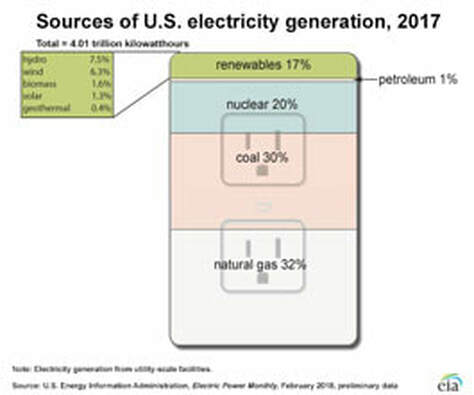

Are you alarmed by the reports of global warming, of sea levels rising, of islands disappearing, of an island of plastic floating in the ocean, of the predictions that, at the current rate, there will be more plastic in the ocean than fish in just a few short decades? Did you know that: * We already have our first climate refugees (from Louisiana). * On sunny days during high tides, fish and seawater flood the streets in Miami. * The mighty Colorado River has dried up 50 miles short of the ocean? * 62% of the U.S. electric grid is still powered with fossil fuels? Global warming isn't something we have to worry about tomorrow. It's here now. What can you do? There are quite a lot of things that everyday folks can do to breathe cleaner air, preserve their fresh water, reduce their plastic usage and promote a healthy planet. I was so impressed with the 4-9 year olds at Damers First School in Poundbury, England, and their outstanding teacher Edd Moore, that I proclaimed them to be England's most powerful green lobby, on my ThriveGlobal blog. (See the picture of Queen Elizabeth visiting with the children below.) The Damers School students are showing how bad habits can be replaced overnight, so that each one of us can "be the change we wish to see." On Wednesday, April 3, 2019, at noon ET (9 am PT), I will interview Edd Moore and a few of the Damers School children for their tips on how we as individuals can inspire our town, county and even country to eliminate plastic, reduce our fossil fuel usage and eat healthier. The following day, on Thursday April 4, 2019 at noon ET, Governor Bill Ritter, Colorado’s 41st governor and a director at the Colorado State University Center for a New Energy Economy, will enlighten us on technological developments in clean energy and steps each one of us can take toward a fossil-free future. You can call into both teleconferences at: 347.215.7305. Listen back links for both teleconferences are at BlogTalkRadio.com/NataliePace. The Put Your Money Where Your Heart Is Conference in Loveland, CO on April 18, 2019 If you are in Colorado for Easter, join me in Loveland on April 18, 2019 for a Put Your Money Where Your Heart Is conference, hosted by the New Thought Northern Colorado Center for Spiritual Living. There we will play the Billionaire Game and learn how to put your money where your heart is and profit, while creating the world of tomorrow, for our children. Call 310-430-2397 or email [email protected] to learn more. Host Your Own Earth Gratitude Celebration On April 22nd, Earth Day, we're encouraging everyone to power up the gratitude and power down the pollution, getting as close to personal net zero as possible for at least one hour. What kind of celebration can you create that is both fun and life-transformational? Be epic. Observe the fresh insights that flood our awareness and the world consciousness. Challenge your friends. Organize an awesome community net zero event. Include the hash tag #EarthGratitude when you share your pictures and video, so that we can like and reshare. Contributors to the Earth Gratitude project include: HH The Dalai Lama, H.R.H. The Prince of Wales (the heir to England's throne), Elon Musk, Deepak Chopra, Arianna Huffington, Kathleen Rogers (the president of the Earth Day Network), Life is Good, WildlifeDirect, Global Green, the NRDC, Green Our Planet and many more. Some of their tips for a memorable Earth Gratitude celebration include:

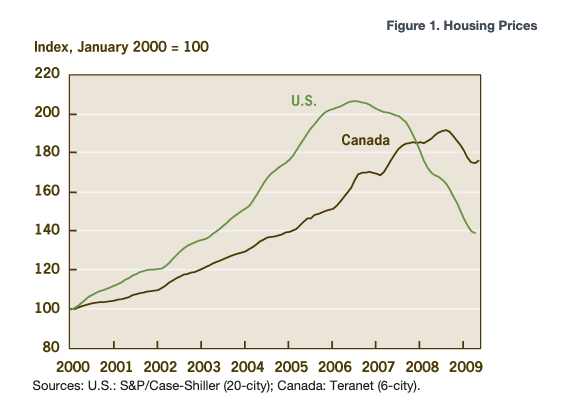

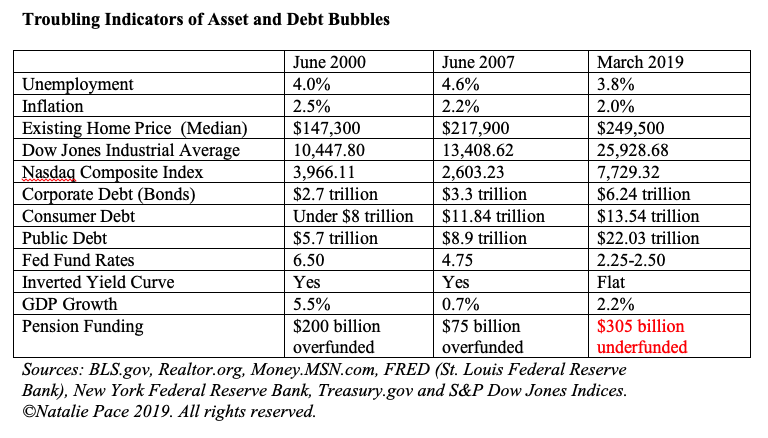

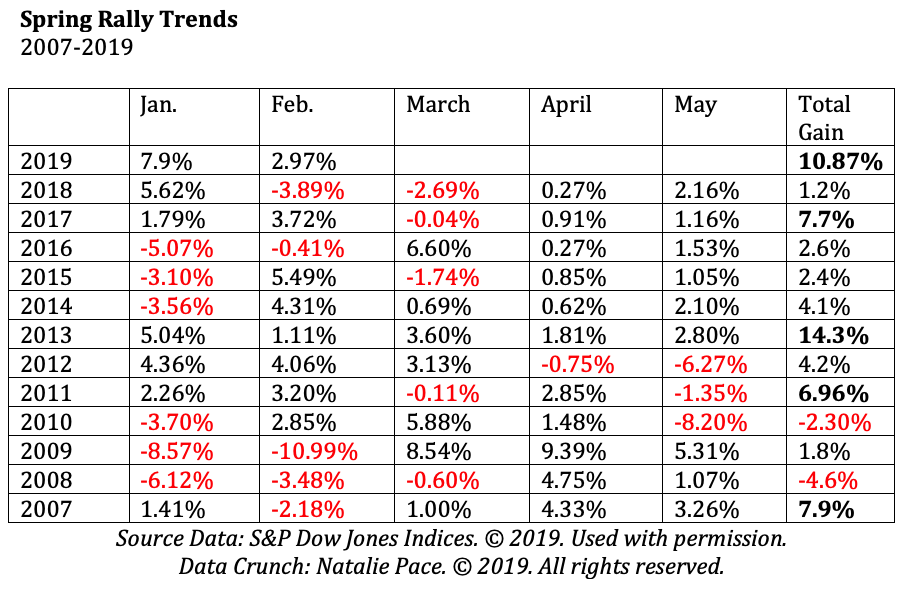

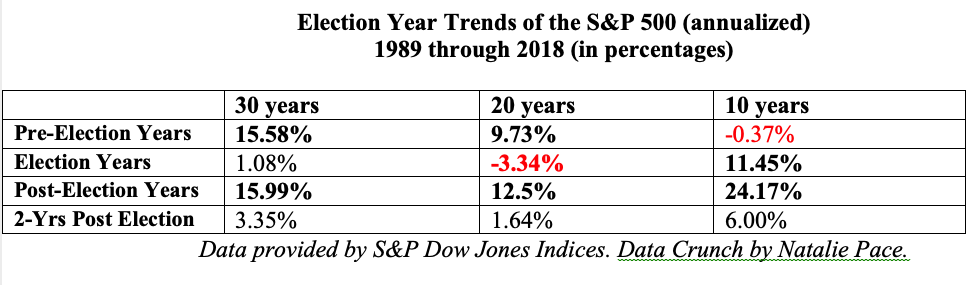

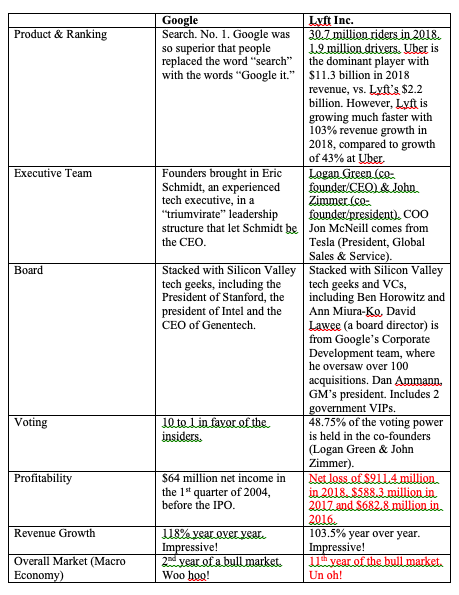

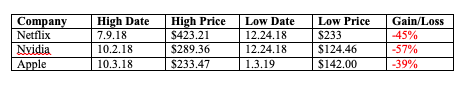

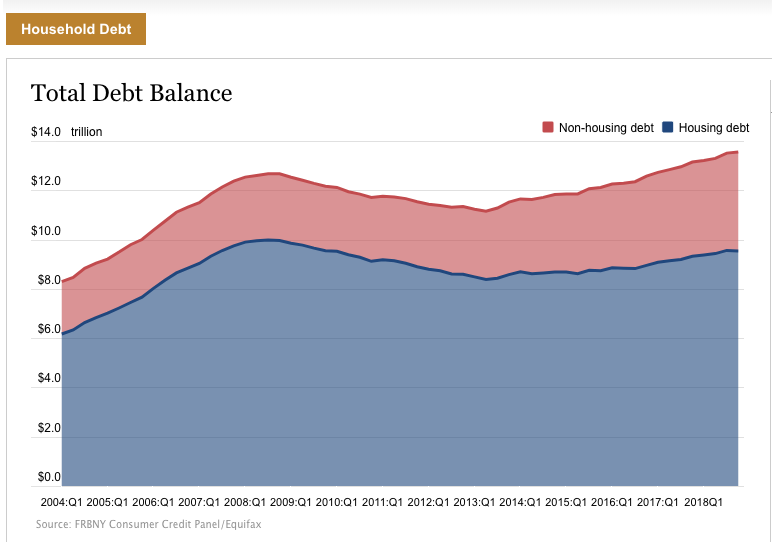

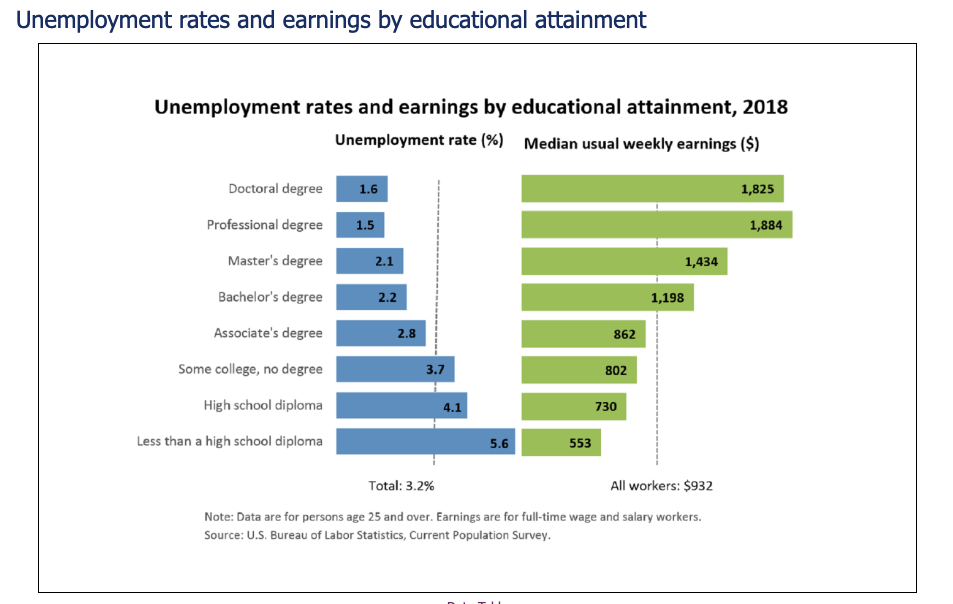

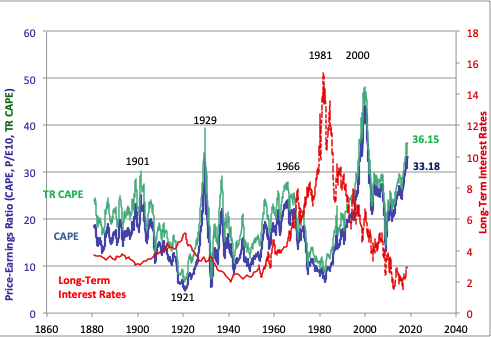

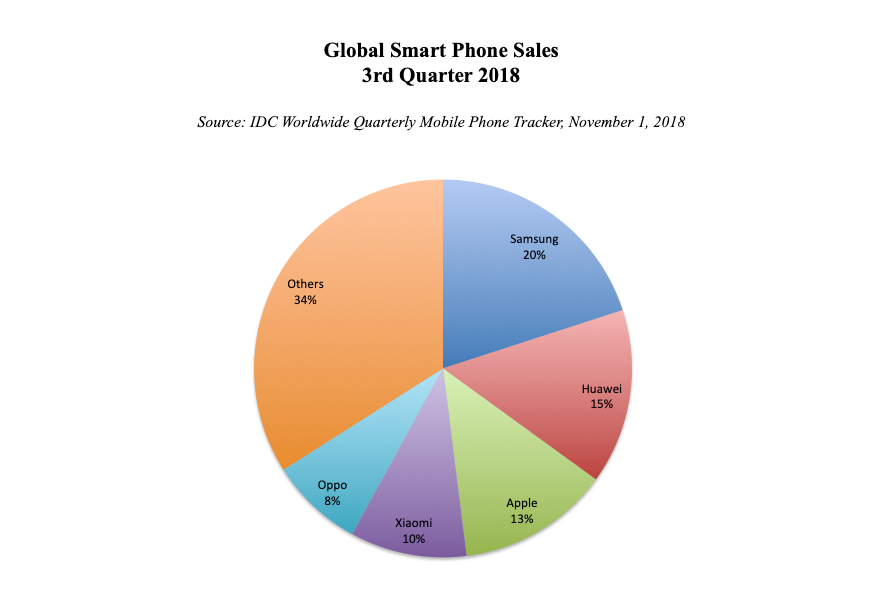

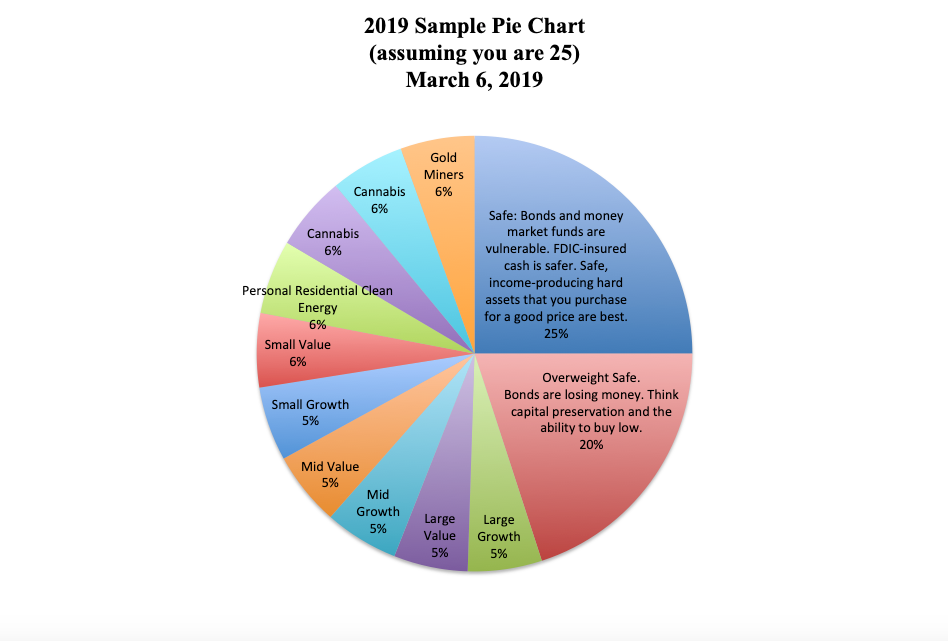

Get additional information about the Earth Gratitude project at http://earthgratitude.org/. There you can download two free picturesque ebooks full of important information on sustainability, Clean Living and Future Earth. Share freely with your friends. http://earthgratitude.org/ Additional Information about my work in financial literacy, sustainability and personal empowerment can be found on my bio. https://www.nataliepace.com/about-natalie-pace.html I'm very interested in learning what you are doing to celebrate and honor Mother Earth this April 22nd. Please use the #EarthGratitude, so that I can find your video & photos easily. Thanks! Buying real estate between 2005 and 2007 was a nightmare. Over 10 million homes were lost in the wake of the Great Recession. If you purchased a home in the years preceding 2008, or refinanced at or above the value of your home, the last decade was a living nightmare. Conversely, the low for real estate was in 2011. If you purchased a home then, you’re up at least by 53% (nationwide). Cities like Las Vegas, Denver, San Francisco and even Detroit have seen home values double or more. Seattle prices have skyrocketed by 76%. You’re riding high and living the Life of Riley! There is no denying that when you purchase an investment can be the most formidable foe, or your best ally. Dreams Do Come True! In February of 2011, a young entrepreneur in his mid-30s attended my Investor Educational Retreat. At that time, real estate was a bargain. He was earning a good, steady income, and had a young family. He lived in Las Vegas, where real estate prices had plummeted. AT could purchase a home and live in it for much less than he was spending on rent. Plus he could write off the mortgage interest to reduce his taxable income and save a boatload on taxes each year. AT was just starting out with his nest egg, and wanted tips to diversify it and get it going. He wasn’t even thinking of purchasing a home. However, I said that the lowest-hanging fruit for him was to purchase a home first, and then start building up the nest egg. He did. His home value doubled by 2017, at which time he sold, took his profits and made a dramatic move to British Columbia, where he built his own off-grid sustainable home, where he lives with his wife and young son. He has traded in the stress of commuting in Vegas for the challenges of living in the wilderness. However, having the funds to create his new life began by making an outstanding home purchase in 2011. The Canadian market tends to shadow the U.S., as you can see in the chart below. This has a lot to do with the fact that low interest rates create asset bubbles. (More on that to come.) Subprime Hell In May of 2005, I began screaming from the rooftops that real estate was in a bubble. One friend refused to be warned about the real estate bubble, however. Her “mentor” kept encouraging her to load up on properties in Las Vegas as late as even 2007. She pooh-poohed my warnings about bubbles with a rather supercilious hubris, as she put down payments on credit cards and relied upon no-interest loans where she didn’t have to show gainful employment or income. When her actions caught up with her in 2009, and she could no longer afford to float things on credit cards, she lost 5 properties, was buried in lawsuits and was financially and emotionally bankrupt. (We offered her husband and her a scholarship to a retreat to put them on the road to recovery.) Another example of subprime hell came in the form of a successful young woman, BB, who was at her wit’s end when she came to my Investor Educational Retreat in January of 2008. Her boyfriend’s friend had suckered her into buying a condo in Florida in 2007. This realtor “friend” promised to flip it within a few short months and give her back a quick and easy $20,000-$40,000. After months of paying high mortgage and Homeowner Association fees, while watching the value of her purchase plummet, she reached out to me in desperation for some private coaching. I found a legal colleague who was able to assist her in getting a deed in lieu (giving the keys back to the bank). When you make a grave investment mistake that is likely to decrease dramatically in value, the sooner you accept this and get out of it, the better off you’ll be. BB’s credit score recovered rather quickly (before most people even got out of their subprime hell). She also saved herself several years of hell and hundreds of thousands of dollars by getting out early. She’s now a proud homeowner and the mother of a young son (rather than the desperate servant of an underwater condo) and in a loving relationship (with a different life partner). Real Estate Education ala Trump University Most real estate seminars offer you very basic tips on how to secure a loan. They tout up the value of owning income-property (which is real) – without having a time-proven system on how to make sure your investment is a rewarding, dream-come-true “money while you sleep” experience, instead of a nightmare that can dog you for decades (which is always a potential reality with a big purchase like real estate). Trump University wasn’t the only ruse that suckered people into investing tens of thousands of dollars for inexperienced mentors offering unsound strategies. This space is still full of marketers who pose as good investors, with enticing language and exciting offers (even free seminars!), who whitewash over the Great Recession as if it never existed. If you take the bait, you’ll then be sold into expensive mentoring and software. However, that’s not the only cost of that free real estate seminar. If you buy high in real estate, you don’t just lose your investment. You could be on the hook for hundreds of thousands of dollars of lost equity, if the value of your property falls beneath the amount of your loan. You’ll be stuck with it, unable to sell it. And if you are able to short sell it, then you could be stuck with a very high tax bill on the “phantom income” of the difference between the sale price and your loan. The Most Important Key to a Great Real Estate Investment Again, one of the most important considerations for buying real estate is the price itself. Real estate prices are back to an all-time high. So, now is the time when most of these real estate mentors will be revealed as self-serving marketers rather than masters. It’s important you learn that lesson in the wings, rather than on your own dime. Low Interest Rates Create Asset Bubbles Low interest rates create asset bubbles. As you can see in the chart below, asset prices (stocks and real estate) are back to all-time highs. Debt is now astronomical. The statistics that politicians use to claim a strong economy, low unemployment and inflation, are not indicators of where the economy is headed. In fact, since 2000, asset bubbles have been the reliable harbingers of recessions. Real estate prices plummeted during the Great Recession, with many markets dropping to less than half their value at the high. It’s a warning worth heading today. With real estate prices back to an all-time high, what’s your best game plan? 1. Learn how to implement the 3-Ingredient Recipe for Cooking Up Profits for your real estate investment. Do your research and planning now, so that you’ll be ready to make a purchase when prices become more favorable. There are many events that create buying opportunities, including bubbles popping, deflation, unaffordability, the labor market slackening, natural disasters, terrorist events, the 4 D’s (death, depression, divorce and disaster) and more. The 3-Ingredient Recipe for Cooking Up Profits 1. Start With What You Know and Love. 2. Pick the Leader. 3. Buy Low; Sell High. 2. There is also more shadow inventory than most professionals are aware of. So, it will really pay to know the market you wish to buy into, and understanding how many people are hanging onto property they cannot afford by a thread. Any local market with a judicial foreclosure process is likely to have a lot more shadow inventory. Did you know that there are still more than five million U.S. homes that are severely underwater – owing at least 25% more than their value (source: AttomData.com)? 3. You will also do well with thinking bigger, and considering innovative solutions to pervasive problems, such as affordable housing, which is needed in most major cities in the developed world. Real estate prices are downright unaffordable in many major cities. As Lawrence Yun, the chief economist of the National Association of Realtors said in our recent conversation, “Unaffordability is making home sales plunge in California, even though the job market is great. Unless California can address the unaffordability of housing, you may see people leaving the area.” Any “guru” who tells you today is different than 2007 is not giving you the complete picture. (Take another look at the Asset Bubble chart above.) You can listen to my complete interview with Lawrence Yun on my BlogTalkRadio.com/NataliePace pod cast. Today, many asset bubbles are at an all-time high. You can’t afford to get bad advice. That is why I’m offering the Real Estate Master Class this April 26, 2019 in Denver, Colorado. Call 310-430-2397 or email info @ NataliePace.com to learn more and register now. Other Blogs of Interest Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Today, the Dow Jones Industrial Average dropped 460 points, marking the worst day-drop since the 660-point drop on January 3, 2019. And both of these plummets were preceded by the worst December since the Great Depression. Is the Spring Rally over? The good news is that the recent tax cuts sparked 2018 to the fastest economic growth the U.S. has seen since 2006, at 2.9% and 3.3%, respectively. The bad news is that wasn’t matched with spending cuts, so the public debt is higher than its ever been – at $22 trillion. On Wednesday, the Federal Reserve Board indicated there will be no interest rate hikes this year, and that they will stop deleveraging their own balance sheet at the end of this September. That seems like good news on the surface, particularly for interest-rate sensitive industries, like housing, and leveraged corporations that need to borrow money. However, since two of the primary economic concerns are overleverage (too much debt) and pricey valuations (bubbles), and since low interest rates contribute to bubbles and borrowing, continuing an accommodative stance risks exacerbating those two problems. Alan Greenspan, Warren Buffett, Robert Shiller and many other economists have all gone on record saying that stocks and bonds are in a bubble. Click to read through 12 Economic Concerns outlined in the Financial Stability Report that was released on November 28, 2018. Also, having the Fed Fund Rate at just 2.25-2.50% doesn’t give the Federal Reserve much room to lower rates, and goose the economy, when things head south. The most recent GDP growth projections are for 2.1% growth in 2019 and 1.9% in 2020 – much lower than 2018’s 2.9% – which is why the Federal Reserve is pausing on their interest rate hikes. The 1st quarter 2019 GDP growth is predicted to be downright dismal – at 1.2-1.3%. What Does All of This Mean for the Spring Rally 2019? After the worst December (2018) on Wall Street since the Great Depression (1931) -9.13 and -14.53% in the S&P500 respectively, Wall Street came roaring back. The Dow Jones Industrial Average is up 10.5% since the beginning of the year. Can the rally continue? Should you lean into the returns assuming there will be more wind at your back? Or is it time to take cover into a defensive position, and do a full assessment of the level of risk in your current plan? To answer these questions, I did a big data crunch to determine… * How well do March, April and May perform, when January and February are strong? * Do they continue the trend or give back some of the gains? * Is the pre-election year a rocket booster or a headwind on the Spring Rally? And here’s what the 10-Year Data revealed. * Most of the time when January and February are strong, the Spring Rally (including May) is weak. * The average gains for the first five months of the year are 4.3%. * The years with the strongest starts had the weakest growth, while the years with the stronger growth had negative (2010) or low performance (2015) in the first five months. * The pre-election year is usually great for the Spring Rally. 2007 gained 7.9% in the 1st five months of the year, while 2011 saw a solid 7% jump over that same period. In 2015, however, returns were tepid, at 2.4%. 10.5% gains (January 1, 2019 – March 21, 2019) is much higher than the average performance. There was only one year, in 2013 with 14.3% gains during the first five months of the year. So, historical performance trends would suggest a weak Spring Rally, giving back some of the gains of January and February. Pre-election trends are not as reliable today as they were in the past. The 10-year average is a loss of -0.37%, while the 20-year average is 15.58% gains. Another interesting point is that two of the strongest 5-month starts on Wall Street, in 2013 and 2011, came with forward projections of an improving economy. The recent projections were revised downward to a very slow growth of 2.1% growth in 2019. Wall Street veterans are always forward-thinking. So, today’s sell-off isn’t surprising. April 26, 2019 is a Big Day for Bad News On April 26, 2019, we’ll get the advance numbers for GDP growth in the first quarter of this year. Economists are projecting growth between 0.4% and 1.4%. That is significantly lower than the 4th quarter 2018 growth of 2.6%. Investors typically don’t respond well to such a sharp slowdown. The Most Predictable Recession Indicator Just Flashed Red The yield curve just inverted today, with the 10-year treasury falling .03 percentage points below the 3-month treasury yield of 2.46%. An inverted yield curve is 100% correlated with recessions over the past half a century. Buybacks Dry Up During the Quiet Period Bloomberg reported on March 20, 2019 that corporations had ceased buying back their own stock – a key driver of this entire bull market – and would stay on the sidelines throughout the 5-week quiet period before earnings announcements – through mid-April. As you can see from the below chart of buybacks, corporations purchasing their own stock is a perfect mirror of Wall Street performance. Purchases were at a high when Wall Street spiked in October. Both hit the pits at the end of December, only to rally strong through the first two months of 2019. Corporate buybacks are clearly driving Wall Street’s performance. In short, there are far more red flags than green lights on Wall Street for the Spring Rally. December 2018 reminds us that when the winds change, losses can cut like a falling knife. The right answer is never all in or all out, but is, rather, a diversified plan that keeps enough safe, underweights the overleveraged companies and adds in performance. A well-diversified plan that is annually rebalanced forces you to do what you must do for successful investing in today’s world – buy low and sell high on auto-pilot in your nest egg. The days of Buy and Hope paying off ended in 1999. 2018 was a year when stocks and bonds lost money, which means that 2019 is the year that you need to know what you own, know what a healthier plan looks like and take charge – being the boss of your money. Below is a list of the Economic Red Flags present in today’s economy… Economic Red Flags Prices are too high. Debt is too high. Growth is too slow. Productivity is too sluggish. There is an $879 billion U.S. trade deficit (2018 FY). $22 trillion U.S. public debt (as of 3.22.19). The Debt Ceiling was hit 3.1.19. X date should land in Aug/Sept/Oct. 1Q 2019 GDP will be released on April 26, 2019. It is predicted to be 0.4% - 1.5%. The Feds have paused on rate hikes, and will stop balance sheet deleveraging at the end of September. Consumer and fixed income spending are softening. U.S. GDP is $20.9 trillion, while Debt is $22 trillion. If you wait for the headlines on these red flags, it will be too late to protect yourself. You don’t have to understand economics to employ a time-proven easy-as-a-pie chart nest egg strategy that earned gains in the last two recessions (when most people lost more than half) and outperformed the bull markets in between. Blind faith that someone else is doing this for you can be very expensive. (It’s a good idea to get a second and third qualified, unbiased opinion on your current plan, rather than just trusting that your money manager has protected you.) Wisdom is the cure. (Click to read more about the High Cost of Free Advice.) As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest